Contents:

- FLAMINGOS FLOCK TO PULICAT LAKE

- EXPLAINED: WHO WAS SWAMI SHRADDHANAND

- EXPLAINED: WHAT IS SNOWEX

- WORST IS NOT OVER YET, RBI FORECASTS NPAs WILL RISE

FLAMINGOS FLOCK TO PULICAT LAKE

The annual flamingo festival in Nellore district is round the corner with the winged visitors arriving in large numbers on their annual sojourn

More than 40,000 flamingos can be seen in action at the lake

More about Pulicat lake

- Pulicat Lagoon is considered to be the second largest brackish water body in India measuring 759 square kilometres (293 sq mi).

- The Lagoon is one of the three important wetlands to attract North-East Monsoon rain clouds during October to December season to Tamil Nadu.

- The lagoon comprises the

following regions, which adds up 759 square kilometres (293 sq mi)

according to Andhra Pradesh Forest Department:

- 1) Pulicat Lake (Tamil Nadu-TN & Andhra Pradesh-AP)

- 2) Marshy/Wetland Land Region (AP)

- 3) Venadu Reserve Forest (AP)

- 4) Pernadu Reserve Forest (AP)

- The lagoon is cut across in the middle by the Sriharikota Link Road, which divided the water body into lake and marshy land.

- The lake encompasses the Pulicat Lake Bird Sanctuary.

- The barrier island of Sriharikota separates the lake from the Bay of Bengal and is home to the Satish Dhawan Space Centre.

- Major part of the lake comes under Nellore district of Andhra Pradesh

EXPLAINED: WHO WAS SWAMI SHRADDHANAND

Why in News?

On December 23, 1926, Arya Samaj missionary Swami Shraddhanand was assassinated by a man called Abdul Rashid.

Who was Swami Shraddhanand?

- Shraddhanand was born on February 22, 1856 in Punjab province. Sometime in the early 1880s, he came into contact with Swami Dayanand, the founder of the Arya Samaj.

- Shraddhanand wrote a book called “Hindu Sangathan”.

- He called untouchability a “curse” and a “blot” on the reputations of the Hindus.

What is Arya Samaj?

• The most profound reform movement which can be

also termed as revivalist movement in the late 19th century India was the Arya

Samaj.

• It started in the western India and the Punjab, and gradually spread to a

large part of the Hindi heartland.

• It was founded by Dayanand Saraswati (1824-83).

• In 1875, he wrote Satyarth Prakash (or the light of truth) and in the same

year founded the Bombay Arya Samaj.

• The Lahore Arya Samaj was founded in 1877. Subsequently, Lahore became the

epicentre of the Arya movement.

• Dayanand opposed a ritual-ridden Hindu religion and called for basing it on

the preaching of the Vedas. Only Vedas, along with their correct analytical

tools, were true.

• He attacked puranas, polytheism, idolatry and domination of the priestly

class.

• He adopted Hindi for reaching out to the masses.

• He also opposed child marriage.

• He was fiercely opposed to multiplicity of castes which he thought was

primarily responsible for encouraging conversion of lower castes into

Christianity and Islam.

• After Dayanand’s death in 1883, the Samaj lay scattered.

• Most important attempt to unite the Samaj and its activities was the founding

of the Dayanand Anglo Vedic Trust and Management Society in Lahore in

1886.

• In 1886, this society opened a school with Lala Hansraj as its principal.

However, some leaders of the Samaj like Munshi Ram (Swami Shraddhanand),

Gurudatt, Lekh Ram and others were opposed to Anglo Vedic education.

• They argued that the Arya Samaj’s educational initiative must focus on

Sanskrit, Aryan ideology and Vedic scriptures and should have little space for

English learning.

• This militant wing thought that Dayanand’s words were sacrosanct and his

message in Satyarth Prakash could not be questioned.

• While the moderate wing led by Lala Hansraj and Lajpat Rai pointed out that

Dayanand was a reformer and not a rishi or sadhu.

• Conflicts also arose over the control of the DAV Management Society.

• These differences finally led to a formal division of the Arya Samaj in 1893

when Munshiram broke away along with his supporters to initiate a gurukul-based

education. Therefore, after 1893 the two wings of the Arya Samaj were – DAV

group and Gurukul group.

• Munshi Ram and Lekh Ram devoted themselves to popularizing of the teachings

of the Vedas and began an Arya Kanya Pathsala at Jalandhar to safeguard

education from missionary influence.

• In 1902, Munshi Ram founded a Gurukul at Kangri in Haridwar. This institute

became the centre of the gurukul education wing of the Arya Samaj in India. It

was here that Munshi Ram adopted sanyas and became Swami Shraddhanand.

• The two wings of the Arya Samaj, i.e. DAV wing and the Gurukul wing had

differences on the question of education but were united on important political

and social issues of the time.

• The Arya Samaj as a whole opposed conversion of Hindus to Islam and

Christianity and therefore advocated re-conversion of recent converts to

Hinduism. This process was called shuddhi.

• They also advocated greater usage of Hindi in Devanagari script.

• In the 1890s, the Arya Samaj also raised the issue of cow slaughter and

formed gaurakshini sabhas (or the cow protection societies) for protection of

cows.

• The Arya Samaj led a prolonged movement against untouchability and advocated

dilution of caste distinctions.

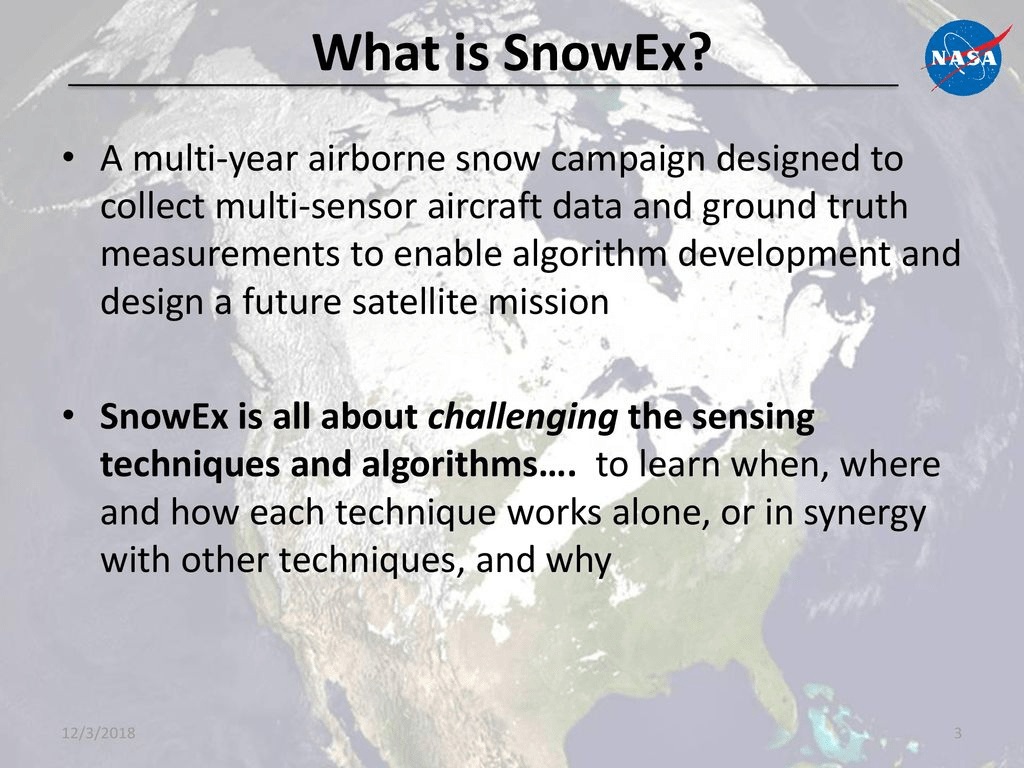

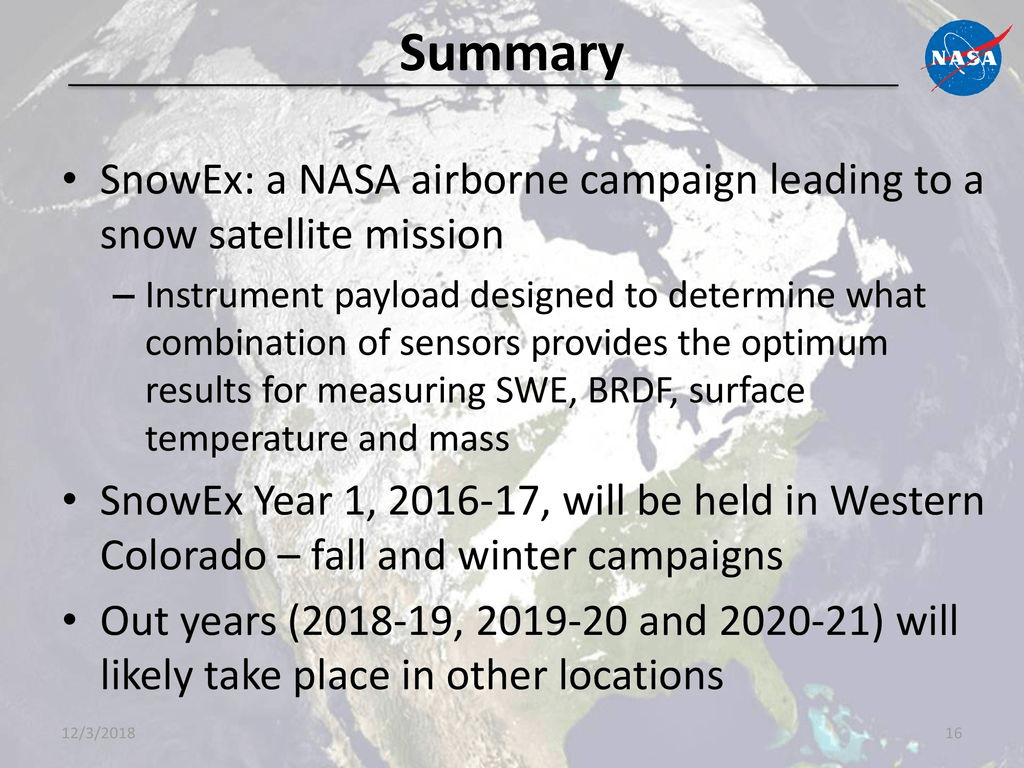

EXPLAINED: WHAT IS SNOWEX

Why in News?

For a better understanding of how much water is contained in each winter’s snowfall and how much will be available when it melts in the spring, NASA has launched a seasonal campaign — part of a five-year programme called SnowEx, initiated in 2016-17.

What is it?

- While the geographical focus of SnowEx is North America, NASA’s overall target is optimal strategies for mapping global snow water equivalent (SWE) with remote sensing and models leading to a Decadal Survey “Earth System Explorer” mission.

- Within its geographic range, SnowEx assesses where snow has fallen, how much there is and how its characteristics change as it melts.

- It uses airborne measurements, ground measurements and computer modelling.

- The airborne campaign will fly radar and lidar (light detection and ranging) to measure snow depth, microwave radar and radiometers to measure SWE, optical cameras to photograph the surface, infrared radiometers to measure surface temperature, and hyperspectral imagers for snow cover and composition.

- Ground teams will measure snow depth, density, accumulation layers, temperature, wetness and snow grain size — the size of a typical particle.

- This year, real-time computer modelling will be integrated into the campaign as well.

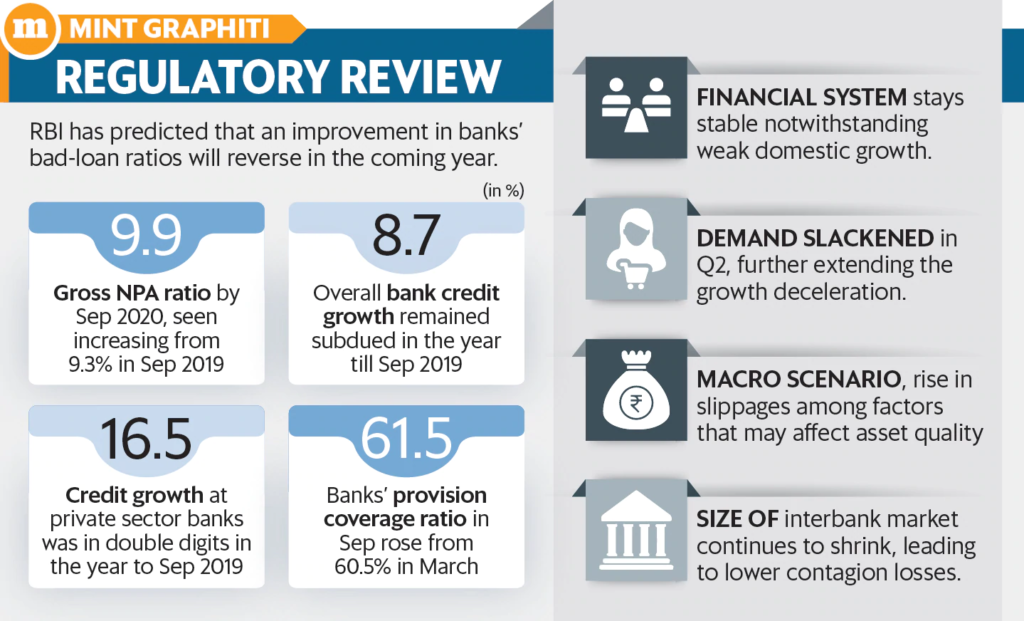

WORST IS NOT OVER YET, RBI FORECASTS NPAs WILL RISE

Why in News?

In its latest Financial Stability Report, the central bank says there remains an inherent risk of‘froth’ building up in the system due to excess liquidity

Governor Shaktikanta Das warns against unbridled rate cuts that may cause a ‘cobra effect

What is Cobra effect?

When a well-intentioned solution ends up worsening the problem.

What was in report?

- The challenge is to ensure transmission of monetary policy impulses to the advantage of real economies and not to aid build-up of froth in financial markets. We need to be mindful of the cobra effect.

- The RBI has cut policy rates by 135 basis points so far this year.

- Multilateral trade and evolving geopolitical uncertainties may continue to have repercussions across financial markets globally.

- PSU bank’s gross non-performing asset ratio may rise from 12.7% in September 2019 to 13.2% by September 2020.

- Private sector banks, too, could see an increase in gross NPAs from 3.9% to 4.2% in the period under consideration.

- A severe shock could bring down the capital adequacy of five banks below 9%.

- The RBI report said reviving the twin engines of India’s economic growth — private consumption and investment — while being vigilant about developments in global financial markets remain a critical challenge for the central bank.

- While the outlook for capital inflow remains positive, India’s exports could face headwinds in the event of sustained global slowdown, but current account deficit is likely to be under control, reflecting muted energy price outlook.

- India’s financial system remains stable notwithstanding domestic growth.

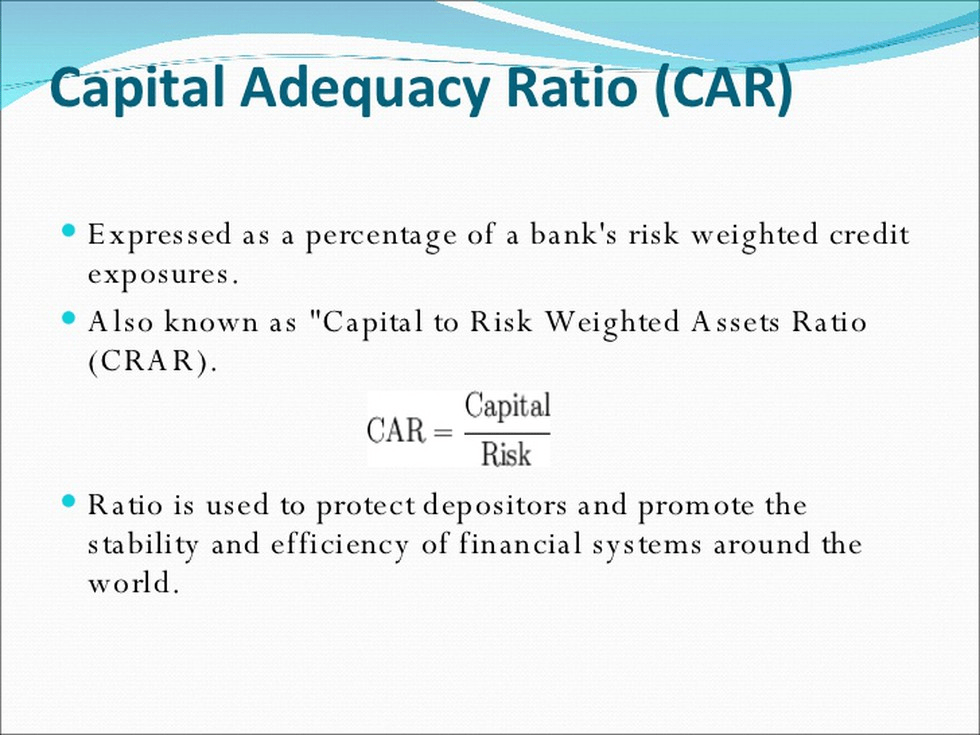

What is capital adequacy ratio?

- Capital Adequacy Ratio (CAR)

is the ratio of a bank’s capital in relation to its risk weighted assets

and current liabilities. It is measured as:

- Capital

Adequacy Ratio = (Tier I + Tier II + Tier III (Capital funds)) /Risk

weighted assets

- The risk weighted assets

take into account credit risk, market risk and operational risk.

- Capital

Adequacy Ratio = (Tier I + Tier II + Tier III (Capital funds)) /Risk

weighted assets

- It is decided by central

banks and bank regulators to prevent commercial banks from taking excess

leverage and becoming insolvent in the process.

- Criteria:

- The Basel

III norms stipulated a capital to risk weighted assets of 8%.

- However, as per RBI norms,

Indian scheduled commercial banks are required to maintain a CAR of 9%

while Indian public sector banks are emphasized to maintain a CAR of

12%.

- The Basel

III norms stipulated a capital to risk weighted assets of 8%.

Need of High CAR: Debate

- Government is complaining

about the ‘unnecessary’ high capital requirements. Govt. wants the capital

adequacy ratio of banks to be at 8% as per Basel norms, but RBI has

prescribed 9%.

- Arguments by

of RBI:

- Maintaining adequate levels

of bank capital enable banks to sustain unexpected losses without

defaulting on its obligations, especially deposits.

- Though higher capital

involves costs, “there is no free lunch”. Also, the costs to the economy are

offset by the savings made in the preventing Banking crises.

- It is a misconception

that capital was some sort of “rainy-day fund” and that the economy was

deprived of that money. Instead, the capital maintained by banks is

deployed on its balance sheet towards creating assets.

- While the argument that higher

capital requirement leads to lower credit growth is ‘mathematically

correct’ but data shows that credit growth in the Indian economy is in line with

nominal GDP growth.

- RBI also warned that in the

past, high levels of credit growth due to ‘supply push’ have

resulted in NPAs in the banking system.

- Any loosening of the prudential norms may result in a reset of their credibility in the international markets. This might push the clients to other banks which are compliant with Basel standards.

- Maintaining adequate levels

of bank capital enable banks to sustain unexpected losses without

defaulting on its obligations, especially deposits.