CONTENTS

- Constitutional Morality

- Supreme Court’s 9-Judge Constitution Bench Examines State Authority on Excise Duty on Industrial Alcohol

- Preventive Detention

- Annular Solar Eclipse

- Glycaemic Index

- Predicate Offence

- Electronic Trading Platforms

- Lavender Cultivation

Constitutional Morality

Context:

The recent arrest of a serving chief minister on corruption charges raises legal, political, and constitutional concerns and poses questions about its consistency with constitutional morality, especially in a parliamentary democracy like India.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- Constitutional Morality: An Overview

- Landmark Judgments Upholding Constitutional Morality

- Challenges to Constitutional Morality in India

- Do Chief Ministers in India Lack Immunity from Arrests?

Constitutional Morality: An Overview

Definition

- Constitutional morality refers to the foundational principles and values that guide both the government and citizens according to a constitution.

Origins

- The concept was first introduced by the British Classicist George Grote in the 19th century, emphasizing “paramount reverence for the forms of the Constitution.”

- In India, Dr. B.R. Ambedkar was among the first to use the term.

Key Pillars

- Upholding core constitutional values such as justice, liberty, equality, fraternity, secularism, and individual dignity.

- Ensuring supremacy of the law, making everyone, including government officials, accountable under it.

- Promoting representative democracy and citizen participation in decision-making.

- Protecting fundamental rights guaranteed by the constitution.

- Maintaining a balance of power among the legislative, executive, and judicial branches.

- Implementing checks and balances against abuse of power.

- Interpreting the constitution to reflect its underlying principles while adapting to societal changes.

- Ensuring ethical conduct, transparency, accountability, and integrity in governance.

Role in Indian Constitution

- Although not explicitly mentioned, the concept is inherent in the Indian Constitution’s core principles, including justice, equality, and liberty.

- These principles are evident in the Preamble, Fundamental Rights, and Directive Principles of State Policy.

- Constitutional morality is also reflected in various Supreme Court judgments.

Landmark Judgments Upholding Constitutional Morality

- Kesavananda Bharati v. State of Kerala, 1973

- Established the “basic structure doctrine” limiting Parliament’s power to amend the Constitution, safeguarding its core principles.

- SP Gupta Case (First Judges Case), 1982

- Supreme Court emphasized that constitutional breaches are severe violations of constitutional morality.

- Naz Foundation v. Government of NCT of Delhi, 2009

- Decriminalized consensual same-sex relationships, prioritizing “constitutional morality” over societal morality.

- Manoj Narula v. Union of India, 2014

- Defined “Constitutional Morality” as adhering to constitutional norms and avoiding arbitrary actions violating the rule of law.

- Indian Young Lawyers Association v. State of Kerala (Sabarimala Case), 2018

- Struck down the practice of barring women from Sabarimala temple, emphasizing principles of justice, equality, and liberty over religious customs.

- Navtej Singh Johar v. Union of India, 2018

- Read down Section 377 of IPC, decriminalizing homosexuality and affirming individual rights in line with constitutional morality.

Challenges to Constitutional Morality in India

Political Interference

- Political meddling in the functioning of constitutional bodies and institutions can erode their autonomy and impartiality.

- Recent changes to the appointment committee for the Election Commission of India and the amended IT Rules 2023 have faced criticism for potentially compromising institutional independence.

Judicial Activism vs. Judicial Restraint

- The balance between judicial activism and restraint is crucial.

- While judicial activism can protect rights and enforce constitutional values, excessive activism may infringe upon the domains of the executive and legislature.

Enforcement and Compliance

- Despite a robust constitutional framework, there are challenges in ensuring effective enforcement and compliance.

- Implementation gaps, delays in justice delivery, and limited awareness about constitutional rights among the public contribute to these challenges.

Do Chief Ministers in India Lack Immunity from Arrests?

Constitutional Immunity

- As per Article 361 of the Constitution, only the President of India and Governors of states are granted immunity from civil and criminal proceedings during their terms.

- This immunity covers acts performed in the discharge of their official duties.

No Immunity for Prime Ministers and Chief Ministers

- Prime Ministers and Chief Ministers do not enjoy similar constitutional immunity and are subject to the principle of equality before the law.

Arrest vs. Disqualification

- Being arrested does not automatically lead to disqualification from holding office for Prime Ministers or Chief Ministers.

-Source: The Hindu

Supreme Court’s 9-Judge Constitution Bench Examines State Authority on Excise Duty on Industrial Alcohol

Context:

The Supreme Court, under the guidance of the Chief Justice of India (CJI), is presently hearing a case involving a 9-judge Constitution Bench. The central issue under consideration is whether states possess the authority to regulate and levy excise duty on industrial alcohol.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- Constitutional Aspects of the Industrial Alcohol Debate

- Arguments Presented by the States

- Understanding Excise Duty

Constitutional Aspects of the Industrial Alcohol Debate

- State List (Entry 8) – Seventh Schedule

- Pertains to the state governments’ authority to legislate on intoxicating liquors, covering production, manufacture, possession, transport, purchase, and sale.

- Union List (Entry 52)

- Grants Parliament the power to legislate on industries considered beneficial in the public interest.

- Concurrent List (Entry 33)

- Allows both state and central governments to legislate on specific industries, ensuring state laws do not contradict central legislation.

- Regulation under IDRA, 1951

- Industrial alcohol is categorized under the Industries (Development and Regulation) Act, 1951 (IDRA), giving the central government regulatory power over it.

Key Concern in the Debate

Autonomy of State Regulation

- The primary issue revolves around whether states possess the authority to regulate industrial alcohol independently or if the Centre retains exclusive control.

Legal Interpretation of the Debate

- Concurrent List Dynamics

- Both state and central governments can legislate on Concurrent List subjects; however, state laws must align with central legislation to avoid contradictions.

- Implication of IDRA, 1951

- The IDRA, 1951, which categorizes industrial alcohol, suggests predominant central control over the regulatory framework.

Arguments Presented by the States

Interpretation of Entry 8

- States argue that “intoxicating liquors” in Entry 8 of the State List covers all alcohol-containing liquids.

- Historical references from pre-constitutional excise laws using terms like ‘liquor’, ‘spirit’, and ‘intoxicant’ are highlighted to support this view.

Scope of Union’s Power

- The states contend that Union List’s Entry 52 doesn’t encompass the regulation of “finished products” such as industrial alcohol after denaturation.

- Control over industrial alcohol, post-denaturation, is claimed to be under the Concurrent List’s Entry 33.

- The exclusive authority of the Centre over industrial alcohol can only be established through an order under Section 18-G of the IDRA. Without such an order, states maintain jurisdiction.

- ‘Denatured alcohol’ refers to alcohol mixed with harmful additives to make it unfit for human consumption.

Preservation of States’ Powers

- States emphasize the significance of not reducing their authority, drawing from the ITC Ltd v Agricultural Produce Market Committee Case, 2002, which underlines the non-subordination of states to the Centre.

- The focus is on safeguarding states’ constitutional powers and preventing interpretations that could undermine their autonomy.

Understanding Excise Duty

Definition

- Excise duty is an indirect tax levied on goods during their production, licensing, and sale. Producers pay this tax to the Government of India.

Types of Excise Duties

- Before the implementation of Goods and Services Tax (GST) in July 2017, there were various central excise duties like Central Excise Duty, Additional Excise Duty, etc.

- GST’s introduction merged several types of excise duties. Currently, excise duty is applicable mainly to petroleum and liquor.

Application and Collection

- Excise duty on alcohol serves as a significant revenue source for states. To increase their revenue, states often augment excise duty on alcohol consumption.

- In a recent example, Karnataka increased the Additional Excise Duty (AED) on Indian Made Liquor (IML) by 20% in 2023.

-Source: The Hindu

Preventive Detention

Context:

Recently, the Supreme Court has held that advisory boards under preventive detention laws should not behave like mere “rubber-stamping authorities” for the government

Relevance:

GS-II: Polity and Governance (Constitutional Provisions, Fundamental Rights), GS-II: Governance (Government Policies and Interventions)

Dimensions of the Article:

- About Preventive Detention in India

- Criticisms of Preventive detention

- The argument in favour of Preventive detention

About Preventive Detention in India

- As the term suggests – Preventive detention helps to prevent a person from committing a crime.

- Article 22 deals with 2 kinds of detentions:

- Preventive

- Punitive

- Article 22 (3) (b) of the Constitution allows for preventive detention and restriction on personal liberty for reasons of state security and public order.

- According to Article 22 (4)– in case of preventive detention as well, the person being detained should be informed of the grounds of arrest, however, in case the authorities consider that it is against the public interest to disclose certain facts, they need not reveal them.

- The person cannot be detained under preventive detention for more than 3 months unless permission to do so has been granted by an advisory board consisting of 3 judges of the Supreme Court.

- The other way by which the period of detention can be extended beyond 3 months is if the Parliament prescribes a law for it.

- Acts by the Parliament which provide for extension of Preventive detention period beyond 3 months:

- National Security Act (NSA) 1980;

- Conservation of Foreign Exchange and Prevention of Smuggling Activities Act (COFEPOSA) 1974;

- Unlawful Activities Prevention Act (UAPA) 1967, etc.

- Many State legislatures have enacted similar laws that authorize preventive detention.

Criticisms of Preventive detention

- Preventive detention becomes a human rights concern as there have been various incidents of misuse of such laws in India.

- Preventive detention represents the police power of the State.

- No other democratic country mentions preventive detention in its constitution and such laws come into effect only under emergency conditions in democratic countries.

The argument in favour of Preventive detention

- Arbitrary action the State is prevented in India as the areas in the context of which Preventive detention laws can be made are laid down in the 7th Schedule of the Constitution itself.

- In the Union list – laws for Preventive detention can be enacted only for reasons connected with Defence, Foreign Affairs, or the Security of India.

- In the Concurrent list – laws for Preventive detention can be enacted only for reasons connected with Security of a State, the Maintenance of Public Order, or the Maintenance of Essential Supplies and Services.

-Source: The Hindu

Annular Solar Eclipse

Context:

Recently, a total solar eclipse crossed North America, passing over Mexico, the United States, and Canada.

Relevance:

GS-I Geography

Dimensions of the Article:

- Solar eclipse

- Types of Solar Eclipse

- Significant observations during solar eclipses

Solar eclipse

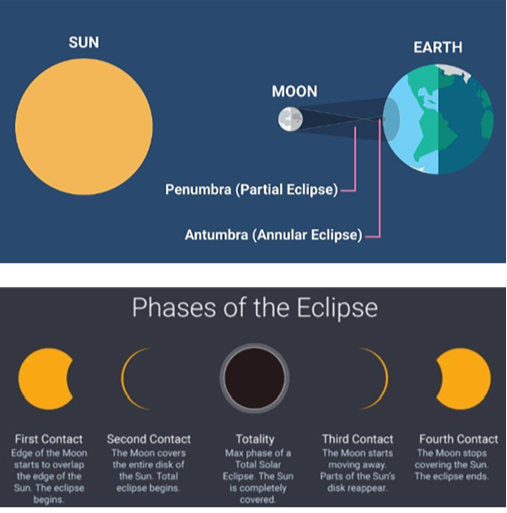

- A solar eclipse occurs when a portion of the Earth is covered in a shadow cast by the Moon which fully or partially blocks sunlight.

- This occurs when the Sun, Moon and Earth are aligned.

- Such alignment coincides with a new moon (syzygy) indicating the Moon is closest to the ecliptic plane.

- The Sun’s distance from Earth is about 400 times the Moon’s distance, and the Sun’s diameter is about 400 times the Moon’s diameter. Because these ratios are approximately the same, the Sun and the Moon as seen from Earth appear to be approximately the same size: about 0.5 degree of arc in angular measure.

Types of Solar Eclipse

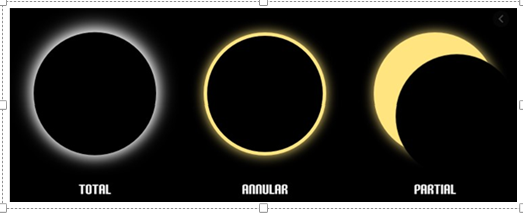

Total Solar Eclipse:

- During a total solar eclipse, the Moon completely covers the Sun from view as seen from a specific location on Earth.

- The sky darkens significantly, and the Sun’s outer atmosphere, known as the solar corona, becomes visible as a bright halo around the obscured Sun.

- Total solar eclipses are rare and can only be observed from a limited geographic area along the eclipse’s path of totality.

Partial Solar Eclipse:

- In a partial solar eclipse, the Moon partially covers the Sun, obscuring only a portion of the Sun’s disk.

- This type of eclipse is visible over a broader geographic region than a total eclipse since it occurs when the Moon partially passes in front of the Sun.

Annular Solar Eclipse:

- An annular solar eclipse occurs when the Moon is near its apogee (farthest from Earth) in its elliptical orbit, causing it to appear smaller than the Sun.

- As a result, the Moon does not completely cover the Sun, and a ring of the Sun’s outer edge, known as the “ring of fire” or annulus, remains visible around the Moon.

- Annular eclipses create a unique and visually striking spectacle.

Hybrid Solar Eclipse (Annular-Total Eclipse):

- A hybrid eclipse is a rare event where an eclipse appears as a total eclipse from some locations on Earth’s surface and as an annular eclipse from others.

- The type of eclipse experienced depends on the viewer’s location within the eclipse’s path.

Why does the Solar Eclipse not occur during every new moon?

- If the Moon were in a perfectly circular orbit, a little closer to the Earth, and in the same orbital plane, there would be total solar eclipses every new moon.

- However, since the Moon’s orbit is tilted at more than 5 degrees to the Earth’s orbit around the Sun, its shadow usually misses Earth.

What are the factors that affect the duration of the eclipse?

- The Moon being almost exactly at perigee (making its angular diameter as large as possible).

- The Earth being very near aphelion (furthest away from the Sun in its elliptical orbit, making its angular diameter nearly as small as possible).

- The midpoint of the eclipse being very close to the Earth’s equator, where the rotational velocity is greatest.

- The vector of the eclipse path at the midpoint of the eclipse aligning with the vector of the Earth’s rotation (i.e. not diagonal but due east).

- The midpoint of the eclipse being near the subsolar point (the part of the Earth closest to the Sun).

Significant observations during solar eclipses

- A total solar eclipse provides a rare opportunity to observe the corona (the outer layer of the Sun’s atmosphere). Normally this is not visible because the photosphere is much brighter than the corona.

- Eclipses may cause the temperature to decrease by up to 3 °C.

- There is a long history of observations of gravity-related phenomena during solar eclipses, especially during the period of totality.

- Confirmation of Einstein’s theory: The observation of a total solar eclipse of 1919, helped to confirm Einstein’s theory of general relativity. By comparing the apparent distance between stars in the constellation Taurus, with and without the Sun between them, Arthur Eddington stated that the theoretical predictions about gravitational lenses were confirmed.

Precautions to take while viewing Solar eclipse

- Looking directly at the photosphere of the Sun (the bright disk of the Sun itself), even for just a few seconds, can cause permanent damage to the retina of the eye, because of the intense visible and invisible radiation that the photosphere emits.

- This damage can result in impairment of vision, up to and including blindness.

- The retina has no sensitivity to pain, and the effects of retinal damage may not appear for hours, so there is no warning that injury is occurring.

- Under normal conditions, the Sun is so bright that it is difficult to stare at it directly, however, during an eclipse, with so much of the Sun covered, it is easier and more tempting to stare at it.

- Special eye protection or indirect viewing techniques are used when viewing a solar eclipse.

- It is safe to view only the total phase of a total solar eclipse with the unaided eye and without protection.

-Source: The Hindu

Glycaemic Index

Context:

The findings of an international study suggest that consuming low glycaemic index and low glycaemic load diets might prevent the development of type 2 diabetes.

Relevance:

GS II: Health

Dimensions of the Article:

- Understanding Glycaemic Index (GI)

- What is Diabetes?

Understanding Glycaemic Index (GI)

Definition

- Glycaemic Index (GI) is a ranking system for carbohydrate-containing foods based on their post-meal blood glucose response. A higher GI indicates a greater increase in blood sugar levels post-consumption.

Measurement

- It measures how swiftly each food impacts blood glucose levels when consumed individually.

Scoring System

- Foods are scored on a scale from 0 to 100. Pure glucose (sugar) serves as the reference point with a GI value of 100.

Interpretation

- A lower GI signifies a slower rise in blood sugar after consuming the food. Typically, processed foods have a higher GI, while foods rich in fiber or fat tend to have a lower GI.

What is Glycaemic Load (GL)?

Definition

- Glycaemic Load (GL) represents both the quality and quantity of carbohydrates in a particular food item. It is derived from multiplying the GI of a food by the amount of available carbohydrates in a serving.

Calculation

- GL = GI x Amount of Carbohydrate (in grams) / 100

What is Diabetes?

- Chronic Disease: Diabetes is a chronic condition characterized by elevated blood sugar levels, resulting from the pancreas’s inability to produce insulin or the body’s ineffective use of the insulin it produces.

- Role of Insulin: Insulin is a hormone responsible for regulating blood glucose levels.

- Consequences of Insufficient Insulin: Inadequate insulin production or utilization leads to hyperglycemia, or high glucose levels in the blood, which can cause long-term damage to various organs and tissues.

- Health Complications: Diabetes is associated with severe health complications, including blindness, kidney failure, heart attacks, stroke, and lower limb amputation.

Different Types of Diabetes:

Type 1 Diabetes:

- Type 1 diabetes is an autoimmune disease where the immune system attacks and destroys cells in the pancreas responsible for insulin production.

- It affects about 10 percent of people with diabetes, and the exact cause of this autoimmune attack is unclear.

Type 2 Diabetes:

- Type 2 diabetes occurs when the body becomes resistant to insulin, leading to the accumulation of sugar in the blood.

- It is influenced by a combination of genetic predisposition and lifestyle factors such as diet and physical activity.

Pre-diabetes:

- Pre-diabetes is a condition where blood sugar levels are higher than normal but not high enough for a diagnosis of type 2 diabetes.

- It serves as a warning sign for the development of diabetes if lifestyle changes are not made.

Gestational Diabetes:

- Gestational diabetes is high blood sugar levels that occur during pregnancy.

- Insulin-blocking hormones produced by the placenta cause this type of diabetes, which usually resolves after childbirth.

-Source: The Hindu

Predicate Offence

Context:

The Supreme Court recently quashed a money laundering case after noting that there was no predicate offence in the case and no proceeds of crime.

Relevance:

GS II: Polity and Governance

Predicate Offence

Definition

- A predicate offence refers to a foundational criminal act that is part of a more intricate criminal scheme, often linked with money laundering or organized crime.

Role

- It acts as the primary criminal act that generates funds or proceeds for subsequent illegal activities.

Context

- The term “predicate offence” is primarily associated with activities related to money laundering or terrorist financing.

Predicate Offence in the Prevention of Money Laundering Act (PMLA)

Legislative Intent

- The aim behind establishing predicate offences under PMLA is to combat not only wealth acquired through illicit means but also income that is legally earned but concealed from public authorities.

Classification in PMLA

- Predicate offences in PMLA are categorized through a Schedule, divided into three parts: Part A, Part B, and Part C.

Part A: Offences under the Indian Penal Code (IPC)

- This section lists various offences under the IPC that are considered as predicate offences.

- It covers a wide range of crimes including criminal conspiracy, waging war against the government, counterfeiting, extortion, robbery, forgery, cheating, and more.

Part B: Offences under the Customs Act

- Offences under the Customs Act are classified as predicate offences if their value surpasses one crore rupees.

- This section concentrates on violations related to customs duties and regulations.

Part C: Cross-border and Other Offences

- This segment includes offences with cross-border implications, encompassing both Part A offences and property-related offences under Chapter XVII of the IPC.

- It also includes the intentional evasion of taxes, penalties, or interest as per the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

Legal Perspective

- The Supreme Court has clarified that without a predicate offence, there cannot be proceeds of crime, and consequently, no money laundering can take place.

-Source: Times of India

Electronic Trading Platforms

Context:

Recently, the Reserve Bank of India (RBI) Governor raised concerns over unauthorised forex trading platforms and asked banks to maintain vigil against such illegal activities.

Relevance:

GS III: Indian Economy

Electronic Trading Platforms (ETPs)

Definition

- ETPs are electronic systems, distinct from recognised stock exchanges, facilitating transactions in eligible instruments such as securities, money market instruments, foreign exchange instruments, and derivatives.

Regulatory Framework in India

- Operation of an ETP in India requires prior authorisation from the Reserve Bank of India (RBI) as per The Electronic Trading Platforms (Reserve Bank) Directions, 2018.

- Unauthorized operation of ETPs by resident entities, along with collecting and remitting payments outside India, can lead to penalties under the Foreign Exchange Management Act, 1999, and the Prevention of Money Laundering Act, 2002.

Guidelines for Authorized ETPs

- ETPs sanctioned by RBI can facilitate transactions solely in instruments endorsed by the Reserve Bank.

Criteria for ETP Authorization

- Entity Requirement

- The entity must be a company registered in India.

- Financial Requirements

- An aspiring ETP operator should maintain a minimum net-worth of Rs.5 crore and uphold this net-worth threshold consistently.

- Existing ETP operators with a net-worth below the mandated amount must reach the Rs.5 crore minimum within one year from receiving RBI authorization.

- Banking Entities

- Banks intending to run ETPs must allocate a minimum capital of Rs.5 crore specifically for this purpose.

-Source: Indian Express

Lavender Cultivation

Context:

According to officials, more than 700 acres of farmland has been brought under lavender cultivation in the Jammu and Kashmir area since 2017, and another 100 acres is set to be added.

Relevance:

Facts for Prelims

Lavender Cultivation

Origin and Introduction

- Lavender is originally native to Europe. However, it was introduced to the temperate regions of Jammu & Kashmir by the CSIR Aroma Mission.

Plant Description

- Lavender is a small, perennial aromatic herbaceous shrub utilized in various industries, including fragrance, specialty foods, and alternative medicine.

Propagation Methods

- Lavender can be propagated through various methods such as seeds, rooted cuttings, tissue culture, and layering.

Climatic and Soil Requirements

- Soil Conditions

- Lavender thrives in light, well-aerated soil enriched with organic matter.

- It prefers neutral to alkaline soil that is free-draining. While it’s sensitive to waterlogging, it can adapt to poor or eroded soils.

- Rainfall

- Lavender can grow well with an annual rainfall ranging from 300 to 1400 mm.

- Climate

- Being a hardy and temperate plant, lavender can tolerate drought and frost.

- Ideal climatic conditions include cool winters, cool summers, and ample sunlight.

- It’s also suitable for regions with snowfall and hilly terrains.

-Source: Indian Express