Contents:

- India to build its first Semiconductor fabrication unit

- India likely to face obesity epidemic

- Government auctions critical and strategic mineral blocks

- Indian manufacturing sector

- Archaeological Survey of India

- Windfall tax increased on domestically produced crude oil

India to Build Its First Semiconductor Fabrication Unit

Context:

The Union Cabinet has recently approved three semiconductor proposals amounting to ₹1,25,600 crore in value in Gujarat and Assam.

- The Tata Electronics Pvt. Ltd. will build a full-fledged fabrication unit producing 50,000 ‘wafer starts,’ the initial form of silicon chips, per month.

Relevance:

GS Paper 3: Semiconductor Industries

Dimensions of the Article:

- Semiconductor chips: what are they?

- Previous Attempts:

- Challenges in Chip Warfare:

- Main factors to take into account while establishing a fab:

- Logical, memory, and analogue fabrication choices

- Drawing Lessons from China:

- The Steps taken by Indian Government

- ISM (India Semiconductor Mission)

Semiconductor chips: what are they?

- Semiconductors are substances with conductivity that is between that of conductors and insulators. They could be compounds like gallium, arsenide, or cadmium selenide or pure elements like silicon or germanium.

- Semiconductor chips are essential components that act as the brain and heart of all contemporary electronics and information and communications technology goods.These chips are now a standard component of modern cars, household appliances, and crucial medical equipment like ECG machines.

Previous Attempts:

- In 2007, a Special Incentive Package (SIP) was launched in an effort to start a fab in India, but this effort was unsuccessful.

- The Modified SIP, a further effort that was made in 2012, showed more potential. India came very near to realising a fab after considerable outreach attempts with key fab businesses worldwide.

- The Cabinet approved two consortia, one led by Jaiprakash Associates in collaboration with IBM and TowerJazz, and the other by Hindustan Semiconductor Manufacturing Corporation in partnership with ST Microelectronics. These two fabs required a combined investment of $10 billion, with the government providing nearly $5 billion in incentives. Land was granted when the decision was made on the fab locations. Both consortia, however, ultimately failed because they were unable to gather the required funding.

Challenges in Chip Warfare:

- The manufacture of semiconductors is at the bleeding edge of modern technology. The number of transistors doubles every 18 months, as per Moore’s Law, although miniaturisation has increased complexity and expense. As a result, the number of players in the industry has decreased.

- China, despite its late entry into the semiconductor fabrication industry, has seen substantial success thanks to the acquisition of multiple loss-making fabs across the globe and significant investment in the industry.

- China has become a significant chip producer thanks to decreasing manufacturing costs, a booming electronics manufacturing sector, and a strategic hold on the rare earths needed for chip production.

- Aware of the potential repercussions, the US and its allies have put restrictions on technology transfer to China in place. The CHIPS and Science Act, passed by the US, provided significant subsidies, and the European Union approved funding for a new fab in France. As a result, India now faces fierce rivalry from these nations in the ongoing chip war.

The following are the main factors to take into account while establishing a fab:

- Investing in a semiconductor fab is inherently risky since vast sums of money must be made back before the technology becomes outdated. Relying simply on the home market is insufficient for a fab’s success because economic sustainability often requires significant output volumes to satisfy global demand.

- Additionally, it is advantageous to manufacture chips in a single site for international sales due to the low freight-to-price ratio and zero-custom duty regime under the Information Technology Agreement. These reasons provide an explanation for why businesses are cautious to build greenfield fabs.

- Building a chip manufacturing ecosystem in a new site is extremely difficult. It needs a wide range of chemicals, gases, staff training, and access to plenty of clean water. Additionally, the art of chip manufacturing is essential since low yields and subpar quality can result in fab failures.

Logical, memory, and analogue fabrication choices

- Selecting the right kind of fab to build is another crucial factor. Advanced technologies are needed for logic/processor fabs, which create chips with the highest strategic value and profitability.

- Analogue fabs can be less advanced but greater in size, whereas memory fabs concentrate on advanced feature nodes. Analogue fabs are more widely available and less expensive than logic fabs.Establishing Assembly, Testing, Packaging, and Marking (ATMP) facilities to build the fab ecosystem before establishing a full-fledged fab is an alternative strategy. However, ATMPs are not very useful for making chips.

Drawing Lessons from China:

- India’s current plan is focused on establishing a new logic fabrication facility. But China’s achievement in acquiring existing fabs teaches us important lessons. This approach enables India to develop the fab ecosystem, train skilled resources, and allocate saved funds for advanced R&D in fab technologies.

- Acquiring established fabs offers benefits such as reasonable pricing, stabilised technology, an existing supply chain ecosystem, established product lines, and an established market.Another plausible approach would involve setting up ATMPs, as Tessolve, which the Tatas now own, has shown by successfully packaging chips with a 7 nm feature size. Over 100 ATMPs exist in China, demonstrating their significance in the fab journey.

The Steps taken by Indian Government

- A 10 billion dollar production-linked incentive (PLI) programme will be implemented by the Indian government in 2021 to promote the nation’s semiconductor and display industry.

- Financial assistance for a design-linked initiative (DLI) programme to promote domestic and international investment in design software, intellectual property rights, etc.

- The Union Cabinet has authorised a uniform incentive of 50% of the project cost for building up semiconductor, display, and compound semiconductor manufacturing units. This is part of the “Programme for Development of Semiconductors and Display Manufacturing Ecosystem in India.”

ISM (India Semiconductor Mission)

- Compound Semiconductors Facilities Establishment Plan

- A semiconductor manufacturing facility worth 1,54,000 crores will be built in Gujarat by Vedanta and Taiwanese chipmaker Foxconn.

-Source: The Indian Express, The Hindu

India Likely to Face Obesity Epidemic

Context:

The new Lancet study finds out that India is sitting on obesity curve.

Relevance:

GS-2- Health

Dimensions of the Article:

- Details

- Relevance of the study to India

- Background: Non-Communicable Diseases in India

- Factors that have led to an Increase in Non-communicable Diseases:

Details:

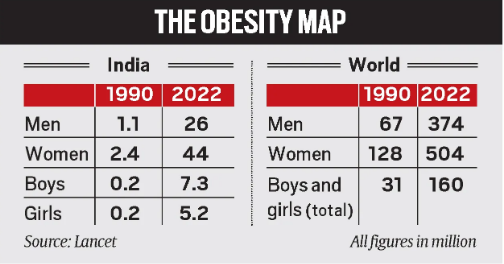

- The Lancet study shows that India could be facing an obesity epidemic particularly among the younger population.

- Obesity among children:

- This global analysis found that around 12.5 million children (7.3 million boys and 5.2 million girls) in the country, aged between five and 19, were grossly overweight in 2022. This figure is up from 0.4 million in 1990.

- The report also showed that the prevalence among children and teens is more than three per cent , an increase of over three percentage points from 1990.

- Obesity among adults:

- The study finds that the obesity prevalence among female is increasing sharply. The

- Women had a 9.8 per cent prevalence, an increase of 8.6 percentage points from 1990.

- Among men, this number stood at 5.4 per cent, an increase of 4.9 percentage points.

Relevance of the study to India:

- The study gains significance as India is already having a high burden of non-communicable diseases such as heart disease, strokes and diabetes.

- It reveals that 44 million women and 26 million men aged above 20 in India were found to be obese, this figure being 2.4 million women and 1.1 million men in 1990.

- India ranks 182 among 197 countries for the prevalence of obesity in women and 180 for men in 2022.

- India ranked 174 in the world for both girls and boys.

- Obesity is a major risk factor and a trigger for early onset of diseases like heart disease, strokes, diabetes, and even Type 2 diabetes among teens.

Background: Non-Communicable Diseases in India

- Non-Communicable Diseases, also recognized as chronic diseases, typically have prolonged durations and result from a combination of genetic, physiological, environmental, and behavioral factors.

- The primary categories of NCDs encompass cardiovascular diseases (such as heart attacks and strokes), cancers, chronic respiratory diseases (including chronic obstructive pulmonary disease and asthma), and diabetes.

A recent collaborative study conducted by the Madras Diabetes Research Foundation in partnership with the Indian Council of Medical Research (ICMR) and Ministry of Health and Family Welfare sheds light on the increasing burden of non-communicable diseases (NCDs) in India.

- This study marks the first comprehensive epidemiological research paper encompassing participants from all 31 states and Union Territories.

- By incorporating data from diverse regions, the research offers valuable insights into the prevalence and impact of NCDs, particularly diabetes, across the nation.

Key Findings:

- Goa, Puducherry, and Kerala exhibit the highest prevalence of diabetes, ranging between 25-26.4%.

- India is now home to 101 million individuals diagnosed with diabetes.

- The study identifies 136 million people with prediabetes.

- Hypertension affects 315 million individuals.

- Generally obese individuals number 254 million, while 351 million have abdominal obesity.

- Generalized obesity is prevalent in 28.6% of the population, and abdominal obesity affects 39.5% of Indians, with a notably high rate of 50% in females.

- Hypercholesterolemia, characterized by fat accumulation in arteries, is observed in 213 million individuals, posing an increased risk of heart attacks and strokes.

- 24% of Indians suffer from hypercholesterolemia.

- Elevated levels of low-density lipoprotein (LDL) cholesterol, often referred to as “bad cholesterol,” are present in 185 million individuals. LDL cholesterol can contribute to arterial plaque buildup, leading to various health risks.

- Cholesterol circulates through the blood on proteins called “lipoproteins.”

Factors that have led to an Increase in Non-communicable Diseases:

Consumption of Processed or Unhealthy Diet:

Over the last three decades, the increased consumption of processed or unhealthy diets, defined as the Nutrition transition, has resulted in reduced intake of coarse cereals, pulses, fruits, and vegetables, and an increased consumption of meat products and salt. This has led to a 6% rise in energy derived from fats and a 7% decrease in energy derived from carbohydrates.

Reduced Physical Activity:

The Nutrition transition, coupled with reduced physical activity due to rapid urbanization, has contributed to a rise in obesity, atherogenic dyslipidemia, subclinical inflammation, metabolic syndrome, type 2 diabetes mellitus, and coronary heart disease in Indians.

Prevalence of Malnutrition:

Additionally, the increased prevalence of malnutrition is characterized by an uptick in the intake of Western-style diets, decreased physical activity, and high consumption of tobacco and alcohol among fathers and mothers.

-Source: The Indian Express

Government Auctions Critical and Strategic Mineral Blocks

Context:

The Government of India launches the auction of 18 critical and strategic mineral blocks valued at around 30 lakh crore.

- The initiative is in-line with the country’s ambition to generate 50 percent of its electric power from non-fossil sources by 2030.

- These efforts are also aligned with global sustainability goals, emphasizing responsible exploration and extraction of critical minerals.

- These minerals are crucial for sectors like renewable energy, defense, pharmaceuticals, and high-tech electronics.

Relevance:

GS III- Indian Economy

Dimensions of the Article:

- What are Critical Minerals?

- Why is this resource critical?

- What is China ‘threat’?

- Challenges Faced by India in Assuring Resilient Critical Minerals Supply Chains

- Way Forward for India’s Critical Minerals Strategy

- What are countries around the world doing about it?

What are Critical Minerals?

- Critical minerals are elements that are the building blocks of essential modern-day technologies, and are at risk of supply chain disruptions.

- These minerals are now used everywhere from making mobile phones, computers to batteries, electric vehicles and green technologies like solar panels and wind turbines.

- Based on their individual needs and strategic considerations, different countries create their own lists.

- However, such lists mostly include graphite, lithium and cobalt, which are used for making EV batteries; rare earths that are used for making magnets and silicon which is a key mineral for making computer chips and solar panels.

- Aerospace, communications and defence industries also rely on several such minerals as they are used in manufacturing fighter jets, drones, radio sets and other critical equipment.

Why is this resource critical?

- As countries around the world scale up their transition towards clean energy and digital economy, these critical resources are key to the ecosystem that fuels this change.

- Any supply shock can severely imperil the economy and strategic autonomy of a country over-dependent on others to procure critical minerals.

- But these supply risks exist due to rare availability, growing demand and complex processing value chain.

- Many times the complex supply chain can be disrupted by hostile regimes, or due to politically unstable regions.

- They are critical as the world is fast shifting from a fossil fuel-intensive to a mineral-intensive energy system.

What is China ‘threat’?

- China is the world’s largest producer of 16 critical minerals.

- China alone is responsible for some 70% and 60% of global production of cobalt and rare earth elements, respectively, in 2019.

- The level of concentration is even higher for processing operations, where China has a strong presence across the board.

- China’s share of refining is around 35% for nickel, 50-70% for lithium and cobalt, and nearly 90% for rare earth elements.

- It also controls cobalt mines in the Democratic Republic of Congo, from where 70% of this mineral is sourced.

- In 2010, China suspended rare earth exports to Japan for two months over a territorial dispute.

Challenges Faced by India in Assuring Resilient Critical Minerals Supply Chains:

- China’s struggle with Covid-19-related lockdowns poses a risk of slowdown in the extraction, processing, and exports of critical minerals, as it is the most dominant player in critical mineral supply chains.

- The war between Russia and Ukraine has implications for critical mineral supply chains, as Russia is one of the significant producers of nickel, palladium, titanium sponge metal, and the rare earth element scandium, while Ukraine is a major producer of titanium and has reserves of other critical minerals.

- The strategic partnership between China and Russia may affect critical mineral supply chains as the balance of power shifts across continents and countries.

- Manufacturing renewable energy technologies and transitioning to electric vehicles would require increasing quantities of critical minerals, many of which India does not have sufficient reserves, necessitating reliance on foreign partners to meet domestic needs.

Way Forward for India’s Critical Minerals Strategy

- India has geological potential for mining, but there are significant challenges to enable sustainable extraction.

- Four challenges include:

- Atomic minerals reserved only for public sector undertakings,

- Imperative need to create a new list of critical and strategic minerals,

- Encouraging reconnaissance and exploration of minerals, particularly deep-seated minerals, and

- Innovative regime to allocate critical mineral mining assets.

- India needs to determine how and where processing of minerals and assembly of critical minerals-embedded equipment will occur, as domestic sources are limited.

- India requires a critical minerals strategy to make the country self-reliant in critical minerals needed for sustainable economic growth and green technologies.

- The strategy should prioritize supply risks, domestic policy regimes, and sustainability, and engage in bilateral and plurilateral arrangements for building assured and resilient critical mineral supply chains.

- The assessment of critical minerals for India needs to be updated every three years to keep pace with changing domestic and global scenarios.

What are countries around the world doing about it?

- US has shifted its focus on expanding domestic mining, production, processing, and recycling of critical minerals and materials.

- India has set up KABIL or the Khanij Bidesh India Limited, a joint venture of three public sector companies, to “ensure a consistent supply of critical and strategic minerals to the Indian domestic market”.

- Australia’s Critical Minerals Facilitation Office (CMFO) and KABIL had recently signed an MoU aimed at ensuring reliable supply of critical minerals to India.

- The UK has unveiled its new Critical Minerals Intelligence Centre to study the future demand for and supply of these minerals.

-Source: The Indian Express, The Hindu

Indian Manufacturing Sector

Context:

India’s manufacturing activity hit a five-month high in February 2024. This id mainly driven by a sharp uptick in orders and lower input costs.

Relevance:

GS-2: Government Policies and Interventions

GS-3: Industrial Growth, Industrial Policy

Dimensions of the Article:

- India’s Manufacturing Sector

- Connection between Faster Economic Growth, Manufacturing, and MSMEs

- Persisting Challenges

- Government Policies for the Manufacturing Sector and MSMEs

India’s Manufacturing Sector:

- The manufacturing industry comprises enterprises involved in the mechanical, physical, or chemical alteration of raw materials, substances, or components to produce finalized goods.

- India’s manufacturing sector is a pivotal driver of the nation’s economic growth, employing approximately 12% of the workforce and contributing around 15% to the country’s GDP. This diverse sector encompasses various businesses, including those in textiles, pharmaceuticals, automotive, and consumer durables.

Connection between Faster Economic Growth, Manufacturing, and MSMEs:

- Job Creation: Manufacturing, especially in the MSME sector, has the potential to generate significant employment opportunities. MSMEs employ around 110 million people in India, a testament to their importance in the job market.

- Exports: MSMEs contribute to around 45% of India’s total exports. An efficient and thriving MSME sector can help improve the balance of payments.

- Local Production: MSMEs play a pivotal role in localizing production, reducing import dependency, and strengthening domestic supply chains.

Persisting Challenges:

- Micro, small, and medium enterprises (MSMEs) constitute 36 percent of India’s manufacturing output but face challenges like limited market reach, financial constraints, and technological gaps.

- Despite the era of liberalization, privatization, and globalization, India has yet to fully capitalize on the manufacturing industry’s benefits.

- While India’s goods exports have shown significant growth, reaching $453 billion in 2022 from $9.1 billion in 1985, the gap with China’s exponential growth in goods exports highlights the need for strategic improvements.

- India’s failure to achieve desired levels of skilling and its inadequate infrastructure, utilizing only 3 percent of GDP for construction compared to China’s 20 percent, hinder its manufacturing efficiency.

Government Policies for the Manufacturing Sector and MSMEs:

- Make in India: Launched in 2014, this initiative aims to make India a global manufacturing hub by attracting investments from across the globe. It focuses on 25 sectors of the economy, with many of them being MSME-intensive.

- MSME Samadhaan: To address the issue of delayed payments, this portal allows MSMEs to file complaints against defaulting entities.

- MSME Sambandh: This portal helps monitor the implementation of the Public Procurement Policy for MSMEs, ensuring that they get their due share in government procurement.

- Credit Guarantee Scheme: To encourage MSME growth, the government offers credit support without the need for collaterals through the Credit Guarantee Trust Fund for Micro and Small Enterprises (CGTMSE).

- Aatmanirbhar Bharat Abhiyan: Amid the 2020 COVID-19 pandemic, the government announced a comprehensive package emphasizing self-reliance, with significant components aimed at aiding MSMEs, including collateral-free loans and equity infusion.

Examples and Facts:

- Investment Clearance Cell: As part of the Union Budget 2020-21, an Investment Clearance Cell was proposed to offer end-to-end facilitation support, including pre-investment advisory, which will be beneficial for MSMEs.

- Definition Change: The government revised the MSME definition in 2020. Investment and annual turnover criteria were revised upwards, ensuring a wider range of businesses could benefit from MSME-specific policies.

- PLI Scheme: The Production Linked Incentive (PLI) Scheme aims to boost domestic manufacturing in specific sectors, potentially benefiting numerous MSMEs in those sectors.

-Source: Livemint

Archaeological Survey of India

Context:

The customs department handed over a total of 101 seized antiquities to the Archaeological Survey of India (ASI).

- These articles included a 206-year-old tracker telescope used by the British East India Company.

Relevance:

GS I: History, Art and Culture

Dimensions of the Article:

- About Archaeological Survey of India (ASI)

- What is the AMASR Act?

About Archaeological Survey of India (ASI)

Nodal: Ministry of Culture

- It administers more than 3650 ancient monuments, archaeological sites and remains of national importance.

- Its activities include carrying out surveys of antiquarian remains, exploration and excavation of archaeological sites, conservation and maintenance of protected monuments etc.

- The Survey also maintains ancient mounds and other similar sites which represent the remains of ancient habitation.

- It was founded in 1861 by Alexander Cunningham- the first Director-General of ASI. Alexander Cunningham is also known as the “Father of Indian Archaeology”.

What is the AMASR Act?

- It is an Act to provide for the preservation of ancient and historical monuments and archaeological sites and remains of national importance, for the regulation of archaeological excavations and for the protection of sculptures, carvings and other like objects.

- It extends to the whole of India.

- The Archaeological Survey of India (ASI) functions under the provisions of this act.

- The rules stipulate that area in the vicinity of the monument, within 100 metres is prohibited area.

- The area within 200 meters of the monument is regulated category. Any repair or modifications of buildings in this area requires prior permission.

-Source: The Hindu

Windfall Tax Increases on Domestically Produced Crude Oil

Context:

The Government of India has increased the windfall tax on domestically produced crude oil to Rs 4,600 per tonne from Rs 3,300 per tonne.

- The tax is levied in the form of Special Additional Excise Duty (SAED).

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- What is a windfall tax?

- Why are countries levying windfall taxes now?

- What are the issues with imposing such taxes?

What is a windfall tax?

- Windfall taxes are designed to tax the profits a company derives from an external, sometimes unprecedented event — for instance, the energy price-rise as a result of the Russia-Ukraine conflict.

- These are profits that cannot be attributed to something the firm actively did, like an investment strategy or an expansion of business.

- The U.S. Congressional Research Service (CRS) defines a windfall as an “unearned, unanticipated gain in income through no additional effort or expense”.

- Governments typically levy this as a one-off tax retrospectively over and above the normal rates of tax.

- One area where such taxes have routinely been discussed is oil markets, where price fluctuation leads to volatile or erratic profits for the industry.

- There have been varying rationales for governments worldwide to introduce windfall taxes, from redistribution of unexpected gains when high prices benefit producers at the expense of consumers, to funding social welfare schemes, and as a supplementary revenue stream for the government.

Why are countries levying windfall taxes now?

- Prices of oil, gas, and coal have seen sharp increases since last year and in the first two quarters of the current year, although they have reduced recently.

- Pandemic recovery and supply issues resulting from the Russia-Ukraine conflict shored up energy demands, which in turn have driven up global prices.

- The rising prices meant huge and record profits for energy companies while resulting in hefty gas and electricity bills for households in major and smaller economies. Since the gains stemmed partly from external change, multiple analysts have called them windfall profits.

What are the issues with imposing such taxes?

Brew uncertainty in the market about future taxes:

- Analysts say that companies are confident in investing in a sector if there is certainty and stability in a tax regime. Since windfall taxes are imposed retrospectively and are often influenced by unexpected events, they can brew uncertainty in the market about future taxes.

IMF’s Advice Note:

- The International Monetary Fund (IMF), which released an advice note on how windfall taxes need to be levied also said that taxes in response to price surges may suffer from design problems—given their expedient and political nature.

- It added that “introducing a temporary windfall profit tax reduces future investment because prospective investors will internalise the likelihood of potential taxes when making investment decisions”.

CRS report:

- There is another argument about what exactly constitutes true windfall profits; how can it be determined and what level of profit is normal or excessive.

- A CRS report, for instance, argues that if rapid increases in prices lead to higher profits, in one sense it can be called true windfalls as they are unforeseeable but on the other hand, companies may argue that it is the profit they earned as a reward for the industry’s risk-taking to provide the end user with the petroleum product.

Another issue is who should be taxed:

- Only the big companies responsible for the bulk of high-priced sales or smaller companies as well— raising the question of whether producers with revenues or profits below a certain threshold should be exempt.

-Source: The Indian Express, The Hindu