Context:

- The rupee and bonds strengthened as a drop in global crude oil prices helped calm investor worries over sustained imported inflationary pressures in the economy.

- Traders said bond yields too dropped – the 10-year bond yield was trading at 6.33%, down 1 basis point on the day after having touched 6.31% earlier in the session.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Inflation, Capital Market)

Dimensions of the Article:

- Why are oil prices falling now (Last week of October 2021)?

- What are Bonds?

- Relating Bond Yields and Exchange rates

Why are oil prices falling now (Last week of October 2021)?

- Oil markets had hit multi-year highs earlier in October 2021 on the back of a global coal and gas crunch, which has driven a switch to diesel and fuel oil for power generation. Higher the demand – Higher the prices.

- The rising oil prices headed for the first weekly losses after U.S. oil stocks rose more than expected, and Iran flagged it was resuming talks with Western powers which could lead to an end to sanctions (end to sanctions = increase in supply).

- Concerns about erratic demand growth persist, with China looking to curb pollution ahead of the Beijing winter Olympics and restricting mobility to curb any outbreaks of COVID-19.

What are Bonds?

- A bond is like an IOU. The issuer of a bond promises to pay back a fixed amount of money every year until the expiry of the term, at which point the issuer returns the principal amount to the buyer.

- When a government issues such a bond it is called a sovereign bond.

- Governments issue bonds as part of their borrowing programme.

- By purchasing a debt instrument like bond, an investor becomes a creditor to the corporation (or government).

- A bond is a financial security issued by a borrower to avail long term funds.

- Thus, a bond is like a loan: the holder of the bond is the lender (creditor), the issuer of the bond is the borrower (debtor). The primary advantage of being a creditor (by purchasing bonds) is that he has a higher claim on assets than shareholders do. That means, in the case of bankruptcy, a bondholder will get his money back before a shareholder.

- However, the bondholder does not have a share in the profits of a company.

What is Bond Yield?

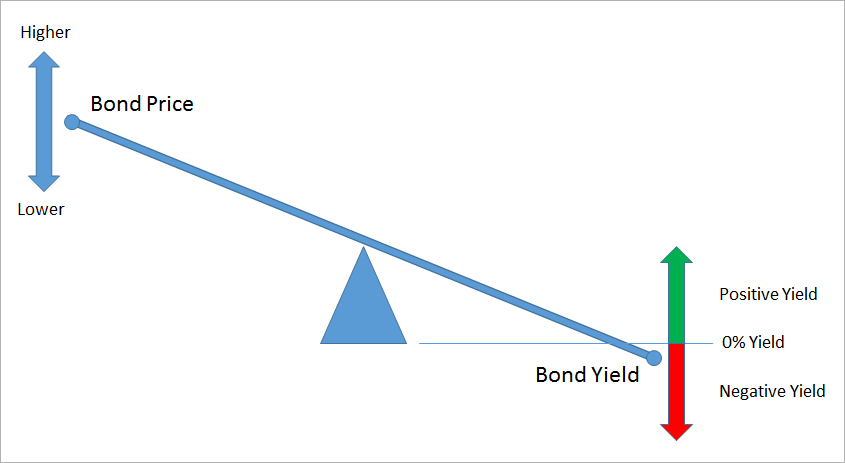

- Bond yield is the return an investor realizes on a bond.

- The bond yield can be defined in different ways.

- Setting the bond yield equal to its coupon rate is the simplest definition.

- The current yield is a function of the bond’s price and its coupon or interest payment, which will be more accurate than the coupon yield if the price of the bond is different than its face value.

As bond prices go down – bond yields go up

- Now, seeing the increased bond yield, more and more buying of the bonds will ensue leading to increased demand of the bonds and we know that increased demand will command a higher price.

- So, an increased demand will propel the bond prices up thereby leading to a reduction in bond yield, which will further lead to reduction in demand.

Relating Bond Yields and Exchange rates

- Bond yields play a significant role in determining the direction of a currency. The difference between one countries bond yield and another countries bond yield, known as an interest rate differential, is more influential on the direction of a currency than the actual bond yield.

- Bond yields differentials usually move in tandem with currency pairs. This phenomenon occurs because capital flows are attracted to higher yielding currencies.

- When people are willing to take risks, the rate of one currency increases relative to another, as investors are attracted to the higher yielding currency. Additionally, the cost of owning the lower yielding currency increase as the bond yield differential moves in favour of the currency that is sold.

- As a rule of thumb, short-term, when a central bank raises rates (liquidity in the market reduces) – the yields rise and bond prices fall; further, the currency appreciates as it becomes more attractive to hold.

- This sort of relationship between Bond yields and exchange rates go into the decisions taken during open market operations conducted by the RBI.

Why is the RBI keen on keeping yields in check?

- The RBI has been aiming to keep yields lower as that reduces borrowing costs for the government while preventing any upward movement in lending rates in the market.

- The RBI wants to keep interest rates steady to kick-start investments. A rise in bond yields will put pressure on interest rates in the banking system which will lead to a hike in lending rates.

Related Prelims Question in 2021:

| Indian Government Bond Yields are influenced by which of the following? 1. Actions of the Federal Reserve United States 2. Actions of the Reserve Bank of India 3. Inflation and short-term interest rates Select the correct answer using the code given below. (a) 1 and 2 only (b) 2 only (c) 3 only (d) 1, 2 and 3 Answer: D |

-Source: The Hindu, Economic Times