Context:

Setting the stage for a closure of the retrospective tax disputes over indirect transfer of assets situated in India, the government notified new rules under the Income Tax Act for specifying the process to be followed by affected taxpayers to settle long-brewing disputes.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Fiscal Policy, Taxation), GS-II: Governance (Government Policies and Interventions)

Dimensions of the Article:

- What is retrospective taxation?

- Why the need for retrospective taxation?

- Provisions of the The Taxation Laws (Amendment) Act, 2021

- About the Income-Tax (31st Amendment) Rules, 2021

What is retrospective taxation?

- Retrospective taxation allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Countries use this route to correct any anomalies in their taxation policies that have, in the past, allowed companies to take advantage of such loopholes.

- Apart from India, many countries including the US, the UK, the Netherlands, Canada, Belgium, Australia and Italy have retrospectively taxed companies, which had taken the benefit of loopholes in the previous law.

What is the need for retrospective taxation?

- Under the IT Act, non-residents are required to pay tax on the income accruing through or arising from any business connection, property, asset, or source of income situated in India.

- The amendments made by the 2012 Act clarified that if a company is registered or incorporated outside India, its shares will be deemed to be or have always been situated in India if they derive their value substantially from the assets located in India. As a result, the persons who sold such shares of foreign companies before the enactment of the Act (i.e., May 28, 2012) also became liable to pay tax on the income earned from such sale.

- Cairn Energy’s case:

- The latest move to amend the law is being seen as a strategic rethink coming in response to the government having suffered reverses in its arbitration case against Cairn Energy and the latter securing an order to freeze Indian assets in Paris last month.

- The Arbitral tribunal, which had its seat in the Hague, has asked India to pay Cairn an award of $1,232.8 million plus interest and $22.38 million towards arbitration and legal costs.

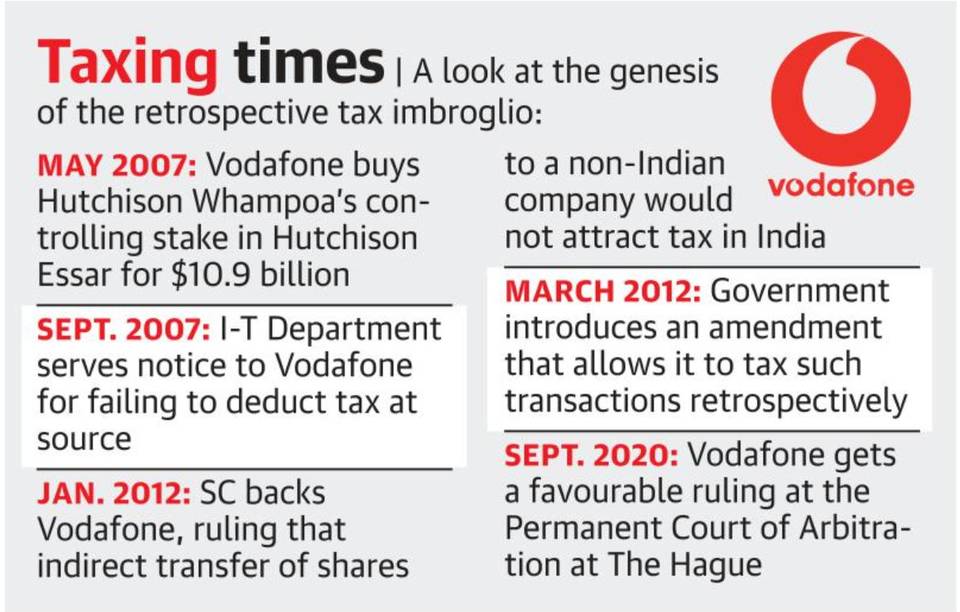

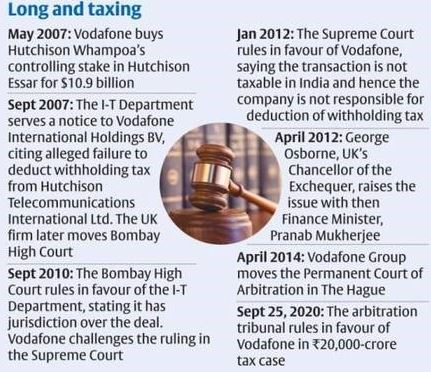

- Vodafone case In May 2007:

- Vodafone had bought a 67% stake in Hutchison Whampoa for $11 billion. This included the mobile telephony business and other assets of Hutchison in India.

- In September that year, the India government for the first time raised a demand of Rs 7,990 crore in capital gains and withholding tax from Vodafone, saying the company should have deducted the tax at source before making a payment to Hutchison.

- Vodafone challenged the demand notice in the Bombay High Court, which ruled in favour of the Income Tax Department. Subsequently, Vodafone challenged the High Court judgment in the Supreme Court, which in 2012 ruled that Vodafone Group’s interpretation of the Income Tax Act of 1961 was correct and that it did not have to pay any taxes for the stake purchase.

- The same year, the then Finance Minister, circumvented the Supreme Court’s ruling by proposing an amendment to the Finance Act, thereby giving the Income Tax Department the power to retrospectively tax such deals.

- Vodafone Group then invoked Clause 9 of the Bilateral Investment Treaty (BIT) signed between India and the Netherlands in 1995.

- In its ruling, the arbitration tribunal also said that now since it had been established that India had breached the terms of the agreement, it must now stop efforts to recover the said taxes from Vodafone.

Provisions of the The Taxation Laws (Amendment) Act, 2021

- The Act proposes to nullify this tax liability imposed on such persons provided they fulfil certain conditions. These conditions are:

- if the person has filed an appeal or petition in this regard, it must be withdrawn or the person must submit an undertaking to withdraw it

- if the person has initiated or given notice for any arbitration, conciliation, or mediation proceedings in this regard, the notices or claims under such proceedings must be withdrawn or the person must submit an undertaking to withdraw them

- the person must submit an undertaking to waive the right to seek or pursue any remedy or claim in this regard, which may otherwise be available under any law in force or any bilateral agreement.

- The Bill provides that if a concerned person fulfils the above conditions, all assessment or reassessment orders issued in relation to such tax liability will be deemed to have never been issued. Further, if a person becomes eligible for refund after fulfilling these conditions, the amount will be refunded to him, without any interest.

Issue related to amendment:

The Bill allows for the refund only of the principal amount in these cases, not the interest. However, considering that in some of these cases, the interest component is sizeable, will these companies avail the offer.

About the Income-Tax (31st Amendment) Rules, 2021

- Union Finance Minister had introduced the Taxation Laws (Amendment) Bill in the Lok Sabha to nullify the retrospective tax clauses that were introduced in 2012 and had issued DRAFT rules to resolve the pending tax disputes.

- Following this, the recently released Income-Tax (31st Amendment) Rules, 2021, introduce a new portion pertaining to ‘indirect transfer prior to May 28, 2012 of assets situated in India’.

- As per the conditions laid down under this new rule, firms disputing retrospective tax demands will have to:

- withdraw all legal proceedings including arbitration, mediation efforts and waive all rights to claim costs or attach Indian assets

- and also indemnify the government on costs and liabilities from any action pursued by other interested parties (including shareholders) in future.

- They would also have to give an undertaking that such initiatives will not be reopened.

-Source: The Hindu