The Economic Survey 2019-2020 has laid stress on wealth creation through the ‘invisible hand of markets’ with the support of the ‘hand of trust’.

Invisible hand of markets

- The ‘invisible hand of markets’ is Adam Smith’s philosophy of wealth creation and economic development and it refers to the indirect or unintended benefits for society that result from the operations of a free market economy (“An Inquiry into the Nature and Causes of the Wealth of Nations”).

- Old Texts support

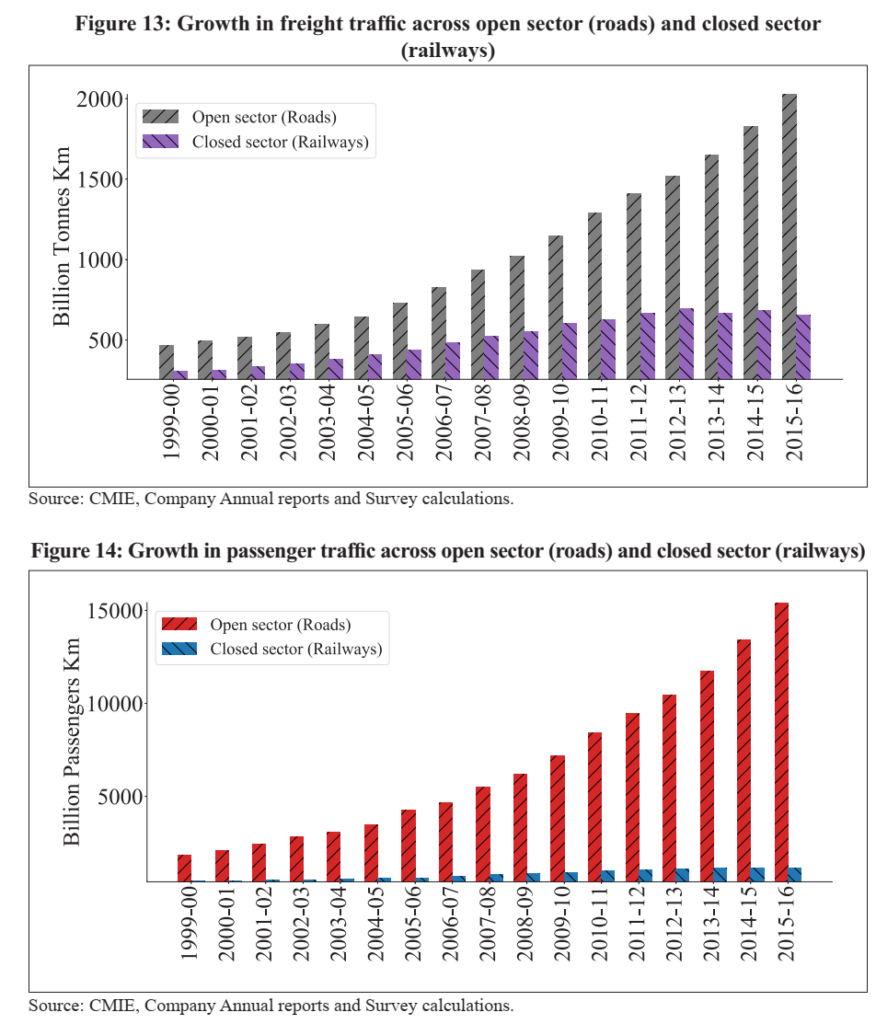

- The Survey says that the evidence since 1991 shows that the sectors that were liberalized grew significantly faster than those that remain closed.

- The open sectors like the Banking sector, cement, and steel, mutual funds, Minor ports, Roads have grown faster than the closed sectors like coal, Railways (in passenger and freight), Major ports

- The Survey says that the

benefits of wealth creation by the market forces are sustainable:

- Benefits accrue to several other stakeholders including employees, suppliers, government, etc.

- Wealth creation by entrepreneurs correlates strongly with the foreign exchange revenues earned by the entrepreneurs’ firms.

- Wealth created by an entrepreneur helps the country’s common citizens. Tax revenues enable Government spending on creating public goods and providing welfare benefits to the citizens.

Instruments for Wealth Creation

- Equal opportunity for new entrants:

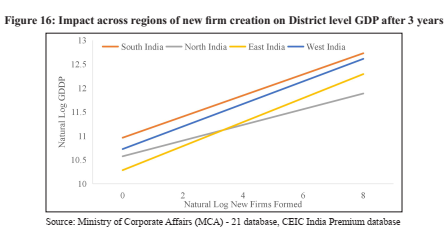

- Enables efficient resource allocation and utilization, facilitates job growth, promotes trade growth and consumer surplus through greater product variety, and increases the overall boundaries of economic activity.

- New firm creation has gone up dramatically since 2014 in India.

- Cumulative annual growth rate of 3.8% from 2006-2014

- From 2014 to 2018 has been 12.2%.

- 70,000 new firms created in 2014, the number has grown by about 80% to about 1,24,000 new firms in 2018. (World Bank Data)

- Enable Fair Competition:

- The Survey says that ‘pro-crony’ economy should be replaced by ‘pro-business’ to correspond to an economy that enables fair competition for every economic participant.

- India’s aspiration to become a $5 trillion economy depends critically on promoting pro-business policies that provide equal opportunities for new entrants.

- Ease of doing business:

- India made a substantial leap forward in The World Bank’s Doing Business rankings from 142 in 2014 to 63 in 2019.

- Yet, the pace of reforms in enabling ease of doing business needs to be enhanced so that India can be ranked within the top 50 economies on this metric.

- India continues to trail in parameters such as Ease of Starting Business, Registering Property, Paying Taxes, and Enforcing Contracts.

- Eliminate policies that unnecessarily undermine markets through government intervention:

- The survey finds that by integrating “Assemble in India for the world” into Make in India, India can create INR 4 crores well-paid jobs by 2025 and INR 8 crores by 2030.

- Enable trade for job creation

- Efficiently scale-up the banking sector to be proportionate to the size of the Indian economy.

Hand of Trust

Introducing the idea of “trust as a public good that gets enhanced with greater use”, the Survey suggests that policies must empower transparency and effective enforcement using data and technology to enhance this public good.

- The Economic Survey has said “a feeling of suspicion and disrespect towards wealth creators is ill-advised,” batting strongly — in one whole chapter — for India Inc which has been facing heat from enforcement agencies. It called for more pro-business measures to encourage wealth creation but cautioned against pro-crony policies that favour specific private interests.

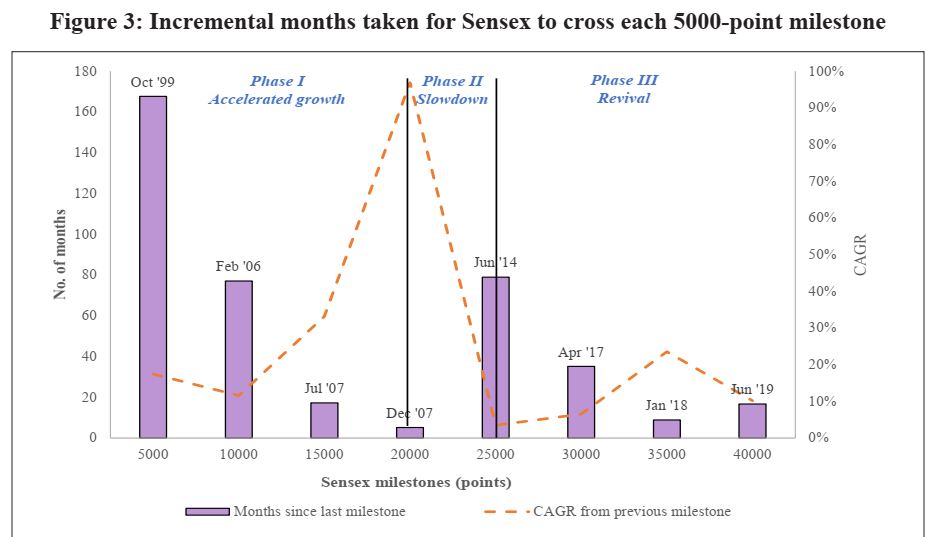

- The Survey says that a market failure of trust happened around 2011-13 due to a few large unscrupulous promoters. This created large Non-Performing Assets (NPAs) in the banking system, especially for Public Sector Banks (PSBs).

- It said that while there is a case for government intervention when markets do not function properly, excessive intervention stifles economic freedom and creates ‘deadweight loss’.

In a market economy too, there is a need for the state to ensure a moral hand to support the invisible hand. Markets are liable to debase ethics in the pursuit of profits at all costs.

- Trust can be conceptualized as a public good with the characteristics of non-excludability, i.e., the citizens can enjoy its benefits at no explicit financial cost.

- Trust also has the characteristics of non-rival consumption, i.e., the marginal cost of supplying this public good to an extra citizen is zero.

- Adam Smith, who did not just advocate the “invisible hand”, but equally the importance of “mutual sympathy” (i.e., trust).

- The same idea is reflected in the writings of Friedrich Hayek, who advocated not only economic freedom but also a set of general rules and social norms that applies evenly to everyone.

- It is also non-rejectable i.e., collective supply for all citizens means that it cannot be rejected. Unlike other public goods, trust grows with repeated use and therefore takes time to build.

- Lack of trust represents an externality where decision-makers are not responsible for some of the consequences of their actions.

Creative destruction

- Entrepreneurs introduce new products and technologies with an eye toward making themselves better off—the profit motive.

- New goods — competition — offering lower prices, better performance, new features, catchier styling, faster service, more convenient locations, higher status, more aggressive marketing, or more attractive packaging.

Paradox of progress

In another seemingly contradictory aspect of creative destruction, the pursuit of self-interest ignites the progress that makes others better off.

- Producers survive by streamlining production with newer and better tools that make workers more productive.

- Companies that no longer deliver what consumers want at competitive prices lose customers and eventually wither and die.

- Over time, societies that allow creative destruction to operate grow more productive and richer; their citizens see the benefits of new and better products, shorter workweeks, better jobs, and higher living standards.

- Herein lies the paradox of progress. A society cannot reap the rewards of creative destruction without accepting that some individuals might be worse off, not just in the short term, but perhaps forever.

- At the same time, attempts to soften the harsher aspects of creative destruction by trying to preserve jobs or protect industries will lead to stagnation and decline, short-circuiting the march of progress.

- The process of creating new industries does not go forward without sweeping away the pre-existing order.

Application of creative destruction:

A key dimension of opportunity pertains to that between new entrants and incumbents.

- While incumbents are likely to be powerful, influential, and have a voice that is heard in the corridors of power, new entrants are unlikely to possess these advantages.

- Yet, new entrants bring path-breaking ideas and innovation that not only help the economy directly but also indirectly by keeping the incumbents on their toes.

- Therefore, the vibrancy of economic opportunities is defined by the extent to which the economy enables fair competition, which corresponds to a “pro-business” economy.

- This is in contrast to the influence of incumbents in extracting rents from their incumbency and proximity to the corridors of power, which corresponds to the “pro-crony” economy.

- It is crucial in this taxonomy to relate the term “pro-business” to correspond to an economy that enables fair competition for every economic participant.

Conclusion

The theme around wealth creation and its role in the economy is notable as it stokes the spirit of entrepreneurship across rural and urban India. Hand of trust stresses on the governance and ethics to be the strong pillars on which industry can contribute to India’s wealth story

MCQs

- Which of the following is the theme of the Economic Survey 2019-20?

A. Wealth creation

B. Faster and sustainable growth

C. Inclusive growth

D. None of the above

Ans. (A) The theme of Economic Survey, 2019-20 is “Wealth Creation” for India’s aspiration of becoming a $5 trillion economy by 2025. - With reference to the “Corruption Perception Index”, consider the following statements:

1- It is released by the “Transparency International”.

2- Since 2013, India has improved significantly on this index.

Which of the above statements is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Ans. (C) The Corruption Perceptions Index (CPI) is an index published annually by Transparency International since 1995 which ranks countries “by their perceived levels of public sector corruption, as determined by expert assessments and opinion surveys.” The corruption perception index, which Transparency International tracks across countries, shows India at its lowest point in recent years in 2011. Since 2013, India has improved significantly on this index. - With reference to the Central Repository of Information on Large Credits (CRILC), consider the following statements:

1- It mandates the banks to report on all their borrowers having aggregate exposure of Rs.1 crores and above.

2- It is an initiative of the Ministry of Finance.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Ans. (D) The RBI has set up a Central Repository of Information on Large Credits (CRILC) to collect, store, and disseminate credit data to lenders. Banks will have to furnish credit information to CRILC on all their borrowers having aggregate fundbased and non fund based exposure of Rs.5 crores and above. Similarly, banks will be required to report, among others, the SMA status of the borrower to the CRILC.

Hence both the statements are not correct. - In the context of economics, which of following best describes the process of Creative Destruction?

A. It refers to change in economic structure where old industrial units are replaced by innovative and novel production units.

B. It refers to process in which government policies unintentionally hinders the development of industries with creative potential.

C. It refers to decline in the quality of social infrastructure in an economy as result of low spending by the successive governments.

D. It refers to a situation where high inflation rates in an economy tends to decrease the investment levels.

Ans. (A) Creative destruction refers to the incessant product and process innovation mechanism by which new production units replace outdated ones. The term was coined by Joseph Schumpeter (1942), who considered it the essential fact about capitalism‘. •Schumpeter described creative destruction as innovations in the manufacturing process that increase productivity, but the term has been adopted for use in many other contexts such as internet, artificial intelligence etc.

•This restructuring process permeates major aspects of macroeconomic performance, not only long-run growth but also economic fluctuations, structural adjustment and the functioning of factor markets. Over the long run, the process of creative destruction accounts for over 50 per cent of productivity growth. Economic Survey 2019-20 notes that ‘when creative destruction is fostered, sectors as a whole will always outperform individual companies within the sector in creating wealth and maximizing welfare. Therein lies the motivation for India to pursue pro-business, rather than pro-crony, growth