Context:

The government is eyeing a sale of its residual stakes in erstwhile public sector firms like Paradeep Phosphates, Hindustan Zinc and Balco, which were privatised during the Atal Behari Vajpayee regime.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Fiscal Policy, Inclusive growth and issues therein, Budgeting)

Dimensions of the Article:

- What is Disinvestment?

- Evolution of Disinvestment Policy in India

- Privatization in 2019 and onwards

- Policy of Strategic Disinvestment announced in the Union Budget FY 2021-22

- Issues related to Disinvestment

- Significance of the disinvestment

What is Disinvestment?

- Disinvestment or divestiture refers to the government selling or liquidating its assets or stakes in PSE (public sector enterprise).

- The Department for investment and public asset management (DIPAM) under Ministry of finance is the nodal agency for disinvestment

- It is done when a PSU start incurring the loss of exchequer.

- Disinvestment proceeds can help the government fund its fiscal deficit.

Evolution of Disinvestment Policy in India

- The liberalization reforms undertaken in 1991 ushered in an increased demand for privatization/ disinvestment of PSUs.

- The new economic policy 1991 indicated that PSUs had shown a very negative rate of return on capital employed due to:

- Subsidized price policy of public sector undertakings.

- Under–utilization of capacity

- Problems related to planning and construction of projects.

- Problems of labour, personnel and management and lack of autonomy

- In the initial phase, this was done through the sale of a minority stake in bundles through auction. This was followed by a separate sale for each company in the following years, a method popularly adopted till 1999-2000.

- India adopted strategic sale as a policy measure in 1999-2000 with the sale of a substantial portion of government shareholding in identified Central PSEs (CPSEs) up to 50% or more, along with transfer of management control. This was started with the sale of 74 % of the Government’s equity in Modern Food Industries Limited (MFIL).

- Thereafter, 12 PSUs (including four subsidiaries of PSUs), and 17 hotels of Indian Tourism Development Corporation (ITDC) were sold to private investors along with transfer of management control by the Government.

- Another major shift in disinvestment policy was made in 2004-05 when it was decided that the government may “dilute its equity and raise resources to meet the social needs of the people”, a distinct departure from strategic sales.

- Department of Investment and Public Asset Management (DIPAM) has laid down comprehensive guidelines on “Capital Restructuring of CPSEs” in May 2016 by addressing various aspects, such as payment of dividends, buyback of shares, issues of bonus shares and splitting of shares.

Privatization in 2019 and onwards

- In November 2019, India launched its biggest privatization drive in more than a decade. An “in-principle” approval was accorded to reduce the government of India’s paid-up share capital below 51% in select Central Public Sector Enterprises (CPSEs).

- Among the selected CPSEs, strategic disinvestment of the Government’s shareholding of 53.29% in Bharat Petroleum Corporation Ltd (BPCL) was approved which led to an increase in value of shareholders’ equity of BPCL by INR 33,000 crore when compared to its peer Hindustan Petroleum Corporation Limited (HPCL) and this reflects an increase in the overall value from anticipated gains from consequent improvements in the efficiency of BPCL when compared to HPCL which will continue to be under Government control.

The Economic Survey 2020 on Govt. Divestment in PSUs

- The Economic Survey 2020 has aggressively pitched for divestment in PSUs by proposing a separate corporate entity wherein the government’s stake can be transferred and divested over a period of time.

- The performance of privatized firms, after controlling for other confounding factors using the difference in the performance of peer firms over the same period, improves significantly the following privatization.

- Further, the survey has said privatized entities have performed better than their peers in terms of net worth, profit, return on equity and sales, among others.

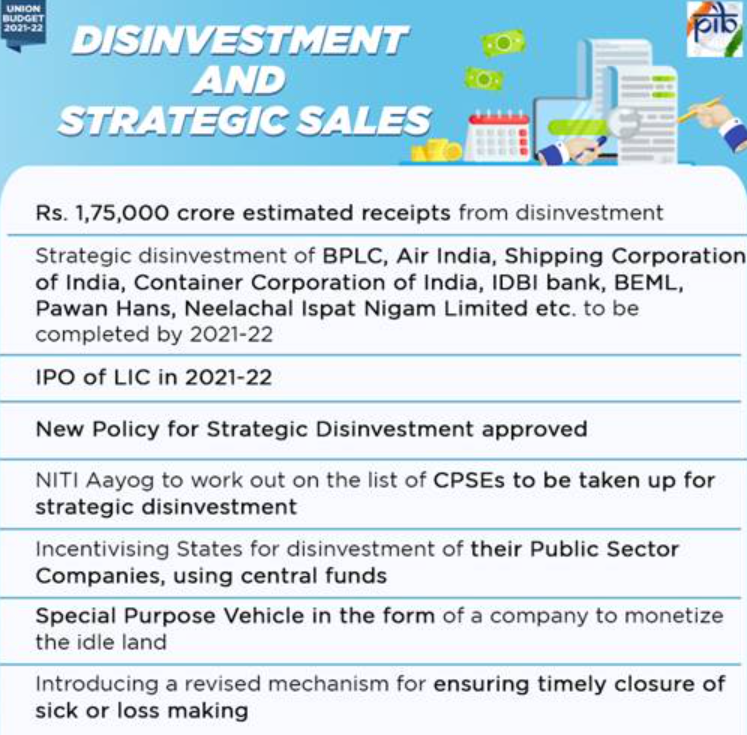

Policy of Strategic Disinvestment announced in the Union Budget FY 2021-22

- The government aims at making use of disinvestment proceeds to finance various social sector and developmental programmes and also to infuse private capital, technology and best management practices in Central Government Public Sector Enterprises.

- Union Minister for Finance and Corporate Affairs, while presenting the Union Budget FY 2021-22 in Parliament announced that government has approved a policy of strategic disinvestment of public sector enterprises that will provide a clear roadmap for disinvestment in all non-strategic and strategic sectors.

- Fulfilling the governments’ commitment under the AtmaNirbhar Package of coming up with a policy of strategic disinvestment of public sector enterprises, the Minister highlighted the following as its main features:

- Existing CPSEs, Public Sector Banks and Public Sector Insurance Companies to be covered under it.

- Most significant, however, is the new strategic disinvestment policy for public sector enterprises and the promise to privatise two public sector banks and a general insurance company in the year.

- The policy, promised as part of the AtmaNirbhar Bharat package, states the government will exit all businesses in non-strategic sectors, with only a ‘bare minimum’ presence in four broad sectors.

Issues related to Disinvestment

- It is against the socialist ideology of equal distribution of resources amongst the population.

- It will lead to monopoly and oligopolistic practices by corporates.

- Proceedings of disinvestment had been used to cater the fiscal deficit of the state which would lead unhealthy fiscal consolidation.

- Private ownership does not guarantee the efficiency (Rangarajan Committee 1993).

- Disinvestment exercise had been done by undervaluation of public assets and favoritism bidding, thereby, leading to loss of public exchequers.

- Private ownership might overlook developmental region disparity in order to cut the cost of operation.

Significance of the disinvestment

- Trade unionism and political interference often lead to halting of PSUs projects thereby hampering the efficiency in long run.

- Problem of disguised unemployment and outdated skill in PSUs employee are the major cause of inefficiency.

- Private prayers works out of Red Tapism bureaucratic mentality and focus on performance-driven culture and effectiveness (Disinvestment Commission 1996).

- More robust competitive bidding leads to competition in private sectors to participate in PSUs.

- Moreover, it ensuring that product service portfolio remains contemporary by developing/ acquiring technology.

-Source: The Hindu