Contents:

- Limit imposed on wheat stocking to prevent hoarding

- Great Indian Bustards

- India’s forex reserves hit a record high

- Governor withholds assent to Bills

- Rajasthan’s 75th Statehood Day

- MHA extends FCRA registration of NGOs

Limit imposed on wheat stocking to prevent hoarding

Context:

The Government has asked the traders, major retailers and food processors to declare wheat stocks every Friday from April to prevent hoarding and price spikes.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- Details

- Why are stock limits being imposed?

- Essential Commodities Act (ECA) 1955

Details:

- The Government also mandates weekly reporting on wheat stocks to prevent hoarding.

- The measure is aimed to manage overall food security and prevent hoarding and unscrupulous speculation.

- The world’s second-biggest wheat consumer after China has been trying to contain wheat prices after heat waves curtailed production for two straight years.

- The Government was forced to sell record volumes to boost domestic supplies.

- Consequently, Wheat inventories held in government warehouses dropped to 9.7 million metric tons at the start of this month, the lowest since 2017.

- In 2023, the government procured 26.2 million tons of wheat from local farmers, compared to its target of 34.15 million tons.

Why are stock limits being imposed?

Concerns over wheat production:

- Unseasonal rains, hailstorms, and higher temperatures in February 2023 have raised concerns about the overall wheat output.

- This lower production can lead to higher prices that may surpass the government’s purchase prices and affect supply stability.

- Initial estimates indicate a potential 20% decrease in wheat procurement.

Crop damage:

- Approximately 5.23 lakh hectares of wheat crop in Madhya Pradesh, Rajasthan, and Uttar Pradesh were estimated to be damaged due to hailstorms.

- The India Meteorological Department had issued warnings about adverse effects on wheat crops due to higher temperatures during the reproductive growth period.

Price rise in pulses:

- Tur prices have been rising since mid-July 2022 due to slow progress in Kharif sowing compared to the previous year.

- Excess rainfall and waterlogging conditions in major tur-growing states like Karnataka, Maharashtra, and Madhya Pradesh have contributed to this situation.

Preventing price rise and ensuring availability:

- To control any unwarranted price rise, the government is taking pre-emptive steps to ensure overall availability and controlled prices of pulses in both domestic and overseas markets.

Essential Commodities Act (ECA) 1955

The Essential Commodities Act (ECA) of 1955 was enacted during a time when India faced food scarcity and relied on imports to feed its population. The act was introduced to prevent hoarding and black marketing of foodstuffs. Here are some key points about the Essential Commodities Act of 1955:

Objective

- The act was enacted to address the scarcity of foodstuffs in the country and to prevent hoarding and black marketing.

- It was introduced when India depended on imports and assistance to meet its food requirements.

Control of Essential Commodities:

- The act allows the central government to exercise control over the trade of a wide range of commodities deemed essential.

- The specific commodities considered essential are listed in the Schedule of the Act.

- The central government has the power to add or remove commodities from the Schedule.

Centre’s Role:

- The central government has the authority to notify a commodity as essential, in consultation with state governments.

- If the central government deems it necessary in the public interest, it can declare an item as essential.

Impact and Powers:

- When a commodity is declared essential, the government can regulate its production, supply, and distribution.

- The government has the power to impose stock limits on essential commodities.

- The act provides mechanisms for controlling prices and preventing artificial scarcity.

-Source: The Indian Express, The Hindu

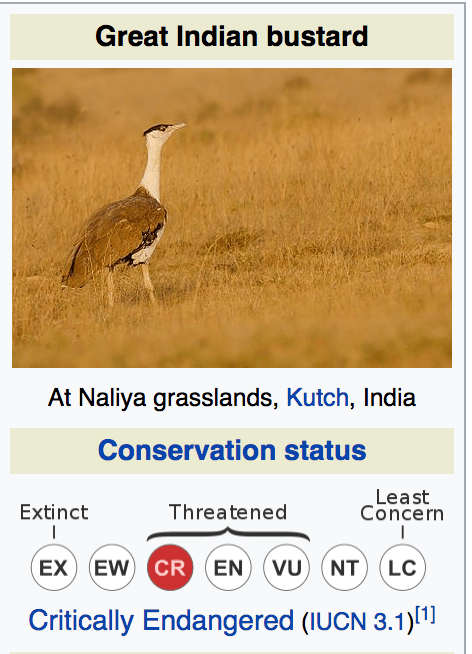

Great Indian Bustards

Context:

The Supreme Court is set to review its April 2021 orders that said to bury underground all power lines in the habitat of the Great Indian Bustard (GIB).

- The reconsideration of its orders was taken up by the SC after the Centre found it “practically impossible to implement” over long distances.

Relevance:

Prelims, GS-III: Environment and Ecology (Species in News, Conservation of Biodiversity)

Dimensions of the Article:

- About the Great Indian Bustard

- About the Habitat of Great Indian Bustard

- On the brink of extinction

About the Great Indian Bustard

- The Great Indian Bustard is one of the heaviest flying birds in the world often found associated in the same habitat as blackbuck.

- GIBs are the largest among the four bustard species found in India, the other three being MacQueen’s bustard, lesser florican and the Bengal florican.

- The GIB is Critically Endangered on the IUCN Red List, and comes under the Appendix I of CITES, and Schedule I of the Indian Wildlife (Protection) Act, 1972.

- Threats to the GIB include widespread hunting for sport and food, and activities such as mining, stone quarrying, excess use of pesticides, grassland conversion and power projects along with the expansion of roads and infrastructures such as wind-turbines and power cables.

About the Habitat of Great Indian Bustard

- The Great Indian Bustard’s habitat includes Arid and semi-arid grasslands with scattered short scrub, bushes and low intensity cultivation in flat or gently undulating terrain. It avoids irrigated areas.

- GIBs’ historic range included much of the Indian sub-continent but it has now shrunken to just 10 per cent of it.

- Among the heaviest birds with flight, GIBs prefer grasslands as their habitats. Being terrestrial birds, they spend most of their time on the ground with occasional flights to go from one part of their habitat to the other.

- GIBs are considered the flagship bird species of grassland and hence barometers of the health of grassland ecosystems.

- They feed on insects, lizards, grass seeds etc.

On the brink of extinction

- In 2020, the Central government had told the 13th Conference of Parties to the United Nations Convention on Migratory Species of Wild Animals (CMS) held in Gandhinagar, that the GIB population in India had fallen to just 150.

- Of the 150 birds in 2020, over 120 birds were in Rajasthan, some were in Kutch district of Gujarat and a few in Maharashtra, Karnataka and Andhra Pradesh.

- Pakistan is also believed to host a few GIBs.

- Due to the species’ smaller population size, the International Union for Conservation of Nature (IUCN) has categorised GIBs as critically endangered, thus on the brink of extinction from the wild.

- Scientists of Wildlife Institute of India (WII) have been pointing out overhead power transmission lines as the biggest threat to the GIBs.

-Source: The Indian Express, The Hindu

India’s forex reserves hit a record high

Context:

As per the latest data from the Central Bank, India’s foreign exchange reserves rose for a fifth straight week to hit a record high of $642.63 billion as of March 22, 2024.

Relevance:

GS-III Indian Economy

Dimensions of the Article:

- What are forex reserves?

- What’s the significance of rising forex reserves?

- What does the RBI do with the forex reserves at its disposal?

- Where are India’s forex reserves kept?

- Is there a cost involved in maintaining forex reserves?

What are forex reserves?

Forex reserves are external assets in the form of gold, SDRs (special drawing rights of the IMF) and foreign currency assets (capital inflows to the capital markets, FDI and external commercial borrowings) accumulated by India and controlled by the RBI.

What’s the significance of rising forex reserves?

- The rising forex reserves give comfort to the government and the RBI in managing India’s external and internal financial issues at a time of major contraction in economic growth.

- It serves as a cushion in the event of a crisis on the economic front, and is enough to cover the import bill of the country for a year.

- The rising reserves have also helped the rupee to strengthen against the dollar.

- The foreign exchange reserves to GDP ratio is around 15 per cent.

- Reserves will provide a level of confidence to markets that a country can meet its external obligations, demonstrate the backing of domestic currency by external assets, assist the government in meeting its foreign exchange needs and external debt obligations and maintain a reserve for national disasters or emergencies.

What does the RBI do with the forex reserves at its disposal?

- The Reserve Bank functions as the custodian and manager of forex reserves, and operates within the overall policy framework agreed upon with the government.

- The RBI uses its forex kitty for the orderly movement of the rupee.

- When the RBI mops up dollars, it releases an equal amount in rupees. This excess liquidity is sterilised through the issue of bonds and securities and LAF operations.

Where are India’s forex reserves kept?

- The RBI Act, 1934 provides the overarching legal framework for deployment of reserves in different foreign currency assets and gold within the broad parameters of currencies, instruments, issuers and counterparties.

- As much as 64 per cent of the foreign currency reserves are held in securities like Treasury bills of foreign countries, mainly the US; 28 per cent is deposited in foreign central banks; and 7.4 per cent is deposited in commercial banks abroad, according to RBI data.

- India also held more than 650 tonnes of gold as of March 2020.

Is there a cost involved in maintaining forex reserves?

- The return on India’s forex reserves kept in foreign central banks and commercial banks is negligible — analysts say it could be around 1 per cent, or even less than that, considering the fall in interest rates in the US and Euro zone.

- There was a demand from some quarters that forex reserves should be used for infrastructure development in the country.

- However, the RBI had opposed the plan. Several analysts argue for giving greater weightage to return on forex assets than on liquidity thus reducing net costs if any, of holding reserves.

-Source: The Indian Express

Governor withholds assent to Bills

Context:

Recently, the Kerala Government has moved to the Top Court stating that the Governor Arif Mohammed Khan had withheld assent to seven Bills- some for as long as two years.

- The Kerala government has also approached the Supreme Court last week saying President had withheld assent to four Bills passed by the state without disclosing a valid reason.

Relevance:

GS-II: Functions and Responsibilities of the Union and the States, Issues and Challenges Pertaining to the Federal Structure, Devolution of Powers and Finances up to Local Levels and Challenges Therein.

Dimensions of the Article:

- Position of Governor in Constitutional setup in India

- What exactly are the options before the Governor in the matter of giving assent to a Bill passed by the Assembly?

- Recent examples highlighting controversies surrounding the role of Governor

Position of Governor in Constitutional setup in India

- Appointee of the President: The Governor is an appointee of the President, which means the Union government.

- Although Article 154(1) of the Constitution vests in the Governor the executive power of the State, he is required to exercise that power in accordance with the Constitution.

- In other words, the Governor can act only on the aid and advice of the Council of Ministers.

- It is a settled constitutional position that the Governor is only a constitutional head and the executive power of the State is exercised by the Council of Ministers.

- In Shamsher Singh vs State of Punjab (1974), the Supreme Court had clearly affirmed this position.

- Dr. Ambedkar explained the position of the Governor in the Constituent Assembly as follows: “The Governor under the Constitution has no functions which he can discharge by himself: no functions at all.”

- The Sarkaria Commission restates this position in its report, “it is a well-recognized principle that so long as the council of ministers enjoys [the] confidence of the Assembly its advice in these matters, unless patently unconstitutional, must be deemed as binding on the governor”.

- In 2016, a five-judge constitution Bench of the Supreme Court (the Nabam Rebia case) reaffirmed the above position on the governors’ powers in our constitutional setup.

What exactly are the options before the Governor in the matter of giving assent to a Bill passed by the Assembly?

- Assent of the Governor or the President is necessary for a Bill to become law.

- Four options: Article 200 of the Constitution provides for four alternative courses of action for a Governor when a Bill after being passed by the legislature is presented to him for his assent.

1] The Governor can give his assent straightaway.

2] The Governor can withhold his assent.

3] He may also reserve it for the consideration of the President, in which case the assent is given or withheld by the President.

4] The fourth option is to return the Bill to the legislature with the request that it may reconsider the Bill or any particular provision of the Bill.

- When such a message is received from the Governor, the legislature is required to reconsider his recommendations quickly.

- However, if the legislature again passes the Bill without accepting any of the amendments suggested by the Governor he is constitutionally bound to give assent to the Bill.

Recent examples highlighting controversies surrounding the role of Governor

- The Maharashtra Governor swore in Devendra Fadnavis as chief minister in 2019 despite an undecided vote, only to see his government fall within 80 hours.

- In September 2022, the Governor of Punjab denied a special session of the Assembly for a vote of confidence in the AAP government.

The Recent Case of Bills in Tamil Nadu:

- The Bills in question primarily aim to transfer the power of appointing Vice-Chancellors of universities from the Governor to the State government.

- There is no valid reason for the Governor to disapprove of these Bills, except for a vested interest in retaining the powers vested in the capacity of the Chancellor.

- The rejection of these Bills seems to be a contentious reaction following the Supreme Court’s justified comments on Governors delaying the assent to pending Bills.

- In response, the DMK government promptly convened a special session of the Assembly and reapproved the same Bills.

- This raises the question of whether the government believed the Governor was obligated to grant assent if the Bills were reconsidered and passed again by the House.

-Source: The Indian Express, The Hindu

Rajasthan’s 75th Statehood Day

Context:

The state of Rajasthan is celebrating its 75th Statehood Day today.

Relevance:

GS II- Governance

Dimensions of the Article:

- Details

- Geography

- Wildlife Sanctuaries and National Parks

Details:

- On March 30th, 2024, Rajasthan is celebrating its 75th State Formation Day.

- The State was formed on 30 March 1949 when Rajputana – name as adopted by British

- Crown was merged into the Dominion of India.

- Jaipur being largest city was declared as capital of the state.

Geography:

- Rajasthan is located in the north-western part of the subcontinent.

- It is bounded on the west and northwest by Pakistan, on the north and northeast by the states of Punjab, Haryana, and Uttar Pradesh, on the east and southeast by the states of Uttar Pradesh and Madhya Pradesh, and on the southwest by the state of Gujarat.

- The Tropic of Cancer passes through its southern tip in the Banswara district.

- Its features include the ruins of Indus Valley Civilization, Temples, Forts and Fortresses in almost every city.

- Rajasthan is divided into nine regions: Ajmer, Hadoti, Dhundhar, Gorwar, Shekhawati, Mewar, Marwar, Vagad and Mewat which are equally rich in its heritage and artistic contribution.

- In the west, Rajasthan is relatively dry and infertile; this area includes some of the Thar Desert, also known as the “Great Indian Desert”. In the south-western part of the state, the land is wetter, hilly, and more fertile. The climate varies throughout Rajasthan.

Wildlife Sanctuaries and National Parks:

National Parks

- Keoladeo National Park

- Ranthambore National Park

- Mukundara National Park

Important Wildlife Sanctuaries:

· Mount Abu Wildlife Sanctuary

· Darrah National Park

· Machiya Biological Park

· Ramgarh Vishdhari Sanctuary

· Baretha Wildlife Sanctuary

· Tal Chhapar Sanctuary

· Bassi Wildlife Sanctuary

· Sajjangarh Wildlife Sanctuary

-Source: AIR

MHA extends FCRA registration of NGOs

Context:

The Ministry of Home Affairs (MHA) recently extended the validity of Foreign Contribution (Regulation) Act (FCRA) registration of non-government organisations (NGOs) and associations till June 30.

Relevance:

GS-II: Polity and Governance (Government Policies & Interventions, Non-Governmental Organisations -NGOs), GS-III: Indian Economy (External Sector, Mobilization of Resources)

Dimensions of the Article:

- What is the FCRA?

- Foreign Contribution (Regulation) Act, 2010

- Foreign Contribution (Regulation) Amendment Act, 2020

- Issues Related to FCRA

- Non-Governmental Organisations (NGOs) in India

What is the FCRA?

- The FCRA was enacted during the Emergency in 1976 amid apprehensions that foreign powers were interfering in India’s affairs by pumping money into the country through independent organisations.

- These concerns were, in fact, even older — they had been expressed in Parliament as early as in 1969.

- The law sought to regulate foreign donations to individuals and associations so that they functioned “in a manner consistent with the values of a sovereign democratic republic”.

Foreign Contribution (Regulation) Act, 2010

The Foreign Contribution (regulation) Act, 2010 is a consolidating act whose scope is to regulate the acceptance and utilisation of foreign contribution or foreign hospitality by certain individuals or associations or companies and to prohibit acceptance and utilisation of foreign contribution or foreign hospitality for any activities detrimental to the national interest and for matters connected therewith or incidental thereto.

Key Points regarding FCRA

- Foreign funding of voluntary organizations in India is regulated under FCRA act and is implemented by the Ministry of Home Affairs.

- The FCRA regulates the receipt of funding from sources outside of India to NGOs working in India.

- It prohibits the receipt of foreign contribution “for any activities detrimental to the national interest”.

- The Act held that the government can refuse permission if it believes that the donation to the NGO will adversely affect “public interest” or the “economic interest of the state”. However, there is no clear guidance on what constitutes “public interest”.

- The Acts ensures that the recipients of foreign contributions adhere to the stated purpose for which such contribution has been obtained.

- Under the Act, organisations require to register themselves every five years.

Foreign Contribution (Regulation) Amendment Act, 2020

- The Act bars public servants from receiving foreign contributions. Public servant includes any person who is in service or pay of the government, or remunerated by the government for the performance of any public duty.

- The Act prohibits the transfer of foreign contribution to any other person not registered to accept foreign contributions.

- The Act makes Aadhaar number mandatory for all office bearers, directors or key functionaries of a person receiving foreign contribution, as an identification document.

- The Act states that foreign contribution must be received only in an account designated by the bank as FCRA account in such branches of the State Bank of India, New Delhi.

- The Act proposes that not more than 20% of the total foreign funds received could be defrayed for administrative expenses. In FCRA 2010 the limit was 50%.

- The Act allows the central government to permit a person to surrender their registration certificate.

Issues Related to FCRA

- The Act also held that the government can refuse permission if it believes that the donation to the NGO will adversely affect “public interest” or the “economic interest of the state” – however, there is no clear guidance on what constitutes “public interest”.

- By allowing only some political groups to receive foreign donations and disallowing some others, can induce biases in favour of the government. NGOs need to tread carefully when they criticise the regime, knowing that too much criticism could cost their survival. FCRA norms can reduce critical voices by declaring them to be against the public interest – Hence, it can be said that FCRA restrictions have serious consequences on both the rights to free speech and freedom of association under Articles 19(1)(a) and 19(1)(c) of the Constitution.

- In 2016, the UN Special Rapporteur on the Rights to Freedom of Peaceful Assembly and of Association undertook a legal analysis of the FCRA and stated that restrictions in the name of “public interest” and “economic interest” failed the test of “legitimate restrictions” as they were too vague and gave the state excessive discretionary powers to apply the provision in an arbitrary manner.

Non-Governmental Organisations (NGOs) in India

- Worldwide, the term ‘NGO’ is used to describe a body that is neither part of a government nor a conventional for-profit business organisation.

- NGOs are groups of ordinary citizens that are involved in a wide range of activities that may have charitable, social, political, religious or other interests.

- In India, NGOs can be registered under a plethora of Acts such as the Indian Societies Registration Act, 1860, Religious Endowments Act,1863, Indian Trusts Act, etc.

- India has possibly the largest number of active NGOs in the world.

- Ministries such as Health and Family Welfare, Human Resource Department, etc., provide funding to NGOs, but only a handful of NGOs get hefty government funds.

- NGOs also receive funds from abroad, if they are registered with the Home Ministry under the Foreign Contribution (Regulation) Act (FCRA). There are more than 22,500 FCRA-registered NGOs.

- Registered NGOs can receive foreign contribution under five purposes — social, educational, religious, economic and cultural.

-Source: The Hindu