Context:

The Narendra Modi Government reduced excise duty on petrol and diesel and this reduction was ‘dedicated’ the reduction to farmers for keeping “the economic growth momentum going even during the Covid-19 Pandemic.

However, the Centre has been levying around ₹31 and ₹33 as additional cess on petrol and diesel, respectively, till the beginning of November 2021.

Relevance:

GS-III: Indian Economy (Taxation, Issues relating to Planning, Mobilization of Resources), GS-II: Polity and Governance (Centre-State Relations)

Dimensions of the Article:

- Current Pricing of Petrol and Diesel

- How much tax we pay on petrol and diesel?

- Concerns regarding the pricing of petrol

- About the Revenue collected from Fuel pricing

- Relevance of Revenue-Neutral Rate (RNR)

- Back to the Basics: Financial relations between Centre and States

- Distribution of tax revenues between the Centre and States at Present

Current Pricing of Petrol and Diesel

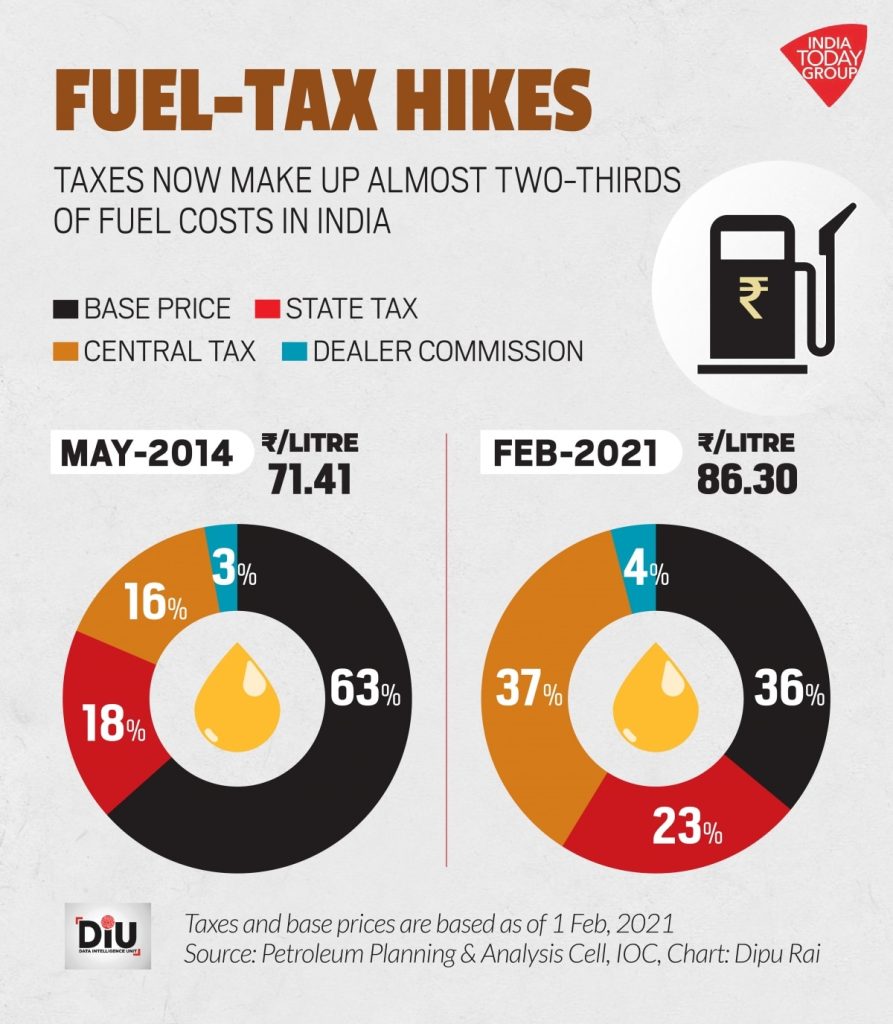

- As per the latest (as of March 2021) price-build of petrol and diesel: State taxes had a smaller contribution to the retail price than central taxes.

- While the state Value Added Tax (VAT) was just over 10 and 20 rupees, on diesel and petrol respectively, the union excise duties for both petrol and diesel exceeded 30 Rs.

- These headline numbers suggest that the centre is a bigger beneficiary of tax incomes from the sale of petrol and diesel.

- This is because FFC’s earmarked share of states in centre’s revenues applies to what is called the divisible pool of taxes, which excludes cess and other forms of special taxes. Overtime, the weight of cess and other such non-sharable taxes has been increasing in the centre’s gross tax revenue. This, in practice, has meant that the share of states in gross total revenue of the centre has never reached 41% and in fact gone down overtime.

How much tax we pay on petrol and diesel?

- The Union and state levies put together account for roughly 55 per cent and 52 per cent of the retail price of petrol and diesel respectively.

- These work out to around 135 per cent and 116 per cent of the base prices of the two products respectively.

- The central levy on petrol and diesel works out to around 36 per cent of the retail price while the state component is around 20 per cent (diesel) to 28 per cent (petrol).

- Of the total central levies on petrol and diesel, Rs 1.40 per litre and Rs 1.80 per litre is the basic excise duty for the two fuels, and Rs 11 per litre and Rs 18 per litre is the special additional excise duty.

- Both these components form part of the divisible pool of taxes i.e. 42 per cent of which (approximately Rs 52,000 crore) goes to the states.

- The remaining portion of Rs 18 per litre in both cases is the Road and Infrastructure Cess and Rs 2.50 per litre and Rs 4 per litre is the Agriculture Infrastructure and Development Cess which are retained by the Centre.

Concerns regarding the pricing of petrol

- The surcharge is an additional charge or tax over and above the existing tax while the cess is a form of tax levied by the government on tax with a specific purpose. Article 270 of the Constitution describes a Cess and surcharge is dealt with under Article 271 of the Constitution.

- Some states have been critical of the Centre’s usage of these provisions. For example, the Centre has been levying around ₹31 and ₹33 as additional cess on petrol and diesel, respectively, till the beginning of November.

- They highlight that in some cases, they are manifold higher than the basic taxes which is a misuse of the provisions of the constitution.

- Since these additional charges are not part of the divisible pool, it undermines the fiscal federalism as enumerated in the Constitution and the autonomy of the states.

- Article 271 which was supposed to be used as a saving clause is being misused by the Centre.

About the Revenue collected from Fuel pricing

- According to the data released by Petroleum Planning and Analysis Cell (PPAC), the Centre has collected around ₹3.72 lakh crore in 2020-21 as revenue from petroleum products. Of this, only around ₹18,000 crores are collected as Basic Excise Duty. Around ₹2.3 lakh crore is collected as cess and the rest ₹1.2 lakh crore is collected as special additional excise duty.

- The divisible pool of 41% as decided by the Finance Commission applies only to the ₹18,000 crores.

- Even after the implementation of GST, States had retained the right to decide on the taxes on petroleum products and alcohol. With the usage of these additional taxes, the Centre has been unilaterally taking away the tax revenues which should be shared with the states.

- The need to alleviate the stress caused by the pandemic has increased the financial burden on the States. States need assistance to offer financial and social security to people.

Relevance of Revenue-Neutral Rate (RNR)

- A key aspect of GST implementation was that it would be a revenue-neutral rate (RNR) to ensure that the State’s revenues would not be diminished.

- Pre- GST, the average tax on goods was 16%. It is 11.3% at present. States are criticising that most essential items are more expensive than the pre-GST price and that the reforms have not benefited the consumers.

- States would have received at least ₹3-lakh crore additionally if the pre-GST rates were maintained. A detailed study must be conducted on why the States are losing their revenue streams.

- States are also apprehensive about the National Monetisation Pipeline and other neoliberal policies due to the mistrust which is increasing.

Back to the Basics: Financial relations between Centre and States

Articles 268 to 293 in Part XII of the Constitution along with some other provisions deal with Centre-State financial relations.

Taxing Powers

- The Parliament has exclusive power to levy taxes on the 13 subjects enumerated in the Union List, and the State legislature has exclusive power to levy taxes on the 18 subjects enumerated in the State List.

- Although there are no tax entries in the Concurrent List, the 101st Amendment Act of 2016 has made an exception by making a special provision with respect to Goods and Services Tax (GST), conferring concurrent power upon both the Parliament and the State Legislatures to make laws governing GST.

- The residuary power of taxation (that is, the power to impose taxes not enumerated in any of the three lists) is vested in the Parliament – e.g.: gift tax, wealth tax and expenditure tax.

- The Constitution also draws a distinction between the power to levy and collect a tax and the power to appropriate the proceeds of the tax so levied and collected.

Distribution of tax revenues between the Centre and States at Present

| Article | Levied, Collected and Appropriated by/ Distributed to: | Type of taxes in the Category | Description |

| Art. 268 | Levied by: Centre Collected by: States Appropriated by States | Stamp duties on bills of exchange, promissory notes, policies of insurance etc. | The proceeds of these duties levied within any state do not form a part of the Consolidated Fund of India, but are assigned to that state. |

| Art. 269 | Levied by: Centre Collected by: Centre Assigned to: States | -Taxes on the sale or purchase of goods (other than newspapers) in the course of inter-state trade or commerce. -Taxes on the consignment of goods in the course of inter-state trade or commerce. | The net proceeds of these taxes do not form a part of the Consolidated Fund of India and are assigned to the concerned states in accordance with the principles laid down by the Parliament. |

| Art. 269-A | Levied by: Centre Collected by: Centre Divided between Centre and States | The Goods and Services Tax (GST) on supplies in the course of inter-state trade or Commerce. The Goods and Services that are EXCLUDED from GST are petroleum products, alcoholic drinks, and electricity (As of 2021). | Distribution is based on the manner provided by Parliament on the recommendations of the GST Council. Parliament can also determine the place and time of supply of goods or services in the course of inter-state trade or commerce. |

| Art. 270 | Levied by: Centre Collected by: Centre Distributed between Centre and States | All taxes and duties in the Union List except: i- Duties and taxes in Articles 268, 269 and 269-A (the above ones). ii- Surcharge on taxes and duties in Article 271. iii- Any cess levied for specific purposes. | The manner of distribution of the net proceeds of these taxes and duties as prescribed by the President on the recommendation of the Finance Commission. |

| Art. 271 | Belonging to the Centre exclusively | The Parliament can levy surcharges on taxes and duties referred to in Articles 269 and 270 (mentioned above). | The states have no share in these surcharges. GST is exempted from this surcharge. |

| – | Belonging to the States exclusively | Taxes on 18 subjects in the State list including land, buildings, agricultural income, succession to agricultural land, mineral rights, alcoholic drinks, electricity, fuel, vehicles, toll booths etc. | These taxes are levied and collected and retained by States and the Centre has no share in it. |

-Source: The Hindu