20th January 2021 Current Affairs for UPSC IAS Exam

Contents

- Arguments for and against a “Bad Bank”

- India to ship vaccine to neighbouring countries

- India prepares to receive first batch of S-400

ARGUMENTS FOR AND AGAINST A BAD BANK

Context:

Reserve Bank of India (RBI) Governor Shaktikanta Das recently agreed to look at the proposal for setting up a bad bank to resolve the growing problem of non-performing assets (NPAs), or loans on which borrowers have defaulted.

Relevance:

GS-III: Indian Economy

Dimensions of the Article:

- Bad Banks Explained

- What is the government’s view on creating a “Bad Bank”?

- What is the RBI’s view on creating a “Bad Bank”?

- How the idea of setting up a “Bad Bank” originated and how has it worked out?

- Will a bad bank solve the problem of NPAs?

- Way Forward: Alternative Options

Bad Banks Explained

- A Bad Bank (usually set up as a government-backed bad bank) is technically an asset reconstruction company (ARC) or an asset management company.

- Bad banks are typically set up in times of crisis when long-standing financial institutions are trying to recuperate their reputations and wallets.

How does it work?

- A bad bank buys the bad loans and other illiquid holdings of other banks and financial institutions, which clears their balance sheet.

- A bad bank structure may also assume the risky assets of a group of financial institutions, instead of a single bank.

- The bad bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans.

What is the government’s view on creating a “Bad Bank”?

- While the finance ministry has not formally submitted its view on the proposal, senior officials have indicated that it is not keen to infuse equity capital into a bad bank.

- The government’s view is that bad loan resolution should happen in a market-led way, as there are many asset reconstruction companies already operating in the private space.

- The government has significantly capitalised state-owned banks in recent years and pursued consolidation in the PSU banking space.

- These steps, along with insolvency resolution under the IBC, are seen as adequate to the tackle the challenge of bad loans.

What is the RBI’s view on creating a “Bad Bank”?

- The central bank has so far never come out favourably about the creation of a bad bank with other commercial banks as main promoters until recently when RBI Governor Das indicated that the RBI can consider the idea of a bad bank to tackle bad loans.

- Former RBI Governor Raghuram Rajan had opposed the idea of setting up a bad bank in which banks hold a majority stake. His view was that “Bad Bank” was basically just shifting loans from one government pocket – the public sector banks, to another government pocket – the bad bank.

- Indeed, if the bad bank were in the public sector, the reluctance to act would merely be shifted to the bad bank.

How the idea of setting up a “Bad Bank” originated and how has it worked out?

- US-based Mellon Bank created the first bad bank in 1988, after which the concept has been implemented in other countries including Sweden, Finland, France and Germany.

- However, resolution agencies or ARCs set up as banks, which originate or guarantee lending, have ended up turning into reckless lenders in some countries.

- The idea gained currency during Rajan’s tenure as RBI Governor.

- The RBI had then initiated an asset quality review (AQR) of banks and found that several banks had suppressed or hidden bad loans to show a healthy balance sheet.

- However, the idea remained on paper amid lack of consensus on the efficacy of such an institution.

- ARCs have not made any impact in resolving bad loans due to many procedural issues.

Will a bad bank solve the problem of NPAs?

- Despite a series of measures by the RBI for better recognition and provisioning against NPAs, as well as massive doses of capitalisation of public sector banks by the government, the problem of NPAs continues in the banking sector, especially among the weaker banks.

- As the Covid-related stress pans out in the coming months, proponents of the concept feel that a professionally-run bad bank, funded by the private lenders and supported the government, can be an effective mechanism to deal with NPAs.

- The bad bank concept is in some ways similar to an ARC but is funded by the government initially, with banks and other investors co-investing in due course.

- The presence of the government is seen as a means to speed up the clean-up process.

- Many other countries had set up institutional mechanisms such as the Troubled Asset Relief Programme (TARP) in the US to deal with a problem of stress in the financial system.

Way Forward: Alternative Options

- Instead of creating a Bad Bank, infusing the capital that would be given to the bad bank directly into the public sector banks is an option.

- The enactment of (Insolvency and Bankruptcy Code) IBC has reduced the need for having a bad bank, as a transparent and open process is available for all lenders to attempt insolvency resolution.

- According to RBI, banks recovered on average more than 40% of the amount filed through the IBC in 2018-19, against just over 20% in total through the SARFAESI, Lok Adalats and Debt Recovery Tribunals.

- A model of Private Asset Management Company (PAMC) which would be suitable for sectors where the stress is such that assets are likely to have economic value in the short run, with moderate levels of debt forgiveness, can be set up.

- National Asset Management Company (NAMC) for sectors where the problem is not just of excess capacity, but possibly also of economically unviable assets in the short- to medium-term, such as in the power sector can also be set up.

-Source: The Hindu

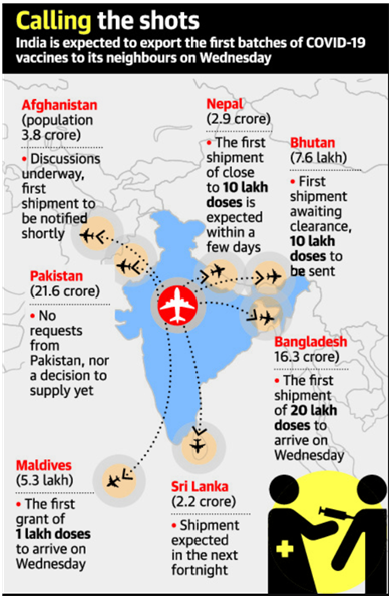

INDIA TO SHIP VACCINE TO NEIGHBOURING COUNTRIES

Context:

India will begin to ship out lakhs of doses of the novel coronavirus vaccine to neighbouring countries with the first batches expected to reach Bhutan and the Maldives among several countries by special planes as a grant or gift.

Relevance:

GS-II: International Relations

Dimensions of the Article:

- India’s generous grant of Vaccines to neighbors

- India as the ‘pharmacy of the world’

- Introduction to India and its policy regarding its neighbours

- India’s Neighbourhood First’ Policy

India’s generous grant of Vaccines to neighbors

- The Ministry of External Affairs said that shipments of the Covid Vaccine to Bhutan, the Maldives, Bangladesh, Nepal, Myanmar and Seychelles would commence in January 2021 itself and shipments to Sri Lanka, Afghanistan and Mauritius are awaiting “necessary regulatory clearances”.

- The release of the shipments is part of the government’s “Neighbourhood First” initiative, and will make India the first country to reach COVID-19 vaccines in South Asia, ahead of China which has promised but not so far delivered, and the World Health Organisation and GAVI’s vaccine alliance programme.

- The region’s preference for Indian vaccines is based on the cost, easier storage requirements and geographical proximity.

- Pakistan has neither requested nor is India discussing supplies to it at present.

India as the ‘pharmacy of the world’

- India is often referred to as ‘the pharmacy of the world’ and this has been proved true especially in the ongoing Covid-19 pandemic when India continued to export critical lifesaving medicines to needy countries even during the countrywide lockdown.

- India enjoys an important position in the global pharmaceuticals sector, as India is the largest provider of generic drugs globally.

- The Indian pharmaceutical industry meets over 50% of global demand for various vaccines, 40% of generic demand in the U.S. and 25% of all medicine in the U.K.

- Presently, over 80% of the antiretroviral drugs used globally to combat AIDS (Acquired Immune Deficiency Syndrome) are supplied by Indian pharmaceutical firms.

- In 2020, India is expected to be amongst the top three pharmaceutical markets in terms of incremental growth.

- The Indian pharmaceuticals market is the world’s third-largest in terms of volume and thirteenth-largest in terms of value. It has established itself as a global manufacturing and research hub.

- India has one of the lowest manufacturing costs in the world – lower than that of the U.S. and almost half of the cost in Europe.

Introduction to India and its policy regarding its neighbours

- India shares its geographical boundary with Afghanistan, Bhutan, Bangladesh, Maldives, Pakistan, Nepal and Sri Lanka.

- India by far is the largest country in terms of area, population, and economic and military capabilities, larger than all its neighbours put together.

- Each neighbour shares some significant ethnic, linguistic or cultural features with India but not so much with the others in the subcontinent. It is this asymmetry which shapes the neighbourhood’s perception of India and vice versa.

- But India also must recognize that the asymmetry is still not of the scale that can compel its neighbours to align their interests with its own. This is the challenge of proximity.

- The ‘Neighbourhood First’ policy of the Indian government actively focuses on improving ties with India’s immediate neighbours.

India’s Neighbourhood First’ Policy

In 2014 India enunciated ‘Neighbourhood first’ policy by inviting leaders of all South Asian Association for Regional Cooperation (SAARC) countries to swearing-in ceremony, of new government.

Salient features of India’s Neighbourhood First’ policy:

- Immediate priority to neighbours: Priority is to improve the relations with immediate neighbours as peace and tranquillity in South Asia is essential for realizing development agenda. The neighbourhood first policy of actively focuses on improving ties with India’s immediate neighbours.

- Dialogue: It focuses on vigorous regional diplomacy by engaging with neighbouring nations and building political connectivity through dialogue. First initiative in this direction was extending an invitation to all heads of government of SAARC countries for the oath taking ceremony of the Prime minister in 2014.

- Resolving bilateral issues: Focus is on resolving bilateral issues through mutual agreement. For instance, India and Bangladesh have signed a pact to operationalise the historic Land Boundary Agreement (LBA).

- Connectivity: India has entered into MoU with members of the South Asian Association for Regional Cooperation (SAARC). These agreements ensure a free flow of resources, energy, goods, labour, and information across borders.

- Economic Cooperation: It focuses on enhancing trade ties with neighbours. India has participated and invested in SAARC as a vehicle for development in the region. One such example is the Bangladesh-Bhutan-India-Nepal (BBIN) grouping for energy development i.e., motor vehicles, waterpower management and inter-grid connectivity.

- Technical Cooperation: The policy put emphasis on technical cooperation. Recently a dedicated SAARC satellite was developed to share the fruits of the technology like tele-medicine, e-learning etc. with the people across South Asia.

- Disaster management: India’s offer cooperation on disaster response, resource management, weather forecasting and communication and also capabilities and expertise in disaster management for all South Asian citizens. For example, India provided immense assistance to its neighbour Nepal in the aftermath of the 2016 earthquake.

- Military and defence cooperation: India is focusing on deepening security in the region through military cooperation. Various exercises like Surya Kiran with Nepal, Sampriti with Bangladesh aim to strengthen defence relations. Also, India has committed to play a greater role in capacity building of the Afghan National Army by providing training to them.

-Source: The Hindu

INDIA PREPARES TO RECEIVE FIRST BATCH OF S-400

Context:

As India prepares to receive the first batch of S-400 long-range air defence system by year-end, the first group of Indian military specialists are scheduled to depart for Moscow soon to undergo training courses on the S-400.

The U.S. did not comment regarding imposition of CAATSA sanctions against India, but said India should consider the impact of such purchases that constrain “technology transfers” and other defence cooperation between India and the US.

Relevance:

GS-II: International Relations, GS-III: Internal Security Challenges

Dimensions of the Article:

- Background to the acquisition of S-400

- Countering America’s Adversaries Through Sanctions Act, CAATSA

- What does it mean for India’s defence landscape?

Background to the acquisition of S-400

- In 2018, India inked an agreement worth more than 5 billion $ with Russia to procure four S-400 Triumf surface-to-air missile defence system, the most powerful missile defence system in the world ignoring the CAATSA act.

- The U.S. threatened India with sanctions over India’s decision to buy the S-400 missile defense system from Russia.

More about S-400

- The S-400 Triumf is a mobile, surface-to-air missile system (SAM) designed by Russia.

- It is the most dangerous operationally deployed modern long-range SAM (MLR SAM) in the world, considered much ahead of the US-developed Terminal High Altitude Area Defense system (THAAD).

- India’s acquisition is crucial to counter attacks in a two-front war, including even high-end F-35 US fighter aircraft.

Countering America’s Adversaries Through Sanctions Act, CAATSA

- The Countering America’s Adversaries Through Sanctions Act, CAATSA is a United States federal law that imposed sanctions on Iran, North Korea, and Russia.

- The Act empowers the US President to impose at least five of the 12 listed sanctions on persons engaged in a “significant transaction” with Russian defence and intelligence sectors.

- The State Department has notified 39 Russian entities including almost all major Russian defence manufacturing and export companies/entities.

- Following the US elections and allegations of Russian meddling some call it collusion in the US elections, the strain between Washington and Moscow has reached a new level.

- Angry with Moscow’s actions around the world, US lawmakers are hoping to hit Russia where it hurts most, its defense and energy business, through CAATSA.

What does it mean for India’s defence landscape?

- As per the Stockholm International Peace Research Institute (SIPRI) Arms Transfer Database, during the period 2010-17, Russia was the top arms supplier to India.

- Most of India’s weapons are of Soviet/Russian origin – nuclear submarine INS Chakra, the Kilo-class conventional submarine, the supersonic Brahmos cruise missile, the MiG 21/27/29 and Su-30 MKI fighters, IL-76/78 transport planes, T-72 and T-90 tanks, Mi-series of helicopters, and Vikramaditya aircraft carrier

- Therefore, CAATSA impacts Indo-US ties and dents the image of the US as a reliable partner.

-Source: The Hindu