Contents

- Threat or Treat: on RCEP trade deal

- Needed, a policy framework in step with technology

- Analysis of the Aatma Nirbhar Bharat Abhiyaan (MSMEs)

THREAT OR TREAT: ON RCEP TRADE DEAL

Context:

The regional trade agreement has been signed by 15 countries, without India. A look at the factors leading to India opting out, how China’s aggression firmed the decision, and the economic implications of the move.

Relevance:

GS Paper 2: Bilateral, Regional, Global groupings & Agreements (involving and/or affecting India)

Mains Question:

- The RCEP presents a unique opportunity to support their economic recovery, inclusive development and job creation even as it helps strengthen regional supply chains. Discuss. 15 marks

- There are strong economic and strategic reasons to not let the RCEP door remain shut permanently for India. Critically Examine. 15 marks

Dimensions of the Article

- What is RCEP?

- Benefits of RECP for India.

- Why Did India walk out?

- What are the implications of India opting out of RCEP?

- Way forward

What is the RCEP?

Described as the “largest” regional trading agreement to this day, RCEP was originally being negotiated between 16 countries — ASEAN members and countries with which they have free trade agreements (FTAs), namely Australia, China, Korea, Japan, New Zealand and India.

RCEP will provide a framework aimed at lowering trade barriers and securing improved market access for goods and services for businesses in the region, through:

- Recognition to ASEAN Centrality in the emerging regional economic architecture and the interests of ASEAN’s FTA partners in enhancing economic integration and strengthening economic cooperation among the participating countries.

- Facilitation of trade and investment and enhanced transparency between the participating countries.

- Facilitation of SMEs’ engagements in global and regional supply chains.

Despite pressure to conclude the Regional Comprehensive Economic Partnership (RCEP) trade agreement this year, there is huge differences among members like India-China trade relationship, Australia and New Zealand on labour and environmental protections etc.

Benefits of RCEP for India

- Market Access: Owing to its size, it is expected to provide market access for India’s goods and services exports and encourage greater investments and technology into India.

- Enhance MSME sector: RCEP recognises the importance of being inclusive, especially to enable SMEs leverage on the agreement and cope with challenges arising from globalisation and trade liberalisation. Hence, RCEP would facilitate India’s MSMEs to effectively integrate into the regional value and supply chains.

- Alternative to APEC: RCEP offers alternative to Asia-Pacific Economic Co-operation (APEC) on economic front in which India has been attempting to join APEC since 1993, but still has not got the membership.

- FDI gains: The arrangement is expected to harmonise the trade-related rules, investment and competition regimes of India with those of other countries in the group. There would be a boost to inward and outward foreign direct investment, particularly export-oriented FDI.

- Increase in Trade: India’s engineering trade with RCEP countries reached $108 billion in 2018 from $79 billion in 2014. Exports increased from $15.34 billion to $17.20 billion in 2018 while imports increased from $64.28 billion to $90.95 billion.

- Increasing hold in Indo-Pacific region: It provides a platform to India for rebalancing the Asia strategy and an acknowledgement of linkage between the Indian and Pacific Oceans.

- Aligned with India’s initiative: India wants its ‘Make in India’ to become a global success, it must participate positively to become a part of the Asian value and supply chain which either begins or ends in India. It also aligns with Act East Policy which make both economic and strategic sense for India to be the part of the agreement.

- Growth of supply chains: Signing the RCEP treaty will enable India to enter the global supply chain as it will be helped by frictionless movement between 16 members.

- RCEP may also encourage regional supply chains involving BIMSTEC countries and ASEAN members in products that the region specialises in like bamboo and wood products, leather goods, garments, silk, handicrafts and jewellery.

- Beneficial for labour market: RCEP will offer India with opportunity to do more labour intensive manufacturing as multinationals would be attracted to set up manufacturing base in India and RCEP membership will enable them to access the large RCEP market.

Why Did India walk out?

On November 4, 2019, India decided to exit discussions over “significant outstanding issues”. India has following concerns with RCEP:

- Trade deficit: India’s trade deficits have always widened with nations after signing free-trade agreements (FTAs) with them. The same is true for India’s FTAs with the ASEAN, Japan, Korea, and Singapore, most of which are RCEP nations.

- India’s merchandise trade deficit with the RCEP grouping hit $105 billion in FY19 (60% of its total deficit).

- The broad trade flows analysis indicates that the Compounded Annual Growth Rate (CAGR) of imports was 9.06 per cent while for exports, it was 2.90 per cent during the period of 2014-2018, reflecting higher growth of imports than exports.

- Threat to domestic market: RCEP members, particularly China, are demanding zero tariffs over 90 per cent tariff lines which is a major concern for India as low cost Chinese manufacturing goods will swamp its domestic market by dumping cheaper goods.

- A large number of Indian industry including iron and steel, dairy, marine products, electronic products, chemicals and pharmaceuticals and textiles have expressed concerns that proposed tariff elimination under RCEP would render them uncompetitive.

- India has several sensitive areas of competing interests in agriculture, horticulture and dairy with other non-FTA partners like Australia and New Zealand.

- Lack of compliance with rules: The surge in goods imports into India is accentuated by instances of non-adherence to the Rules of Origin provisions and lack of full cooperation in investigating and addressing such breaches. India has made tagging the “Country of Origin” on all products a sticking point in RCEP negotiations.

- Competition from China: It is evident that the size and scale of Chinese manufacturing industry backed with extensive financial and non-financial support provide a clear edge to Chinese manufacturing producers.

- Product groups such as electrical machinery and equipment and parts thereof, and machinery, mechanical appliances, nuclear reactors are major contributors to India’s trade deficit in engineering goods with China.

- Low labour productivity: Despite low relative labour cost, labour productivity in India in manufacturing is still one of the lowest in the world, and spatially fragmented labour laws escalate costs of transaction. Under such circumstances, the Indian industry is hardly in a position to compete in a level playing ground in a free-trade region.

- Strict IPR policy: The “stringent IP provisions” have been stumbling blocks for a while, with India arguing for these to be taken out of the agreement.

- The provisions, if adopted, would lead to domestic pharma companies not being able to launch or export affordable life-saving drugs across the world.

- While in the agriculture sector, farmers would lose the right to save or sell seeds or the harvested produce from plant varieties that have been granted intellectual property.

- India had negotiated to reject high-level protections at RCEP under the International Union for the Protection of New Varieties of Plants (UPOV), a provision going beyond World Trade Organization, or ‘WTO-plus.

What are the implications of India opting out of RCEP?

There are strong economic and strategic reasons to not let the RCEP door remain shut permanently for India. The economic reasons first:

- The RCEP members now account for about 30% of the global GDP and a third of the world’s population, the signatory states were emphatic that the timing of the accord presents a unique opportunity to support their economic recovery, inclusive development and job creation even as it helps strengthen regional supply chains.

- Trade data suggests that India’s deficit with China, with which it does not have a trade pact, is higher than that of the remaining RCEP constituents put together.

- Trade deficits are not all bad, and definitely not for consumers. Even otherwise, import of cheaper intermediate goods only help add value to final products.

- India was much better off, both in terms of its share in global trade, FDI inflows, growth of the domestic industry, and rising income levels of its people.

The China factor and India’s strategic thinking on RCEP:

- India does need to prepare itself for China’s maritime challenge and the aggression it has displayed along the borders.

- Alliances such as the informal strategic forum, the Quad, which includes the US, Australia and Japan, will help New Delhi check Beijing’s dominance in the South China seas and the Indo-Pacific region.

Way forward

- Protect domestic industry: Given the costs and benefits in RCEP, it is important for India to strike a balance between domestic and external interests to minimise the adverse effects of RCEP on its domestic engineering industry. It is important to grasp the possible opportunities that RCEP will extend to the Indian engineering industry as some of RCEP countries, particularly China, are moving up the value chain and vacating space for other low-cost economies.

- Use of skilled labour: India has been insisting on capitalising on its pool of ‘skilled’ labour force to gain from improved access to employment opportunities in these economies. This has been expected to come about by increasing the ease of movement of professionals through the liberalisation of what is called Mode 4 in services trade.

- Protect tariff structure: India should continue to maintain its position of proposed dual tariff structure in the RCEP as it will help India to protect its tariff lines which are more vulnerable to cheap Chinese imports. It must emphasise on a special and differential treatment based on stages of economic development.

- Restrict Rules of Origin (RoO): It can be used as a strong instrument in RCEP to curb the free flow of Chinese goods into the domestic market.

- Labour and market reforms: If domestic industry has to thrive, it needs protection as also the enabling conditions created by factor and product market reforms.

- Placing suitable safeguards: Within the FTA, provision should be made for safeguard measures like antidumping etc. which should be invoked if a volume or price trigger for the concerned products is reached.

Despite all the differences with China, at the end of the day, Australia and Japan have not stayed out of RCEP. Being an emerging power, New Delhi must send the right messages. Instead of sitting out and building tariff walls across sectors, it must prod and incentivise the industry to be competitive, and get inside the RCEP tent at the earliest opportune moment.

Background

1: Potential of RCEP

- RCEP has the potential to deliver significant opportunities for businesses in the East Asia region making it the world’s largest trading bloc.

- 16 RCEP participating countries account for almost half of the world’s population.

- It contributes about 30 per cent of global GDP and over a quarter of world exports.

- SMEs make up more than 90 per cent of business establishments across all RCEP participating countries.

2: Rules of origin

- They are the criteria needed to determine the national source of a product.

- Their importance is derived from the fact that duties and restrictions in several cases depend upon the source of imports.

3: Mode 4 in services trade

- The movement of natural persons is one of the four ways through which services can be supplied internationally.

- Otherwise known as “Mode 4”, it covers natural persons who are either service suppliers (such as independent professionals) or who work for a service supplier and who are present in another WTO member to supply a service.

4: RCEP compared with Trans-Pacific Partnership (TPP)

- TPP negotiations was led by US while RCEP was led by China.

- The TPP was a more ambitious plan, including market access for goods and services as well as regulations on labour, the environment, intellectual property and state-owned companies.

- The RCEP, on the other hand, is more narrowly focused on standardising tariffs across the region, as well as improving market access for services and investment.

- RCEP includes special provisions for developing economies, such as gradual tariff liberalisation and transition times.

- According to forecasts from the Asian Development Bank in 2016, the TPP had the potential to provide up to US$400 billion in global income benefits before the US withdrawal, whereas the RCEP’s contribution would amount to an estimated US$260 billion.

NEEDED, A POLICY FRAMEWORK IN STEP WITH TECHNOLOGY

Context:

As technology has evolved in the latter part of the 20th century and the early part of the 21st century, the traditional boundaries between goods and services have blurred.

Relevance

GS Paper 3: S&T developments and everyday applications & effects; Awareness in fields of IT, Space, Computers, Robotics, Nanotech, Biotech, IPR issues.

Mains Questions

- Information is the new currency powering economies. The new currency drives processes and decision-making across a wide array of products and services, making them more efficient and value accretive for consumers. Discuss. 15 marks

Dimensions of the Article:

- What is Big Data?

- Benefits of Big Data

- Applications of Big Data

- Challenges

- Way forward

What is Big Data?

Big data refers to the large, diverse sets of information that grow at ever-increasing rates. It encompasses the volume of information, the velocity or speed at which it is created and collected, and the variety or scope of the data points being covered. Big data often comes from multiple sources.

Big data analytics is the use of advanced analytic techniques against very large, diverse data sets that include structured, semi-structured and unstructured data, from different sources, and in different sizes from terabytes to zettabytes.

Key technologies involved in Big Data Analytics

- Machine Learning: It is a specific subset of AI that trains a machine how to learn, makes it possible to quickly and automatically produce models that can analyse bigger, more complex data and deliver faster, more accurate results – even on a very large scale.

- Data mining: Data mining technology helps to examine large amounts of data to discover patterns in the data – and this information can be used for further analysis to help answer complex business questions.

- Predictive analytics: It uses data, statistical algorithms and machine-learning techniques to identify the likelihood of future outcomes based on historical data.

Benefits of Big Data

- Improves decision making: Big data allows businesses to analyse information immediately. Instead of focusing only on profit and loss, it integrates a wide range of insights, taking into account each and every factor that could possibly influence the business.

- Protects company and client information: Since big data can immediately detect irregularities in any business network, it can help evade cybercrimes and enhance the overall security of the network.

- Enables effective marketing: Big data keeps us informed about marketing trends and it also ensures that right marketing method is picked up which is best suited to needs and objectives. It helps providing businesses with better insights about their clients.

- Facilitates cost and time reduction: Big data helps cut down costs by streamlining processes and improving operational efficiency. It can be used to identify trends, patterns, and probabilities in incurring.

- Better product designing: With better information and analysis of the data, it helps to design products in a better way.

Applications of Big Data

- Banking: With large amounts of information streaming in from countless sources, banks are faced with finding new and innovative ways to manage big data. Big data brings big insights, but it also requires financial institutions to stay one step ahead of the game with advanced analytics.

- Education: By analysing big data, educators can identify at-risk students, make sure students are making adequate progress, and can implement a better system for evaluation and support of teachers and principals.

- Government: When government agencies are able to harness and apply analytics to their big data, they gain significant ground when it comes to managing utilities, running agencies, dealing with traffic congestion or preventing crime.

- Government launched a project called Project insight in 2017, to catch tax evaders. The project leveraged data mining techniques and analysed the data to achieve its objective of a corruption-free country.

- Andhra Pradesh is employing big data and analytics to launch a real-time monitoring system to monitor the performance of each department in its government.

- Odisha government is banking on data analytics technology to ensure that the least served areas can benefit from Government Welfare schemes.

- Health Care: When big data is managed effectively, health care providers can uncover hidden insights that improve patient care.

- Manufacturing: Big data can provide, manufacturers can boost quality and output while minimizing waste – processes that are key in today’s highly competitive market.

- Agriculture: Sensor data to optimise crop efficiency can be used. This is used to measure how plants react to changes in various conditions by planting test crops and running simulations.

Challenges related to utilising potential of Big Data

- Keeping Pace with growing amount of data: Although new technologies have been developed for data storage, data volumes are doubling in size about every two years. Organizations still struggle to keep pace with their data and find ways to effectively store it.

- Lack of data Scientists: India reportedly has fewer than 10% of data scientists available globally while the US has over 40% skilled professionals in the big data and analytics domain.

- Privacy issue: Privacy has become a big concern when it comes to the use of customer data. Big Data analytics have the potential to reveal sensitive personal information by uncovering hidden connections between pieces of data that seems unrelated.

- Security issues due to outsourcing: Outsourcing of data analysis only increases the security risks as information like customers’ earnings, mortgages, savings and insurance policies are required to be shared for the purpose.

- Availability of quality data: One of the major challenges in the sector to enable the use of Big Data is the availability of quality data. Most of the data in the development sector is yet to be digitised.

- Technological issue: Big data is often defined by volume, velocity and variety, may result in an incomplete and biased data set. Therefore, while the quantity of data should not be regulated, what needs to be controlled is the quality of data and the method of analysis. Some of the key technologies for mastering this is still missing.

- Ethics of big data: It comes into role as huge amount of private data is available and how and where it should be put to use raises the question.

- Need for synchronization across data sources: As data sets become more diverse, there is a need to incorporate them into an analytical platform. If this is ignored, it can create gaps and lead to wrong insights and messages.

Way forward

- Wider acceptance of Big data: All the departments in government as well as private sector should be aware about the use of big data.

- Cyber security: Policies should be drawn to strengthen the cyber security framework for making the data safe.

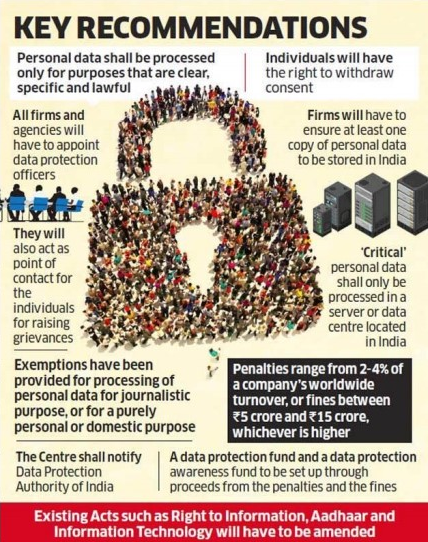

- Privacy: Data Management should address the ethical issues regarding big data analytics and formulate a policy regarding data privacy. Guidelines formulated by Justice B N Srikrishna committee on data protection can be followed in this regard (refer infographics).

- Increase R&D and funding to master technologies: Research and other institution need to develop R&D to learn about all the important technologies in order to better utilize the applications of big data.

- Establish data centers: Government needs to set up data center for effective collection, segregation and analysing.

- Training: Data scientists needs to be trained to learn on handling the big data.

Background

1: Initiatives taken by the government

- The ‘big data management policy’ introduced by the Comptroller and Auditor General of India (CAG) paved the way for Data Analytics Centre (first of its kind in the country) and aims to exploit the data-rich environment in the union and state governments to build capacity in the Indian audit and accounts department.

- NITI Aayog is planning to develop National Data and Analytics Platform in collaboration with private tech players.

- Government of India is also working towards an Open Data Policy, to encourage sharing information between departments and across ministries.

- National Data Sharing and Accessibility Policy (NDSAP), 2012 aims to provide an enabling provision and platform for proactive and open access to the data generated by various Government of India entities.

- Open Government Data (OGD) Platform India – data.gov.in – intends to increase transparency in the functioning of Government and also open avenues for many more innovative uses of Government Data to give different perspective.

- National Association for Software and Services Company (NASSCOM) has proposed a curriculum upgradation to include big data and data analytics in engineering colleges.

2: Recommendations of B N Srikrishna committee

ANALYSIS OF THE AATMA NIRBHAR BHARAT ABHIYAAN (MSMES)

Context:

Emphasising that the special economic package would focus on land, labour, liquidity and laws, PM Modi said it would benefit labourers, farmers, honest tax payers, MSMEs and cottage industry.

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein.

Mains Questions:

- For India, just achieving economic growth is not sufficient. We require job-led growth to provide employment to 400 million plus workforce. Discuss this statement in context of MSMEs sector in India. 15 marks

Dimensions of the Topic:

- About MSMEs

- MSME under the Aatma Nirbhar Bharat Abhiyaan

- Way forward

About MSMEs

The Government of India has introduced MSME or Micro, Small, and Medium Enterprises in agreement with Micro, Small and Medium Enterprises Development (MSMED) Act of 2006. These enterprises primarily engaged in the production, manufacturing, processing, or preservation of goods and commodities.

As per the ‘MSME at a Glance’ Report of the Ministry of MSMEs, the sector consists of 36 million units and provides employment to over 80 million persons. The Sector produces more than 6,000 products contributing to about 8% of GDP besides 45% to the total manufacturing output and 40% to the exports from the country.

MSMEs under the Aatma Nirbhar Bharat Abhiyaan

Enhance liquidity for Non-Banking Financial Companies (NBFCs), Housing Finance Companies (HFCs), and Micro Finance Institutions (MFIs):

- Purchase of debt: The government will allow purchase and sale of short-term debt of NBFCs, HFCs and MFIs. The RBI defines NBFCs as financial intermediaries engaged in the business of loans, acquisition of shares, stocks or bonds, or leasing, insurance and hire-purchase. HFCs are engaged in providing finance for housing sector and are the main providers of home loans in India.

- The purchase of debt will be facilitated by a Special Purpose Vehicle (SPV) (a business association formed primarily to raise funds) managing a Stressed Asset Fund (SAF) (a fund of pooled money used to purchase loans from banks).

- Credit Guarantee: The Ministry of Finance had launched a Partial Credit Guarantee Scheme (PCGS). It provides a credit guarantee on a portion (10%) of the first loss on the purchase of bonds or debt issued by NBFCs, HFCs or MFIs. The credit guarantee is borne by public sector banks.

Aid payment of instalments of loans:

- The RBI has mandated banks to place a moratorium on payment of instalments and interest on loans between March-August 2020. A moratorium legally authorises postponement of payment on the specified transaction. Such deferment will not result in downgrade in asset classification.

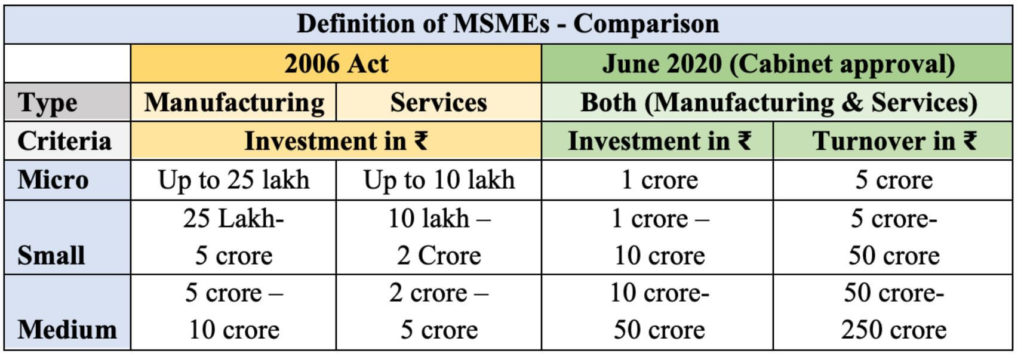

Change qualifying limits of investment for MSMEs

- The government revised the upper limit for investment in MSMEs and established a new criterion based on the firm’s annual turnover in the Micro, Small and Medium Enterprises Development Act, 2006. The new definition also states that MSMEs from service and manufacturing sectors will have the same investment limits, in contrast to the separate categorisation for the two sectors as per the 2006 Act.

Provide liquidity through investment and credit facilities for MSMEs

- Fund of funds: A fund with a corpus of Rs 10,000 crore will be set up to provide equity funding for MSMEs with growth potential and viability. The government expects that Rs 50,000 crore will be leveraged through it.

- Emergency Credit Line Guarantee Scheme (ECLGS): Under this, MSMEs can borrow up to 20% of their entire outstanding credit from banks and NBFCs through loans guaranteed by the government.

Provide liquidity to MSMEs with stressed or non-performing assets (NPAs)

- NPAs are loans and advances where the borrower has stopped making interest or principal repayments for over 90 days while Special Mention Account-2 (SMA-2) are ones with a delay of payment between 61 and 90 days. Sub-ordinate debt is debt which can only be repaid after all other debt has been settled.

- As part of the Credit Guarantee Scheme for Subordinate Debt, MSMEs with NPAs or SMA-2, will be given credit of Rs 75 lakh or 15% of their stake (whichever is lower), in exchange for equity under. This credit will be offered by promoters as equity and will have a moratorium of seven years.

Release of payments due to MSMEs by the government

- According to the Micro, Small and Medium Enterprises Development Act, 2006, payment by any buyer of goods or services from an MSME cannot exceed 45 days.

Limit competition from global firms

- Under the Scheme, the government announced that global tenders (an invitation for a bid by suppliers and manufacturers) of up to Rs 200 crores will not be allowed in tenders related to government procurement. In May 2020, the government notified the General Financial Rules, 2017 to specify that global tenders up to Rs 200 crore may only be notified with prior approval of the Cabinet in exceptional cases. The previous procedure of approaching foreign embassies in India and Indian embassies abroad will continue.

Amend the Insolvency and Bankruptcy Code, 2016

- The Insolvency and Bankruptcy Code, 2016 provides a time-bound process for resolving insolvency in companies and among individuals. The Ordinance amends the Code to prohibit the initiation of insolvency proceedings, by either the debtor himself or its creditors, for defaults arising during the six months from March 25, 2020.

- The Code also allows the creditors of the company to initiate an insolvency resolution process, if the amount of default by the debtor company is at least one lakh rupees. The Ministry of Corporate Affairs has increased this threshold from one lakh rupees to one crore rupees.

Way forward

The development of MSMEs is crucial on many counts for Indian economy and society. Apart from proper implementation of U.K. Sinha Committee recommendations, a cue could be taken from the global best practices such as the Competition by cooperation concept in Italy, Contract Financing in Mexico and success stories of Shenzhen as a technology hub in China.