Context:

The Reserve Bank of India released its latest Financial Stability Report (or FSR).

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Fiscal Policy, Taxation)

Dimensions of the Article:

- What is the Financial Stability Report (FSR)?

- Trends regarding data in the FSR

- The latest 2021 FSR regarding impact of regulatory relief

- Other Key pointers in the FSR

- Systemic Risk Survey (SRS) April 2021

What is the Financial Stability Report (FSR)?

- Published twice each year, the FSR is one of the most crucial documents on the Indian economy as it presents an assessment of the health of the financial system.

- As such, the FSR looks sufficiency of capital for operation of Indian banks (both public and private), levels of bad loans (or non-performing assets) and their manageable limits, ability of different sectors of the economy to get credit (or new loans) for economic activity etc.

- The FSR puts together a wealth of data and information that also allows the RBI to assess the state of the domestic economy, especially in a fast-changing global economy.

- The FSR also allows the RBI to assess the macro-financial risks in the economy. [Macro-financial risks refer to the risks that originate from the financial system but affect the wider economy as well as risks to the financial system that originate in the wider economy.]

- As part of the FSR, the RBI also conducts “stress tests” to figure out what might happen to the health of the banking system if the broader economy worsens.

- With the FSR, the RBI also tries to assess how factors outside India — say the crude oil prices or the interest rates prevailing in other countries — might affect the domestic economy.

- Each FSR also contains the results of something called the Systemic Risk Surveys.

Trends regarding data in the FSR

- The RBI was most worried about bad loans shooting through the roof. According to the FSR in June 2020, depending on the level of stress in the economy, Gross NPAs could rise from 8.5% (of gross loans and advances) at the end of March 2020 to a two-decade high of as much as almost 15% by March 2021.

- In 2021, the FSR has found that the actual level of bad loans as of March 2021 is just 7.5%.

- However, the FSR is quick to point out that “macro-stress tests” for credit risk show that the GNPA ratio of Scheduled Commercial Banks “may increase from by more 2% from March 2021 to 2022 under the baseline scenario and by almost 4% under a severe stress scenario”.

- In other words, while relief provided by the RBI in the past year — cheap credit, moratoriums and facilities to restructure existing loans — has contained the number of Indian firms that openly defaulted on their loan repayment, things could yet get worse, especially for the small firms (or MSMEs).

- It all depends on factors such as the evolution of the virus (and its impact on the economy) as well as the decision of central banks the world over (especially the RBI) to raise interest rates (to contain rising inflation) and wind up their cheap money policy.

The latest 2021 FSR regarding impact of regulatory relief

- Historical experience shows that credit losses remain elevated for several years after recessions end. Indeed, in EMEs [Emerging Market Economies], non-performing assets typically peak six to eight quarters after the onset of a severe recession.

- Eventually as the support measures will be phased out, it is important to note that he longer that blanket support is continued, the higher the risk that it props up persistently unprofitable firms (‘zombies’), with adverse consequences for future economic growth”. In other words, providing excess regulatory relief might just help firms that don’t deserve to get it because they are inherently inefficient. Moreover, helping out inefficient firms in this way is eventually a burden on the taxpayers of the country.

Flip side

- If support measures are phased out before firms’ cash flows recover, however, banks will have to increase provisions and might tighten lending standards to preserve capital which might, in turn, undermine the recovery. Banks need sufficient buffers to absorb losses along the entire path to full recovery,” states the FSR.

Other Key pointers in the FSR

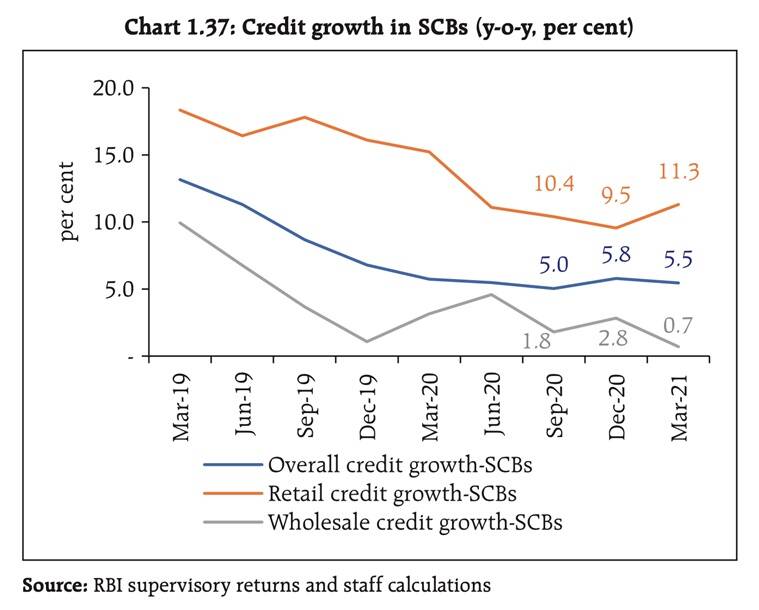

- The chart which shows the rate of credit growth in commercial banks indicates three things:

- One, at less than 6%, the overall rate of credit growth (blue line) is quite dismal.

- The overall rate of credit growth also shows how the sharp fall in credit growth happened much before the Covid pandemic hit India. This points to a considerable weakness in demand even before the pandemic and, in turn, suggests that recovery in credit growth may take longer than usual because the Indian economy had lost its growth momentum long before Covid.

Systemic Risk Survey (SRS) April 2021

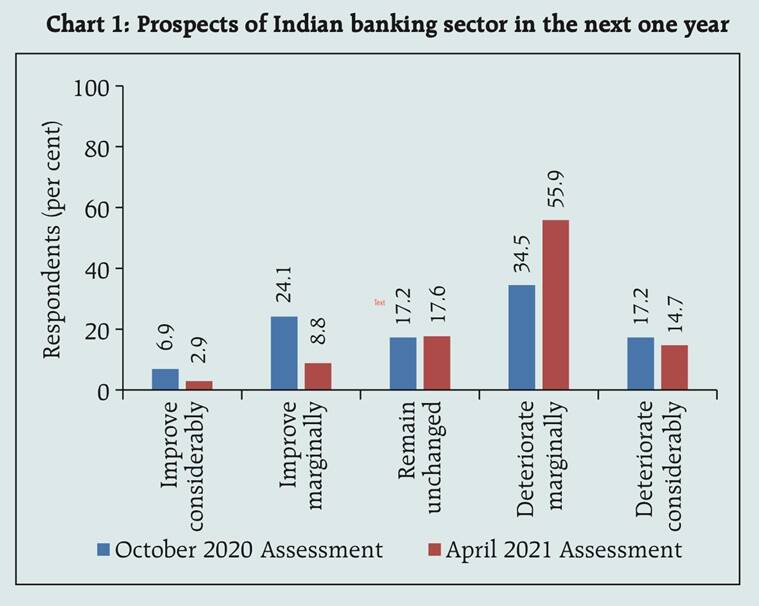

The chart below maps the prospects of the Indian banking sector in the next year. More than 70% of the respondents felt the prospects would worsen.

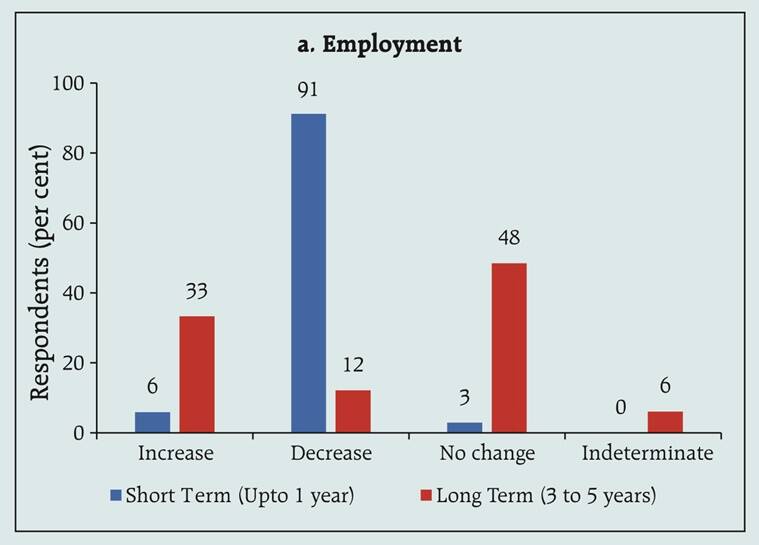

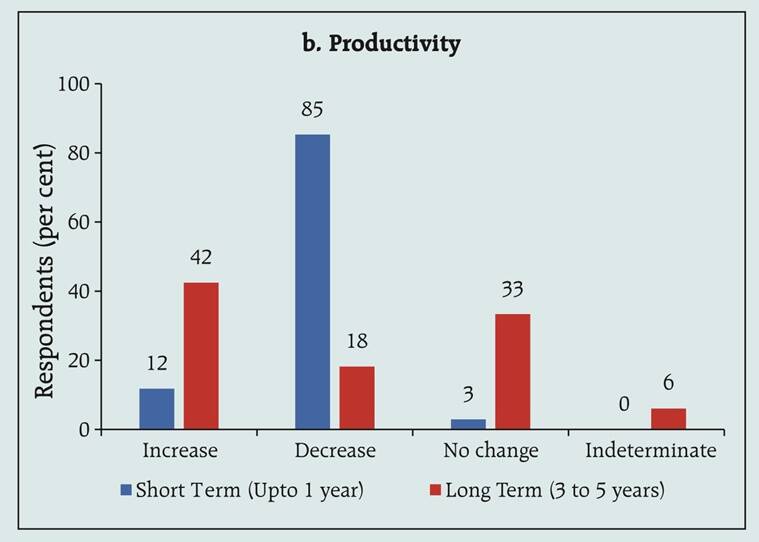

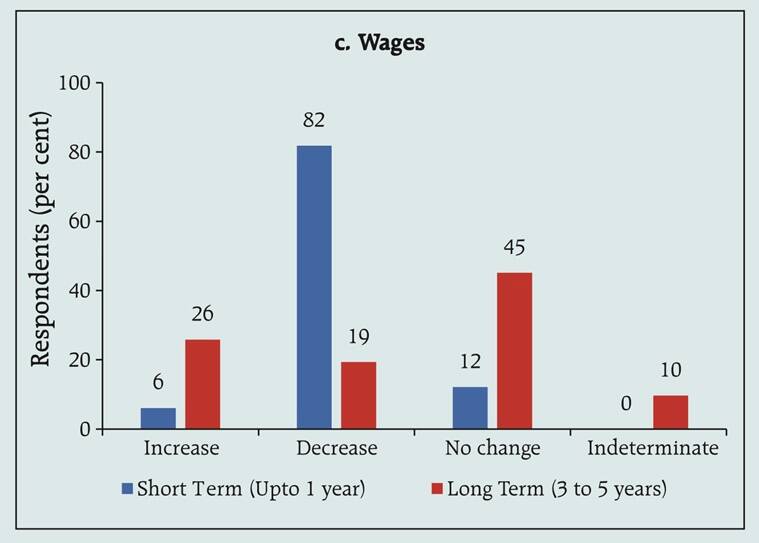

The table below names the sectors with the bleakest prospects in the first half of this year.

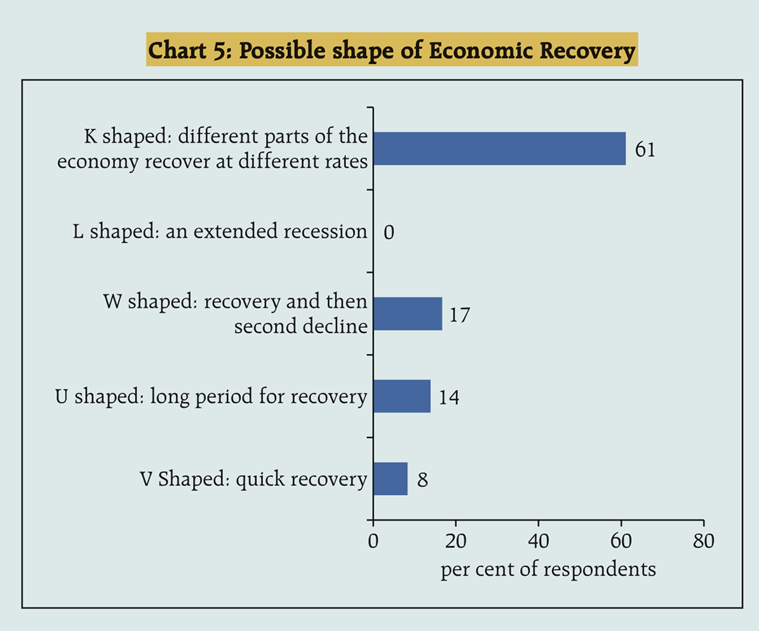

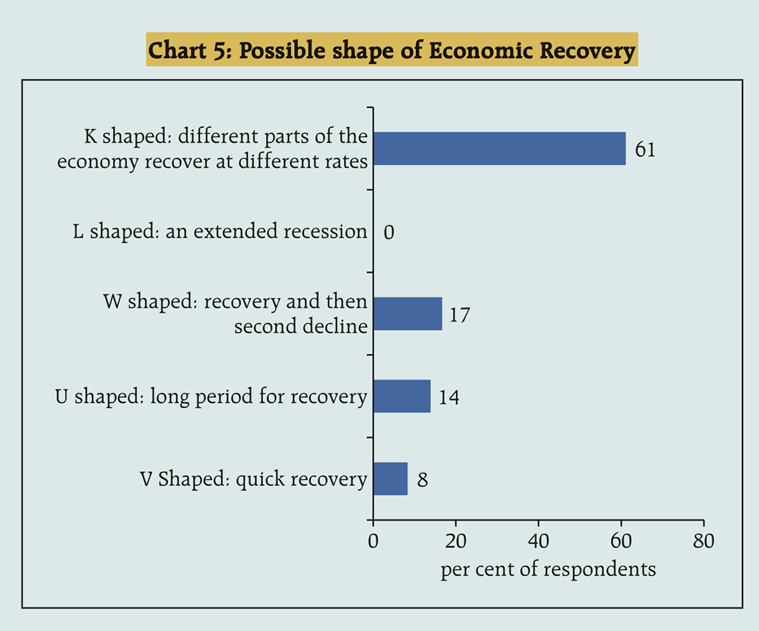

Of course, not everyone or every sector will recover at the same pace. As the chart below shows, most experts expect a K-shaped recovery from the second Covid wave. It is noteworthy that only a paltry 8% expect a “V-shaped” recovery.

-Source: The Hindu, Indian Express