Contents

- Base Year for CPI – Industrial Workers Revised

- Sri Lankan 20th Amendment passed

- EC on studying candidates’ expenditure limit

- U.S. asks India to join the Blue Dot Network

- U.S.-India 2+2 talks will focus on regional issues

BASE YEAR FOR CPI – INDUSTRIAL WORKERS REVISED

Focus: GS-III Indian Economy

Why in news?

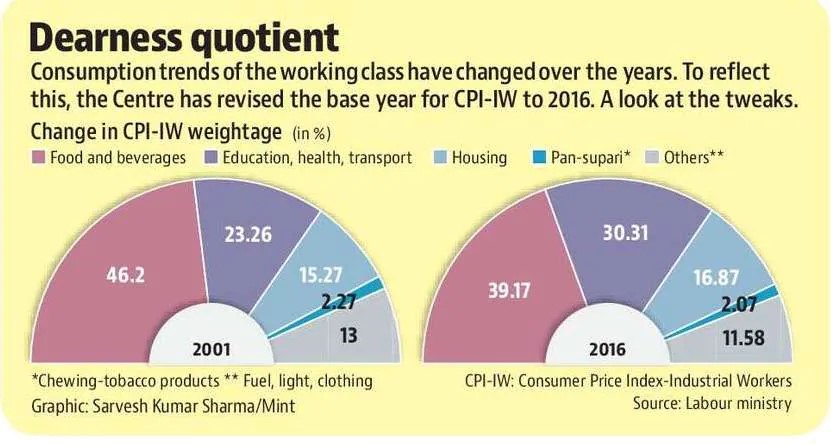

- The Labour and Employment Ministry revised the base year of the Consumer Price Index for Industrial Workers (CPI-IW) from 2001 to 2016 to reflect the changing consumption pattern.

- Labour and Employment Secretary said that in the future, the Bureau would work towards revising the index every five years.

Details

- The change in base year for CPI-IW gives more weightage to spending on health, education, recreation and other miscellaneous expenses, while reducing the weight of food and beverages.

- The new series would not have an impact on the dearness allowance (DA) given to government employees for now.

- The reduction in weight to spending on food and beverages indicated an increase in disposable income.

- The number of centres, markets and the sample size for working class family income and expenditure survey were all increased.

- The number of items directly retained in the index basket has increased to 463 items as against 392 items in the 2001 series.

- The weight of food and beverages has declined over time whereas the weight of miscellaneous group (health; education and recreation; transport and communication; personal care and effects; household goods and services etc.) has increased substantially under 2016 series vis-à-vis earlier series.

- The weight of housing group has reported an increasing share over period of time.

- The weight to food and beverage was reduced from 46.2% to 39%, while spending on housing increased from 15.2% to 17%.

Consumer Price Index (CPI)

- Consumer Price Index (CPI) is the measure of changes in the price level of a basket of consumer goods and services bought by households.

- It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

- The CPI measures the average change in prices over time that consumers pay for a basket of goods and services, commonly known as inflation.

- Changes in the CPI are used to assess price changes associated with the cost of living; the CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

- The weighted average of the prices of goods and services that approximates an individual’s consumption patterns is used to calculate CPI.

- The Consumer Price Index or CPI is calculated by multiplying 100 to the fraction of the cost price of the current period and the base period. CPI = (Cost of basket in current period/ Cost of basket in base period) x 100

Click Here to read more about the Consumer Price Index Numbers for Agricultural Labourers & CPI vs WPI

-Source: The Hindu

SRI LANKAN 20TH AMENDMENT PASSED

Focus: GS-II International Relations

Why in news?

The controversial 20th Amendment to Sri Lanka’s Constitution that envisages expansive powers and greater immunity for the Executive President was passed in Parliament with a two-thirds majority, following a two-day debate.

Now, the spotlight has fallen on two key legislations in Sri Lanka’s Constitution-

- the 19th Amendment, that was passed in 2015 to curb powers of the Executive President, while strengthening Parliament and independent commissions.

- the 13th Amendment passed in 1987, which mandates a measure of power devolution to the provincial councils established to govern the island’s nine provinces.

The 20th Amendment in Sri Lanka – Road to Authoritarianism?

- The 20th Amendment rolls back Sri Lanka’s 19th Amendment (a 2015 legislation that sought to clip presidential powers, while strengthening Parliament).

- The new legislation – the 20th Amendment in turn reduces the Prime Minister’s role to a ceremonial one.

- The Opposition broadly argued that the Amendment threatened to take the country on the path of authoritarianism, giving the President unbridled powers, while government MPs emphasised the need for centralised power for better governance.

The 13th Amendment

- It is an outcome of the Indo-Lanka Accord of July 1987, signed by the then Prime Minister Rajiv Gandhi and President J.R. Jayawardene, in an attempt to resolve Sri Lanka’s ethnic conflict that had aggravated into a full-fledged civil war, between the armed forces and the Liberation Tigers of Tamil Eelam, which led the struggle for Tamils’ self-determination and sought a separate state.

- The 13th Amendment, which led to the creation of Provincial Councils, assured a power sharing arrangement to enable all nine provinces in the country, including Sinhala majority areas, to self-govern.

Why is it contentious?

- The 13th Amendment carries considerable baggage from the country’s civil war years.

- It was opposed vociferously by both Sinhala nationalist parties and the LTTE. The former thought it was too much power to share, while the Tigers deemed it too little.

- Though signed by the powerful President Jayawardene, it was widely perceived as an imposition by a neighbour (India) wielding hegemonic influence.

- Till date, the 13th Amendment represents the only constitutional provision on the settlement of the long-pending Tamil question.

Recently in news: Click Here to read the Editorial Analysis of Shashi Tharoor’s article giving arguments for a Presidential Form of Government in India

Here’s a part of the article:

Reasons for a Presidential System

- For the individual he or she wants to be ruled by, and the president will truly be able to claim to speak for a majority of Indians rather than a majority of MPs.

- At the end of a fixed period of time, the public would be able to judge the individual on performance in improving the lives of Indians, rather than on political skill at keeping a government in office.

- Presidential System will ensure stability of tenure free from legislative whim.

- The Presidential System will provide sufficient power and space to be able to appoint a cabinet of talents,

- With the Presidential system in place, a President will be able to devote his or her energies to governance, and not just to government.

-Source: The Hindu

EC ON STUDYING CANDIDATES’ EXPENDITURE LIMIT

Focus: GS-II Governance

Why in news?

- The Election Commission said that it had set up a committee “to examine the issues concerning expenditure limit for a candidate in view of the increase in number of electors and rise in the Cost Inflation Index and other factors.”

- The expenditure limit for Lok Sabha and Assembly candidates is Rs. 70 lakh and Rs. 28 lakh respectively.

- However, the Law Ministry has approved a 10% hike for the COVID-19 period – As Political parties in the feedback to the Commission had asked for an increase in the expenditure of Bihar assembly elections to meet the increased digital campaign expenses amid the Covid-19 pandemic.

Details

- The committee, comprising former IRS officer and Director General (Investigation) and Secretary General and DG (Expenditure) would submit its report within 120 days of its constitution, an EC statement said.

- It has been tasked with assessing the change in the number of electors across states/UTs and the change in the Cost Inflation Index (CII) and their bearing on expenditure pattern of candidates in recent elections.

- The committee’s terms of reference will include assessment of the change in the number of electors and its bearing on spending, assessment of the change in the Cost Inflation Index and to examine other factors that may impact the expenditure.

Revision of Expenditure Limits in the past

- The expenditure limit for a candidate was last revised in 2014, and for Andhra Pradesh and Telangana, it was revised in 2018, the EC said.

- In last six years the limit was not increased despite increase in electorate from 834 million to 910 million in 2019 to 921 million now.

- Further, the Cost Inflation Index during this period has increased from 220 to 280 in 2019 to 301 now.

What is Expenditure Limit?

- It is the amount an election candidate can legally spend for their election campaign and has to account for, which includes expenses on public meetings, rallies, advertisements, posters, banners vehicles and advertisements.

- These limits range from Rs. 20 lakh to Rs. 28 lakh for assembly elections and from Rs. 54 lakh to Rs. 70 lakh for Lok Sabha elections.

- Under Section 77 of the Representation of the People Act (RPA), 1951, every candidate shall keep a separate and correct account of all expenditure incurred between the date on which they have been nominated and the date of declaration of the result.

- All candidates are required to submit their expenditure statement to the ECI within 30 days of the completion of the elections.

- An incorrect account or expenditure beyond the cap can lead to disqualification of the candidate by the ECI for up to three years, according Representation of Peoples Act (RPA), 1951.

- The limit prescribed by the ECI is meant for legitimate expenditure because a lot of money in elections is spent for illegitimate purposes.

Critcisms

- It has often been argued that these limits are unrealistic as the actual expenditure incurred by the candidate is much higher.

- In 2019, a private member’s bill was introduced in the Parliament which intended to do away with the cap on election spending by candidates. The move was taken on the ground that the ceiling on election expenses ends up being counterproductive by encouraging candidates to under-report their expenditure.

- There is no cap on a political party’s expenditure, which is often exploited by candidates of the party. However, all registered political parties have to submit a statement of their election expenditure to the ECI within 90 days of the completion of the elections.

Possible Way Forward: State Funding of Elections

- In this system, the states bear the election expenditure of political parties contesting the Election.

- This can bring transparency in the funding process as public finance can limit the influence of interested donors’ money and thereby help curb corruption.

Recommendations by various committees

- Indrajit Gupta Committee (1998) suggested that state funding would ensure a level playing field for poorer political parties and argued that such a move would be in public interest. It also recommended that state funds should only be given to recognised national and State parties and funding should be given in the form of free facilities provided to these parties and their candidates.

- Law Commission Report (1999) stated that a state funding of elections is ‘desirable’ provided that political parties are prohibited from taking funds from other sources.

- National Commission to Review the Working of the Constitution (2000) did NOT support the idea but mentioned that an appropriate framework for the regulation of political parties needs to be implemented before state funding is considered.

ECI’s stand

The ECI is not in favour of state funding of elections on the grounds that it would not be able to prohibit or check candidates’ and other expenditures over and above what is provided for by the state.

-Source: The Hindu

U.S. ASKS INDIA TO JOIN THE BLUE DOT NETWORK

Focus: GS-II International Relations

Why in news?

- A bipartisan group of Senators had written a letter to India’s Ambassador to the United States which included an invitation for India to join the Blue Dot Network.

- The letter also says strengthening the Quad — the group comprising India, the U.S., Australia and Japan — has become especially important in the face of China’s “rising military and economic assertiveness”.

The Blue Dot Network

- The Blue Dot Network is a U.S.-led collaboration with Australia and Japan that supports private-sector led infrastructure financing opportunities in response to China’s Belt and Road Initiative (BRI).

- The BDN was formally announced in 2019 at the Indo-Pacific Business Forum in Bangkok, Thailand.

- It is a multi-stakeholder initiative to bring together governments, the private sector and civil society to promote high-quality, trusted standards for global infrastructure development.

- It is expected to serve as a globally recognized evaluation and certification system for roads, ports and bridges with a focus on the Indo-Pacific region.

- This system would apply to projects in any citizen-centric country where citizens would like to evaluate such projects.

- It is planned as a direct counter to China’s Belt and Road Initiative (BRI).

- However, unlike the BRI, the BDN would not offer public funds or loans for the project.

- Blue Dot certification: BDN will serve as a globally recognized seal of approval for major infrastructure projects, letting people know that projects are sustainable and not exploitative.

-Source: The Hindu

U.S.-INDIA 2+2 TALKS WILL FOCUS ON REGIONAL ISSUES

Focus: GS-II International Relations

Why in news?

India and the U.S. will discuss “salient regional” issues when U.S. Secretary of State and U.S. Defence Secretary travel to India for the “2+2 Ministerial dialogue”.

Details

- The Third India-U.S. 2+2 Ministerial Dialogue will entail a comprehensive discussion on cross-cutting bilateral issues of mutual interest.

- In addition, both sides will also exchange views on salient regional and global issues.

- India and U.S. have a comprehensive global strategic partnership which includes political, security and defence, economic, commercial, technology and people-to-people contacts.

- The 2+2 Foreign and Defence Minister’s mechanism, which was announced by U.S. President Trump and PM Modi during their first meeting in 2017, was held in 2018 and 2019.

- It replaced the “India-U.S. Strategic and Commercial dialogue”, involving the Foreign and Commerce Ministers, announced by then U.S. President Barack Obama and PM Modi in 2015.

-Source: The Hindu