Editorials/Opinions Analysis For UPSC 15 February 2022

Contents:

- Zooming in on the potential of India’s geospatial sector

- Insuring India

Zooming In on the Potential of India’s Geospatial Sector

Context:

February 15, 2022 marks one year since the new guidelines to completely de-regulate the geospatial sector for Indians took effect.

Relevance:

GS II: E-Governance, Human Resource, Government Policies & Interventions

Dimensions of the Article:

- De-regulation of the geospatial sector

- What are the issues?

- Need for Protocol

- Academic Support

- Way Forward

De-regulation of the geospatial sector:

- De-regulation of the geospatial sector is regarded as a significant moment and the new guidelines have certainly helped to boost the sector.

- The market for this sector is projected to close ₹1 lakh-crore by the year 2029 with 13% Compound Annual Growth Rate (CAGR).

- Consequently, the sector is now seeing new interest by the investors, which was not seen earlier.

- One of the noticeable example is over subscription of the initial public offering of MapmyIndia.

What are the issues?

- Lack of percolation:

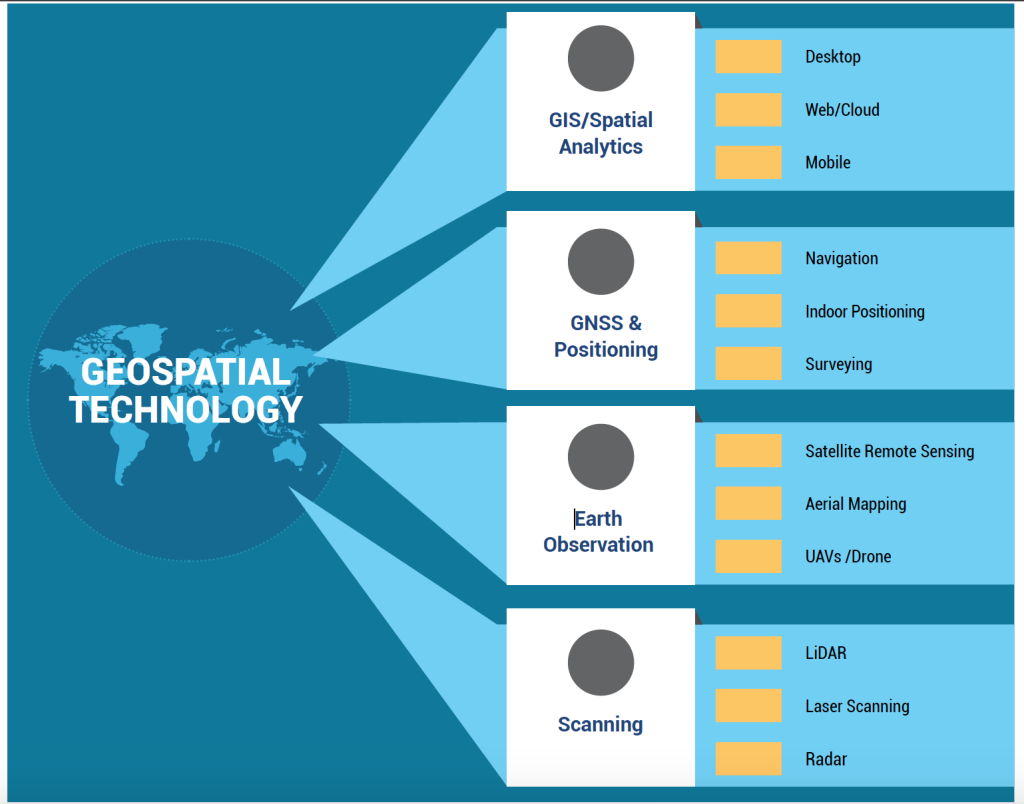

- India has a robust ecosystem in geospatial which mainly includes the Survey of India (SoI), the Indian Space Research Organization (ISRO), remote sensing application centers (RSAC)s, and the National Informatics Centre (NIC). All ministries and departments, in general, use geospatial technology.

- However, the full potential of the geospatial sector is not fully exploited. The sector’s contribution towards India’s GDP is not considerable and its full benefits are yet to percolate to the public.

- Lack of demand: Absence of a sizeable geospatial market in India is one of the prominent hurdle.

- There is no demand for geospatial services and products on a scale linked to India’s potential and size.

- This is mainly due to the lack of awareness among potential users in government and private.

- The sector suffers from lack of skilled manpower across the entire pyramid.

- Unavailability of Data: The unavailability of foundation data, especially at high-resolution, is also a constraint.

- The lack of clarity on data sharing and collaboration prevents co-creation and asset maximisation.

- There are still no ready-to-use solutions especially built to solve the problems of India.

- The root cause of all these problems is attribution to the restrictive data policy followed by India in the past.

- These problems need to be addressed to ensure the effectiveness of Policy.

- However, despite one year since the new guidelines came into effect, users are still not fully aware of things.

Need for Protocol:

- Formulation of guidelines alone cannot bring in the required progress.

- The sector requires special attention to shrug off the mindset caused by the restriction that was in place for decades.

- Create Awareness: The Government need to publish the entire policy document and make government and private users aware of things. These data needs to be shared further to reach many users.

- One possible way to is through an open data sharing protocol.

- Adoption of Standards: The Government needs to invest in developing standards and must mandate the adoption of standards.

- A geo-portal can be established to make all public-funded data accessible through data as a service model, with no or nominal charge.

- It should inculcate the culture of data sharing, collaboration and co-creation.

- Other steps needed:

- There is a need to generate foundation data across India.

- Solution developers and start-ups should be engaged to build solution templates for various business processes across departments.

- Local technology and solutions should be promoted, and competition should be encouraged for quality output.

- Geospatial Data cloud: There is a need to develop a geospatial data cloud locally and facilitate a solution as service.

- The new guidelines prevent high-accuracy data being stored in overseas clouds

Academic support:

- Lack of Core Professionals: As seen in most of the western countries, India lacks core professionals who understand geospatial end-to-end.

- Though a significant number of people receive geospatial training, they are trained mostly through a master’s level programme or on-job training.

- Bachelor’s programme in geospatial: India should start a bachelor’s programme in geospatial also in the Indian Institutes of Technology and the National Institutes of Technology

- Geospatial University: There should be a dedicated geospatial university to support the bachelor’s programme.

- These efforts are significant to improve research and development efforts which are crucial for the development of technologies and solutions locally.

Way Forward:

- The geospatial sector is the one that has enough potential for investment. However, this to happen, it requires addressing the issues discussed above, along with the creation of an enabling ecosystem.

- India should look forward to achieve its projected market volume and to have Indian entrepreneurs stand out internationally

-Source: The Hindu

Insuring India

Context:

Recently, the Life Insurance Corporation of India (LIC) has filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI).

Relevance:

GS III: Mobilization of Resources, Government Budgeting

Dimensions of the Article:

- Disinvestment of LIC

- What are the concerns?

- Way Forward

Disinvestment of LIC:

- The initial public offering is for 31.6 crore shares or 5 per cent of the government’s stake.

- This will be a significant step towards the government’s disinvestment target of Rs 78,000 crore. The Government so far was able to achieve only a part of this target.

- The LIC has been ceding space to private players and the size of this large organization is truly staggering.

- Between 2015-16 and 2020-21, private sector life insurance players saw their premiums grow at 18 per cent, while LIC’s premium grew at 9 per cent.

What are the concerns?

- Market in India: The market for insurance sector in India is still under-penetrated.

- The country’s insurance density is much lower than that of other developing countries which indicates scope for growth.

- Global crisis:

- The IPO comes at a time of tightening global financial conditions.

- There is a significant decline in the investment by the foreign investors.

- May not benefit the Organization:

- LIC has often been used by the government to serve its own ends — for instance, it helped bail out the troubled IDBI bank.

- There are legitimate concerns that its investment decisions may continue to be guided by other motives.

- As the DRHP notes: The “corporation may be required to take certain actions in furtherance of the GoI’s economic or policy objectives. There can be no assurance that such actions would necessarily be beneficial to our Corporation.”

- Though the sector has enough potential to generate interest, there are concerns about the capacity of the market to absorb such a large offering.

Way Forward:

- Listing of LIC can certainly bring its governance structures and investment decisions to public scrutiny.

- However, continued government interference in its decision making will affect the corporation’s prospects.

- LIC being a custodian of the policy holder’s money, the government should respect its autonomy for corporation to realise its potential

-Source: The Indian Express