Contents

- Vying for influence over Kabul: OIC and Central Asian states

- What are the head and tailwinds in the economy?

Vying for influence over Kabul: OIC and Central Asian states

Context:

December 2021, Pakistan hosted a special session of the Organisation of Islamic Cooperation (OIC) to address the crisis in Afghanistan.

Relevance:

GS-II: International Relations

Dimensions of the Article:

- Why is there so much interest on Afghanistan?

- About the Organisation of Islamic Cooperation (OIC)

- Developments between Islamic nations on Afghanistan

- 2015 Strains in the Saudi – Pakistan Relationship

- Conclusion

Why is there so much interest on Afghanistan?

- Afghanistan is sitting on mineral deposits estimated to be worth up to $3 trillion according to a a former mines minister of Afghanistan.

- The country is probably home to what may be the world’s largest reserves of lithium – the key ingredient of the large-capacity lithium-ion batteries. Since, China dominates Lithium-Ion Battery Production worldwide, it may seek long-term a contract with the Taliban to develop Afghanistan’s massive untapped lithium reserves in return for mining rights and ownership arrangements.

- Afghanistan is also rich in several other resources such as gold, oil, bauxite, rare earths, chromium, copper, natural gas, uranium, coal, iron ore, lead, zinc, gemstones, talc, sulphur, travertine, gypsum and marble.

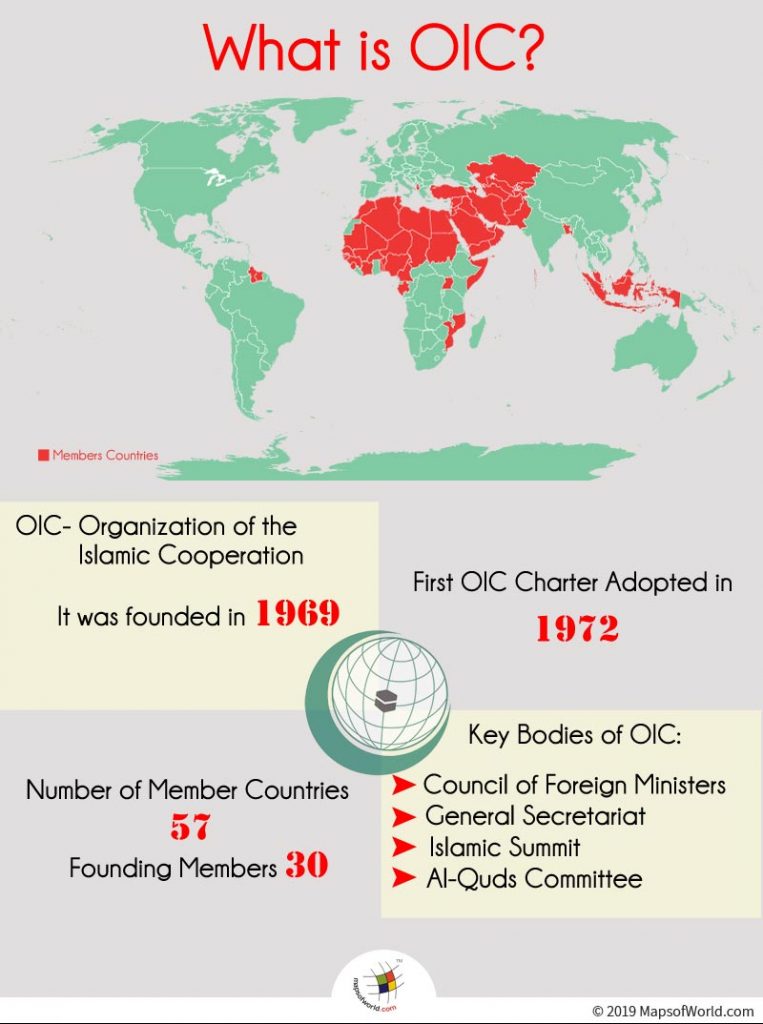

About the Organisation of Islamic Cooperation (OIC)

- The Organisation of Islamic Cooperation is an international organization founded in 1969, consisting of 57 member states, with a collective population of over 1.8 billion as of 2015 with 53 countries being Muslim-majority countries.

- The organisation states that it is “the collective voice of the Muslim world” and works to “safeguard and protect the interests of the Muslim world in the spirit of promoting international peace and harmony”.

- The OIC has permanent delegations to the United Nations and the European Union.

- Some members, especially in West Africa and South America, are – though with large Muslim populations – not necessarily Muslim majority countries.

- A few countries with significant Muslim populations, such as Russia and Thailand, sit as Observer States.

Developments between Islamic nations on Afghanistan

- Pakistan hosted a special session of the Organisation of Islamic Cooperation (OIC) to address the crisis in Afghanistan in which Taliban, which took over Kabul in August 2021 after a 20-year-long war with the U.S., also attended.

- Saudi Arabia, the UAE, and Pakistan were the only three countries that had officially recognised the previous Taliban government in 1996, until its fall in 2001.

- In 2010s, Qatar became the mediating force on Afghanistan and hosted the official Taliban political office from 2013 to allow negotiations with the U.S.

- In 2017, fissures such as the unease in the traditional power centres in Abu Dhabi and Riyadh due to Qatar’s growing clout and ambition, broke the levee within the Gulf Cooperation Council, as the UAE and Saudi Arabia initiated an economic blockade against Doha in the hope of reigning the Kingdom in and disallowing it from pursuing its geopolitical designs that were challenging the long-held power status quos. This four-year long impasse ended in 2021.

Post OIC meeting in 2021

- The centrality of Saudi Arabia’s presence during the 2021 OIC session comes after Riyadh maintained a certain distance over the developments involving the U.S., the Taliban and the erstwhile Afghan government of President Ashraf Ghani.

- Qatar’s new role on Afghanistan gave it significant diplomatic and political visibility the world over.

- Both Qatar and Turkey are bidding to operate a landlocked Afghanistan’s airports under the Taliban regime.

- Saudis played a central role during the recent OIC – repaired their broken relationship with Pakistan, where Riyadh had repeatedly cold-shouldered the government of Prime Minister Imran Khan.

2015 Strains in the Saudi – Pakistan Relationship

- When, in 2015, Saudi Arabia asked Pakistan to join the coalition it was leading to undertake the ground offensive in Yemen against the Iran-backed Houthis, Islamabad refused and let it be known that it would prefer to stand “neutral” in the Iran-Saudi rivalry.

- The decision was taken keeping in mind the possible implications of joining the coalition on domestic politics and on bilateral relations with Iran.

- The Saudi-Iran conflict in West Asia has serious ramifications for Pakistan’s relationship with Saudi Arabia. Saudi Arabia sees Iranian involvement and growing salience in regional politics as a threat to its security.

- Pakistan, for its part, is worried about India’s improving relations with West Asian countries in general and Saudi Arabia in particular. While Pakistan wants to maintain a delicate balance between Saudi Arabia and Iran, the Saudis are not happy with this balancing game and want Pakistan to support them.

Conclusion

- The Arab Gulf is poised to become an important player once again in an Afghanistan under the shadow of the Taliban.

- Over the past decade, India has recognised the importance of middle powers in the Arab Gulf to a fast-evolving global order, from fighting against terrorism to newer diplomacy challenges such as Afghanistan.

- Individually, India has good relations with almost all member nations of the OIC and the ties with the UAE and Saudi Arabia, especially, have improved significantly in recent years – India can use the untroubled nature of these relations to protect its interests within and in Afghanistan.

-Source: The Hindu

What are the head and tailwinds in the economy?

Context:

For India, the year 2021 that went by has been about rebuilding from the ravages of 2020 amid the COVID-19 storm which had pushed the already slowing economy into contraction mode.

The pandemic-related lockdowns sent the stalling economy into free fall, causing output to shrink by 24.4% and 7.4% in the first two quarters of 2020-21, respectively.

The country’s Gross Domestic Product (GDP) growth had dipped to a mere 3% in the fourth quarter of 2019-2020. The resultant destruction meant that job and income losses coincided with the unfolding health crisis.

Relevance:

GS-III: Indian Economy (Economic Growth and Development, Planning usage and Mobilisation of resources, Inclusive growth and issues therein)

Dimensions of the Article:

- Objectives of growth in India

- Understanding the Economic Outlook of India

- Indian Economy After Pandemic

- Sectors during Pandemic

- Back to basics: Economic Recovery

- What is a K-shaped recovery?

- About V-Shaped Recovery

Objectives of growth in India

- Besides having high growth rate, it is also necessary to ensure that growth is inclusive, sustained, clean and formalized.

- The investment rate should be raised from 29 per cent to 36 per cent of GDP which has been achieved in the past, by 2022-23.

- Exports of goods and services combined should be increased from USD 478 billion in 2017-18 to USD 800 billion by 2022-23.

- Moving from capital intensive sectors to labour intensive sectors to provide employments to young generation.

- Making India as a five trillion-dollar economy by 2024.

Understanding the Economic Outlook of India

- What makes economic recovery challenging is that this decline followed three years of sharp decline in GDP even before the novel coronavirus pandemic hit the country.

- Economic growth had already decelerated to 4% in 2019-20, less than half from the high of 8.3% in 2016-17.

- Since then, the slowdown in the economy has not only made things worse as far as economic recovery is concerned but also come at a huge cost for a majority of households which have lost jobs and incomes.

Indian Economy After Pandemic

- An ambitious target was set for disinvestment from public sector enterprises backed by a new policy to retain a ‘bare minimum’ presence of state-owned firms even in strategic sectors.

- The government explained that higher capital spending would trigger multiplier effects by nudging up demand in several sectors and spur job creation and consumption.

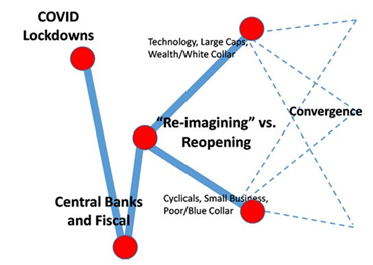

- A K-shaped recovery is unfolding thanks to a divergence between those who needed to protect their lives and livelihoods.

- While manufacturing and construction recovered, the economy’s overall output remained far below even the low pre-pandemic levels.

- The recovery remains uneven and fragmented with economists also unconvinced about its sustainability.

- Demand and investments were yet to see a meaningful and durable pick-up and any improvements were expected to be limited.

- Gradual domestic economy had been grappling with low demand and a subdued investment climate.

Sectors during Pandemic

- Agriculture is the only sector to record positive growth throughout the pandemic.

- Sectors like manufacturing, mining, electricity, recovered above pre-COVID levels by September.

- Employment-intensive sectors like construction, the contact-intensive trade and hotels industry, as well as financial services and real estate, continue to languish below their pre-pandemic levels.

- There are some other interesting aspects of this year’s economic trajectory.

- Wholesale price inflation has also hit an all-time high in the current series of the index, making input costs the number one worry for businesses.

Back to basics: Economic Recovery

- Economic Recovery is the business cycle stage following a recession that is characterized by a sustained period of improving business activity.

- Normally, during an economic recovery, GDP grows, incomes rise, and unemployment falls and as the economy rebounds.

- Economic recovery can take many forms, which is depicted using alphabetic notations. For example, a Z-shaped recovery, V-shaped recovery, U-shaped recovery, elongated U-shaped recovery, W-shaped recovery, L-shaped recovery and K-shaped recovery.

What is a K-shaped recovery?

- A K-shaped recovery happens when different sections of an economy recover at starkly different rates.

- A K-shaped recovery leads to changes in the structure of the economy or the broader society as economic outcomes and relations are fundamentally changed before and after the recession.

- This type of recovery is called K-shaped because the path of different parts of the economy when charted together may diverge, resembling the two arms of the Roman letter “K.”

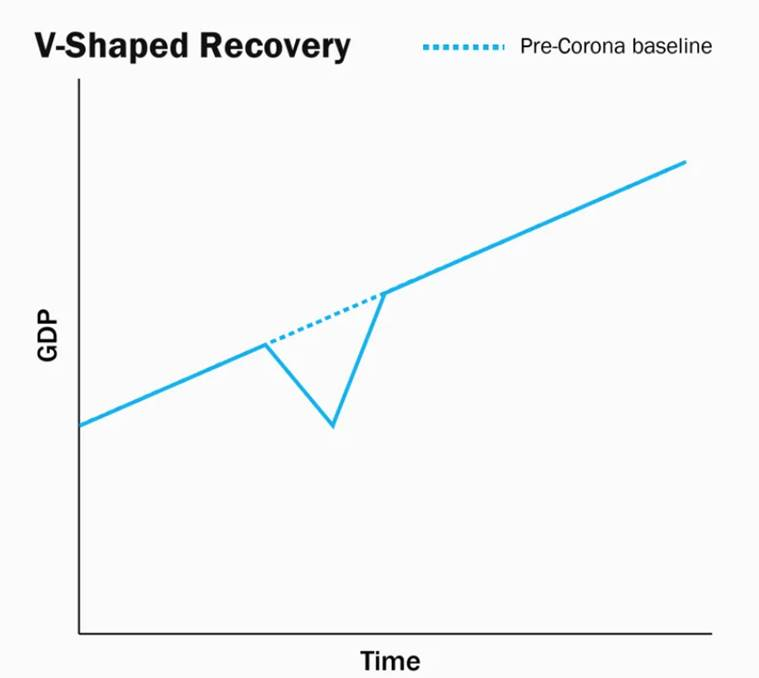

About V-Shaped Recovery

- V-shaped recovery is a type of economic recession and recovery that resembles a “V” shape in charting.

- Specifically, a V-shaped recovery represents the shape of a chart of economic measures economists create when examining recessions and recoveries.

- A V-shaped recovery involves a sharp rise back to a previous peak after a sharp decline in these metrics.

- It is the next-best scenario after Z-shaped recovery in which the economy quickly recoups lost ground and gets back to the normal growth trend-line.

- In this, incomes and jobs are not permanently lost, and the economic growth recovers sharply and returns to the path it was following before the disruption.

-Source: The Hindu