Content

- Partners, not rivals’: India & China

- What are Blue Dragons, which caused beach closures in Spain?

- Fertiliser crisis

- Mini-cloudbursts’ are on the rise: IMD chief

- The importance of India’s federal design

- Inside the APK scam: how fake apps are used for financial fraud

- Why NRIs are choosing India for medical tourism

- Decoding cryptos

‘Partners, not rivals’: India & China

Relevance : GS 2(International Relations -Bilateral relations with China)

Context

- Event: PM Narendra Modi and Chinese President Xi Jinping met on the sidelines of the Shanghai Cooperation Organisation (SCO) Summit in Tianjin, China (August 31).

- Key Message: Both sides agreed to be “partners, not rivals”, emphasizing mutual trust and respect.

- Context: Meeting came after a five-year military standoff along the Line of Actual Control (LAC) in Eastern Ladakh.

- Objective: To gradually normalize bilateral ties strained by the border conflict.

- Readouts:

- India’s stance: Strategic autonomy, fair trade, repairing ties.

- China’s stance: Don’t let border issues define overall relations.

- Modi’s Visit: First trip to China in five years; also aimed at balancing global power shifts after turbulence in India–US ties (under Trump).

- Border Milestones:

- Oct 2024: Border patrol leaders met, discussed sensitive points.

- Aug 2025: 24th round of border talks held, easing tensions.

- Modi–Putin Meet: Same day, focus on tariffs after US levied 50% duty on Indian goods.

Strategic Context

- India–China ties oscillate between cooperation and competition.

- SCO platform used by India to engage without appearing weak, while balancing against US/Japan strategic pressures.

- Post-2020 Galwan clash, this marks India’s calibrated re-engagement.

Border Issue Management

- Border is core irritant; India insists peace at LAC is prerequisite for broader cooperation.

- China emphasizes compartmentalization – don’t let border disputes spill into trade/investment.

- Recent patrol-level and ministerial talks show slow but steady de-escalation.

Economic & Trade Angle

- China remains India’s largest trading partner despite tensions (>$135 bn trade, 2024).

- India seeks fair trade, reduced deficit, and technology access.

- China wants continued export market in India amid Western decoupling.

Diplomatic Rebalancing

- India leveraging ties with US, Japan, and Russia to avoid overdependence on China.

- Engagement with Xi signals India’s multi-alignment policy – strategic autonomy at core.

- “Partners, not rivals” line meant more for optics to stabilize ties ahead of SCO/BRICS agendas.

Security & Geopolitical Dimensions

- Both nations are nuclear powers and neighbors, yet security dilemma persists.

- India wary of China–Pakistan axis and China’s influence in Indian Ocean (String of Pearls).

- Dialogue reduces immediate risk of escalation, but trust deficit remains.

What are Blue Dragons, which caused beach closures in Spain?

Relevance : GS 3(Environment and Ecology- Marine Biodiversity)

What are Blue Dragons?

- Scientific Name: Glaucus atlanticus.

- Category: Small sea slug (gastropod mollusk), belongs to the family Glaucidae.

- Appearance:

- Barely 4 cm long.

- Striking blue & silver coloration → camouflage in ocean (countershading strategy).

- Habitat:

- Float upside down on the ocean surface, drifting with currents.

- Found in warm tropical/subtropical waters (Pacific, Atlantic, Indian Oceans).

- Feeding:

- Prey on venomous cnidarians like Portuguese man o’ war, bluebottles, jellyfish.

- Ingest venom & concentrate it in their finger-like appendages.

- Their sting can be more potent than their prey.

Why Dangerous?

- Venom Potency:

- Capable of delivering stings stronger than jellyfish they consume.

- Toxins can cause severe pain, nausea, vomiting, allergic reactions.

- In rare cases, may lead to death.

- Public Health Concern:

- Presence along tourist beaches → caused closure of several beaches in Spain.

Global Distribution

- Recorded in: Australia, South Africa, India (rare sightings), USA (Texas), Portugal, Spain.

- Rare in the Mediterranean Sea, but recent sightings have increased.

- First record in Spain → 1839 (Canary Islands).

- Since 2016 → increasing frequency, linked to climate change & shifting ocean currents.

Why Rising Now?

- Climate Change Factor:

- Mediterranean → among the fastest-warming seas (warming 20% faster than global oceans).

- Rising sea surface temperature → 4–5°C anomalies.

- Expanding habitats of tropical species into temperate zones.

- Ocean Currents & Wind Patterns:

- Stronger winds & altered currents carry them closer to coasts.

- Food Availability:

- Bloom in jellyfish populations → attracts blue dragons.

Ecological Role

- Predator of Jellyfish: Helps regulate jellyfish populations.

- Indicator Species: Their movement indicates shifts in ocean temperature & biodiversity patterns.

Conclusion

- Blue dragons are both a public health concern and an ecological indicator species, symbolizing how climate change-driven ocean warming and current shifts are altering marine biodiversity.

- Their rising presence in new habitats reflects broader climate challenges, requiring integrated responses in marine conservation, tourism safety, and coastal management policies.

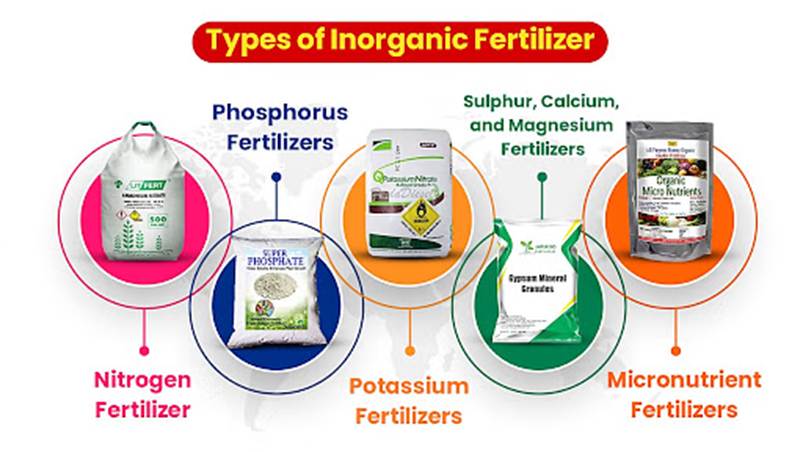

Fertiliser crisis

Relevance : GS 3(Agriculture and Food Security -Fertiliser Production and Subsidies)

Context

- Rainfall & Crop Sowing

- India had a very good southwest monsoon (June–August: 8.9% above normal rainfall).

- Farmers planted more kharif crops: paddy, pulses, coarse cereals, maize.

- As of Aug 22, rice acreage was 420.4 lakh hectares (vs 390.8 lakh last year).

- Fertiliser Consumption Surge

- With more sowing, fertiliser demand shot up.

- Major nutrients: Nitrogen (N), Phosphorus (P), Potassium (K), Sulphur (S).

- Fertiliser sales (Apr–Jul 2025 vs Apr–Jul 2024):

- Urea: 108.86 lt (+21.6%)

- DAP: 56.68 lt (+33.6%)

- NPKS: 50.03 lt (+15.5%)

- SSP: 45.06 lt (+8.6%)

- MOP: 12.42 lt (-43.6%)

- Imports & Supply Gaps

- India imports ~25–30% of fertiliser needs.

- Urea: imports down to 1.24 mt (Apr–Jun 2025) from 2.6 mt last year.

- DAP: imports down to 1.88 mt from 2.1 mt.

- Morocco & China are key suppliers.

- Global supply disruptions and China’s export restrictions worsened shortages.

- Shortages & Queues

- Farmers queued for urea/DAP at sowing time (July).

- Pre-stocking by farmers added stress.

- Shortage visible in rice-growing regions needing higher fertiliser doses.

- Policy Lessons

- Govt underestimated higher fertiliser demand due to increased paddy acreage.

- Future planning must account for fertiliser-intensive crops like rice/pulses.

- Imports need advance booking; rabi demand must be secured early.

Why the Shortage Happened

- Domestic production lag: India still depends on imports for ~30% of fertilisers.

- High demand spike: Good monsoon encouraged extra planting, esp. rice.

- Global disruption:

- China restricted exports of urea/DAP.

- Morocco’s output limited.

- Prices of raw materials like phosphoric acid and ammonia surged.

- Inefficient planning: Govt procurement underestimated demand in kharif 2025.

Economic Impact

- Farmers: Higher fertiliser prices in black markets, long queues at centres.

- Inflation risk: Fertiliser shortages can reduce yields → push up food inflation.

- Fiscal stress: Fertiliser subsidies already exceed ₹2 lakh crore annually; shortages may force more imports at higher costs.

Agriculture & Food Security

- Rice & Pulses (nitrogen-demanding crops) most affected.

- Potential yield losses if farmers can’t access fertiliser on time.

- Could reduce India’s exportable rice surplus, impacting global food markets.

Strategic Dependence

- India relies heavily on a few suppliers (China, Morocco, Oman, Russia).

- Import volatility = strategic vulnerability.

- Need for domestic revival of fertiliser manufacturing capacity.

Policy Lessons & Reforms

- Advance contracts for imports before kharif season.

- Diversify sourcing (Africa, Gulf countries, new FTAs).

- Invest in domestic production via joint ventures & PLI-type incentives.

- Promote alternative inputs: nano-urea, biofertilisers, integrated nutrient management.

- Better demand forecasting using satellite data & crop sowing trends.

‘Mini-cloudbursts’ are on the rise: IMD chief

Basics

- Cloudburst:

- Sudden, extreme rainfall in a localized area (≥100 mm/hr over a few sq. km).

- Common in hilly regions due to orographic lift and moisture-laden winds.

- Mini-cloudburst:

- Smaller in scale, but with intense rainfall (typically 50–100 mm/hr).

- Increasingly reported in recent years.

- Forecasting:

- IMD states that cloudbursts remain “impossible to forecast” due to their highly localized and short-lived nature.

- Mini-cloudbursts, though more frequent, are also hard to predict with current models.

Relevance : GS 3(Disaster Management – Floods , Cloudbursts, Environment – Climate Change)

Recent Rainfall Trends (2025 Monsoon till Aug 31)

- Overall Monsoon (June–Aug 2025): 6% above normal (76.2 cm vs usual 70 cm).

- Regional distribution:

- Northwest India: +26% above normal (Uttarakhand, UP, Punjab, Haryana, J&K, Rajasthan, Delhi).

- Central India: +8.6% above normal.

- Southern Peninsula: +9.3% above normal; August rainfall (25 cm) = 3rd highest since 2001.

- East & Northeast India: –17% deficit despite being the traditional rain-surplus zone.

- September Outlook: Expected above normal rainfall (+9% vs average 16.7 cm), continuing a trend noticed since 1980.

Heavy Rainfall Episodes

- August 2025:

- 700+ instances of heavy rain (≥20 cm/day), 2nd highest since 2021 (behind 800+ in 2024).

- Northern India: August rainfall = 26.5 cm, highest since 2001.

- Drivers of extreme events:

- Interaction between Western Disturbances (from Mediterranean) and Bay of Bengal storms → convergence of moisture → intense rain bursts.

- Resulted in devastating floods and landslides in Himachal Pradesh, J&K, Uttarakhand.

Key Analytical Insights

- Mini-cloudbursts on the rise:

- May be linked to climate change-driven shifts: warming atmosphere holds more moisture, increasing probability of intense short-duration rainfall.

- Urbanization + deforestation in hilly areas amplifies impacts (flash floods, landslides).

- Changing monsoon dynamics:

- September becoming wetter since 1980 (possibly due to delayed monsoon withdrawal + oceanic-atmospheric changes like Indian Ocean Dipole).

- Regional inequality: Surplus in NW & Central India, deficit in East & NE → disrupts agriculture, hydrology, disaster preparedness.

- Forecasting limitations:

- While seasonal/weekly monsoon forecasts improving, sub-hourly localized predictions like cloudbursts remain beyond current radar and model resolution.

- IMD using Doppler radars + AI-based nowcasting to reduce unpredictability.

- Policy & Preparedness Implications:

- Need for micro-level disaster management plans, especially in Himalayan states and urban flood-prone zones.

- Resilient infrastructure + improved early warning systems essential.

The importance of India’s federal design

Basics

- Context:

- SC hearing Zahoor Ahmed Bhat v. UT of J&K.

- Plea: non-restoration of statehood violates citizens’ rights + federalism (basic structure).

- SC stance:

- Separation of powers → some decisions belong to govt., not judiciary.

- But federal design of Constitution requires statehood restoration.

Relevance : GS 2(Polity and Constitution – Federalism, Statehood)

Constitutional Provisions on State Creation

- Article 1: India = Union of States, not a federation of states.

- Processes of State creation:

- Admission: political unit joins India (e.g., J&K in 1947 through Instrument of Accession).

- Establishment: acquisition under international law (e.g., Goa 1961, Sikkim 1975).

- Formation (Art. 3): reorganisation of existing states → increase, decrease, alter boundaries/names.

- Limits of Art. 3:

- Parliament can diminish a state’s area but cannot convert it into a Union Territory permanently.

- Making J&K a UT is exceptional, not meant to be permanent.

Federal Design of India

- Union vs Federation:

- Word Union chosen deliberately → strong Centre, inseparable unity.

- Yet federalism built into Basic Structure → equitable distribution of powers/resources.

- Balance of power:

- Unitary tilt → Centre strong enough to preserve unity & integrity.

- Federal features → state participation & representation (Rajya Sabha permanent under Art. 83(1)).

- Basic Structure Doctrine (Kesavananda Bharati, 1973):

- Federalism = unamendable feature of the Constitution.

- Arbitrary dilution (e.g., indefinite UT status for J&K) undermines basic structure.

J&K Case Study

- 2019: J&K Reorganisation Act split J&K into UT of J&K + UT of Ladakh.

- Dec 2023 SC verdict:

- Upheld abrogation of Articles 370 & 35A.

- Directed restoration of statehood to J&K + assembly elections.

- Oct 2024: Elections to 90-member Assembly held, but statehood still withheld.

- Criticism:

- Without statehood, federal balance tilted in favour of Union.

- LG holds overriding power, reducing elected govt. authority → weakens democracy.

Constitutional Context

- Why statehood matters:

- Ensures representation of people at Union level.

- Strengthens federal bargain: Centre strong but States empowered.

- Prevents constitutional inconsistency: a UT with an assembly ≠ true federal design.

- Implications of delay:

- Creates trust deficit between Union & people of J&K.

- Weakens cooperative federalism.

- Sets precedent for excessive centralisation.

- Constitutional principle:

- Restoring J&K’s statehood is not just political, but a constitutional necessity to uphold federalism.

What Next?

- Union Government: obligated (per SC) to restore J&K’s statehood.

- Timeline: Centre may justify delay citing ground realities/security concerns, but indefinite postponement undermines federal design.

- Broader lesson:

- Federalism = cornerstone of Basic Structure.

- States cannot be downgraded permanently to UTs without damaging India’s constitutional identity.

Inside the APK scam: how fake apps are used for financial fraud

Basics

- APK files: Android Package Kit files, used to install apps on Android (like .exe files on Windows).

- Modus operandi:

- Victim gets a call/message claiming urgent action (blocked account, subsidy, electricity bill).

- Sent a link to download an app disguised as a govt./bank portal.

- App installs easily, mimics official branding.

- Once permissions are granted, the device is compromised → financial & personal data stolen.

How the Fraud Works

- Permissions requested: access to SMS, contacts, call logs, notifications, location, microphone.

- Functions after install:

- Monitors real-time activity.

- Intercepts OTPs and passwords.

- Closes fixed deposits, siphons funds.

- Mirrors & transmits data to fraudster servers in encrypted form.

- Techniques:

- Apps appear dormant during install to bypass antivirus checks.

- Minor modifications to logo/name/URL allow reuse after blacklisting.

Scale of the Problem

- Cybercrime surge: 900% rise between 2021–2025 (Parliament data).

- National Cyber Crime Portal (2025): 12,47,393 cases logged in 6 months.

- Telangana Cyber Security Bureau (Jan–Jul 2025):

- 2,188 APK fraud cases.

- ₹779.06 crore lost.

- 20–30 cases/day; daily loss = ₹10–15 lakh.

- High-value scams: up to ₹30–40 lakh each.

- Apps in circulation: Hundreds of cases linked to ~10 core APK files reused repeatedly.

Who Operates These Apps?

- Local ecosystem:

- 60–70% developed in India (Delhi-NCR, Meerut, UP, Jamtara, Jharkhand).

- International linkages:

- 30–40% traced to U.S., U.K., China.

- Distribution channels:

- Telegram channels, dark web marketplaces, pre-built APK kits sold for a fee.

- Organised underground economy: coders, distributors, mule account handlers.

How Victims Are Targeted

- Digital surveillance & data leaks:

- Fraudsters purchase leaked customer databases (from malls, hospitals, service portals).

- Data includes names, numbers, emails, addresses, income, profession.

- Target profile:

- High-earning professionals (doctors, bankers, teachers, real estate agents).

- Social engineering:

- Messages are customised, urgent, and exploit trust to force quick action.

Investigations & Challenges

- Cyber forensics:

- Only 20–30% of APKs successfully decrypted.

- Often reveal just server addresses, rarely developer signatures.

- Financial trails:

- Stolen funds funneled into mule accounts, quickly converted into cryptocurrency.

- Local accomplices sometimes arrested, masterminds remain elusive (esp. offshore).

- Tech interventions:

- Google removed ~50 malicious apps recently.

- But platforms don’t pre-scan all hosted apps; fraudsters use fake identities for hosting/publishing.

Comprehensive Analysis

- Structural Drivers:

- Widespread smartphone penetration + digital payments boom.

- Weak cyber hygiene & low awareness among users.

- Cheap dark web data sets fueling targeted scams.

- Systemic Gaps:

- Lack of strong pre-screening by app stores.

- Delays in forensic decryption and inter-agency coordination.

- International jurisdiction hurdles in catching masterminds.

- Economic & Social Impact:

- Daily financial hemorrhage of ₹10–15 lakh.

- Trust deficit in digital systems, affecting adoption of fintech/government platforms.

- Policy Imperatives:

- Stricter KYC norms for digital wallets and hosting accounts.

- Mandatory app vetting by intermediaries.

- Investment in cyber forensic capacity and cross-border cooperation.

- Public awareness campaigns on phishing & fake apps.

Why NRIs are choosing India for medical tourism

Basics

- Medical tourism: Traveling across borders to seek healthcare due to cost, quality, or accessibility reasons.

- NRI context: Rising healthcare costs abroad, distance from family, and affordability in India make it an attractive option.

- Key drivers:

- Cost savings (60–90% cheaper vs. U.S./Europe).

- Comparable or superior quality of care in many specialties.

- Growing adoption of health insurance policies tailored for NRIs.

- Digital ease in policy purchase and claim settlement.

Relevance : GS 2(Social Issues- Healthcare)

Cost Advantage

- Heart bypass surgery:

- U.S.: $70,000–$1,50,000

- India: $5,000–$8,000

- Knee replacement:

- U.S.: up to $50,000

- India: $4,000–$6,000

- Complex surgeries:

- U.S.: > $1,00,000

- India: $10,000–$20,000

- Medicines: Up to 90% cheaper in India compared to global markets.

- Insurance premiums: 25–40 times cheaper in India vs. U.S./GCC.

Adoption of Health Insurance by NRIs

- Growth trend: >150% rise in NRI adoption in 1 year.

- Young NRIs (<35 years): 148% growth.

- Women buyers: 125% growth.

- Coverage: Includes parents/elderly living in India.

- Recurring care: Helps cover long-term costs of cancer, respiratory, cardiac, and infectious diseases.

Policy & Digital Push

- Government initiatives: Heal in India, promoting India as a healthcare hub.

- Digital platforms: NRIs can explore, compare, and buy insurance remotely.

- Cashless claims: Seamless access across Indian hospitals, bridging geographical distance.

- Tier-3 cities rising: ~50% of NRI claims now from smaller hubs (Thrissur, Kollam, Thane) besides metros (Hyderabad, Chennai, Kochi, Thiruvananthapuram).

Healthcare Infrastructure & Quality

- Accredited hospitals: India has >40 JCI-accredited hospitals meeting global standards.

- Specialties in demand: Cardiology, oncology, organ transplants, orthopedics, dentistry.

- Doctor pool: Large number of English-speaking, globally trained doctors.

- Technology: Advanced robotic surgeries, telemedicine, and diagnostics.

Financial Ripple Effect

- Direct impact: Savings on procedures free up funds for mortgages, education, retirement.

- Macro-level effect: India’s medical tourism market is expected to cross $13 billion soon.

- Insurance as a catalyst: Extends protection beyond surgery costs → covers recurring illnesses.

- Regional development: Smaller towns benefit as insurance claims and hospital infra expand beyond metros.

Comprehensive Analysis

- Push factors abroad:

- Exploding healthcare costs in U.S. & GCC.

- Long wait times for elective surgeries in U.K./Canada.

- Limited insurance portability for NRIs abroad.

- Pull factors in India:

- Affordability without quality compromise.

- Comprehensive insurance offerings for NRIs and families.

- Emotional and cultural comfort of being treated near family.

- Challenges:

- Quality disparity between top-tier hospitals and smaller facilities.

- Need for transparent insurance claim processing.

- Risk of over-commercialization of care.

- Future outlook:

- With digital health ecosystems, expanded insurance, and govt. policy support, India is positioned as a global hub combining healthcare + financial protection.

Decoding cryptos

Basics

- Blockchain recap: A digital, decentralised ledger where transactions are recorded in blocks linked sequentially.

- Verification need: Every transaction must be validated before being added to the blockchain.

- Difference from banks:

- Banks → verified by officials in a centralised system.

- Cryptos → verified by miners/validators in a decentralised network.

- Consensus mechanism: The method by which blockchain participants agree on the validity of transactions.

Relevance : GS 3(Economy – Digital Currencies , Technology – Block Chain

Consensus Mechanisms

- Proof of Work (PoW):

- Miners solve complex puzzles using computing power.

- Winner adds block + earns rewards (coins + fees).

- Secure but energy-intensive, slow, costly.

- Example: Bitcoin.

- Proof of Stake (PoS):

- Validators chosen based on how much crypto they “stake.”

- Honest validators earn fees/rewards; dishonest ones lose staked coins.

- Faster, more energy-efficient.

- Example: Ethereum (post-Merge), Solana.

- Core purpose of both: Prevent fraud, ensure security, incentivize participation.

Other Consensus Mechanisms (Emerging)

- Delegated Proof of Stake (DPoS): Voting system where stakeholders elect validators (EOS, Tron).

- Proof of Authority (PoA): Validators selected based on reputation/identity.

- Hybrid models: Combining PoW + PoS for balance of security and scalability.

Key Factors Before Investing in Cryptos

- Network security: Must have active, decentralised nodes that resist hacking.

- Transaction efficiency: Speed (TPS – transactions per second) + fees (affect usability).

- Market reputation: Coin’s history, community support, transparency of developers.

- Real-world utility: Adoption potential in payments, finance, supply chain, gaming, healthcare.

- Volatility: Prices swing dramatically; not suitable for risk-averse investors.

- Regulatory environment: Varies across countries; legal uncertainty remains a big risk.

Types of Cryptocurrencies

- Bitcoin (BTC): First, most famous; store of value (“digital gold”).

- Altcoins:

- Ethereum: Smart contracts, DeFi, NFTs.

- Solana, Cardano, Polygon: Faster transactions, scalable dApps.

- Stablecoins: Pegged to assets (e.g., USDT, USDC); reduce volatility.

- Utility tokens: Access to services (Binance Coin, Chainlink).

- Governance tokens: Voting rights in decentralised organisations (UNI, AAVE).

- Meme coins: Community/hype driven (Dogecoin, Shiba Inu).

- Sector-specific coins: Gaming (Axie Infinity), supply chain (VeChain), finance (Ripple/XRP).

Opportunities

- Wealth creation: Early adopters of BTC/ETH saw exponential gains.

- Financial inclusion: Provides access where banking infrastructure is weak.

- Innovation: Smart contracts, decentralised finance (DeFi), NFTs, tokenisation of assets.

- Portfolio diversification: Non-correlated asset, but very high risk.

Risks & Challenges

- Extreme volatility: Gains/losses can exceed 30% in days.

- Regulatory crackdowns: Uncertain legal status in India, US, EU.

- Scams & rug pulls: Many coins are hype-based, without real value.

- Environmental impact: PoW energy consumption (e.g., Bitcoin mining).

- Custody risk: Losing private keys = permanent loss of funds.

- Liquidity traps: Small coins may lack active buyers/sellers.

Takeaways

- Cryptos are more than speculation: They represent a new financial architecture (DeFi, Web3, tokenised economies).

- Long-term value likely lies in:

- Coins with real-world utility (payments, contracts, decentralised apps).

- Strong developer community + transparent governance.

- Short-term risk: High; better suited for informed, risk-tolerant investors.

- Cautionary stance: Research > Hype. Diversify. Don’t over-allocate.

- Global future: Cryptos may evolve into mainstream finance if regulation balances innovation + investor protection.