Content

- Unlocking the potential of India-Africa economic ties

- Prisoner of Data: Why Prison Statistics Don’t Tell the Full Story

Prisoner of Data: Why Prison Statistics Don’t Tell the Full Story

Why is it in News?

- Editroials piece critiques India’s prison data ecosystem, arguing that headline statistics mask structural injustices, especially for undertrial prisoners.

- Relevant for criminal justice reform, governance, human rights, and data-driven policymaking.

Relevance

- GS II (Governance & Constitution):

- Article 21 (personal liberty).

- Access to justice.

- GS III (Internal Security):

- Prison reforms.

- Criminal justice system efficiency.

Practice Question

- Despite extensive prison statistics, India’s criminal justice system continues to violate the spirit of Article 21. Examine how data gaps in undertrial incarceration undermine access to justice.(250 Words)

India’s Prison System: Macro Snapshot

- As per National Crime Records Bureau (Prison Statistics India):

- Undertrials ≈ 75–77% of total prison population (one of the highest globally).

- Convicts ≈ 22–24%.

- India ranks among the top 5 countries globally in absolute prison population.

Core Concern

- Quantitative dominance of undertrials reflects process failure, not crime trends.

Undertrials & Bail: The Invisible Injustice

Bail vs Reality Gap

- No national data on:

- Undertrials remaining in jail after bail is granted.

- Duration of illegal or excessive detention post-bail.

- Field evidence (from high-burden states like:

- Uttar Pradesh

- Bihar

- Jharkhand

- Punjab) shows:

- ~25% undertrials remain incarcerated >2 years without conviction.

Structural Causes

- Marginal inability to pay bail bonds (even ₹2,000–₹10,000).

- Lack of legal awareness.

- Absence of real-time court–prison data integration.

Supreme Court Interventions: Limited Reach

- Supreme Court of India guidelines (e.g., NALSA directions):

- Release of undertrials detained beyond half of maximum sentence.

- Result:

- >21,000 prisoners released (Nov 2023).

- Limitation:

- One-time relief, not systemic correction.

- Does not address daily inflow of similarly placed undertrials.

Data Deficit: What Prison Statistics Miss

A. Missing Process Indicators

- No tracking of:

- Time between bail order and actual release.

- Frequency of non-production before courts.

- Delays due to paperwork, surety verification, or digital gaps.

B. Quality of Legal Aid

- No data on:

- Lawyer–client interaction frequency.

- Case load per legal aid counsel.

- Effectiveness of representation.

Prison Conditions: Health, Education & Human Capital

Health & Mental Health

- Mental healthcare largely invisible in datasets.

- Overcrowding → higher incidence of:

- Depression.

- Substance withdrawal.

- Self-harm.

Education & Skills

- >50% of undertrials are:

- 18–30 years age group.

- Education profile:

- ~60% educated below Class X.

- Skill training:

- Only ~0.5% inmates received skill training (2023 data).

- Financial allocation:

- ~0.5% of prison budgets spent on education, skilling, vocational training.

Implication

- Prison system acts as a warehouse, not a reformative institution.

Deaths in Custody: Data Without Accountability

- Total deaths in prisons (2023): ~1,900.

- Natural deaths: ~1,500+.

- Unnatural deaths: ~400.

- Problem:

- Over 50% of unnatural deaths categorised as “others”.

- “Others” may conceal:

- Custodial violence.

- Negligence.

- Medical denial.

- NCRB does not mandate cause-wise forensic granularity.

Governance Gap: Oversight Mechanisms

Undertrial Review Committees (UTRCs)

- Mandated by SC at district level.

- On paper: quarterly reviews.

- In practice:

- Irregular meetings.

- Poor follow-up.

- No public dashboards.

Community Oversight

- Limited use of:

- Non-official visitors.

- Civil society monitoring.

- Absence of citizen accountability loops.

Why “More Data” ≠ “Better Justice”

- India’s prison statistics are:

- Static (stock numbers).

- Not dynamic (process flows).

- Focus on:

- Occupancy, admissions, releases.

- Ignore:

- Delay.

- Discretion.

- Discrimination.

Data that does not track injustice over time risks normalising it.

Way Forward

What Should Be Counted ?

- Time-to-release after bail.

- Undertrial detention beyond statutory limits.

- Bail amount vs income levels.

- Cause-specific custodial deaths.

- Access to legal aid & counselling.

Institutional Measures

- Real-time court–prison–police digital integration.

- Mandatory UTRC dashboards.

- Independent prison ombudsman.

- Expanded role for civil society & district judiciary.

Conclusion

India’s prison statistics offer numerical clarity but moral opacity. Without tracking delays, discretion, and deprivation, data risks legitimising injustice rather than correcting it. True reform lies not in counting prisoners, but in counting how the system fails them.

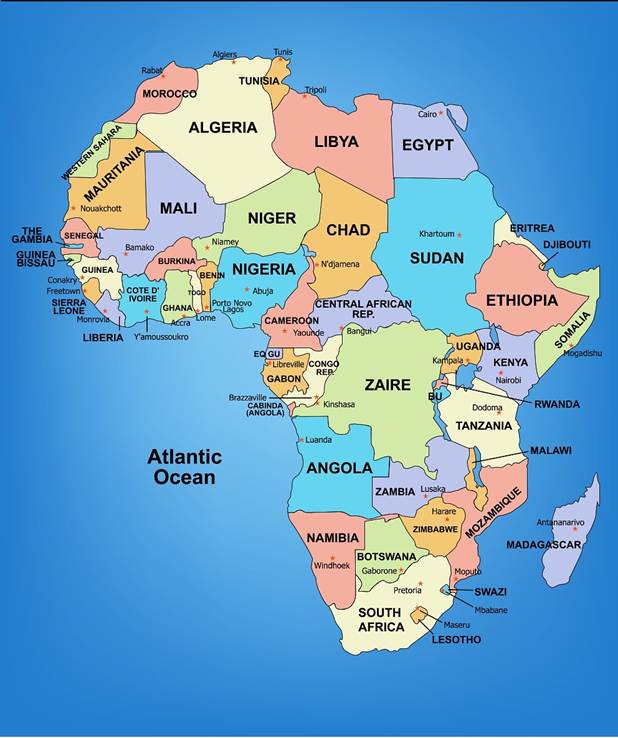

Unlocking the potential of India-Africa economic ties

Why is it in News?

- Narendra Modi’s visits to Namibia and Ghana (July 2025) and Ethiopia (Dec 16–17, 2025) renewed focus on India–Africa economic engagement.

- Symbolic milestone:

- African Union admitted as a permanent G20 member in 2023 during India’s presidency → elevation of Africa’s global economic voice.

- Context:

- Slowing and uncertain Western markets.

- Reconfiguration of global supply chains.

- Intensifying competition with China in Africa.

Relevance

- GS II (International Relations):

- India–Africa relations.

- South–South cooperation.

- G20 and global governance reforms.

- GS III (Economy):

- Trade diversification.

- MSMEs.

- Logistics and services exports.

Relevance

- Africa has re-emerged as a strategic priority in India’s foreign policy. Analyse the economic and geopolitical drivers behind India’s renewed engagement with African countries.(250 Words)

Structural Context: Why Africa Matters to India Now ?

- Export concentration risk:

- FY24: US + EU accounted for ~40% of India’s total exports.

- Rising protectionism, economic slowdown risks in the West.

- Africa offers:

- Fast-growing consumer markets.

- Young demographics.

- Resource security.

- Strategic depth in a multipolar world.

India–Africa Trade: Key Data Snapshot

Trade Volumes

- India is Africa’s 4th-largest trading partner.

- India–Africa bilateral trade: ~US$ 100 billion.

- FY24 Indian exports to Africa: US$ 38.17 billion.

Major Export Destinations

- Nigeria

- South Africa

- Tanzania

Key Indian Export Items

- Petroleum products

- Engineering goods

- Pharmaceuticals

- Rice

- Textiles

Africa’s Import Structure (Comparative Insight)

- India’s share in Africa’s imports (2024): ~6%.

- China’s share:

- ~21% of Africa’s total imports.

- Bilateral trade >US$ 200 billion.

- ~33% of Chinese exports to Africa fall under HSN 84 & 85:

- Machinery

- Boilers

- Electrical machinery

- Semiconductor-linked equipment

Reflects China’s manufacturing and industrial dominance.

Strategic Gap: India vs China in Africa

- India’s Africa exports:

- Still skewed towards commodities and low-value goods.

- China:

- Embedded in industrial ecosystems, infrastructure, and manufacturing.

- Implication:

- India risks being a peripheral trader, not a production partner.

India’s Target

- Doubling India–Africa trade by 2030.

- Requires:

- Structural transformation, not incremental growth.

Five-Pillar Strategy for India–Africa Economic Recalibration

Pillar 1: Trade Agreements & Market Access

- Negotiate:

- Preferential Trade Agreements (PTAs).

- Comprehensive Economic Partnership Agreements (CEPAs).

- Engage with:

- Regional economic blocs.

- Major African economies.

- Strategic alignment with African Continental Free Trade Area (AfCFTA).

Pillar 2: Shift to Value-Added Manufacturing

- Move beyond:

- Petroleum and traditional exports.

- Promote:

- Two-way value chains.

- Joint-venture manufacturing in Africa.

- Strategic advantage:

- Production in Africa allows preferential access to US markets.

- Simultaneously taps Africa’s domestic demand.

- Current problem:

- Indian firms under-utilise African investment incentives.

Pillar 3: MSMEs, Trade Finance & Risk Mitigation

- Africa is more MSME-friendly than US/EU markets.

- Constraints:

- Lack of trade finance.

- High perceived political and commercial risk.

- Policy tools suggested:

- Scaling up Lines of Credit (LoCs).

- Trade in local currencies.

- Joint India–Africa insurance pool for medium-term projects.

- MSMEs crucial for employment-intensive exports.

Pillar 4: Logistics & Maritime Connectivity

- High freight costs reduce competitiveness.

- Required investments:

- Port modernisation.

- Hinterland connectivity.

- Dedicated India–Africa maritime corridors.

- Logistics efficiency as a growth multiplier.

Pillar 5: Services, Digital Trade & Human Capital

- India’s comparative advantage:

- IT & digital services.

- Healthcare.

- Education & skill development.

- Professional services.

- Services trade:

- Enables high-value, low-volume exports.

- Acts as a catalyst for goods trade.

- Current gap:

- Policy ecosystem for services trade with Africa remains weak.

Investment Dimension: Role of Indian Public Sector

- Current issue:

- India’s Africa FDI inflated due to Mauritius-routed investments (tax arbitrage).

- Real investment gaps in:

- Manufacturing.

- Agro-processing.

- Infrastructure.

- Renewable energy.

- Critical minerals.

- Recommendation:

- Indian PSUs to lead in:

- Mining.

- Mineral exploration.

- Strategic infrastructure.

- Indian PSUs to lead in:

- Barriers:

- Bureaucracy.

- Political instability.

- High financing costs.

Strategic & Geopolitical Significance

- Africa is central to:

- Global supply chain diversification.

- Critical mineral security.

- South–South cooperation.

- India–Africa ties reinforce:

- India’s leadership in the Global South.

- Multipolar economic order.

Conclusion

India–Africa relations are at an inflection point. To compete with entrenched players like China and reduce over-dependence on Western markets, India must pivot from commodity-led trade to value-added manufacturing, services exports, and long-term investment partnerships—transforming Africa from a market into a strategic economic partner.