CONTENTS

- Rising Demand for Separate Bhil Pradesh State

- India’s Climate Change Position and Critique of EU’s CBAT

- Ban Lifted on Public Servants’ Participation in RSS Activities

- Chandra Shekhar Azad

- Skill Loan Scheme

- Angel Tax

Rising Demand for Separate Bhil Pradesh State

Context:

Recently, there has been a growing demand for the formation of a separate Bhil state, “Bhil Pradesh,” in Rajasthan and neighbouring states.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- Bhills: An Overview

- Demand for Bhil Pradesh

- Regions Demanding Separate States

- Issues Arising from the Creation of New States

- Way Forward

Bhills: An Overview

Background:

- Identity: The Bhills are one of the oldest tribes in India, belonging to the Dravidian racial group and part of the Austroloid tribal category.

- Language: They speak Bhili, a language of Dravidian origin.

- Historical Significance: Historically, they ruled parts of Rajasthan, Gujarat, Malwa, Madhya Pradesh, and Bihar.

- Population: As per the 2011 Census, there are approximately 1.7 crore Bhils across India, with significant populations in:

- Madhya Pradesh: About 60 lakh

- Gujarat: About 42 lakh

- Rajasthan: About 41 lakh

- Maharashtra: About 26 lakh

Cultural and Religious Practices:

- Religion: Primarily Hindus, the Bhills worship forest deities, evil spirits, Lord Shiva, and Durga.

Demand for Bhil Pradesh

Historical Context:

- Origins of the Demand: The demand for a separate Bhil state, known as Bhil Pradesh, began in 1913 with Govind Giri Banjara, a tribal activist. His call for a separate state was accompanied by a tragic massacre of around 1,500 tribals by British forces.

- Continued Advocacy: Over the years, various tribal leaders and political figures have periodically revived this demand.

Proposed Area:

- Coverage: The proposed Bhil Pradesh would span 49 districts across four states: Rajasthan, Madhya Pradesh, Gujarat, and Maharashtra. This includes 12 districts from Rajasthan.

Reasons for Demand:

- Cultural and Linguistic Unity: The Bhil community shares a common language (Bhili) and cultural practices across the four states. Proponents argue that a separate state would better preserve and promote their cultural heritage.

- Historical and Cultural Ties: The proposed state region has significant historical and cultural ties that transcend current state boundaries.

- Political and Administrative Failures: Tribal leaders argue that existing political structures have failed to address their needs effectively. A separate state is seen as a way to ensure more focused governance and development.

- Development Needs: A separate state could lead to more tailored development policies and better resource utilization for tribal welfare. Historical neglect and slow implementation of laws like the Panchayats (Extension to Scheduled Areas) Act, 1996, underscore the need for more localized governance.

Criticisms:

- Potential Fragmentation: Critics argue that creating states based on caste or community could lead to further fragmentation and instability within India.

- Unity of India: The Fazl Ali Commission emphasized the importance of national unity over redrawing political boundaries based on ethnic or linguistic identities.

- Political Resistance: Established political parties, with vested interests in maintaining the status quo, may resist the formation of a new state.

- Social Divisions: Opponents believe that forming states based on tribal identity could exacerbate social divisions rather than address the underlying issues.

Regions Demanding Separate States

1. Vidarbha:

- Location: Comprises the Amravati and Nagpur divisions of eastern Maharashtra.

- Historical Context: The State Reorganisation Act of 1956 recommended the creation of a Vidarbha state with Nagpur as the capital. To address fears of neglect, Nagpur was designated as the second capital of Maharashtra.

- Current Demand: The demand for a separate Vidarbha state is driven by perceptions of backwardness and neglect by successive Maharashtra state governments.

2. Bodoland:

- Location: Northern Assam.

- Ethnic Group: The Bodos, the largest ethnic and linguistic community in the region.

- Historical Context: Agitation for a separate Bodoland state led to a 2003 agreement between the Government of India, Assam state government, and Bodo Liberation Tigers Force. This agreement led to the creation of Bodoland Territorial Region (BTR), granting autonomy but not full statehood.

3. Other Regions:

- Gorkhaland: A demand from the Gorkha community in Darjeeling, West Bengal.

- Kukiland: A demand from the Kukis in Manipur.

- Mithila: A demand from the Maithili-speaking community in Bihar.

Issues Arising from the Creation of New States

- Dominance and Rivalries:

- New states may lead to dominance by a particular community, caste, or tribe, potentially marginalizing others.

- This can result in intra-regional rivalries and conflicts among sub-regions.

- Political Consequences:

- Smaller states may experience political instability, where a small group of legislators can significantly influence or disrupt governance.

- Resource and Boundary Disputes:

- New states may lead to increased disputes over resources like water and power. For example, disputes between Delhi and Haryana over water sharing.

- Financial and Administrative Costs:

- Significant funds are required to build new capitals and maintain administrative structures, as seen in the division of Andhra Pradesh and Telangana.

- Ineffectiveness of New State Structures:

- Creating new states may only shift power from the old state capital to the new one without improving local governance structures like Gram Panchayats or District Collectors.

Way Forward

- Strengthening National Integration:

- The National Integration Council should be bolstered to address regionalism challenges.

- High-Powered Commission:

- Form a commission to assess existing laws and policies and propose necessary amendments to address regional concerns.

- Empowering Local Governance:

- Strengthen Panchayati Raj Institutions and Urban Local Bodies through capacity building, financial empowerment, and constitutional safeguards.

- Finance and Resource Utilization:

- Use Finance Commission recommendations for equitable distribution and implement performance-based budgeting.

- Special Packages:

- Design special packages tailored to specific regional needs, similar to the one provided to Telangana.

- Economic Development Programs:

- Use economic parameters like per capita income, infrastructure index, and human development indicators to identify deserving regions.

- Implement programs similar to the NITI Aayog’s Aspirational Districts Programme for regions demanding statehood.

- Regional Dialogue Mechanisms:

- Create platforms for center-state and regional dialogues similar to the Inter-State Council.

- Cultural Preservation:

- Expand initiatives like the National Cultural Fund and Sahitya Akademi to support regional language promotion and cultural festivals.

-Source: The Hindu

India’s Climate Change Position and Critique of EU’s CBAT

Context:

In the Economic Survey (ES) 2023-24 presented in Parliament, the Indian government expressed a distinct stance on climate change, acknowledging the likely failure to meet the 1.5℃ target. Additionally, the ES criticized the European Union’s proposed Carbon Border Adjustment Tax (CBAT), deeming it contrary to the Paris Agreement’s spirit and highlighting concerns about protectionism.

Relevance:

GS III: Environment and Ecology

Dimensions of the Article:

- Global Temperature Target

- India’s Criticisms of the Global Climate Change Discourse

- Suggestions from the Economic Survey for Addressing Climate Change

- Carbon Border Adjustment Mechanism (CBAM)

- India’s Criticisms of CBAM

Global Temperature Target

Paris Agreement Targets (2015):

- Primary Goal: Limit the increase in global average annual temperature to within 2°C above pre-industrial levels (1850-1900 average).

- Aspirational Goal: Strive to limit the temperature rise to 1.5°C above pre-industrial levels.

Implementation:

- Action Plans: Countries are required to prepare and implement national action plans to contribute towards these temperature targets.

India’s Criticisms of the Global Climate Change Discourse

1. Inequity of the Climate Change Architecture:

- India has consistently criticized the global climate change framework for its inequity, particularly highlighting the lack of substantial climate action from developed nations despite their historical responsibility.

2. Inadequate Temperature Targets:

- The single global temperature targets (1.5°C or 2°C) are viewed as insufficient for addressing the complex relationships between climate change, ecological integrity, and human well-being.

3. Problems with Alternate Energy Solutions:

- The extraction of critical minerals for renewable energy technologies, such as batteries, often occurs in underdeveloped regions, leading to adverse effects on regional ecological health.

Suggestions from the Economic Survey for Addressing Climate Change

1. Lifestyle Changes:

- Emphasis on adopting more sustainable lifestyle choices, reducing waste, and minimizing overconsumption as a means to address climate change effectively.

2. Shorter-Term Policies:

- Implement policies aimed at improving quality of life in the short term as a more balanced approach to climate action, rather than focusing solely on switching to alternate energy sources.

Carbon Border Adjustment Mechanism (CBAM)

Overview:

- Purpose: Implement tariffs on energy-intensive goods imported into the EU to prevent local producers from facing a competitive disadvantage compared to producers in countries with more lenient emission standards.

- Target Goods: Includes iron, steel, and aluminium.

- Implementation Date: Expected to come into force on January 1, 2026.

India’s Criticisms of CBAM

1. Contravention of the Paris Agreement:

- CBAM is seen as contrary to the Paris Agreement’s principle of Common but Differentiated Responsibilities (CBDR), which recognizes the different capacities and responsibilities of countries.

2. Adverse Impact on India:

- Export Dependency: In 2022, India exported iron, steel, and aluminium products worth $8.2 billion to the EU, representing 27% of its total exports in these sectors.

- Financial Strain: Achieving net zero by 2070 requires an annual investment of $28 billion, and India’s climate action is largely funded through domestic resources due to limited international finance.

- Resource Impact: CBAM could strain India’s financial resources needed for climate change adaptation and mitigation efforts.

-Source: The Hindu

Ban Lifted on Public Servants’ Participation in RSS Activities

Context:

Recently, the Indian government lifted a longstanding ban preventing public servants from participating in Rashtriya Swayamsevak Sangh (RSS) activities. This decision, issued by the Department of Personnel and Training (DoPT), removed references to the RSS from official memorandums dating back to 1966, 1970, and 1980.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- Rules Regarding Government Employees Joining RSS

- Rashtriya Swayamsevak Sangh (RSS)

Rules Regarding Government Employees Joining RSS

Recent Developments:

- DoPT Directive (July 9, 2024):

- The Department of Personnel and Training (DoPT) has recently removed references to the Rashtriya Swayamsevak Sangh (RSS) from official memorandums issued in 1966, 1970, and 1980.

- As a result, the RSS is no longer classified as a “political” organization, allowing central government employees to participate in its activities without facing penalties under Rule 5(1) of the Conduct Rules.

- Jamaat-e-Islami:

- The Jamaat-e-Islami remains classified as a political organization. Government employees are prohibited from engaging in its activities.

Conduct Rules:

- Rule 5 of the Central Civil Services (Conduct) Rules, 1964:

- This rule prohibits government servants from being associated with political parties or engaging in political activities.

- Prior to the recent directive, involvement with organizations like the RSS and Jamaat-e-Islami was considered a violation of this rule, leading to potential disciplinary actions.

- All India Services (Conduct) Rules, 1968:

- Similar rules apply to IAS, IPS, and Indian Forest Service officers, prohibiting political affiliations and activities.

Official Memorandums:

- OM of 1966 (November 30, 1966):

- Issued by the Ministry of Home Affairs (MHA), this circular clarified that involvement with the RSS and Jamaat-e-Islami was contrary to government policy and could result in disciplinary action.

- This circular referenced Rule 5 of the Central Civil Services (Conduct) Rules, 1964.

- OM of 1970 (July 25, 1970):

- Emphasized that government employees should face disciplinary action for violating the 1966 instructions.

- During the Emergency (1975-1977), directives were issued against members of various groups, including the RSS, Jamaat-e-Islami, Ananda Marg, and CPI-ML.

- OM of 1980 (October 28, 1980):

- Stressed the importance of maintaining secularism among government employees and eliminating communal sentiments and biases.

Historical Context:

- Position Before 1966:

- Government employees were governed by the Government Servants’ Conduct Rules of 1949, which explicitly prohibited participation in political activities.

- This prohibition was aligned with Rule 23 of the 1949 rules, continuing into Rule 5 of the 1964 rules and the 1968 All India Services rules.

Penalties for Violations:

- Consequences:

- Violations of Rule 5 of the Central Civil Services (Conduct) Rules, 1964, and the All India Services (Conduct) Rules, 1968, can lead to serious consequences, including dismissal from service.

- The government retains final authority in determining compliance and interpreting the rules concerning political activities and affiliations.

Rashtriya Swayamsevak Sangh (RSS)

Overview:

- Founding:

- Established in 1925 in Nagpur by Dr. K.B. Hedgewar.

- Created in response to perceived threats to Hindu culture and society during British colonial rule.

- Objective:

- Promote Hindutva, emphasizing Hindu cultural and national identity.

Historical Context:

- Pre-Independence Era:

- Focused on social and cultural mobilisation among Hindus.

- Engaged in community service, education, and the promotion of Hindu values.

- Post-Independence:

- Scrutiny increased after Mahatma Gandhi’s assassination in 1948 by Nathuram Godse, leading to a temporary ban.

- The ban was lifted after RSS pledged loyalty to the Indian Constitution.

Ideology:

- Core Belief:

- India is fundamentally a Hindu nation, as articulated by Vinayak Damodar Savarkar.

- Emphasizes Indian culture and heritage, aiming to unite people under a common national identity.

- Activities:

- Engages in social service activities including education, healthcare, and disaster relief.

- Promotes the concept of “Seva” (service) among its members.

Contribution to Freedom Struggle:

- Role:

- Did not participate directly in the Indian independence movement.

- Contributed to the socio-political awakening of Hindus.

History of Bans:

- 1948:

- Banned following Gandhi’s assassination; reinstated in 1949 after a pledge to uphold the Constitution.

- 1966:

- Government employees banned from joining the RSS, reiterated in 1970 and 1980.

- 1975-1977:

- Banned during Indira Gandhi’s Emergency; ban lifted in 1977.

- 1992:

- Banned post-Babri Masjid demolition; lifted in 1993 after a commission found the ban unjustified.

Structure and Functioning:

- Organization:

- Operates through a network of shakhas (branches) across India and abroad.

- Focuses on physical, intellectual, and cultural training.

- Influence:

- Inspired organizations such as Vishva Hindu Parishad (VHP), Bajrang Dal, and Akhil Bharatiya Vidyarthi Parishad (ABVP).

Political Influence:

- BJP Linkage:

- Considered the ideological parent of the Bharatiya Janata Party (BJP), a major political force in India since the 1990s.

-Source: Indian Express

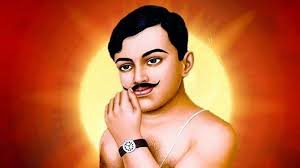

Chandra Shekhar Azad

Context:

On 23rd July, India paid tribute to the freedom fighter Chandra Shekhar Azad on his birth anniversary.

Relevance:

GS I: History

About Chandra Shekhar Azad:

- Birth: 23rd July 1906

- Place: Alirajpur district of Madhya Pradesh.

- Early Life: Chandra Shekhar, then a 15-year-old student, joined a Non-Cooperation Movement in December 1921. As a result, he was arrested.

- Death: He died at Azad Park in Allahabad on 27th February 1931.

- On being presented before a magistrate, he gave his name as “Azad” (The Free), his father’s name as “Swatantrata” (Independence) and his residence as “Jail” .Therefore, he came to be known as Chandra Shekhar Azad.

Contribution to Freedom Movement:

Hindustan Republican Association (HRA)

- After the suspension of the non-cooperation movement in 1922 by Gandhi, Azad joined Hindustan Republican Association (HRA).

- HRA was a revolutionary organization of India established in 1924 in East Bengal by Sachindra Nath Sanyal, Narendra Mohan Sen and Pratul Ganguly as an offshoot of Anushilan Samiti.

- Members: Bhagat Singh, Chandra Shekhar Azad, Sukhdev, Ram Prasad Bismil, Roshan Singh, Ashfaqulla Khan, Rajendra Lahiri.

Kakori Conspiracy

- Most of the fund collection for revolutionary activities was done through robberies of government property.

- In line with the same, Kakori Train Robbery near Kakori, Lucknow was done in 1925 by HRA.

- The plan was executed by Chandra Shekhar Azad, Ram Prasad Bismil, Ashfaqulla Khan, Rajendra Lahiri, and Manmathnath Gupta.

Hindustan Socialist Republican Association

- HRA was later reorganised as the Hindustan Socialist Republican Army (HSRA).

- It was established in 1928 at Feroz Shah Kotla in New Delhi by Chandra Shekhar Azad, Ashfaqulla Khan, Bhagat Singh, Sukhdev Thapar and Jogesh Chandra Chatterjee.

- HSRA planned the shooting of J. P. Saunders, a British Policeman at Lahore in 1928 to avenge the killing of Lala Lajpat Rai.

-Source: The Hindu

Skill Loan Scheme

Context:

The finance minister recently announced a revision to the model skill loan scheme, which will now facilitate loans up to Rs 7.5 lakh backed by a guarantee from a government-promoted fund.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- Skill Loan Scheme

- Credit Guarantee Fund

Skill Loan Scheme

Introduction:

- Launch Date: July 2015

- Purpose: To provide institutional credit to individuals pursuing skill development courses aligned with National Occupation Standards and Qualification Packs (NOS and QPs).

- Target: Courses conducted by training institutes following the National Skill Qualification Framework (NSQF), leading to certifications, diplomas, or degrees.

Eligibility:

- Who Can Apply: Any Indian national with admission in a recognized course at:

- Industrial Training Institutes (ITIs)

- Polytechnics

- Schools recognized by Central or State Education Boards

- Colleges affiliated with recognized universities

- Training partners affiliated with the National Skill Development Corporation (NSDC), Sector Skill Councils, State Skill Missions, or State Skill Corporations.

- Age Restriction: None

Features:

- Courses: Must be aligned with NSQF.

- Course Duration: No minimum duration.

- Quantum of Finance: Initially Rs. 5,000 to Rs. 1,50,000, now increased to Rs. 7.5 lakh.

- Moratorium Period: Duration of the course.

- Repayment Period:

- Loans up to Rs. 50,000: Up to 3 years.

- Loans between Rs. 50,000 to Rs. 1 lakh: Up to 5 years.

- Loans above Rs. 1 lakh: Up to 7 years.

- Coverage: Includes course fees, assessment, examination, study materials, etc.

- Interest Rate: Should not exceed 1.5% per annum over the repo-linked lending rate (RLLR) or other external benchmark rates as per RBI guidelines.

- Collateral: No collateral required from the beneficiary.

Credit Guarantee Fund:

- Credit Guarantee Fund for Skill Development (CGFSSD):

- Implemented by the Ministry of Skill Development and Entrepreneurship (MSDE) through a notification in November 2015.

- Administered by the National Credit Guarantee Trust Company (NCGTC).

- Guarantee Coverage:

- Banks can apply for a credit guarantee against defaults.

- NCGTC provides this guarantee at a nominal fee (up to 0.5% of the outstanding amount).

- Guarantee cover is up to 75% of the outstanding loan amount (including interest).

Key Points:

- Purpose: To facilitate access to credit for skill development and enhance employability.

- Support: Backed by a credit guarantee scheme to reduce risk for lenders and increase access to loans for borrowers.

-Source: Business Standards

Angel Tax

Context:

Recently, the Union Minister for Finance proposed to abolish ‘angel tax’ for all classes of investors, while presenting the Union Budget 2024-25 in Parliament.

Relevance:

GS III: Indian Economy

Angel Tax

Definition:

- Angel Tax refers to the tax levied on the capital raised by unlisted companies from Indian investors when the share price issued is above the fair market value of the company. The excess funds raised at prices above fair value are treated as income, subject to tax.

Legal Basis:

- Genesis: Section 56(2)(viib) of the Income Tax Act, 1961.

- Introduction: Introduced in 2012 to curb black money laundering through inflated share sales.

Tax Rate:

- Rate: 30.9% on net investments exceeding the fair market value.

Exemption for Startups (2019):

- Conditions for Exemption:

- Recognition: The startup must be recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) as an eligible startup.

- Capital Limit: The aggregate amount of paid-up share capital and share premium cannot exceed ₹25 crores. This excludes money raised from Non-Resident Indians (NRIs), Venture Capital Firms, and specified companies.

Investor Conditions:

- Tax Exemption: Angel investors can claim a 100% tax exemption on the amount invested that exceeds the fair market value.

- Eligibility: The investor must have:

- Net Worth: ₹2 crores or more.

- Income: More than ₹25 lakhs in the past 3 fiscal years.

Purpose:

- Objective: To prevent the misuse of share valuations to launder black money by imposing taxes on the excess amounts raised above fair market values.

-Source: The Hindu