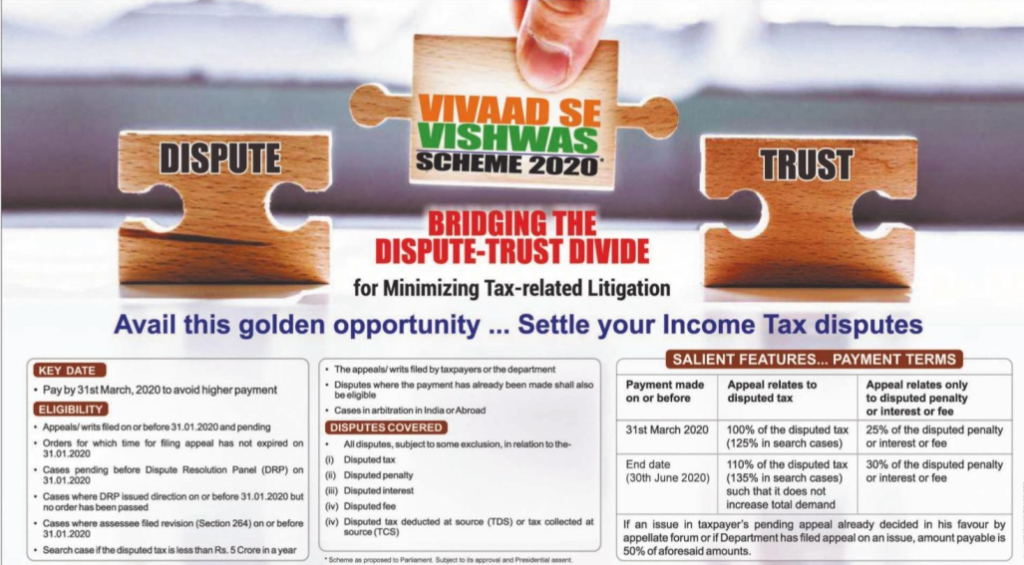

- Introduction of the Vivad Se Vishwas scheme during budget speech with a view to “provide for resolution of pending tax disputes.”

- The scheme was introduced after the success of the “Sabka Vishwas Scheme,” which was introduced to reduce indirect tax disputes.

- It provides waiver from interest and penalty.

- The bill shall apply to all the appeals filed by declarants or the Government, which are pending with the Commissioner (Appeals), DRP, Income-tax Appellate Tribunal, High Court or Supreme Court and revision cases that are pending before the CIT as on the January 31, 2020

- The scheme applies to all the

pending litigation except the following cases:-

- Cases related to search or seizure;

- Cases where the prosecution has been instituted on or before the date of filing of declaration;

- Cases related to any undisclosed foreign income or assets;

- Cases which are completed based on information received as a result of exchange of information with other tax jurisdictions

- Cases where the CIT (Appeals) has issued a notice of enhancement;

- Cases in which an order of detention has been made or prosecution has been instituted/ conviction has been made under specified Acts or notification has been made under the Special Court (Trial of Offences Relating to Transactions in Securities) Act, 1992.