Context:

A group of 17 elements, dubbed rare earths and placed at the bottom of periodic table, have remarkable electrical and magnetic properties, while a dozen others can store energy and transmit them with minimal losses. These elements, such as neodymium, molybdenum, titanium, lithium, cobalt, vanadium etc., are crucial in the new energy era where a battery is key for storing the variable solar and wind energy and powering vehicles.

Relevance:

GS-III: Industry and Infrastructure, GS-I: Geography (Distribution of Key Natural Resources, Mineral & Energy Resources), GS Paper-II: International Relations (India and its Neighborhood)

Dimensions of the Article:

- Understanding the battery and the minerals used

- Scramble for the availability of these minerals

- Dominance of China

- Reasons for Dominance of China

- De-risk supply disruption: How other countries are reacting?

Understanding the battery and the minerals used

- Essentially, batteries have three main parts: cathode, anode and electrolyte, which collect and discharge electricity.

- Different minerals are used for making these parts depending on the technology. For instance, rechargeable batteries in hybrid electric vehicles (EVs) use a nickel-metal hydride which involves rare earth elements.

Batteries are basically classified into 2 types:

- Non-rechargeable batteries (primary batteries) – they can be used only once.

- Rechargeable batteries (secondary batteries) – can be recharged and can be reused.

Important Types of Batteries

- Alkaline batteries: It is basically constructed with the chemical composition of Zinc (Zn) and Manganese dioxide (MnO2), as the electrolyte used in it is potassium hydroxide (KOH) which is purely an alkaline substance.

- Coin cell batteries: Apart from alkaline composition, lithium and silver oxide chemicals will be used to manufacture these batteries.

- Lead-acid batteries: It consists of lead-acid which is very cheap and seen mostly in cars and vehicles to power the lighting systems in it.

- Ni-Cd batteries: These batteries are made of Nickel and Cadmium chemical composition. These are very rarely used; these are very cheap and their discharge rate is very low.

- Ni-MH batteries: The Nickel – Metal Hydride batteries are much preferable than Ni-Cad batteries because of their lower environmental impact.

- Li-ion batteries: These are made up of Lithium metal and are latest in rechargeable technology. As these are compact in size, they can be used in most of the portable applications which need high power specifications. These are the best rechargeable batteries available.

Scramble for the availability of these minerals

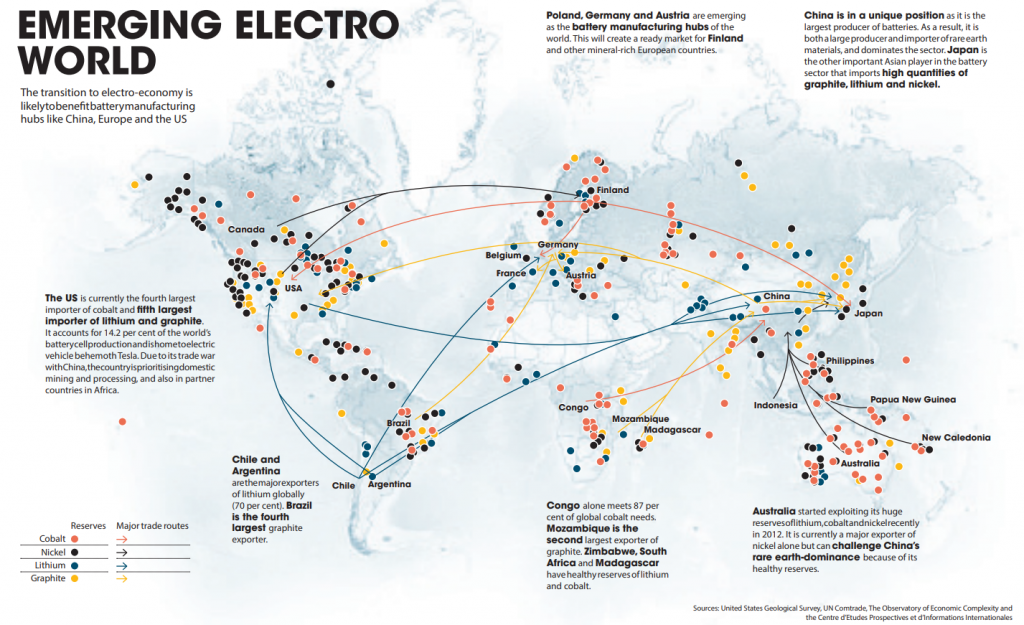

The global scramble is particularly high for lithium, cobalt, nickel, copper and graphite that are key to the dominant lithiumion (Li-ion) batteries, used to power anything from mobile phones to electric cars to power grids.

Global uncertainties around their supply loom large as these minerals are concentrated in a few pockets and their supply chain is controlled by even fewer players.

Example: Lithium:

- In theory, Li is sufficiently available in the Earth’s crust, subsurface brines and even seawater.

- The salt flats of Argentina, Bolivia and Chile hold 54 % of the world’s lithium resources. The dominant position of the Latin American trio makes them known as the lithium triangle.

- But when it comes to production, Australia takes the top spot (by contributing almost 50 % of the global trade flow), followed by Chile (22 %) and China (17 %).

- This disruption has become possible as supply chains are heavily concentrated – and Chinese companies have pursued mine investments in both Australia and Latin America to ensure an overall command of lithium supply chain.

- Most mines of these critical minerals are located in fragile and unstable parts of the world.

Dominance of China

- China today controls 70-80 % of the global trade of most critical minerals.

- This growing dominance of China over reserves and supply chain of critical minerals has sent jitters across most parts of the world, which is wary of the Asian giant’s intentions.

- During the early part of the last decade, when China cut its export quota of rare earths making global supply uncertain, it had stirred trade disputes – as US, Japan and EU had filed a complaint with the World Trade Organization (WTO), which in 2014 said China’s rare earth export quota was inconsistent with the body’s regulations.

- With mega battery factories, China dominates more than 70 % of the battery supply chain.

Reasons for Dominance of China

- China has grabbed the advantage of being the sector’s early bird to systematically build its trade and industry.

- Starting around 2010, its electro-economy has grown to dominate the entire chain — from upstream mining of battery raw material (lithium, cobalt, nickel, graphite, manganese and rare earth elements), to midstream production of battery grade chemicals, cathode and anode; and to downstream production of Li-ion battery cells and other end products.

- In 2019, China accounts for 23 % of the global mine-output of battery minerals. Yet its chemical companies churn out 80 % of the world’s processed battery-grade raw materials and 66 % of the global production of cathodes and anodes for Li-ion batteries.

- In 2020 China led the world’s battery cell production with a more than 60 % share, while the US was in second place with less than 15 %.

Where China does not have enough reserves, it is accessing mines overseas.

- China has supported mining and processing firms and mega battery manufacturing facilities with low-interest loans. Trade policy has, thus, secured minerals needed for batteries, especially for EVs.

- China has developed a comprehensive battery manufacturing supply chain internally and also the world’s largest public charging network.

- To help build the domestic industry, China requires foreign automakers to enter joint ventures with Chinese firms to share profits and technology. Several global vehicle brands have entered into joint ventures with Chinese companies to access markets and secure supplies of battery materials.

De-risk supply disruption: How other countries are reacting?

- With decarbonisation and the net-zero race gaining pace, countries have started to strategise to reduce dependence on China. The US and EU are taking steps to reduce supply risks and price volatility. Nations are jostling to invest in mines of these critical minerals to secure direct access to raw material outside China or getting into offtake agreements.

- New mines are opening up in Latin America and other regions. Countries are improving stockpiling of these minerals, particularly cobalt which faces severe supply constraints. They are exploring substitution of such materials either by increasing battery-cell efficiency or by changing to a different chemistry. Focus is also shifting towards recycling of end-of-life of batteries to recover rare earths and other such critical minerals.

- The US is prioritising mining and processing at home and in partner countries. Three North American companies are setting up a rare earths supply chain to reduce dependence on China for EVs and other technologies.

- Europe is aggressively building its own supply network, with rise in EV sales. The European Commission has launched an action plan on critical raw materials and an industry alliance to strengthen EU’s “strategic autonomy” on key raw materials. Europe aims to be 80 per cent self-sufficient in lithium for battery storage by 2025.

- The World Economic Forum (WEF) has proposed the idea of the G20 nations setting up a process to handle emerging tensions and also the possibility of the US, EU, China, Japan and South Korea pledging to increase support to international R&D initiatives on EVs.

-Source: Down to Earth Magazine