Contents:

- Setting the stage for the Sixteenth Finance Commission

- Avian influenza virus kills Antarctica Penguin

- Key Highlights of Union Budget 2024

- Payments Bank

- ED arrests former Jharkhand Chief Minister

- India and UAE sign Bilateral investment treaty

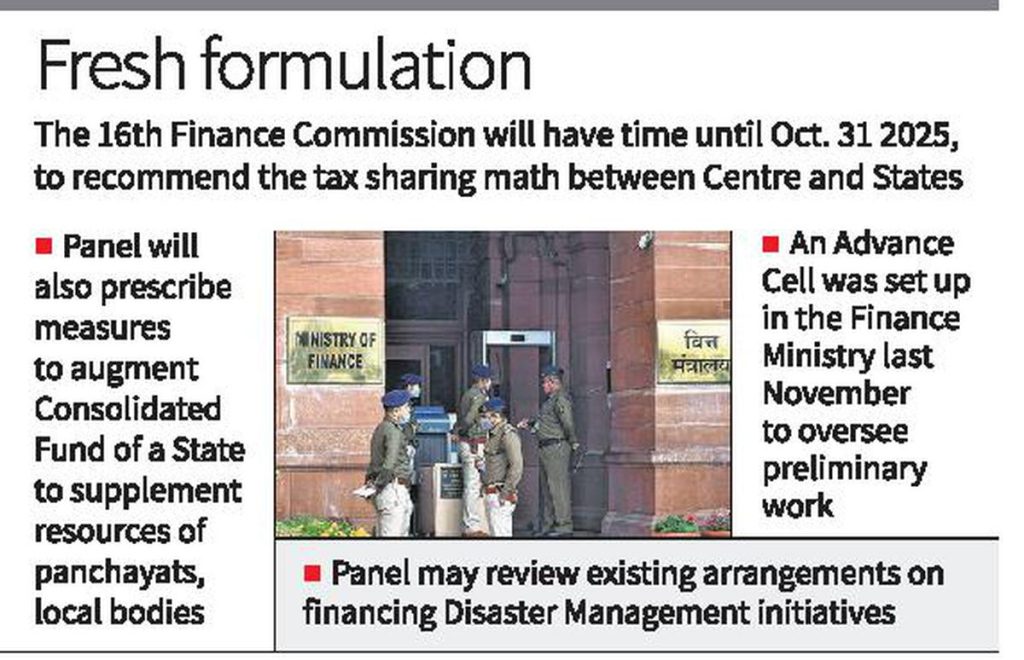

Setting the Stage for the Sixteenth Finance Commission

Context:

Recently the centre notified the appointment of four full-time members for the panel tasked with recommending the tax-revenue sharing formula between the Centre and the States for the five-year period beginning April 2026.

- Former Expenditure Secretary Ajay Narayan Jha, who was also part of the Fifteenth Finance Commission that was headed by N.K. Singh, has been reappointed as a member of the new panel.

Relevance:

GS 3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Dimensions of the Article:

- The Sixteenth Finance Commission

- About Finance Commission (FC);-

- Functions of the Finance Commission;-

- Finance Commission and Qualifications of its Members;-

- The recommendations of the Finance Commission are implemented as under:-

- Need for a Finance Commission

The Sixteenth Finance Commission:

- The Sixteenth Finance Commission was constituted on 31 December 2023 with Shri Arvind Panagariya, former Vice-Chairman, NITI Aayog as its Chairman.

- The terms of reference of the Commission include a review of the present arrangements for financing disaster management initiatives and mooting measures to augment States’ consolidated funds to supplement resources available with panchayats and municipalities.

- October 2025 is the deadline set for the commission to submit its recommendations

- The chairman and other members of the commission shall hold office from the date on which they respectively assume office up to the date of the submission of report or October 31, 2025, whichever is earlier

About Finance Commission (FC);-

- The Finance Commission (FC) is constituted by the President of India every fifth year under Article 280 of the Constitution.

- The Fifteenth Finance Commission (XV-FC) was constituted in November 2017 to give recommendations for vertical and horizontal devolution of taxes for five fiscal years, commencing 1 April 2020.

- Finance Commission is a constitutional body, that determines the method and formula for distributing the tax proceeds between the Centre and states, and among the states.

- Two distinctive features of the Commission’s work involve redressing the vertical imbalances between the taxation powers and expenditure responsibilities of the centre and the States respectively and equalization of all public services across the States.

- The Finance Commission also decides the share of taxes and grants to be given to the local bodies in states. This part of tax proceeds is called Finance Commission Grants, which is a part of the Union Budget.

- The Finance Commission has a chairman and four members appointed by the President of India.

- They hold office for such period as specified by the president in his order. They are eligible for reappointment.

- The 15th Finance Commission was constituted by the President of India in November 2017, under the chairmanship of NK Singh. Its recommendations will cover a period of five years from April 2020 to March 2025.

- The share of states in the center’s taxes is recommended to be decreased from 42% during the 2015-20 period to 41% for 2020-21. The 1% decrease is to provide for the newly formed Union Territories of Jammu and Kashmir, and Ladakh from the resources of the central government.

Functions of the Finance Commission;-

- It is the duty of the Commission to make recommendations to the President as to:-

- The distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them and the allocation between the States of the respective shares of such proceeds.

- The principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India.

- The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the State on the basis of the recommendations made by the Finance Commission of the State.

- Any other matter referred to the Commission by the President in the interests of sound finance.

- The Commission determines its procedure and have such powers in the performance of their functions as Parliament may by law confer on them.

Finance Commission and Qualifications of its Members;-

The Finance Commission is appointed by the President under Article 280 of the Constitution.

As per the provisions contained in the Finance Commission [Miscellaneous Provisions] Act, 1951 and The Finance Commission (Salaries & Allowances) Rules, 1951, the Chairman of the Commission is selected from among persons who have had experience in public affairs, and the four other members are selected from among persons who:-

- Are, or have been, or are qualified to be appointed as Judges of a High Court or

- Have special knowledge of the finances and accounts of Government or

- Have had wide experience in financial matters and in administration or

- Have special knowledge of economics

The recommendations of the Finance Commission are implemented as under:-

Those to be implemented by an order of the President

- The recommendations relating to distribution of Union Taxes and Duties and Grants-in-aid fall in this category.

- Those to be implemented by executive orders.

- Other recommendations to be made by the Finance Commission, as per its Terms of Reference

Need for a Finance Commission;-

- The Indian federal system allows for the division of power and responsibilities between the centre and states. Correspondingly, the taxation powers are also broadly divided between the centre and states.

- State legislatures may devolve some of their taxation powers to local bodies

-Source: The Hindu

Avian Influenza Virus Kills Antarctica Penguin

Context:

First penguin death in the Antarctic from H5N1 bird flu raise concerns of an impending ecological disaster.

Relevance:

GS II: Health, GS-III: Environment and Ecology

Dimensions of the Article:

- Antarctica Penguin

- What is H5N1 Avian Influenza?

- Avian Influenza in India

- Influenza Virus Types

Antarctica Penguin:

- The Antarctic was the sole major geographical region where high pathogenicity avian influenza virus had not been previously identified.

- Concerns have been raised by experts about the impact of the potentially devastating disease on remote penguin populations.

- The death of one king penguin is suspected to have been due to bird flu. This will be the first of the species to be killed by the highly contagious H5N1 virus in the wild if confirmed.

- Earlier, a gentoo penguin succumbed to H5N1 at the same location, and another gentoo penguin was confirmed to have died from the virus on the Falkland Islands.

- Previous outbreaks in South Africa, Chile, and Argentina demonstrated the high vulnerability of penguins to the disease, resulting in the death of over 500,000 seabirds, including penguins, pelicans, and boobies, in South America.

- Birds such as penguins in the region are highly susceptible to the virus as they have never encountered the virus before and lacked prior immunity.

- About King Penguins:

- These are the world’s second-largest penguin species, standing about 3 feet tall.

- They are capable of living over 20 years in the wild.

- A 2018 study predicted that king penguins in Antarctica could face extinction by the end of the century.

What is H5N1 Avian Influenza?

- Avian influenza or bird flu refers to the disease caused by infection with avian influenza Type A viruses.

- H5N1 avian influenza is a highly infectious and often deadly strain of the influenza virus that primarily affects birds, but can also infect humans.

- Virus can infect mammals from birds, a phenomenon called spillover, and rarely can spread between mammals.

- The virus is primarily found in birds such as chickens, ducks, and geese, and can be transmitted to humans who come into close contact with infected birds, either live or dead, or their secretions and excretions.

- Symptoms of H5N1 in humans are similar to those of other types of influenza, and may include fever, cough, sore throat, headache, muscle aches, and pneumonia. In severe cases, H5N1 can cause respiratory failure and death.

Transmission:

- Transmission of the virus from human to human is rare, but it is possible.

- Most cases of H5N1 infection in humans have occurred in individuals who had close contact with infected birds.

- There have been a few cases of limited human-to-human transmission, but this has not yet led to sustained human-to-human transmission.

Treatment:

- There is no specific treatment for H5N1 avian influenza, but antiviral medications such as oseltamivir and zanamivir may be used to treat the symptoms of the virus.

- A vaccine is available for use in birds, but there is no vaccine currently available for humans.

Avian Influenza in India:

- In 2019, India was declared free from the H5N1 strain of Avian Influenza, and this was reported to the World Organization for Animal Health.

- However, in December 2020 and early 2021, several outbreaks of Avian Influenza were reported in 15 states in India.

- These outbreaks involved the H5N1 and H5N8 strains of the virus.

Concern:

- The primary concern with H5N1 avian influenza is its potential to cause a global pandemic if it were to mutate and become more easily transmissible between humans.

- The virus has a high mortality rate in humans, with more than half of those infected dying from the disease.

- As such, H5N1 remains a significant public health concern and a focus of ongoing research and monitoring.

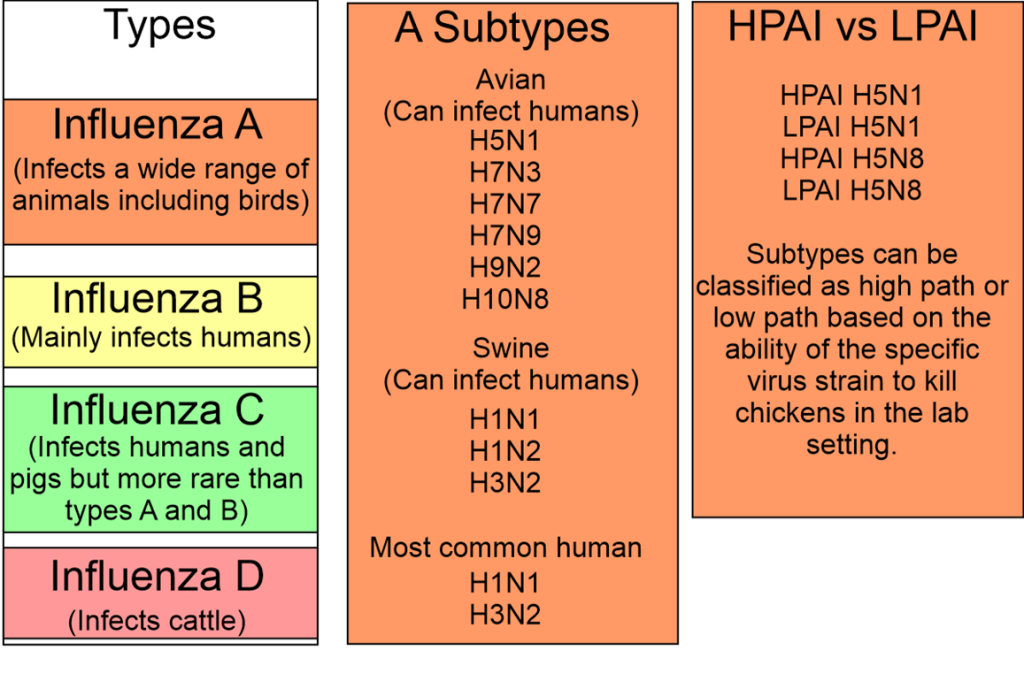

Influenza Virus Types

- The influenza virus can be classified into four types, namely influenza A, B, C, and D.

- Influenza A and B are the two types that cause epidemic seasonal infections every year.

- Influenza C primarily occurs in humans, but it has also been reported in dogs and pigs.

- Influenza D is mainly found in cattle and is not known to cause illness in humans.

Avian Influenza Type A Viruses:

- The type A influenza viruses are classified based on two proteins on their surface, namely Hemagglutinin (HA) and Neuraminidase (NA).

- There are around 18 subtypes of HA and 11 subtypes of NA.

- Several combinations of these two proteins are possible, such as H5N1, H7N2, H9N6, H17N10, H18N11, etc.

- All subtypes of influenza A viruses can infect birds, except subtypes H17N10 and H18N11, which have only been found in bats.

-Source: Financial express, The Hindu

Key Highlights of Union Budget 2024

Context:

The Interim Union Budget for the financial year 2024-25 was tabled in the Parliament by Finance Minister Nirmala Sitharaman on 1st February 2024.

Relevance:

GS-3 Indian Economy

Dimensions of the Article:

- Budget 2024 Key Highlights

- Terms Related to Union Budget

Budget 2024 Key Highlights:

Focus:

Social justice:

The budget focus on social justice with a clear emphasis on garib, mahilayen, yuva and annadata (poor, women, youth and farmers)

The budget focused on fiscal consolidation, infra, agri, green growth, and railways.

Target:

The Fiscal Deficit target for FY25 was set at 5.1 percent of the GDP. while the capex target of FY25 was increased by 11.1 percent to ₹11.1 lakh crore.

Income Tax:

The current budget maintains the status quo in both direct and indirect taxation, including import duties.

Over the last 10 years, tax collections have more than doubled.

Infrastructure Development:

Tripling of the capital expenditure outlay in the past 4 years resulted in a huge multiplier impact on economic growth and employment creation.

The outlay for the next year is being increased by 11.1 percent to 11.11 lakh crore, announced the FM. This is 3.4 percent of the GDP.

‘Lakhpati Didi’ Schem:

The Lakhpati Didi Scheme, aiming to empower two crore women in villages, has achieved notable success by reaching 83 lakh self-help groups and benefiting 9 crore women.

With a financial injection of ₹1 lakh per household for one crore beneficiaries, this initiative is poised to significantly uplift the economic status of rural women.

This empowerment not only stimulates the rural economy but also enhances credit demand for micro-financiers, particularly from women and self-help groups, potentially reducing stress on asset quality issues.

It has been decided to enhance the target for ‘Lakhpati Didi’ from 2 crore to 3 crore.

Electricity:

Through roof-top solarisation, 10 million households will be enabled to obtain up to 300 units of free electricity every month.

Green Energy

Towards meeting the commitment to ‘net zero’ by 2070, the following measures were announced.

Viability gap funding will be provided for harnessing offshore wind energy potential for the initial capacity of one giga-watt.

Coal gasification and liquefaction capacity of 100 MT will be set up by 2030. This will also help in reducing imports of natural gas, methanol, and ammonia.

Phased mandatory blending of compressed biogas (CBG) in compressed natural gas (CNG) for transport and piped natural gas (PNG) for domestic purposes will be mandated.

Financial assistance will be provided for procurement of biomass aggregation machinery to support collection.

Electric vehicles

Union Bugeht aims to incentivise and substantially expand the electric vehicle ecosystem, with a focused investment in boosting the number of charging stations.

FDI Investments:

The FDI inflow during 2014-23 was $596 billion marking a golden era. That is twice the inflow during 2005-14. For encouraging sustained foreign investment, the government is negotiating bilateral investment treaties with foreign partners, in the spirit of ‘first develop India’.

Terms Related to Union Budget:

According to Article 112 of the Indian Constitution, the Union Budget of a year, also referred to as the annual financial statement, is a statement of the estimated receipts and expenditure of the government for that particular year. The information on the Consolidated Fund of India, Contingency Fund of India and Public Accounts is provided.

Revenue – Receipt & Expenditure

Revenue Receipt:

- The receipts received which cannot be recovered by the government.

- It comprises income amassed by the Government through taxes and non-tax sources like interest, dividends on investments.

Revenue Expenditure:

- Expenditure incurred by the Union Government for purposes other than for the creation of physical or financial assets.

- It includes those expenditures incurred for the usual functioning of the government departments, grants given to state governments and interest payments on the debt of the Union Government etc.

Capital – Receipt & Expenditure

Capital Receipt:

- Receipts which generate liability or decrease the financial assets of the government.

- It includes borrowings from the Reserve Bank of India and commercial banks and other financial institutions.

- It also consists of loans received from foreign governments and international organization and repayment of loans granted by the Union government.

Capital Expenditure:

- Spending incurred by the government which results in the formation of physical or financial possessions of the Union government or decrease in financial liabilities of the Union Government.

- It contains expenditure on procuring land, equipment, infrastructure, expenditure in shares.

- It also includes mortgages by the Union government to Public Sector Undertakings, state and union territories.

-Source: Livemint, Indian express

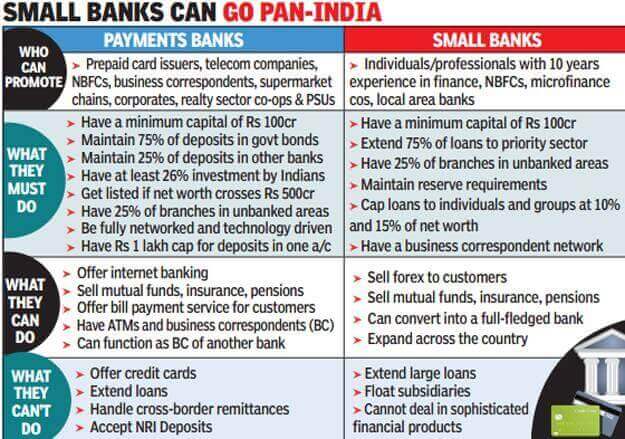

Paytm Payments Bank

Context

Paytm share price is under selloff pressure because the market is expecting a hit on its lending business after RBI’s restrictions on Paytm Payment Bank

Relevance:

GS III- Indian Economy

Dimensions of the Article:

- Paytm Payments Bank faces compliance Issues:

- What are Payments banks?

Paytm Payments Bank faces compliance Issues:

- The RBI on January 31 imposed restrictions on Paytm Payments Bank Limited (PPBL), following a system audit report and subsequent compliance validation report of external auditors.

- PPBL is barred from accepting deposits or top-ups in any customer account, wallets or FASTags after February 29 under section 35A of the Banking Regulation Act, 1949.

- As an impact of this move, the Paytm’s share price witnessed a huge selling pressure.

What are Payments banks?

- A payments bank is like any other bank, but operating on a smaller scale without involving any credit risk.

- A committee headed by Dr. Nachiket Mor recommended setting up of ‘Payments Bank’ to cater to the lower income groups and small businesses.

- The objectives of setting up of a payments bank is to further financial inclusion by providing small savings accounts and payments/remittance services to migrant labour workforce, low income households, small businesses, other unorganised sector entities and other users.

- Payments Bank are only allowed to accept deposits and cannot give loans.

- They can issue debit cards but not credit cards.

- The Payment Banks cannot set up subsidiaries to undertake non-banking financial services activities.

- It can accept demand deposits (up to Rs 1 lakh), offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third party fund transfers.

-Source: The Economic Times, Livemint

ED Arrests Former Jharkhand Chief Minister

Context:

The Enforcement Directorate on January 31 arrested Hemant Soren in a land scam case soon after he resigned as Jharkhand Chief Minister.

The resignation came after the ED officials questioned him for more than seven hours at his official residence in Ranchi.

Relevance:

GS-II: Polity and Constitution, Governance

Dimensions of the Article:

- Enforcement Directorate

- Functions of Enforcement Directorate

- From where does the ED get its powers?

- At what stage does the ED step in when a crime is committed?

- What differentiates the probe between the local police and officers of the ED?

Enforcement Directorate

- The Directorate of Enforcement (ED) is a law enforcement agency and economic intelligence agency responsible for enforcing economic laws and fighting economic crime in India.

- It is part of the Department of Revenue, Ministry of Finance, Government Of India.

- It is composed of officers from the Indian Revenue Service, Indian Corporate Law Service, Indian Police Service and the Indian Administrative Service.

- The origin of this Directorate goes back to 1 May 1956, when an ‘Enforcement Unit’ was formed, in Department of Economic Affairs, for handling Exchange Control Laws violations under Foreign Exchange Regulation Act, 1947.

- In the year 1957, this Unit was renamed as ‘Enforcement Directorate’.

Functions of Enforcement Directorate

- The prime objective of the Enforcement Directorate is the enforcement of two key Acts of the Government of India namely, the Foreign Exchange Management Act 1999 (FEMA) and the Prevention of Money Laundering Act 2002 (PMLA).

- The ED’s (Enforcement Directorate) official website enlists its other objectives which are primarily linked to checking money laundering in India.

- In fact this is an investigation agency so providing the complete details on public domain is against the rules of GOI.

- The ED investigates suspected violations of the provisions of the FEMA. Suspected violations includes; non-realization of export proceeds, “hawala transactions”, purchase of assets abroad, possession of foreign currency in huge amount, non-repatriation of foreign exchange, foreign exchange violations and other forms of violations under FEMA.

- ED collects, develops and disseminates intelligence information related to violations of FEMA, 1999. The ED receives the intelligence inputs from Central and State Intelligence agencies, complaints etc.

- ED has the power to attach the asset of the culprits found guilty of violation of FEMA. “Attachment of the assets” means prohibition of transfer, conversion, disposition or movement of property by an order issued under Chapter III of the Money Laundering Act [Section 2(1) (d)].

- To undertake, search, seizure, arrest, prosecution action and survey etc. against offender of PMLA offence.

- To provide and seek mutual legal assistance to/from respective states in respect of attachment/confiscation of proceeds of crime and handed over the transfer of accused persons under Money Laundering Act.

- To settle cases of violations of the erstwhile FERA, 1973 and FEMA, 1999 and to decide penalties imposed on conclusion of settlement proceedings.

The PMLA being relatively new, can the ED investigate cases of money laundering retrospectively?

- If an ill-gotten property is acquired before the year 2005 (when the law was brought in) and disposed off, then there is no case under PMLA.

- But if proceeds of the crime were possessed before 2005, kept in cold storage, and used after 2005 by buying properties, the colour of the money is still black and the person is liable to be prosecuted under PMLA.

- Under Section 3 (offence of money laundering) a person shall be guilty of the offence of money-laundering, if such person is found to have directly or indirectly attempted to indulge or knowingly assist a party involved in one or more of the following activities — concealment; possession; acquisition; use; or projecting as untainted property; or claiming as untainted property in any manner.

At what stage does the ED step in when a crime is committed?

- Whenever any offence is registered by a local police station, which has generated proceeds of crime over and above ₹1 crore, the investigating police officer forwards the details to the ED.

- Alternately, if the offence comes under the knowledge of the Central agency, they can then call for the First Information Report (FIR) or the chargesheet if it has been filed directly by police officials.

- This will be done to find out if any laundering has taken place.

What differentiates the probe between the local police and officers of the ED?

- Consider the following scenario: If a theft has been committed in a nationalised bank, the local police station will first investigate the crime.

- If it is learnt that the founder of the bank took all the money and kept it in his house, without being spent or used, then the crime is only theft and the ED won’t interfere because the amount has already been seized.

- But if the amount which has been stolen is used after four years to purchase some properties, then the ill-gotten money is brought back in the market; or if the money is given to someone else to buy properties in different parts of the country, then there is ‘laundering’ of money and the ED will need to step in and look into the layering and attachment of properties to recover the money.

- If jewellery costing ₹1 crore is stolen, police officers will investigate the theft. The ED, however, will attach assets of the accused to recover the amount of ₹1 crore.

-Source: The Hindu

India and UAE Sign Bilateral Investment Treaty

Context:

The Union Cabinet chaired by the Prime Minister has given its approval for signing and ratification of Bilateral Investment Treaty between the India and the Government of the UAE.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Mobilization of Resources, Liberation and Planning of Indian Economy), GS-II: International Relations

Dimensions of the Article:

- About India-UAE Bilateral Investment Treaty

- Bilateral Relationship between India and the UAE

- India UAE Comprehensive Economic Partnership Agreement (CEPA)

About India-UAE Bilateral Investment Treaty:

- The Treaty is expected to improve the confidence of the investors, especially large investors, resulting in an increase in Foreign Investments and Overseas Direct Investment (ODI) opportunities.

- This will significantly boost employment generation.

- The move is significant in realizing the goal of Atmanirbhar Bharat by encouraging domestic manufacturing, reducing import dependence, increasing exports etc.

- The two nations have also implemented a free trade agreement in May 2022.

- India received an FDI of $ 16.7 billion between April 2000 and September 2023.

Bilateral Relationship between India and the UAE

- India and the United Arab Emirates established diplomatic relations in 1972. Their bond has grown exponentially since then.

- In January 2017, India and the United Arab Emirates signed a Comprehensive Strategic Partnership Agreement.

- The exchange of high-level visits by both sides has given impetus to the strong bilateral relations.

- In February 2019, the UAE invited India to address the Organization of Islamic Cooperation’s Inaugural Plenary 46th Session as the “Guest of Honour.”

- In August 2019, Prime Minister Modi paid his third visit to the UAE. He received the UAE’s highest civilian award, the ‘Order of Zayed.’

- In January 2017, the Crown Prince of the UAE visited India for the second time as the Chief Guest at India’s Republic Day celebrations.

- In April 2019, the foundation stone for Abu Dhabi’s first traditional Hindu Temple was laid.

- PM Modi and Crown Prince of Abu Dhabi HH Sheikh Mohammed bin Zayed Al Nahyan held a virtual summit in February 2022.

- Both leaders issued a Joint Vision Statement titled “Advancing India and the UAE’s Comprehensive Strategic Partnership: New Frontiers, New Milestones.”

Commercial Relationship

- Until FY20, the UAE was India’s second-largest goods export market, trailing only the US. When the pandemic caused severe trade disruptions in FY21, China pipped it.

- The UAE is currently India’s third-largest trading partner, with bilateral trade worth $59 billion in FY20.

- In addition, the UAE is India’s second-largest export destination after the United States (approximately $29 billion in FY20).

India UAE Comprehensive Economic Partnership Agreement (CEPA)

- Both countries have begun negotiations for a mutually beneficial CEPA in September 2021.

- The India-UAE CEPA was signed in New Delhi in February 2022 during the India-UAE Virtual Summit.

- India announced the signing of the CEPA with the UAE in March 2022.

Coverage

- It covers almost all of India’s (11,908 tariff lines) and the UAE’s tariff lines (7581 tariff lines)

Priority access to goods

- CEPA establishes an institutional mechanism to encourage and improve bilateral trade.

- India will benefit from the UAE’s preferential market access on over 97% of its tariff lines, accounting for 99% of Indian exports to the UAE in value terms.

- India will also grant the UAE preferential access to over 90% of its tariff lines, including those of export interest to the UAE.

Services Trade

- India has offered the UAE market access in approximately 100 sub-sectors.

- Indian service providers, on the other hand, will have access to approximately 111 sub-sectors from the 11 broad service sectors.

- Both parties have also agreed to a separate Pharmaceutical Annex to facilitate access to Indian pharmaceuticals

- For the first time, a separate section of pharma has been created to facilitate the export of Indian generic medicines.

Investment

- The UAE is India’s eighth-largest investor, with $11 billion invested between April 2000 and March 2021.

- Indian companies are expected to invest more than $85 billion in the UAE.

Remittances from Non-Resident Indians

- The annual remittances made by the UAE’s large Indian community (estimated at around 3.3 million) total US$ 17.56 billion in 2018.

Cooperation in Energy

- In 2017, the Abu Dhabi National Oil Company (ADNOC) and the Indian Strategic Petroleum Reserves Ltd. (ISPRL) signed a Memorandum of Understanding (MOU) to establish a strategic crude oil reserve in Mangalore (Karnataka).

- In addition, ADNOC is investigating the possibility of storing its crude oil at ISPRL’s underground oil storage facility in Padur, Karnataka.

- The Lower Zakum Concession has been awarded to a consortium led by ONGC, which includes Indian Oil and Bharat Petro Resources.

-Source: Business Standard