Focus: GS-III Indian Economy

Why in news?

About 200 investment proposals from China are awaiting security clearance from the Ministry of Home Affairs (MHA) after new rules were notified making prior government approval mandatory for foreign direct investments (FDI) from countries which share a land border with India.

Details

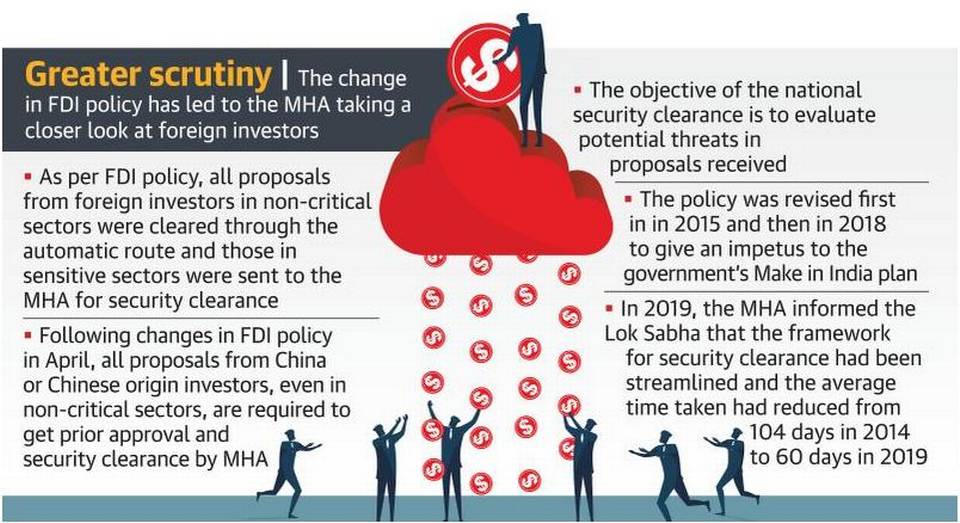

- As FDI is allowed in non-critical sectors through the automatic route, earlier these proposals would have been cleared without the MHA’s nod.

- Prior government approval or security clearance from MHA was required for investments in critical sectors such as defence, media, telecommunication, satellites, private security agencies, civil aviation and mining and any investments from Pakistan and Bangladesh.

What does New Policy say?

- A non-resident entity can invest in India, subject to the FDI Policy except in those sectors/activities which are prohibited.

- However, an entity of a country, which shares land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country, can invest only under the Government route.

- Pakistani investors face further restrictions in requiring government approval for FDI in defence, space and atomic energy sectors as well.

- Investors from countries not covered by the new policy only have to inform the RBI after a transaction rather than asking for prior permission from the relevant government department.

- The official statement added that a transfer of ownership of any existing or future FDI in an Indian entity to those in the restricted countries would also need government approval.

- The decisions will become effective from the date of the Foreign Exchange Management Act notification.

Why was this necessary?

- India shares land borders with Pakistan, Afghanistan, China, Nepal, Bhutan, Bangladesh and Myanmar.

- With many Indian businesses coming to a halt due to the lockdown imposed to contain the COVID-19 pandemic and valuations plummeting, a number of domestic firms may be vulnerable to “opportunistic takeovers or acquisitions” from foreign players.

- Given the macro situation, it is a measure to protect vulnerable companies, with possibly low valuations, from unwelcome takeovers.

-Source: The Hindu