Contents

- India Post Payments Bank (IPPB)

- Financial Stability and Development Council

- National Family Health Survey-5

- Crime and Criminal Tracking Network & Systems (CCTNS)

INDIA POST PAYMENTS BANK (IPPB)

Focus: GS 3 ;Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in News?

India Post Payments Bank launches its digital payments’ services ‘DakPay’, aims to Transform Banking Experience at the last mile

About India Post Payments Bank (IPPB)

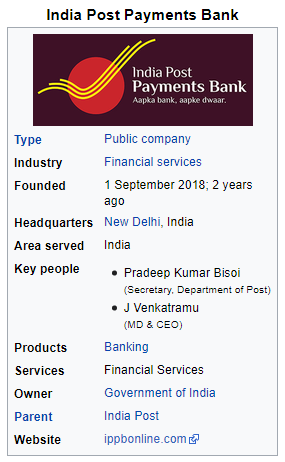

- The India Post Payments Bank is a public sector payments bank from India operated by the India Post.

- It is opened in 2018, the bank had acquired about 3.5 crore customers by September 2020.

- The India Post Payment Bank (IPPB) was setup under the Department of Post, Ministry of Communication with 100% equity Owned by Government of India.

- The India Post Payments Bank (IPPB) will be like any other banks but its operations will be on a smaller scale without involving any credit risk.

- It will carry out most banking operations like accepting deposits but won’t advance loans or issue credit cards.

- The motto of IPPB is “Every customer is important, every transaction is significant and every deposit is valuable”.

- The IPPB vision is to “Building the most accessible, affordable and trusted bank for the common man”.

- The IPPB mission is to “Spearheading financial inclusion by removing barriers and reducing costs for accessing banking services”.

- The IPPB has been integrated with Post Office Savings Bank (POSB).

- The IPPB is the sixth Payments bank, which has become operational after Aditya Birla, Airtel, Fino, Jio and Paytm Payments Banks.

- The freshly-minted payments bank will accept deposits of up to Rs. 1 lakh, offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third-party fund transfers.

- The Payments bank are licensed under Section 23 of the Banking Regulation Act 1949, and registered as public limited company under the Companies Act, 2013.

About Hurdles of IPPB

- Despite various efforts by the Government like the Jan Dhan Yojna, it is estimated that about 18% of the Indian population is not being served by the banking system.

- The IPPB can be seen as filling an important gap in the scheme of financial inclusion.

- The service available should be efficient and cost effective.

- The making available a good connectivity and network, for example, can be a major challenge in remote parts for IPPB to be a success.

- Also, the postmen need to be trained periodically to provide such new services and he may demand an incentive for this new job.

- To overcome the possible challenges lying ahead required training programs have been started by the Department of Posts.

- The micro ATMs have been given in many of the Post Offices in rural areas.

- To sort out the issue of connectivity in remote areas, different connectivity providers are being contacted to issue SIM cards, etc.

Way Forward

- The IPPB is a welcome step to connect the rural masses and remotest areas of India to provide banking services and connect to the unconnected places to have a better financial inclusion.

- The IPPB has its hurdles but it can overcome with proper infrastructure and proper training of the staff by the department of post, the IPPB can be a revolutionary in Payment Banking sector and helps in achieving the Financial Inclusion

FINANCIAL STABILITY and DEVELOPMENT COUNCIL

Focus: GS 3 ;Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in News?

Finance Minister Smt. Nirmala Sitharaman chairs 23rd Meeting of the Financial Stability and Development Council

About Financial Stability Development Council (FSDC)

- The Financial Stability and Development Council (FSDC) was constituted by an Executive Order of the Union Government as a non-statutory apex body under the Ministry of Finance in 2010.

- The idea to create such a super regulatory body was first mooted by the Raghuram Rajan Committee in 2008.

- No funds are separately allocated to the council for undertaking its activities.

- The FSDC was formed to bring greater coordination among financial market regulators.

About Composition of the FSDC

- The membership of the FSDC is are as discussed below;-

- The Finance Minister is the Chairman of the FSDC.

- The council is headed by the finance minister and has the Reserve Bank of India (RBI) governor and chairpersons of the Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority (IRDA) and Pension Fund Regulatory and Development Authority (PFRDA) as other members along with finance ministry officials.

- Other members are Finance Secretary, Chief Economics Advisor and Secretary of the Department of Financial Services.

About Functions and Responsibilities of the FSDC

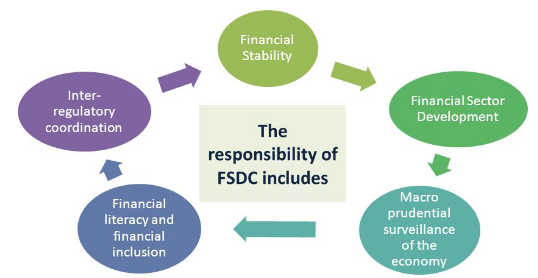

- The FSDC was formed to bring greater coordination among financial market regulators.

- To strengthen and institutionalize the mechanism of maintaining financial stability and responsibilities of FSDC as shown in the below image

National Family Health Survey-5

Focus: GS 2 ;Issues relating to development and management of Social Sector/Services relating to Health, Education, Human Resources.

Why in News?

Dr. Harsh Vardhan, Union Minister of Health and Family Welfare, Government of India, released the Factsheets of key indicators on population, reproductive and child health, family welfare, nutrition and others for 22 States/UTs of the first Phase of the 2019-20 National Family Health Survey (NFHS-5) on Universal Health Coverage Day on 12th December, 2020.

About National Family Health Survey

- The National Family Health Survey (NFHS) is a large-scale, multi-round survey conducted in a representative sample of households throughout India.

- The NFHS is a collaborative project of the Institutional Institute for Population Sciences (IIPS), Mumbai, India, ORC Macro, Calverton, Maryland, USA and the East-West Center, Honolulu, Hawaii, USA.

- The Ministry of Health and Family Welfare (MOHFW), Government of India, designated IIPS as the nodal agency, responsible for providing coordination and technical guidance for the NFHS.

- The NFHS was funded by the United States Agency for International Development (USAID) with supplementary support from United Nations Children’s Fund (UNICEF).

- The main objective of successive rounds of the NFHS is to provide reliable and comparable datasets on health, family welfare and other emerging issues.

- Till now total five rounds of survey have been conducted to date, the below information gives details on the round and the year it was conducted as follows;-

- The First Round of NFHS conducted in 1992-93

- The Second Round of NFHS conducted in 1998-99

- The Third Round of NFHS conducted in 2005-06

- The Fourth Round of NFHS conducted in 2015-16

- The Fifth Round of NFHS conducted in 2018-19.

About NHFS-5 Survey

- Recently, the first-phase data of the National Family Health Survey-5 (NFHS-5) 2019-20 has been released by the Ministry of Health and Family Welfare.

- The NFHS-5 captured data during 2014-19 and its content is similar to NFHS-4 (2015-16) to allow comparisons over time and also marks a shift from it.

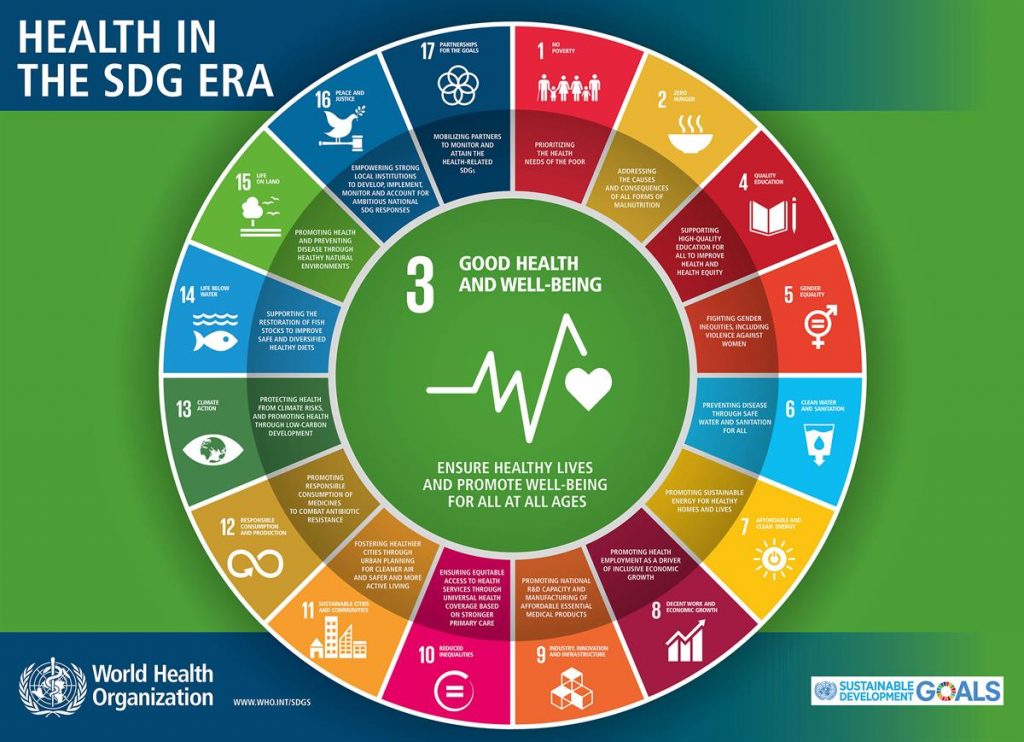

- It provides an indicator for tracking 30 Sustainable Development Goals (SDG) that the country aims to achieve by 2030.

- The Recent round conducted NFHS-5 that includes new focal areas such as expanded domains of child immunization, components of micro-nutrients to children, menstrual hygiene, frequency of alcohol and tobacco use, additional components of non-communicable diseases (NCDs), expanded age ranges for measuring hypertension and diabetes among all, aged 15 years and above, will give requisite input for strengthening existing programmes and evolving new strategies for policy intervention.

- In 2019, for the first time, the NFHS-5 sought details on the percentage of women and men who have ever used the Internet.

- On comparing NFHS-4 and NFHS-5 data, the increase in full immunization coverage is observed to be expeditious in many states and UT’s in 11 out of the 22 states/UTs, the increase was to the tune of over 10 percentage point and in another 4 states/UTs between 5 to 9 percentage point over the short span of 4 years.

- The Total Fertility Rates (TFR) has further declined since NFHS-4 in almost all the Phase-1 States and UTs.

- The use of modern methods of contraception has also increased in almost all States/UTs.

- The unmet needs of family planning have witnessed a declining trend in most of the Phase-1 States/UT’s.

- Full immunization drive among children aged 12-23 months has recorded substantial improvement across States/UTs/districts.

- There is increase in the per cent of women receiving the recommended four or more Antenatal care (ANC) visits by health providers in many States/UTs.

- The Institutional births have increased substantially with over four-fifth of the women delivering in institutions in 19 States and UTs.

- The sex ratio at birth has remained unchanged or increased in most States/UTs.

- The child nutrition indicators show a mixed pattern across states.

- The Anaemia among women and children continues to be a cause of concern.

- The Women’s empowerment indicators portray considerable improvement across all the States/UTs included in Phase 1.

- The considerable progress has been recorded between NFHS-4 and NFHS-5 in regard to women operating bank accounts.

CRIME and CRIMINAL TRACKING NETWORK and SYSTEMS (CCTNS)

Focus: GS 3 ;Various Security forces and agencies and their mandate.

Why in News?

Minister of State (Home) Shri G. Kishan Reddy says integrated database concepts like the CCTNS and ICJS indispensable to realize the dream of New India

About Crime and Criminal Tracking Network and Systems (CCTNS)

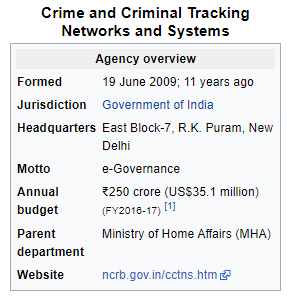

- The Crime and Criminal Tracking Networks and Systems, abbreviated to CCTNS, is a project under Indian government for creating a comprehensive and integrated system for effective policing through e-governance.

- The system includes nationwide online tracking system by integrating more than 14,000 police stations across the country.

- The project is implemented by National Crime Records Bureau (NCRB).

- The concept of CCTNS was first conceived in the year 2008 by the then Home minister P.Chidambaram in the after match of Mumbai Attacks.

- The MHA and NCRB would play a key role in planning the program in collaboration with the Police leadership within States. Role of the Centre (MHA and NCRB) focuses primarily around planning, providing the Core Application Software (CAS) (to be configured, customized, enhanced, and deployed in States.

- The States and UTs that would drive the planning and implementation at the State level after deployment by the Centre.

- The objectives of the CCTNS can broadly be listed as follows:-

- To make the Police functioning citizen friendly and more transparent by automating the functioning of Police Stations.

- To Improve delivery of citizen-centric services through effective usage of ICT.

- To Provide the Investigating Officers of the Civil Police with tools, technology and information to facilitate investigation of crime and detection of criminals.

- To Improve Police functioning in various other areas such as Law and Order, Traffic Management etc.

- To Facilitate Interaction and sharing of Information among Police Stations, Districts, State/UT headquarters and other Police Agencies.

- To Assist senior Police Officers in better management of Police Force

- To Keep track of the progress of Cases, including

- To Reduce manual and redundant Records keeping.

About Interoperable Criminal Justice System (ICJS)

- The CCEA also decided to implement the Interoperable Criminal Justice System (ICJS) by 2017.

- It will be done by integrating CCTNS with e-Courts, e-prisons, Forensics, and Prosecution, which are the key components of the Criminal Justice System. e-prosecution in Delhi has already launched by the ICJS team.

- The Implementation of ICJS will ensure as follows;-

- Quick data transfer among different pillars of criminal justice system, which will not only enhance transparency but also reduce processing time.

- To enable National level crime analytics to be published at increased frequency, which will help the policy makers as well as lawmakers in taking appropriate and timely action.

- To enable pan-India criminal/accused name search in the regional language for improved inter-state tracking of criminal movement.