CONTENTS

- Inaugural Meeting of Social Audit Advisory Body (SAAB) in New Delhi

- India-Bangladesh Relation

- Great Indian Bustard

- Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme

- RoDTEP scheme

- Madhika language

- Andrographis theniensis

Inaugural Meeting of Social Audit Advisory Body (SAAB) in New Delhi

Context:

The inaugural meeting of the Social Audit Advisory Body (SAAB) occurred at the Dr. Ambedkar International Centre in New Delhi. SAAB, established as a pioneering advisory body, holds the objective of providing guidance to the Ministry of Social Justice & Empowerment. The primary focus is on the systematic institutionalization of social audits across the diverse schemes operated by the Ministry.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- Social Audits: Overview and Types

- Challenges and Solutions in Social Audits in India

Social Audits: Overview and Types

What is a Social Audit?

- A social audit involves a methodical and independent evaluation of an organization’s or program’s social impact and ethical performance.

- It scrutinizes the alignment of actions and policies with stated values and goals, particularly concerning their effects on communities, employees, and the environment.

- Coined by Howard Bowen in 1953, it delves into the social responsibilities of businesses.

Key Features:

- Fact finding rather than fault finding.

- Facilitating dialogue among diverse stakeholders.

- Ensuring timely grievance redressal.

- Strengthening democratic processes and institutions.

- Mobilizing public pressure for improved program implementation.

Types:

- Organisational: Evaluates a company’s overall social responsibility efforts.

- Program-Specific: Focuses on the impact and effectiveness of a particular program.

- Financial: Reviews social and environmental implications of financial decisions.

- Stakeholder-Driven: Involves various stakeholders in the auditing process.

Framework Associated with Social Audit in India:

- MGNREGA 2005: Mandates social audits for monitoring work execution, emphasizing community-driven verification.

- Meghalaya Community Participation and Public Services Social Audit Act, 2017: First state-level legislation in India, making social audits mandatory.

- BOCW Act Implementation Framework: Issued by the Ministry of Labour & Employment for conducting social audits under the Building and Other Construction Workers Act, 2013.

- Right to Information Act, 2005: Enhances transparency, crucial for effective social audits by providing access to relevant documents.

- National Resource Cell for Social Audit (NRCSA): Established by the Department of Social Justice and Empowerment, ensuring social audits through dedicated units at the state level.

Challenges and Solutions in Social Audits in India

Challenges:

- Lack of Standardised Procedures:

- Absence of standardized procedures leads to variations in methodologies and reporting, hindering result comparison.

- Limited Awareness:

- Stakeholders, including local communities, often lack awareness and understanding of social audit processes, impacting effective implementation.

- Incomplete Participation:

- Limited involvement of marginalized groups in the audit process results in incomplete or biased assessments.

- Political Interference:

- Political interference can compromise the independence and objectivity of social audits, influenced by local authorities or figures.

- Resource Constraints:

- Insufficient financial and human resources in many local bodies limit their ability to conduct comprehensive social audits.

- Struggling Audit Units:

- Social audit units, designed to detect malpractice, suffer from a lack of funds and trained professionals.

Way Forward:

Blockchain Technology:

- Explore blockchain technology to enhance transparency and integrity, providing a secure platform for storing tamper-proof audit information.

Simplify Processes:

- Simplify audit processes and present information in local languages and formats for broader accessibility.

Diverse Participation:

- Ensure diverse participation from marginalized groups, women, and youth through targeted incentives and outreach.

Uniform Guidelines:

- Develop clear and uniform guidelines for conducting social audits across various programs and states.

Legal Safeguards:

- Enact strong legal safeguards to protect individuals reporting irregularities, ensuring a safe reporting environment.

-Source: The Hindu

India-Bangladesh Relation

Context:

Recently, the Prime Minister of Bangladesh Sheikh Hasina returned to power in Bangladesh for a historic fourth straight term. India was among the first countries to congratulate, illustrating the close bilateral relationship between the two countries.

Relevance:

GS II: International Relations

Dimensions of the Article:

- Flourishing Ties Between India and Bangladesh

- Points of Tensions Between India and Bangladesh

- Way Forward

Flourishing Ties Between India and Bangladesh

Historical Foundation:

- The relationship began during the 1971 Bangladesh Liberation War, where India played a crucial role in supporting Bangladesh’s fight for independence.

Periods of Strain:

- Relations faced challenges in the mid-1970s, marked by anti-India sentiment, boundary disputes, and insurgency issues.

Revival under Sheikh Hasina:

- Since Sheikh Hasina came to power in 1996, bilateral ties improved, highlighted by a Ganga water-sharing treaty.

Areas of Cooperation:

- Trade Growth:

- Bilateral trade reached USD 18 billion in 2021-22, making Bangladesh India’s largest trade partner in South Asia.

- Economic Agreements:

- A joint feasibility study on a Comprehensive Economic Partnership Agreement (CEPA) was concluded in 2022.

- Lines of Credit:

- India extended over USD 7 billion in Lines of Credit to Bangladesh since 2010.

- Infrastructure Development:

- Joint projects like the Akhaura-Agartala Rail Link and the BIMSTEC Master Plan for Transport Connectivity.

- Energy Collaboration:

- Bangladesh imports nearly 2,000 MW of electricity from India, and both countries collaborate on the Rooppur Nuclear power plant project.

- Border Relations:

- Shared borders of 4096.7 km, the longest land boundary India has with any neighbor, leading to joint exercises and cooperation.

- Regional and Multilateral Engagement:

- Participation in regional forums such as SAARC, BIMSTEC, and Indian Ocean Rim Association enhances regional cooperation.

Points of Tensions Between India and Bangladesh

- River Water Sharing:

- Despite sharing 54 common rivers, only two treaties (Ganga Waters Treaty and Kushiyara River Treaty) have been signed, leaving issues concerning major rivers like Teesta and Feni unresolved.

- Illegal Migration:

- The persistent issue of illegal migration from Bangladesh to India, including refugees and economic migrants, creates strain in Indian border states, impacting resources and security.

- Rohingya Crisis:

- Rohingya refugees entering India through Bangladesh pose a challenge, leading to concerns over resources and security in Indian border states. The National Register of Citizens (NRC) in India has raised apprehensions in Bangladesh.

- Cross-Border Issues:

- Incidents of cross-border drug smuggling, human trafficking, and poaching of animal and bird species are significant challenges.

- Belt and Road Initiative (BRI):

- Bangladesh’s active participation in China’s Belt and Road Initiative, while India abstains, creates a potential source of tension as China’s influence in the region could affect India’s strategic standing.

Way Forward:

- Joint Task Forces:

- Establish joint task forces with law enforcement agencies from both countries to combat cross-border drug smuggling and human trafficking effectively.

- Intelligence Sharing:

- Promote shared intelligence and coordinated operations to disrupt illegal networks operating across borders.

- Smart Border Management:

- Implement smart border management solutions utilizing Artificial Intelligence (AI) and data analytics to streamline cross-border movements, ensuring both security and efficiency.

- Digital Connectivity Corridor:

- Establish a digital connectivity corridor focusing on high-speed internet connectivity, digital services, and e-commerce to create new avenues for trade, collaboration, and technological exchange between India and Bangladesh.

-Source: The Hindu

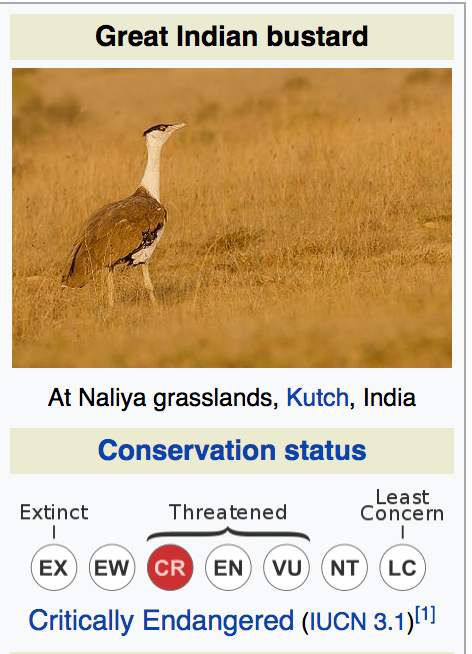

Great Indian Bustard

Context:

The Supreme Court recently directed the Centre to come clean on its plans to save the critically endangered Great Indian Bustard.

Relevance:

Prelims, GS-III: Environment and Ecology (Species in News, Conservation of Biodiversity)

Dimensions of the Article:

- About the Great Indian Bustard

- About the Habitat of Great Indian Bustard

- On the brink of extinction

- Project Tiger

About the Great Indian Bustard

- The Great Indian Bustard is one of the heaviest flying birds in the world often found associated in the same habitat as blackbuck.

- GIBs are the largest among the four bustard species found in India, the other three being MacQueen’s bustard, lesser florican and the Bengal florican.

- The GIB is Critically Endangered on the IUCN Red List, and comes under the Appendix I of CITES, and Schedule I of the Indian Wildlife (Protection) Act, 1972.

- Threats to the GIB include widespread hunting for sport and food, and activities such as mining, stone quarrying, excess use of pesticides, grassland conversion and power projects along with the expansion of roads and infrastructures such as wind-turbines and power cables.

About the Habitat of Great Indian Bustard

- The Great Indian Bustard’s habitat includes Arid and semi-arid grasslands with scattered short scrub, bushes and low intensity cultivation in flat or gently undulating terrain. It avoids irrigated areas.

- GIBs’ historic range included much of the Indian sub-continent but it has now shrunken to just 10 per cent of it.

- Among the heaviest birds with flight, GIBs prefer grasslands as their habitats. Being terrestrial birds, they spend most of their time on the ground with occasional flights to go from one part of their habitat to the other.

- GIBs are considered the flagship bird species of grassland and hence barometers of the health of grassland ecosystems.

- They feed on insects, lizards, grass seeds etc.

On the brink of extinction

- In 2020, the Central government had told the 13th Conference of Parties to the United Nations Convention on Migratory Species of Wild Animals (CMS) held in Gandhinagar, that the GIB population in India had fallen to just 150.

- Of the 150 birds in 2020, over 120 birds were in Rajasthan, some were in Kutch district of Gujarat and a few in Maharashtra, Karnataka and Andhra Pradesh.

- Pakistan is also believed to host a few GIBs.

- Due to the species’ smaller population size, the International Union for Conservation of Nature (IUCN) has categorised GIBs as critically endangered, thus on the brink of extinction from the wild.

- Scientists of Wildlife Institute of India (WII) have been pointing out overhead power transmission lines as the biggest threat to the GIBs.

Project Tiger

- Project Tiger is a tiger conservation programme launched in April 1973 by the Government of India.

- The project aims at ensuring a viable population of Bengal tigers in their natural habitats, protecting them from extinction, and preserving areas of biological importance as a natural heritage forever represented as close as possible the diversity of ecosystems across the distribution of tigers in the country.

- The project’s task force visualized these tiger reserves as breeding nuclei, from which surplus animals would migrate to adjacent forests. Funds and commitment were mastered to support the intensive program of habitat protection and rehabilitation under the project.

- The government has set up a Tiger Protection Force to combat poachers and funded relocation of villagers to minimize human-tiger conflicts.

-Source: The Hindu

Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme

Context:

Rs 17,490 crore has been set aside for the Strategic Interventions for Green Hydrogen Transition (SIGHT) programme, to bolster domestic electrolyser manufacturing, green hydrogen production.

Relevance:

GS III: Infrastructure

Dimensions of the Article:

- Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme

- What is the National Green Hydrogen Mission?

- What is Green hydrogen?

Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme

- Subcomponent of National Green Hydrogen Mission: The SIGHT Programme operates as a vital subcomponent of the broader National Green Hydrogen Mission in India.

- Objective: The primary aim is to strengthen the domestic manufacturing of electrolysers and enhance green hydrogen production capacity within the country.

Financial Incentives:

- Two Incentive Mechanisms: In its initial stage, the SIGHT Programme proposes two distinct financial incentive mechanisms.

- Incentive for Electrolyser Manufacturing: This incentive is designed to boost the manufacturing of electrolysers within the country.

- Incentive for Green Hydrogen Production: The second mechanism focuses on providing incentives for the actual production of green hydrogen.

- Financial Outlay: The programme is allocated a substantial outlay of ₹17,490 crore up to the fiscal year 2029-30.

Evolution of Incentive Schemes:

- Adaptability: Recognizing the dynamic nature of markets and technology advancements, the SIGHT Programme emphasizes the continuous evolution of specific incentive schemes and programs. These adaptations will align with the progress and changing landscape of the National Green Hydrogen Mission.

Implementation:

- Implementing Agency: The Solar Energy Corporation of India (SECI) has been designated as the implementing agency responsible for executing the SIGHT Programme. SECI’s role encompasses overseeing the effective implementation and realization of the mission’s objectives.

What is the National Green Hydrogen Mission?

- The intent of the mission is to incentivise the commercial production of green hydrogen and make India a net exporter of the fuel.

- The mission has laid out a target to develop green hydrogen production capacity of at least 5 MMT (Million Metric Tonne) per annum.

- This is alongside adding renewable energy capacity of about 125 GW (gigawatt) in the country.

- This will entail the decarbonisation of the industrial, mobility and energy sectors; reducing dependence on imported fossil fuels and feedstock; developing indigenous manufacturing capabilities; creating employment opportunities; and developing new technologies such as efficient fuel cells.

- By 2030, the Centre hopes its investments will bring in investments worth ₹8 trillion and create over six lakh jobs. Moreover, about 50 MMT per annum of CO2 emissions are expected to be averted by 2030.

- As per its Nationally Determined Contribution (NDC) to meeting the goals of the Paris Agreement, India has committed to reduce emissions intensity of its GDP by 45% by 2030, from 2005 levels.

Advantages:

- The National Green Hydrogen Mission will make India a leading producer and supplier of Green Hydrogen in the world.

- It would result in attractive investment and business opportunities for the industry.

- Will contribute significantly to India’s efforts for decarbonization and energy independence.

- Will create opportunities for employment and economic development.

- The Mission will drive the development of the Green Hydrogen ecosystem in the country.

- The targeted production capacity will bring over ₹8 lakh crore in total investments and will result in creation of over 6 lakh clean jobs.

- The Mission will support pilot projects in other hard-to-abate sectors.

- The Mission will also support R&D projects.

What is Green hydrogen?

- A colourless, odourless, tasteless, non-toxic and highly combustible gaseous substance, hydrogen is the lightest, simplest and most abundant member of the family of chemical elements in the universe.

- But a colour — green — prefixed to it makes hydrogen the “fuel of the future”.

- The ‘green’ depends on how the electricity is generated to obtain the hydrogen, which does not emit greenhouse gas when burned.

- Green hydrogen is produced through electrolysis using renewable sources of energy such as solar, wind or hydel power.

- Hydrogen can be ‘grey’ and ‘blue’ too.

- Grey hydrogen is generated through fossil fuels such as coal and gas and currently accounts for 95% of the total production in South Asia.

- Blue hydrogen, too, is produced using electricity generated by burning fossil fuels but with technologies to prevent the carbon released in the process from entering the atmosphere.

Green Hydrogen Importance

- Hydrogen is being used across the United States, Russia, China, France and Germany. Countries like Japan desire to become a hydrogen economy in future.

- Green hydrogen can in future be used for

- Electricity and drinking water generation, energy storage, transportation etc.

- Green hydrogen can be used to provide water to the crew members in space stations.

- Energy storage- Compressed hydrogen tanks can store the energy longer and are easier to handle than lithium-ion batteries as they are lighter.

- Transport and mobility- Hydrogen can be used in heavy transport, aviation and maritime transport.

-Source: Down To Earth

RoDTEP Scheme

Context:

The Centre has no plans of re-working the popular Remission of Duties and Taxes on Exported Products (RoDTEP) scheme for exporters, despite the US government imposing anti-subsidy duties against it.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Taxation)

Dimensions of the Article:

- Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme

- RoDTEP Benefits

Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme

- The RoDTEP Scheme allows exporters to receive refunds on taxes and duties that are not exempted or refunded under any other scheme.

- Under the scheme, exporters receive refunds on the embedded taxes and duties previously non-recoverable.

- The chief aim of the scheme is to boost the export of goods that were poor in volume.

- The scheme basically replaces the Merchandise Export from India Scheme (MEIS).

- The scheme provides for rebates of Central, State and Local duties/taxes/ levies which are not refunded under any other duty remission schemes.

- The RoDTEP scheme can be said to be a combination of the MEIS and the Rebate of State and Central Taxes and Levies (RoSCTL).

- Under this scheme, refund would be claimed as a percentage of the Freight On Board (FOB) value of exports.

Features of RoDTEP Scheme

- It covers duties and taxes levied at the central, state and local levels that are not reimbursed under any other mechanism. Items that were under the MEIS and the RoSCTL are shifted to the RoDTEP.

- Refunds will be issued to exporters as transferable duty credit/electronic scrips and maintained in an electronic ledger. This is keeping in line with the Digital India mission. This can be used to pay basic customs duty on imported goods. The credits can also be transferred to other importers.

- Faster clearance through a digital platform will be facilitated through a monitoring & audit mechanism, with an IT-based risk management system that would physically verify the exporters’ records.

- The scheme is applicable across all sectors.

RoDTEP Benefits

- Being WTO-compliant, the RoDTEP scheme can make available from the government benefits to the exporters seamlessly.

- The scheme is more exhaustive in that certain taxes that were not covered under the previous scheme are also included in the list, for example, education cess, state taxes on oil, power and water.

- It will add more competitiveness in the foreign markets, with assured duty benefits by the Indian Government.

- It will also help exporters meet international standards and promote business growth.

- Also under RoDTEP, tax assessment is set to become fully automatic for exporters, hence, Businesses will get access to their refunds for GST via an automatic refund-route.

-Source: The Hindu

Madhika Language

Context:

In the remote colony of Kookanam, near Karivellur grama panchayat in Kerala, the Chakaliya community is grappling with the imminent loss of its unique language Madhika.

Relevance:

Facts for Prelims

Dimensions of the Article:

- Madhika Language and Chakaliya Community

- Government Initiative to Preserve Languages

Madhika Language and Chakaliya Community

Madhika Language:

- Spoken by Chakaliya Community: Madhika is a language spoken by the Chakaliya community, known for its unique linguistic characteristics.

- Script Absence: This language lacks a script, making it distinct from many other languages.

- Diverse Influences: Despite sounding similar to Kannada, Madhika can be perplexing due to its diverse influences. It is a linguistic blend incorporating Telugu, Tulu, Kannada, Malayalam, and is notably influenced by Havyaka Kannada, an ancient form of Kannada.

- Endangerment: Madhika is facing the risk of extinction as younger generations are increasingly opting for Malayalam, contributing to the decline of this unique linguistic heritage.

Chakaliya Community:

- Nomadic Origin: The Chakaliya community, initially nomadic, migrated from the hilly regions of Karnataka to northern Malabar centuries ago.

- Religious Practices: Traditionally worshippers of Thiruvenkatramana and Mariamma, the community’s religious practices are integral to its identity.

- Socio-Economic Classification: Initially recognized as a Scheduled Tribe, the community was later included in the Scheduled Caste category in Kerala.

Government Initiative to Preserve Languages:

- Scheme for Protection and Preservation of Endangered Languages of India (SPPEL): The Government of India has launched the SPPEL to protect, preserve, and document endangered languages spoken by less than 10,000 people.

- Central Institute of Indian Languages (CIIL): CIIL, located in Mysore, works on the protection and preservation of endangered languages, contributing to the documentation of India’s linguistic diversity.

-Source: The Hindu

Andrographis Theniensis

Context:

A new plant species has been discovered in Theni district of Tamil Nadu in the Western Ghats by a research student from Wanaparthy.

Relevance:

GS III: Environment and Ecology

Andrographis theniensis: Newly Discovered Plant in Theni

Botanical Discovery:

- Origin: Named after its location, Andrographis theniensis is a newly discovered plant found in Theni.

- Resemblance: The plant shares similarities with Andrographis megamalayana, featuring glabrous leaves and stems, a distinctive nine-veined lower lip, sparse hair on the middle lobe of the lower lip, and yellow anther.

Genus Overview:

- Tropical Origin: Andrographis is a genus native to tropical Asia, with distribution in Bangladesh, India, Myanmar, Nepal, Sri Lanka, and the West Himalaya.

- Concentration: While the genus is widespread, the majority of Andrographis taxa are concentrated in southern India and Sri Lanka, particularly in the Western and Eastern Ghats.

- Species Count: India hosts nearly 25 Andrographis species, contributing to the rich biodiversity of the region.

Traditional Uses:

- Medicinal Significance: Andrographis species have been traditionally utilized for their medicinal properties, offering remedies for various ailments such as cold, cough, fever, jaundice, diarrhoea, and cardiovascular and hepatic diseases. These applications are observed in both codified and non-codified medicinal systems.

-Source: The Times of India