Contents

- RBI launches Digital payments index

- PM unveils project for affordable housing

- Fiscal deficit shoots up to 135% of target

RBI LAUNCHES DIGITAL PAYMENTS INDEX

Context:

The Reserve Bank of India (RBI) announced a Digital Payments Index (DPI) to assess and capture the extent of digitalization of payments effectively.

Relevance:

GS-III: Indian Economy

Dimensions of the Article:

- What is digital payment system?

- Different digital payment modes in India

- About the Digital Payment Index (DPI) and its Significance

What is digital payment system?

- Digital payment system is a way of payment which is made through digital modes- completely online. No hard cash is involved in digital payments.

- In this system, payer and payee both use digital modes to send and receive money.

- It is also called electronic payment.

- Example- Internet Banking, Debit Cards, Credit Cards, e-Wallets.

Different digital payment modes in India

Cards

- Banking cards offer consumers more security, convenience, and control than any other payment method.

- There are wide variety of cards available – including credit, debit and prepaid.

Internet Banking

- It is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution’s website.

- Different types of online financial transactions are: National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS), and Immediate Payment Service (IMPS).

Unstructured Supplementary Service Data (USSD)

- This service allows mobile banking transactions using basic feature mobile phone (dialling *99#), there is no need to have mobile internet data facility for using USSD based mobile banking.

- Key services offered under *99# service include, interbank account to account fund transfer, balance enquiry, mini statement besides host of other services.

Mobile Banking

- Mobile banking is a service provided by a bank that allows its customers to conduct different types of financial transactions remotely using a mobile device.

- It uses software, usually called an app, provided by the banks or financial institution for the purpose. Each Bank provides its own mobile banking App.

Unified Payments Interface (UPI)

- It is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- Each Bank provides its own UPI App.

Mobile Wallets

- It is a way to carry cash in digital format. Instead of using physical plastic card to make purchases, we can pay with our smartphone, tablet, or smart watch.

- An individual’s account is required to be linked to the digital wallet to load money in it.

Aadhaar Enabled Payment System (AEPS)

- AEPS is a bank led model which allows online interoperable financial transaction at PoS (Point of Sale / Micro ATM) through the Business Correspondent or Bank Mitra of any bank using the Aadhaar authentication.

About the Digital Payment Index (DPI) and its Significance

- With the launch of Digital India and the GoI’s push towards Digital Economy, the digital payments in the country has been growing fast.

- The index will reflect the penetration of digital payments in the country.

- The main aim of the index creation is to capture the extent of digitization of monetary payments in the country.

- Payments via digital modes are expected to make transactions more transparent and thereby prevent tax evasion.

- The DPI would be based on multiple parameters and shall reflect accurately the penetration and deepening of various digital payment modes.

- The Digital Payment Index (DPI) comprises of 5 broad parameters with varying weightage to measure the penetration of digital payments.

The 5 key Parameters for the DPI are:

- Payment Enablers (25%)

- Payment Infrastructure – Demand-side Factors (10%)

- Payment Infrastructure – Supply-side Factors (15%)

- Payment performance (45%)

- Consumer centricity (5%)

These factors include multiple sub-parameters that would help the regulator conduct its study into the digital payment ecosystem.

- Payment enablers comprises multiple channels through which digital payments can be accessed. This includes the internet, mobile, Aadhaar, bank accounts, merchants, and participants.

- Under payment performance, which carries the highest weight in the index, the regulator would measure factors such as the volume and value of digital payments, unique users, paper clearing, currency in circulation and cash withdrawals.

-Source: The Hindu

PM UNVEILS PROJECT FOR AFFORDABLE HOUSING

Context:

- Prime Minister Narendra Modi laid the foundation of six Light House Projects, as part of the Global Housing Technology Challenge-India (GHTC-India) initiative, in Indore, Rajkot, Chennai, Ranchi, Agartala and Lucknow via videoconference.

- The Prime Minister gave away annual awards for excellence in six categories for the implementation of Pradhan Mantri Awas Yojana-Urban (PMAY-Urban).

Relevance:

GS-II: Social Justice (Government Interventions and Schemes)

Dimensions of the Article:

- What are Light house projects?

- Details about GHTC-India

- Pradhan Mantri Awas Yojana – Urban (PMAY-U)

What are Light house projects?

- The LHPs are being constructed at Indore (Madhya Pradesh), Rajkot (Gujarat), Chennai (Tamil Nadu), Ranchi (Jharkhand), Agartala (Tripura) and Lucknow (Uttar Pradesh).

- They comprise about 1000 houses at each location along with allied infrastructure facilities.

- These projects will demonstrate and deliver ready to live houses at an expedited pace within twelve months, as compared to conventional brick and mortar construction, and will be more economical, sustainable, of high quality and durability.

- These LHPs demonstrate a variety of technologies, including Prefabricated Sandwich Panel System in LHP at Indore, Monolithic Concrete Construction using Tunnel Formwork etc.

Details about GHTC-India

- GHTC India was launched in 2019, the challenge is undertaken under the Pradhan Mantri Awas Yojana Urban (PMAY-U).

- GHTC aims to fast-track the construction of affordable housing and meet the target of constructing 2 crore houses by 2022.

- GHTC focuses on identifying and mainstreaming proven demonstrable technologies for lighthouse projects and spotting potential future technologies for incubation and acceleration support through ASHA (Affordable Sustainable Housing Accelerators) — India.

- The GHTC provided the scope of incubating new technologies for construction and innovating, he pointed out and called upon planners, architects and students from various universities and institutions to visit sites, learn from the technologies and mould them for use in accordance with local requirements.

- About 1,000 houses at each location are to be constructed in a year, using six distinct technologies from a basket of 54 such technologies shortlisted under the GHTC-India, 2019.

- Addressing the respective Chief Ministers, Governors and other officials, the Prime Minister said the country was getting new technologies for providing resilient, affordable and comfortable houses to the poor and the middle class.

- The cooperation extended by the States in the projects was in a way strengthening cooperative federalism.

Pradhan Mantri Awas Yojana – Urban (PMAY-U)

- PMAY-U was launched by the Ministry of Housing and Urban Poverty Alleviation (MoHUPA).

- It envisions provision of Housing for All by 2022, when the Nation completes 75 years of its Independence.

- Beneficiaries include Economically weaker section (EWS), low-income groups (LIGs) and Middle-Income Groups (MIGs).

- “Housing for All” Mission for urban area is being implemented during 2015-2022 and this Mission will provide central assistance to implementing agencies through States and UTs for providing houses to all eligible families/beneficiaries by 2022.

- Mission will be implemented as Centrally Sponsored Scheme (CSS) except for the component of credit linked subsidy which will be implemented as a Central Sector Scheme.

The Mission seeks to address the housing requirement of urban poor including slum dwellers through following programme verticals:

- Slum rehabilitation of Slum Dwellers with participation of private developers using land as a resource

- Promotion of Affordable Housing for weaker section through credit linked subsidy

- Affordable Housing in Partnership with Public & Private sectors

- Subsidy for beneficiary-led individual house construction /enhancement.

CLSS (Credit Linked Subsidy Scheme) is a component of PMAY under which, not only economically weaker sections, but also middle-income groups can avail of home loans at reduced EMIs.

-Source: The Hindu

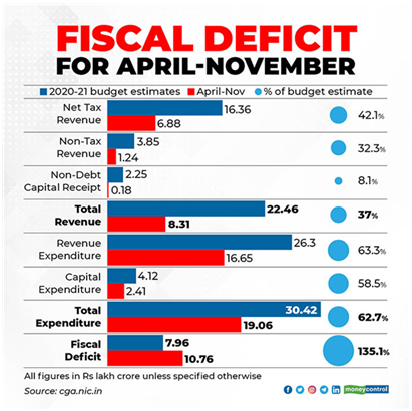

FISCAL DEFICIT SHOOTS UP TO 135% OF TARGET

Context:

India’s fiscal deficit shot up to 135.1% of the Budget target of nearly Rs. 8 lakh crores for 2020-21, in the 8 months from April to November 2020, as per data released by the Controller General of Accounts.

Relevance:

GS-III: Indian Economy

Dimensions of the Article:

- What is Fiscal Deficit?

- Extras: What is Current Account Deficit?

- What was in the News regarding Fiscal Deficit in India

What is Fiscal Deficit?

- A fiscal deficit is a shortfall in a government’s income compared with its spending. The government that has a fiscal deficit is spending beyond its means.

- A fiscal deficit is calculated as a percentage of gross domestic product (GDP), or simply as total dollars spent in excess of income.

- In either case, the income figure includes only taxes and other revenues and excludes money borrowed to make up the shortfall.

Fiscal Deficit = Total Expenditure (Revenue Expenditure + Capital Expenditure) – (Revenue Receipts + Recoveries of Loans + Other Capital Receipts (all Revenue and Capital Receipts except loans taken))

- A recurring high fiscal deficit implies that the government has been spending beyond its means.

- However, the fiscal deficit is seen in almost every economy while the fiscal surplus is quite rare. The high fiscal deficit is not always a negative thing if the amount is utilised for constructing roads, airports, infrastructure, etc. since these will generate revenue in the long run.

- Fiscal Consolidation refers to the policies undertaken by governments (national and sub-national levels) to reduce their deficits and accumulation of debt stock.

Extras: What is Current Account Deficit?

- The current account deficit is a measurement of a country’s trade where the value of the goods and services it imports exceeds the value of the products it exports.

- The current account includes net income, such as interest and dividends, and transfers, such as foreign aid, although these components make up only a small percentage of the total current account.

- The current account represents a country’s foreign transactions and, like the capital account, is a component of a country’s balance of payments (BOP).

What was in the News regarding Fiscal Deficit in India

- Revenue deficit, which had crossed 125% in the first half of the year, almost touched 140% of the Budget target by November 2020 with just about 40% of the annual estimated revenue receipts coming in.

- Government spending, including capital expenditure considered critical to revive the economy, remained lower than a year earlier, though there was a month-on-month uptick in November.

-Source: The Hindu