Static Quiz 23 May 2022

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

Static Quiz 23 May 2022 for UPSC Prelims

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

- Question 1 of 5

1. Question

Which of the folloing statements regarding Monetary Policy Committee are correct?

1. The Monetary Policy Committee (MPC) is a committee constituted by the Reserve Bank of India and led by the Governor of RBI.

2. Monetary Policy Committee was formed with the mission of fixing the benchmark policy interest rate (repo rate) to restrain inflation within the particular target level.CorrectAns;- c) Both 1 and 2

Explanation;-

• Both the statements are correct regarding Monetary Policy Committee

About Monetary Policy Committee

• The Monetary Policy Committee (MPC) is a committee constituted by the Reserve Bank of India and led by the Governor of RBI.

• Monetary Policy Committee was formed with the mission of fixing the benchmark policy interest rate (repo rate) to restrain inflation within the particular target level.

• Monetary Policy was implemented with an initiative to provide reasonable price stability, high employment, and a faster economic growth rate.

• The major four objectives of the Monetary Policy are mentioned below:

1. To stabilize the business cycle.

2. To provide reasonable price stability.

3. To provide faster economic growth.

4. Exchange Rate Stability.

• Monetary Policy Committee (MPC) was constituted as per Section 45ZB under the RBI Act of 1934 by the Central Government.

• The committee comprises six members – three officials of the Reserve Bank of India and three external members nominated by the Government of India.

• The current mandate of the committee is to maintain 4% annual inflation until 31 March 2021 with an upper tolerance of 6% and a lower tolerance of 2%.

• Decisions are taken by majority with the Governor having the casting vote in case of a tie.IncorrectAns;- c) Both 1 and 2

Explanation;-

• Both the statements are correct regarding Monetary Policy Committee

About Monetary Policy Committee

• The Monetary Policy Committee (MPC) is a committee constituted by the Reserve Bank of India and led by the Governor of RBI.

• Monetary Policy Committee was formed with the mission of fixing the benchmark policy interest rate (repo rate) to restrain inflation within the particular target level.

• Monetary Policy was implemented with an initiative to provide reasonable price stability, high employment, and a faster economic growth rate.

• The major four objectives of the Monetary Policy are mentioned below:

1. To stabilize the business cycle.

2. To provide reasonable price stability.

3. To provide faster economic growth.

4. Exchange Rate Stability.

• Monetary Policy Committee (MPC) was constituted as per Section 45ZB under the RBI Act of 1934 by the Central Government.

• The committee comprises six members – three officials of the Reserve Bank of India and three external members nominated by the Government of India.

• The current mandate of the committee is to maintain 4% annual inflation until 31 March 2021 with an upper tolerance of 6% and a lower tolerance of 2%.

• Decisions are taken by majority with the Governor having the casting vote in case of a tie. - Question 2 of 5

2. Question

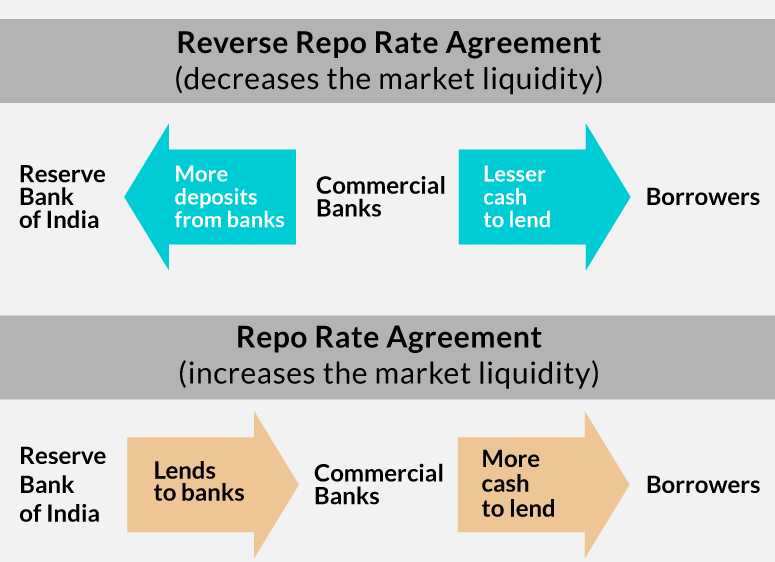

Which of the following are correctly matched?

1. Repo Rate = is when the RBI borrows money from banks when there is excess liquidity in the market.

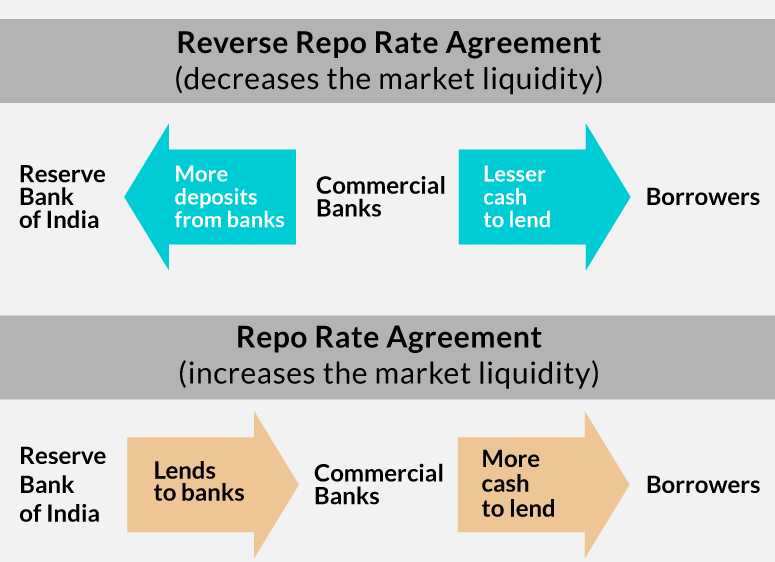

2. Reverse Repo Rate = is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds.CorrectExplanation;-

• Both the statements are reversed.

• Reverse Repo Rate is a mechanism to absorb the liquidity in the market, thus restricting the borrowing power of investors. Reverse Repo Rate is when the RBI borrows money from banks when there is excess liquidity in the market. The banks benefit out of it by receiving interest for their holdings with the central bank.

• Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Repo rate is used by monetary authorities to control inflation.

IncorrectExplanation;-

• Both the statements are reversed.

• Reverse Repo Rate is a mechanism to absorb the liquidity in the market, thus restricting the borrowing power of investors. Reverse Repo Rate is when the RBI borrows money from banks when there is excess liquidity in the market. The banks benefit out of it by receiving interest for their holdings with the central bank.

• Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Repo rate is used by monetary authorities to control inflation.

- Question 3 of 5

3. Question

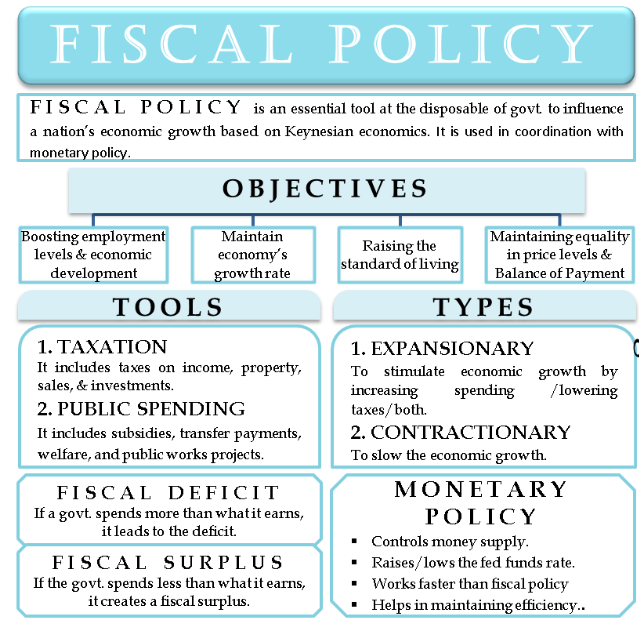

Which of the following are correct regarding Fiscal Policy of Government?

1. Fiscal Policy deals with the revenue and expenditure policy of the Govt

2. Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation’s economy.CorrectAns;- c) Both 1 and 2

Explanation;-

• Both the statements are correct

• Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation’s economy. It is the sister strategy to monetary policy through which a central bank influences a nation’s money supply.

• Fiscal Policy deals with the revenue and expenditure policy of the Govt.

• The word fiscal has been derived from the word ‘fisk’ which means public treasury or Govt funds.

• Tools of fiscal policy:-

a. Taxation

b. Public expenditure

c. Public debt

d. Plan and Non-Plan Expenditure

• Public Debt means debt on the Govt -It is accumulated borrowing of the Govt Incorrect

IncorrectAns;- c) Both 1 and 2

Explanation;-

• Both the statements are correct

• Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation’s economy. It is the sister strategy to monetary policy through which a central bank influences a nation’s money supply.

• Fiscal Policy deals with the revenue and expenditure policy of the Govt.

• The word fiscal has been derived from the word ‘fisk’ which means public treasury or Govt funds.

• Tools of fiscal policy:-

a. Taxation

b. Public expenditure

c. Public debt

d. Plan and Non-Plan Expenditure

• Public Debt means debt on the Govt -It is accumulated borrowing of the Govt

- Question 4 of 5

4. Question

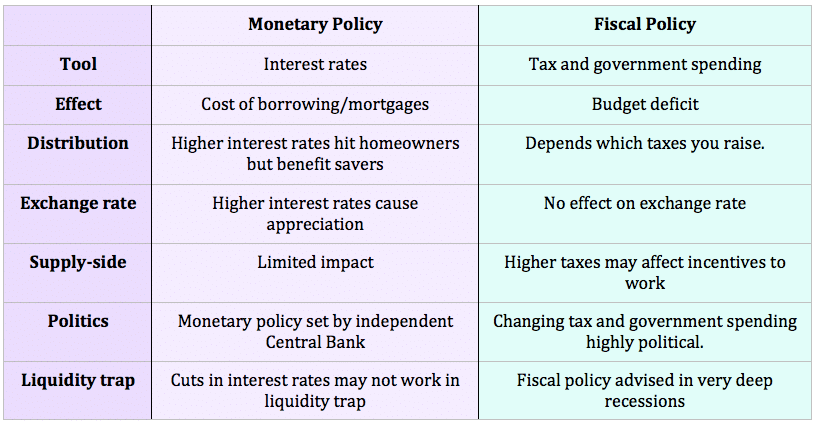

Which of the following difference between Monetary and Fiscal Policy?

1. The tools of Monetary policy is taxation and fiscal policy is Interest rates

2. The monetary policy is having effect on budget deficit and fiscal policy on cost of borrowingsCorrectAns;- d) None of the above

Explanation;-

• In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country’s economy.

• Monetary policy the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often as an attempt to reduce inflation or the interest rate to ensure price stability and general trust of the value and stability of the nation’s currency. Incorrect

IncorrectAns;- d) None of the above

Explanation;-

• In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country’s economy.

• Monetary policy the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often as an attempt to reduce inflation or the interest rate to ensure price stability and general trust of the value and stability of the nation’s currency.

- Question 5 of 5

5. Question

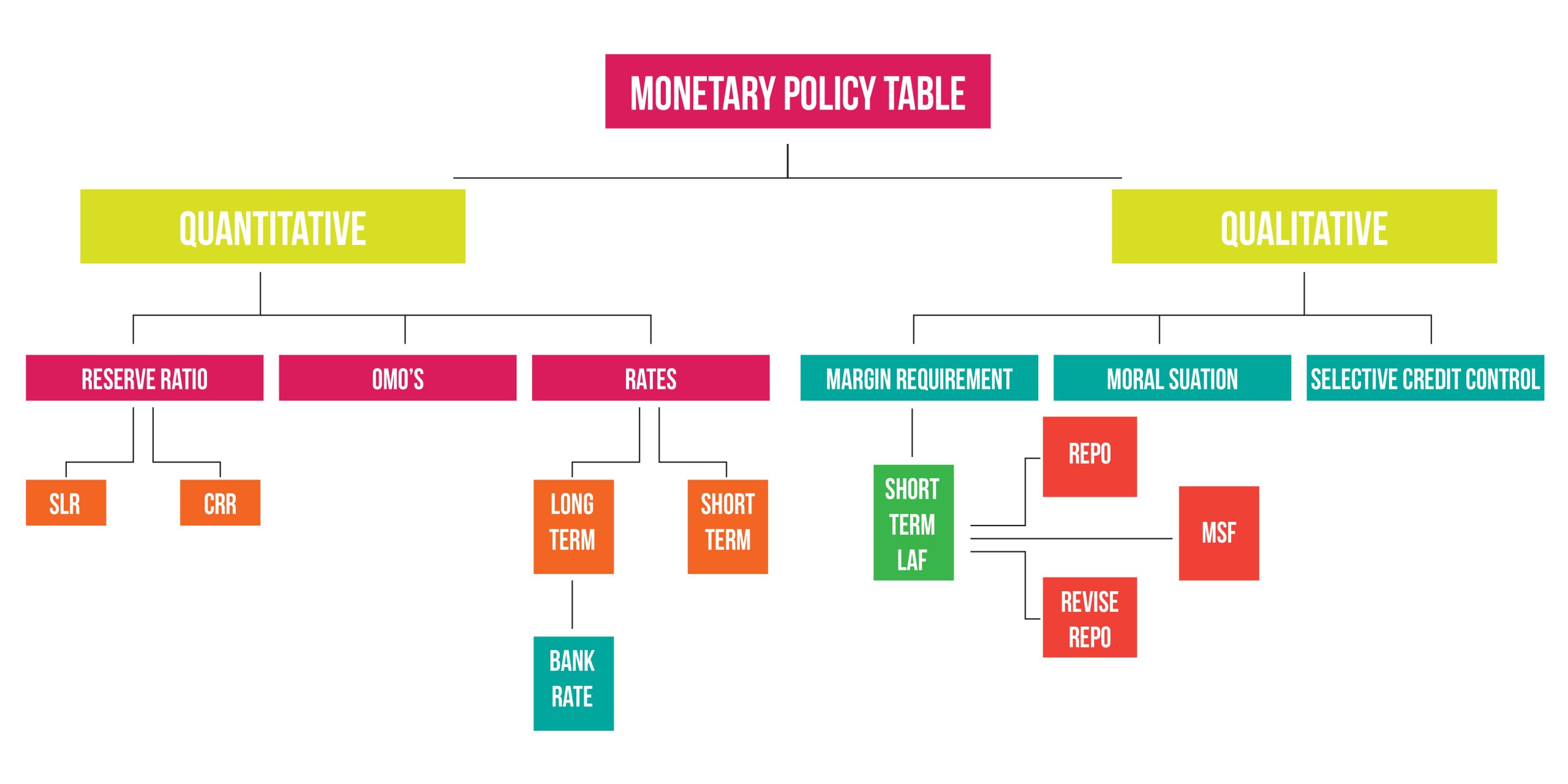

Which of the following statements are correct regarding tool of Monetary Policy?

1. Quantitative tool= are not directed towards the quality of credit or the use of the credit.

2. Qualitative tool = are related to the Quantity or Volume of the moneyCorrectAns;- d) None of the above

Explanation;-

• Both the statements are reversed.

• The Quantitative Instruments are also known as the General Tools of monetary policy. These tools are related to the Quantity or Volume of the money. The Quantitative Tools of credit control are also called as General Tools for credit control.

• The Qualitative Instruments are also known as the Selective Tools of monetary policy. These tools are not directed towards the quality of credit or the use of the credit. They are used for discriminating between different uses of credit. Incorrect

IncorrectAns;- d) None of the above

Explanation;-

• Both the statements are reversed.

• The Quantitative Instruments are also known as the General Tools of monetary policy. These tools are related to the Quantity or Volume of the money. The Quantitative Tools of credit control are also called as General Tools for credit control.

• The Qualitative Instruments are also known as the Selective Tools of monetary policy. These tools are not directed towards the quality of credit or the use of the credit. They are used for discriminating between different uses of credit.