Introduction

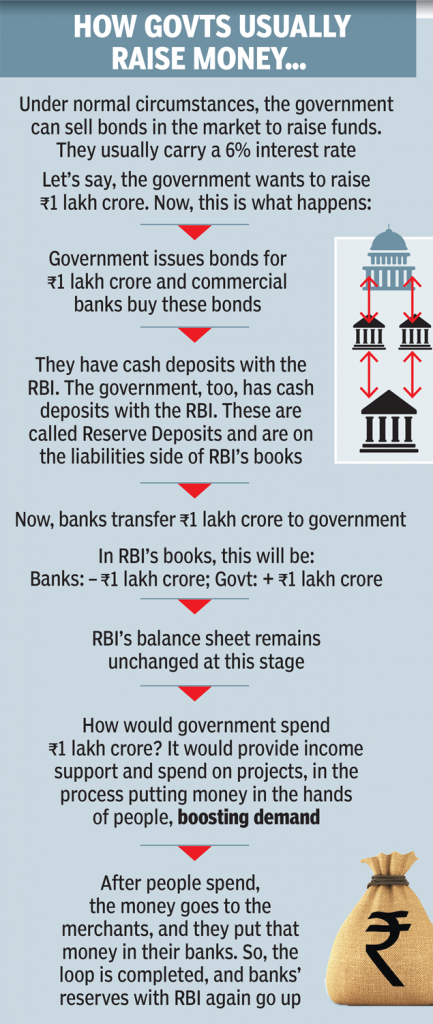

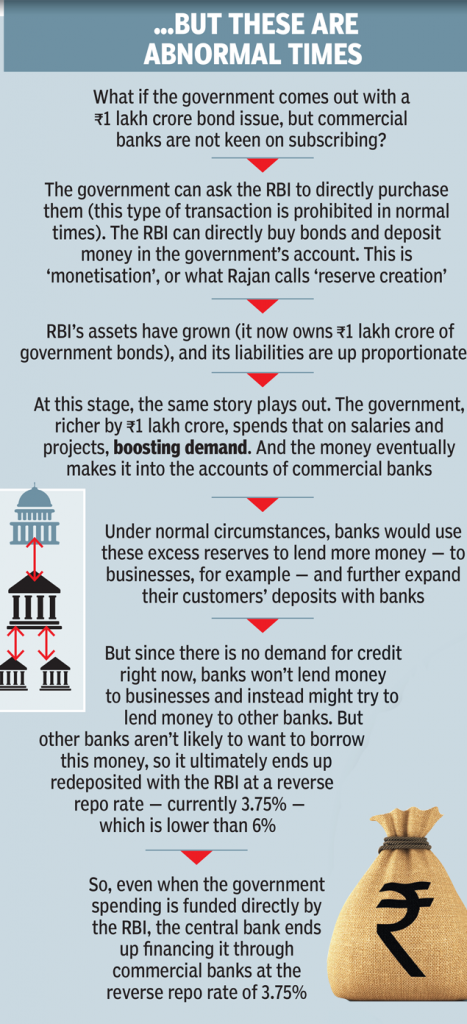

- To fund a bigger public spending programme, the government can either ask the RBI to print more money (monetise the deficit) or it can issue new bonds to be subscribed by the banks (raise money through borrowing).

- The Former RBI governor Raghuram Rajan explained how the two paths work and why ‘monetisation’ is a good option in the short-term and within reasonable limits

Highlights

Government finances itself from RBI while RBI finances itself from the banks at the reverse repo rate of 3.75% – Hence, RBI’s Direct Funding is termed as Printing Money wrongly.

RBI’s Direct Funding represents a loss to the government in two ways:

- A reduction in the annual dividend RBI pays the government

- Banks get 3.75% instead of the 6% they could get by buying government bonds directly.

Since the government owns 70% of the banking sector, its dividends from public sector banks also fall commensurately.

Will it Fuel Inflation?

Such direct financing is “not inflationary per se” as long as banks are reluctant to lend further to business or consumers.

However, as normal times return, RBI will have to pay a higher rate on excess reserves, or sell its government bond holdings and extinguish excess reserves, else it will risk excessive credit expansion and inflation.

-Source: Times of India