Contents

- China extends $500 million loan to Lanka

- Military exercise in Bangladesh ends

- U.S. urges G20 on Global Minimum Corporate Tax

CHINA EXTENDS $500 MILLION LOAN TO LANKA

Context:

China signed a $500 million loan agreement with Sri Lanka, in a move that Colombo hopes would boost its foreign reserves that are under severe strain since the pandemic struck last year.

Relevance:

GS-II: International Relations (India’s Neighbors, Foreign Policies affecting India’s Interests)

Dimensions of the Article:

- About recent extension of loan by China and Sri Lanka’s Position

- China’s Debt-trap Diplomacy

- Chinese presence in Sri Lanka

- Recently in News: China’s New Project in Sri Lanka

About recent extension of loan by China and Sri Lanka’s Position

- The recent $500 million loan agreement is the second instalment of the $1 billion loan sought by Sri Lanka in 2020.

- The approval comes after Sri Lanka obtained a currency swap facility from China for $1.5 billion.

- Meanwhile, the Beijing-based Asian Infrastructure Investment Bank (AIIB) also sanctioned Sri Lanka’s request for a $180 million loan earlier in 2020.

- Sri Lanka already owes more than $ 5 billion to China from past loans.

- Sri Lanka is due to repay some $ 4.5 billion of its outstanding debt in 2021 and the Sri Lankan government has said it is “exploring all options”.

China’s Debt-trap Diplomacy

- Research shows developing countries owe much larger debts to China than was earlier believe.

- They allege many loans to build infrastructure projects using Chinese contractors in strategically located developing nations are a form of debt-trap diplomacy.

- China is accused of extending excessive credit with the intention of extracting economic or political concessions when countries cannot honour their debts. This raises fears that China’s credit to countries such as Pakistan, Sri Lanka and Nepal could be a strategic disadvantage for India.

Chinese presence in Sri Lanka

- Besides the huge financial help, there is the presence of Chinese officials and military officers in Sri Lanka along with Chinese workers.

- Over a period of 12 years (2005- 17), Beijing has poured over 15 billion dollars into projects in Sri Lanka.

- For India, this is a discomforting situation and bad development as Indian foreign policy has heavily dependent on time-tested and historical links and now, over the period of time, there is a sense of thinking among Sri Lankans that India failed to see and respond to various demands and began to compare with the scale and speed of help Beijing is offering.

Chinese acquisition of Hambantota Port

- Over the years, Sri Lanka has been lost its financial strength. China’s acquisition of the strategic Hambantota port from Sri Lanka has given it “control of a territory” is one such example.

- This port is just a few hundred miles off the shores of India, highlighting its “debt trap” the country is facing.

- Besides, Sri Lanka’s failure has resulted in China strategic advantage over the position.

- It should be noted that Hambantota port would not work and “frequent lenders” like India had refused to provide loans or assistance for the port, developed during Sri Lanka’s president Mahinda Rajapaksa’s rule.

Recently in News: China’s New Project in Sri Lanka

- In 2021, a Chinese company has won a contract to set up hybrid wind and solar energy projects on three Sri Lankan islands off the northern Jaffna peninsula 45 km from Rameswaram in Tamil Nadu.

- Asian Development Bank (ADB) is set to fund the project, which will come up on Delft, Nainativu and Analativu, three islands in the Palk Strait off Jaffna peninsula.

- India’s concern is the project site’s proximity to the Indian coastline.

- India had lodged a strong protest with the Sri Lankan government on the contract to the Chinese company.

-Source: The Hindu

MILITARY EXERCISE IN BANGLADESH ENDS

Context:

Multinational military exercise Shantir Ogrosena was under way in Bangladesh in April 2021.

Relevance:

Prelims, GS-II: International Relations (India’s Neighbors, Foreign Policies affecting India’s Interests)

Dimensions of the Article:

- About Shantir Ogrosena

- Trends in India-Bangladesh relations

- Other Recent Developments in India-Bangladesh Relationship

- Issues and Complications in India-Bangladesh relations

About Shantir Ogrosena

- Shantir Ogrosena is a military exercise in which India, Bhutan, Sri Lanka and Bangladesh participate.

- The exercise in 2021 was held with the theme of ‘Robust Peace Keeping Operations’.

- Military observers from the US, UK, Turkey, Kingdom of Saudi Arabia, Kuwait and Singapore were also in attendance throughout the exercise.

- The aim of the exercise was to strengthen defence ties and enhance interoperability amongst neighbourhood countries to ensure effective peace keeping operations.

- The Armies of all participating nations shared their wide experiences and enhanced their situational awareness through robust information exchange platforms.

Trends in India-Bangladesh relations

- The friendship between India and Bangladesh is historic, evolving over the last 50 years ever since the extension of India’s political, diplomatic, military and humanitarian support during Bangladesh’s Liberation War which resulted in Bangladesh’s independence.

- Post-Independence, the India-Bangladesh relationship has oscillated with the cordial relationship being maintained until the assassination of Bangladesh’s founding President Sheikh Mujibur Rahman in 1975.

- After the assassination of Sheikh Mujibur Rahman and his family (except his daughters, of whom Sheikh Hasina is the current Prime Minister of Bangladesh), a period of military rule and the rise of General Ziaur Rahman followed.

- General Ziaus Rahman became the president and was assassinated as well in 1981, following which the India-Bangladesh Relationship became more cordial between 1982-1991 under the military-led government.

- Since Bangladesh’s return to parliamentary democracy in 1991, relations have gone through highs and lows with the relations becoming friendlier in the last decade (2010-2020).

Other Recent Developments in India-Bangladesh Relationship

- On the account of the COVID-19 pandemic, India assured Bangladesh to make available vaccines for the country as and when produced in India, signifying India’s ‘Neighbourhood First Policy’.

- India organized events on ‘Mujib Borsho’ which is the birth centenary year of Bangladesh’s founder president Sheikh Mujibur Rahman.

- Framework of Understanding (FOU) on Cooperation in Hydrocarbon Sector; Protocol on Trans-boundary Elephant Conservation, MoU on Cooperation in the field of Agriculture and other agreements have also been signed between the two countries.

-Source: The Hindu

U.S. URGES G20 ON GLOBAL MINIMUM CORPORATE TAX

Context:

In a declaration of war on low-tax jurisdictions around the globe, US Treasury Secretary has urged G20 nations to move towards a global minimum corporate tax.

Relevance:

GS-II: International Relations (International Groupings, Foreign policies affecting India’s Interests) GS-III: Indian Economy (Taxation, External

Dimensions of the Article:

- About the Global Minimum Corporate Tax Rate proposal

- The necessity of the Global Minimum Corporate Tax according to U.S.

- How did other countries react to the proposal?

About the Global Minimum Corporate Tax Rate proposal

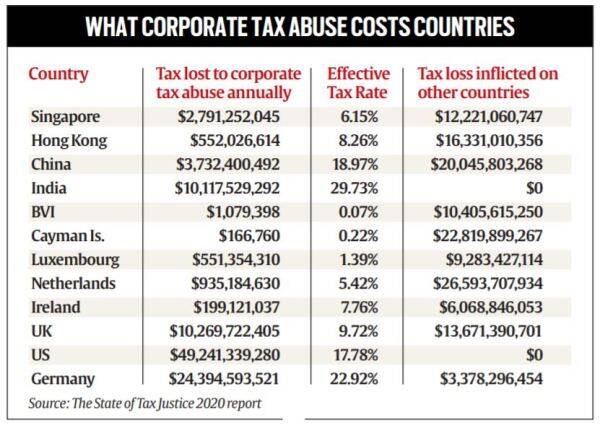

- The US proposal envisages a 21% minimum corporate tax rate, coupled with cancelling exemptions on income from countries that do not legislate a minimum tax to discourage the shifting of multinational operations and profits overseas.

- The US views a Global Minimum Corporate Tax Rate as an attempt to reverse a “30-year race to the bottom” in which countries have resorted to slashing corporate tax rates to attract multinational corporations (MNCs).

- The proposal for a minimum corporate tax is tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including digital giants such as Apple, Alphabet and Facebook, as well as major corporations such as Nike and Starbucks.

- These companies typically rely on complex webs of subsidiaries to hoover profits out of major markets into low-tax countries such as Ireland or Caribbean nations such as the British Virgin Islands or the Bahamas, or to central American nations such as Panama.

The necessity of the Global Minimum Corporate Tax according to U.S.

- The proposal aims to somewhat offset any disadvantages that might arise from the proposed increase in the US corporate tax rate.

- The proposed increase to 28% from 21% would partially reverse the previous cut in tax rates on companies from 35% to 21% by way of a 2017 tax legislation.

- The increase in corporation tax comes at a time when the pandemic is costing governments across the world, and is also timed with the US’s push for a USD 2.3 trillion infrastructure upgrade proposal.

- A global compact on this issue, at the time of pandemic, will work well for the US government and for most other countries in western Europe, even as some low-tax European jurisdictions such as the Netherlands, Ireland and Luxembourg and some in the Caribbean rely largely on tax rate arbitrage to attract MNCs.

- The plan to peg a minimum tax on overseas corporate income seeks to potentially make it difficult for corporations to shift earnings offshore.

- However, a global minimum rate would essentially take away a tool that countries use to push policies that suit them. A lower tax rate is a tool they can use to alternatively push economic activity.

How did other countries react to the proposal?

- The European Commission backed the proposal, but the global minimum rate should be decided after discussions in the Organisation for Economic Cooperation and Development (OECD).

- China is not likely to have a serious objection with the US call, but an area of concern for Beijing would be the impact of such a tax stipulation on Hong Kong, the seventh-largest tax haven in the world and the largest in Asia.

- The US proposal also has support from the International Monetary Fund (IMF).

-Source: Indian Express