Contents

- PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi)

- Indian Govt. & AIIB sign an Agreement for $750 Million

- World Sickle Cell Day

PM STREET VENDOR’S ATMANIRBHAR NIDHI (PM SVANIDHI)

Focus: GS-II Social Justice, GS-III India Economy

Why in news?

Ministry of Housing & Urban Affairs and Small Industries Development Bank of India (SIDBI) have signed an MoU regarding PM SVANidhi.

PM Street Vendor’s Atmanitbhar Nidhi (PM SVANidhi)

- PM SVANidhi is a Special Micro-Credit Facility.

- PM SVANidhi was launched by the Ministry of Housing and Urban Affairs for providing affordable Working Capital loan to street vendors to resume their livelihoods that have been adversely affected due to Covid-19 lockdown.

- Under the Scheme, the vendors can avail a working capital loan of up to Rs. 10,000, which is repayable in monthly instalments in the tenure of one year.

- The scheme promotes digital transactions through cash back incentives.

- Beneficiaries: 50 lakh Street Vendors.

PM SVANidhi and SIDBI

- Small Industries Development Bank of India (SIDBI) is the Implementation Agency for PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi)

- SIDBI will also manage the credit guarantee to the lending institutions through Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

- SIDBI will leverage the network of lending Institutions like Non-Bank Finance Companies (NBFCs), Co-operative Banks etc., for the Scheme implementation.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- The Ministry of Micro, Small and Medium Enterprises, GoI and Small Industries Development Bank of India (SIDBI), established a Trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to implement the Credit Guarantee Fund Scheme for Micro and Small Enterprises.

- Beneficiaries: New and existing Micro and Small Enterprises engaged in manufacturing or service activity excluding Educational Institutions, Agriculture, Self Help Groups (SHGs), Training Institutions etc., are eligible.

- Fund and non-fund based (Letters of Credit, Bank Guarantee etc.) credit facilities up to Rs 200 lakh per eligible borrower are covered under the guarantee scheme provided they are extended on the project viability without collateral security or third-party guarantee.

INDIAN GOVT. & AIIB SIGN AN AGREEMENT FOR $750 MILLION

Focus: GS-III Indian Economy

Why in news?

The Government of India and the Asian Infrastructure Investment Bank (AIIB) signed a $750 million “COVID-19 Active Response and Expenditure Support Programme” to assist India to strengthen its response to the adverse impacts of the COVID-19 pandemic.

Details

- This is the first ever budgetary support programme from the AIIB to India.

- The Programme will provide the Government of India with budget support to mitigate the severe adverse social and economic impact of COVID-19.

- The current loan will be the second to India from AIIB under its COVID-19 crisis recovery facility apart from the earlier approved $500 million loan for the COVID-19 Emergency Response and Health Systems Preparedness Project.

- The Primary Programme beneficiaries would be families below the poverty line, farmers, healthcare workers, women, women’s self-help groups, widows, people with disabilities, senior citizens, low wage earners, construction workers and other vulnerable groups.

About Asian Infrastructure Investment Bank (AIIB)

- The Asian Infrastructure Investment Bank (AIIB) is an international financial institution proposed by China. The purpose of the multilateral development bank is to provide finance to infrastructure projects in the Asia-Pacific region.

- It is headquartered in Beijing and commenced operations in 2016.

- By investing in sustainable infrastructure and other productive sectors today, it aims to connect people, services and markets that over time will impact the lives of billions and build a better future.

- China is the largest shareholder with 26.61 % voting shares in the bank followed by India (7.6%), Russia (6.01%) and Germany (4.2 %).

Membership of AIIB

- Membership in the AIIB is open to all members of the World Bank or the Asian Development Bank and is divided into regional and non-regional members.

- Regional members are those located within areas classified as Asia and Oceania by the United Nations.

- Unlike other MDBs (multilateral development bank), the AIIB allows for non-sovereign entities to apply for AIIB membership, assuming their home country is a member.

- Thus, sovereign wealth funds (such as the China Investment Corporation) or state-owned enterprises of member countries could potentially join the Bank.

- Countries accepted as AIIB founding members include China, India, Malaysia, Indonesia, Singapore, Saudi Arabia, Brunei, Myanmar, the Philippines, Pakistan, Britain, Australia, Brazil, France, Germany and Spain.

- As of May, 2020, the bank currently has 78 members as well as 24 prospective members from around the world.

WORLD SICKLE CELL DAY

Focus: GS-III Science and Technology

Why in news?

A webinar ‘National Sickle Cell Conclave’ was held to mark the World Sickle Cell Day on June 19th 2020.

Highlights

In order to collect real time data and provide relevant information related to Sickle Cell, the government has launched a new portal which will act as catalyst in creating awareness.

This World Sickle Cell Day is observed every year on June 19.

Sickle cell disease (SCD)

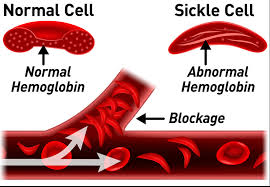

Sickle cell disease (SCD) is an inherited blood disorder that causes “sickle” shaped red blood cells that can stick together, blocking blood flow and oxygen from reaching all parts of the body.

It results in an abnormality in the oxygen-carrying protein haemoglobin found in red blood cells.

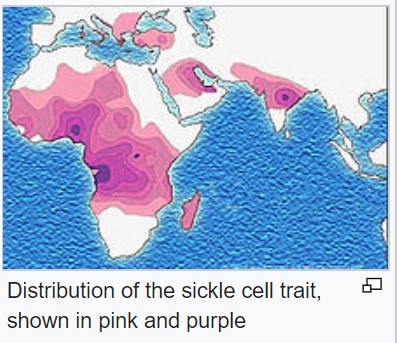

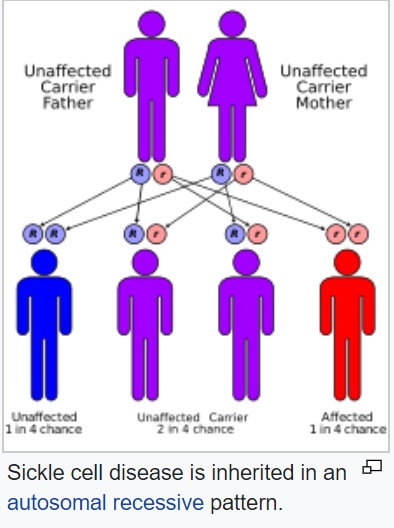

Sickle cell disease occurs when a person inherits two abnormal copies of the β-globin gene that makes haemoglobin, one from each parent. (A person with a single abnormal copy does not usually have symptoms and is said to have sickle cell trait.)

People with SCD can experience pain, anaemia, infection, and other serious health problems (also known as complications) that may require care by a healthcare provider.