Why in news?

NAA with the Centre stepping up a GST, A wave of orders is expected in the months of February, March and April of 2020, with the Centre stepping up a goods and services tax (GST) compliance drive.

Background

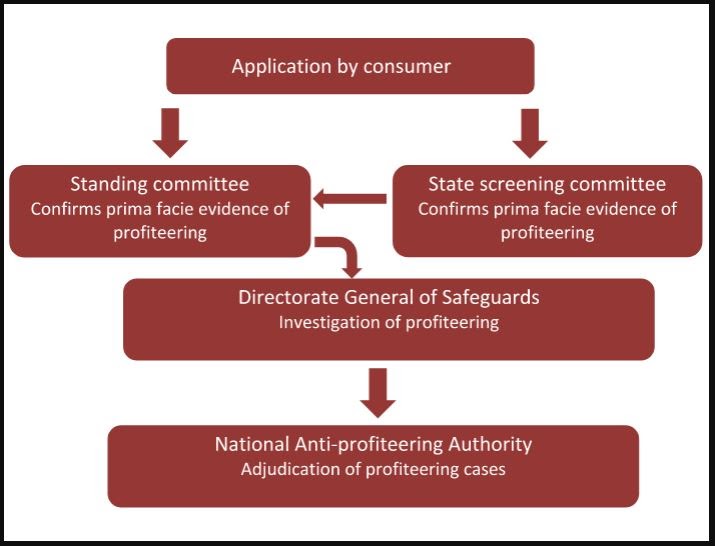

- The National Anti-profiteering Authority (NAA) was established under section 171 of the Central Goods and Services Tax Act, 2017.

- The NAA was set up to monitor and to oversee whether the reduction or benefit of input tax credit is reaching the recipient by way of appropriate reduction in prices.

- National Anti-profiteering Authority (NAA) is therefore primarily constituted by the central government to analyse whether input tax credits availed by any registered person or the reduction in the tax is passed onto the consumer and he/she is protected from random price increase for self-interests in the name of GST.

- NAA has the authority to deregister an entity or business if it fails to pass on the benefit of lower taxes under GST to the customer.

- Deregistering a business will be the last course of action and extreme step against any violator

- NAA will recommend the return of undue profit which a business earned from not passing on reduction and benefit of tax to consumers along with an 18 per cent interest. It can also impose a penalty if it sees it necessary.