Focus: GS-III Indian Economy

Why in news?

- The Indian economy saw its worst contraction in decades, with Gross Domestic Product (GDP) shrinking by a record 23.9% in the April to June quarter (Q1FY21) in comparison to the same period last year, according to data released by the National Statistical Office (NSO).

(The numbers are the first estimates and they could be revised downwards further – This is because, the informal sector numbers, which are likely to have suffered more, will only become available at a later stage).

- The contraction reflects the severe impact of the COVID-19 lockdown, which halted most economic activities, as well as the slowdown trend of the economy even pre-COVID-19.

- Economists expect this to contribute to a contraction in annual GDP this year, which may be the worst in the history of independent India.

Pre-Covid times

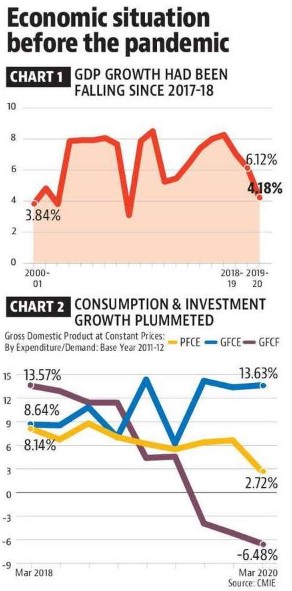

- The Indian economy was in one of its worst ever deceleration phases even before the Covid-19 pandemic.

- GDP growth fell continuously for eight quarters (except for a 0.08 percentage point blip between December 2018 and March 2019.

- It was 8.2% in March 2018 and had fallen to just 3.1% in March 2020.

Both current and future drivers of growth collapsed

- Consumption demand is the biggest driver of economic growth in India.

- In 2019-20, Private Final Consumption Expenditure (PFCE) had a share of 57% in India’s GDP.

- Given the strengthening headwinds to consumption demand, firms started shelving investment plans.

- This can be seen in Gross Fixed Capital Formation (GFCF) contracting at an increasing rate for three consecutive quarters ending March 2020.

- A collapse in investment demand has adverse implications for future growth potential of the economy.

- It was only government expenditure which was acting as a counter-cyclical force to some extent.

The Current Lockdown Phase

- India was under an almost complete lockdown for the months of April and May.

- Some experts say: The lockdown was not the problem, but it is the manner in which it was implemented and the policy response which has followed that have made things worse.

- The economic contraction has affected the entire non-farm economy including the government sector.

Highlights

- The last contraction of the economy occurred in 1979-80, when GDP shrank 5.2%. There have been four other instances of minor contraction between 1965-68, and 1972-73, but this year is likely to be the worst since Independence.

- The steepest fall came from the 50% in construction, and 47% fall in trade, hotels, transport and communication. Manufacturing shrank more than 39%, while mining and quarrying dropped 23%.

- “The major burden on the economy is the contraction you are seeing in private final consumption, which has a weight of almost 60% in the GDP.

- Agriculture was the only silver lining with a growth of 3.4%.

- Gross Value Added (GVA), which measures the value of production minus taxes contracted by 22.8%.

- The expenditure side numbers suggest that both consumption and investment demand collapsed during the lockdown.

- Private Final Consumption Expenditure contracted by 26.7%.

The Decline and Prospect of Recovery

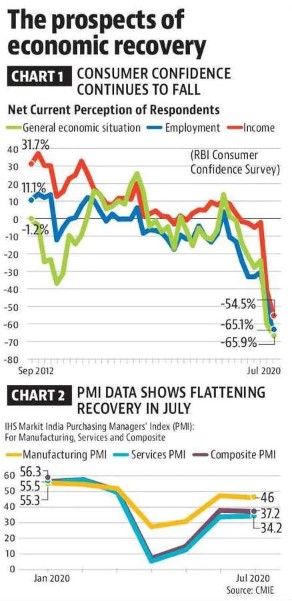

- While lockdown restrictions have been eased significantly from July onwards, the continuous rise in the number of Covid-19 infections has led to a continuous deterioration in consumer sentiment- as seen in RBI’s latest consumer confidence survey conducted.

- The worsening economic outlook, according to experts, will generate additional headwinds for consumption demand as households increase precautionary savings.

- High frequency indicators also suggest that some of the recovery seen in June might have been the result of pent-up demand due to the lockdown in April and May.

- Prospects of a co-ordinated fiscal stimulus will become difficult given the disproportionate hit to finances of state governments.

- Railway freight traffic, is often times a good indicator of economic activity, an in July 2020 it is 95% of the level that it was in 2019.

- Power consumption is only 1.9% lower than in 2019.

- The GDP contraction can be put in the context of a global recession due to COVID-19 according to the Indian Chief Economic Advisor.

RBI’s plan to rescue

- In a bid to cool rising bond yields and maintain market stability in the financial system, the Reserve Bank of India (RBI) announced a slew of measures including two more tranches of special open market bond operations or ‘Operation Twist’ and additional term repo operations of Rs 1 lakh crore at a floating rate basis.

- The RBI also reiterated that it “remains committed to use all instruments at its command to revive the economy by maintaining congenial financial conditions, mitigate the impact of COVID-19 and restore the economy to a path of sustainable growth while preserving macroeconomic and financial stability.”

- The RBI has allowed an additional 2.5 per cent of deposits for banks as HTM for the second half of the current financial year (September – March).

- The RBI said that there will be another set of ‘Operation twists’ where it will buy and sell securities of different maturities to manage yields in the market.

- There will also be a term repo auction in mid-September to address the issue of advance tax payments.

Operation Twist

- ‘Operation Twist’ is when the central bank uses the proceeds from sale of short-term securities to buy long-term government debt papers, leading to easing of interest rates on the long term papers.

- The name “Operation Twist” was given by the mainstream media due to the visual effect that the monetary policy action was expected to have on the shape of the yield curve.

- If we visualize a linear upward sloping yield curve, this monetary action effectively “twists” the ends of the yield curve, hence, the name Operation Twist.

- To put another way, the yield curve twists when short-term yields go up and long-term interest rates drop at the same time.

- This is expected to lead to a flattening of the yield curve. Long-end rates are expected to come off, while short-term rates could rise

-Source: The Hindu, Hindustan Times, Business Standard