CONTENTS

- Global Trade Concerns: Red Sea Ship Attacks and Panama Canal Drought

- Improvement in GNPA Ratio: RBI Report

- Prevention of Money Laundering Act

- Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY)

- Green Deposits

- Strategic Lithium Deal with Argentina

- United Nations Relief and Works Agency for Palestinian Refugees in the Near East

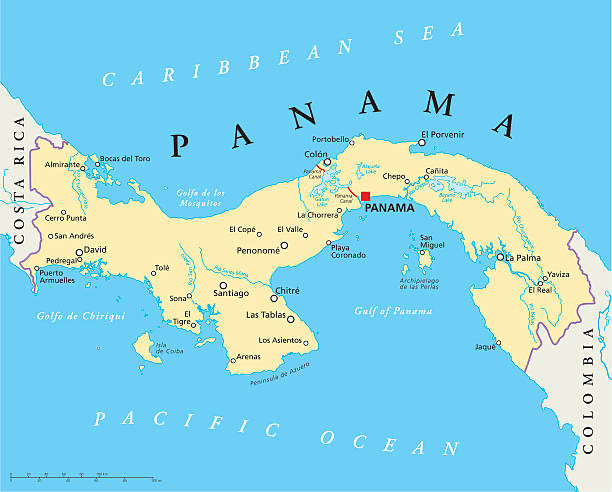

Global Trade Concerns: Red Sea Ship Attacks and Panama Canal Drought

Context:

Recent attacks on ships in the Red Sea trade route and the ongoing drought problem at the Panama Canal have raised worries about global trade disruptions.

Relevance:

GS II: International Relations

Dimensions of the Article:

- Key Issues in the Red Sea and Panama Canal: Overview

- Significance of Maritime Transport in Global Trade

- Measures India Can Adopt to Reduce Vulnerability

Key Issues in the Red Sea and Panama Canal: Overview

Red Sea:

- Chemical Tanker Attack:

- Incident: Drone attack on chemical tanker MV Chem Pluto.

- Location: Approximately 200 nautical miles off Gujarat’s coast.

- Vessel Details: Liberia-flagged, Japanese-owned, and Netherlands-operated.

- Journey: Commenced journey carrying crude from Al Jubail, Saudi Arabia.

- Alleged Perpetrators: Houthi rebels based in Yemen, expressing protest against Israel’s actions in Gaza.

- Conflict Context: Houthi rebels involved in a decade-long civil conflict with Yemen’s government

- Impact on India:

- Concerns for Importers and Exporters:

- Indian oil importers and exporters face potential disruptions.

- Key commodities like basmati and tea at risk.

- Trade Route Significance:

- Critical trade route disruptions may elevate Indian agricultural product prices.

- Rerouting through the Cape of Good Hope may lead to a 10-20% increase.

- Concerns for Importers and Exporters:

Panama Canal:

- Drought-Induced Shipping Reduction:

- Issue: Due to drought conditions, shipping through the 51-mile stretch of the Panama Canal has decreased by over 50%.

- Climate Pattern Impact:

- Naturally occurring El Nino climate pattern, associated with warmer-than-usual water in the central and eastern tropical Pacific Ocean, contributes to Panama’s drought.

- Impact on Trade Routes:

- Water shortage compels vessels from Asia to the US to choose the Suez Canal, adding six extra days compared to the Panama Canal route.

- Strategic Significance:

- Bab-el-Mandeb Strait connects Asia to Europe via the Suez Canal in the Red Sea region.

- The 100-year-old Panama Canal connects the Atlantic and Pacific Oceans.

- Both routes rank among the world’s busiest.

Significance of Maritime Transport in Global Trade:

- Dominance in Global Trade:

- Maritime transport accounts for 80% of global trade by volume and over 70% by value.

- This dominance surpasses other transportation modes, as reported by the United Nations Conference on Trade and Development.

- Trade Value:

- In 2019, the annual world shipping trade’s total value exceeded 14 trillion US Dollars.

- Environmental Impact:

- While shipping contributes to about 3% of global greenhouse gas emissions, it is more fuel-efficient and emits less per ton of cargo compared to modes like air freight.

- Energy Resource Transport:

- Critical for global energy needs, with the majority of energy resources (e.g., oil and natural gas) transported by sea.

- Tankers play a crucial role, carrying resources from production to consumption regions.

Measures India Can Adopt to Reduce Vulnerability:

- Collaborative Security Framework:

- Propose a security framework involving key Red Sea stakeholders (Egypt, Saudi Arabia, UAE, Yemen).

- Emphasize intelligence sharing, coordinated patrols, and joint exercises to enhance maritime security.

- Surveillance Systems:

- Install integrated radar and drone surveillance systems along India’s western coastline.

- Enhance early threat detection and response capabilities to safeguard against potential maritime security threats.

- Engagement with Panama Canal Authorities:

- Collaborate with Panama Canal authorities.

- Explore options for preferential passage or potential toll discounts for Indian vessels on specific routes to mitigate trade disruptions.

Source: Indian Express

Improvement in GNPA Ratio: RBI Report

Context:

The Reserve Bank of India’s recent report reveals a noteworthy reduction in the gross non-performing asset (GNPA) ratio for Scheduled Commercial Banks (SCBs). The ratio, which stood at 3.9% at the end of March 2023, experienced a significant decline, reaching 3.2% by the end of September 2023. This positive shift can be attributed to key contributing factors, including strategic write-offs, successful upgrades of previously non-performing assets, and effective recoveries.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- Understanding Non-Performing Assets (NPAs)

- Understanding Financial Actions Regarding NPAs

- Provisions to Address NPAs in India

Understanding Non-Performing Assets (NPAs)

- According to the Reserve Bank of India (RBI), an asset is classified as non-performing when it stops generating income for the bank.

- Typically, NPAs are loans or advances where principal or interest payments have been overdue for a specific period.

Criteria for Classification:

- Debt is commonly labeled as non-performing when loan payments remain unpaid for a minimum of 90 days.

- In agriculture, if principal and interest are unpaid for two cropping seasons, the loan is deemed an NPA.

Types of NPAs:

- Sub-standard Assets:

- NPAs for a period less than or equal to 12 months.

- Doubtful Assets:

- NPAs existing for more than 12 months.

- Loss Assets:

- Uncollectible assets with little to no hope of recovery, requiring full write-off.

Gross NPA (GNPA) and Net NPA:

- GNPA:

- Total amount of NPAs without deducting the provisional amount.

- Net NPA:

- Gross NPA minus the provision.

- Provision represents funds set aside by banks to cover potential losses from bad loans or NPAs.

Understanding Financial Actions Regarding NPAs:

Write-offs:

- Definition:

- Write-offs involve the removal of a non-performing loan or asset from the bank’s records, recognizing the unlikelihood of debt recovery.

- Implication:

- This action doesn’t relieve the borrower of repayment obligations but acknowledges the challenging prospect of recovery.

Upgrades:

- Definition:

- Upgrades signify the reclassification of a loan account from Non-Performing Asset (NPA) status back to a “standard” asset category.

- Conditions for Upgrades:

- Typically occurs when arrears of interest and principal are paid by the borrower.

Recoveries:

- Definition:

- Recoveries denote funds or assets regained by the bank through various actions aimed at collecting on defaulted loans or NPAs.

- Recovery Mechanisms:

- Include repayments, collateral liquidation, or settlements achieved through pursuing effective recovery strategies.

Provisions to Address NPAs in India:

Recovery of Debts due to Banks and Financial Institutions Act (RDB Act), 1993:

- Established Debt Recovery Tribunals (DRTs) and Debts Recovery Appellate Tribunals (DRATs).

- Aims to facilitate swift adjudication and recovery of debts owed to banks and financial institutions.

Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act), 2002:

- Empowers banks and financial institutions to seize and sell secured assets of defaulting borrowers without requiring court intervention.

- Enhances the efficiency of the debt recovery process.

Insolvency and Bankruptcy Code (IBC), 2016:

- Provides a streamlined corporate insolvency resolution process for stressed assets, including NPAs.

- Facilitates a time-bound and effective mechanism for the resolution of insolvency cases.

Impact of IBC:

- Since its inception, the Insolvency and Bankruptcy Code has successfully resolved Rs 3.16 lakh crore of debt in 808 cases.

- Demonstrates the effectiveness of IBC in addressing and mitigating the impact of non-performing assets on the financial sector.

Source: Indian Express

Prevention of Money Laundering Act

Context:

The Financial Intelligence Unit India (FIU-IND) has issued show cause notices to 9 offshore cryptocurrency and virtual digital assets service providers (VDA SPs) including Binance Kucoin, Huobi for not being compliant with the requisite provisions of the Prevention of Money Laundering Act (PMLA).

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- PMLA Compliance Obligations for VDA SPs:

- Prevention of Money Laundering Act (PMLA), 2002

- Recent Changes Made Under the PMLA

PMLA Compliance Obligations for VDA SPs:

Registration Requirement:

- VDA SPs involved in activities related to virtual digital assets and fiat currencies must register with FIU-IND as reporting entities.

Activity-Based Compliance:

- PMLA compliance is not tied to physical presence but is determined by activities performed, encompassing reporting, record-keeping, and other specified obligations.

Regulatory Framework Expansion and Enforcement:

- Regulatory expansion in March 2023 brought VDA SPs under the Anti Money Laundering (AML) and Counter Financing of Terrorism (CFT) framework within PMLA.

Anti-Money Laundering Law Requirements:

- Reporting entities must maintain Know Your Customer (KYC) details, client identity records, beneficial owner information, account files, and relevant business correspondence.

Statements of Financial Transactions (SFT):

- Reporting entities are obligated to file Statements of Financial Transactions (SFT) detailing specific financial transactions or reportable accounts maintained during the year under the Income Tax Act.

Prevention of Money Laundering Act (PMLA), 2002

- According to the Prevention of Money Laundering Act (PMLA) 2002, Money laundering is concealing or disguising the identity of illegally obtained proceeds so that they appear to have originated from legitimate sources.

- It is frequently a component of other, much more serious, crimes such as drug trafficking, robbery or extortion.

- Money laundering is punishable with rigorous imprisonment for a minimum of 3 years and a maximum of 7 years and Fine under the PMLA.

- The Enforcement Directorate (ED) is responsible for investigating offences under the PMLA.

- The Financial Intelligence Unit – India (FIU-IND) is the national agency that receives, processes, analyses and disseminates information related to suspect financial transactions.

- After hearing the application, a special court (designated under the Prevention of Money Laundering Act PMLA, 2002) may declare an individual as a fugitive economic offender and also confiscate properties which are proceeds of crime, Benami properties and any other property, in India or abroad.

- The authorities under the PMLA, 2002 will exercise powers given to them under the Fugitive Economic Offenders Act.

- These powers will be similar to those of a civil court, including the search of persons in possession of records or proceeds of crime, the search of premises on the belief that a person is an FEO and seizure of documents.

Recent Changes Made Under the PMLA

The Indian government has made several changes to the Prevention of Money-Laundering Act (PMLA) to plug loopholes and comply with Financial Action Task Force (FATF) regulations. Some of the key changes are:

- More disclosures for non-governmental organizations by reporting entities like financial institutions, banking companies, or intermediaries.

- Definition of “politically exposed persons” (PEPs) as individuals who have been entrusted with prominent public functions by a foreign country, which brings uniformity with a 2008 Reserve Bank of India (RBI) circular for Know Your Customer (KYC) norms and anti-money laundering standards for banks and financial institutions.

- Inclusion of practicing chartered accountants, company secretaries, and cost and works accountants carrying out financial transactions on behalf of their clients under the ambit of the money laundering law.

- Widening the list of non-banking reporting entities to allow 22 financial entities like Amazon Pay (India) Pvt. Ltd, Aditya Birla Housing Finance Ltd, and IIFL Finance Ltd. to verify the identity of their customers via Aadhaar under the ambit of the money laundering law.

The financial transactions covered under the money laundering law include buying and selling of any immovable property, managing client money, securities, or other assets, management of bank, savings, or securities accounts, organization of contributions for the creation, operation, or management of companies, creation, operation, or management of companies, limited liability partnerships, or trusts, and buying and selling of business entities.

-Source: The Hindu

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY)

Context:

The Ministry of Health & Family Welfare has recently unveiled certain statistics pertaining to the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY).

Relevance:

GS II: Government policies and Interventions

Dimensions of the Article:

- Key Highlights of AB PM-JAY Statistics

- Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY)

Key Highlights of AB PM-JAY Statistics:

- Gender Distribution:

- Women constitute around 49% of the total Ayushman cards created.

- Approximately 48% of total authorized hospital admissions are accounted for by women.

- Ayushman Card Creation:

- As of December 2023, a total of approximately 28.45 Crore Ayushman Cards have been generated.

- Notably, around 9.38 crore Ayushman Cards were created in the year 2023 alone.

- Coverage and Expansion:

- The scheme extends coverage to 55 crore individuals belonging to 12 crore families.

- Many states and union territories implementing AB PM-JAY have independently expanded the beneficiary base, incurring additional costs.

- Hospital Admissions:

- A significant total of 6.11 crore hospital admissions, amounting to Rs 78,188 crores, have been authorized.

- In the year 2023 (Jan-Dec), 1.7 crore hospital admissions, worth over Rs 25,000 crores, were specifically authorized, reflecting the scheme’s substantial impact on healthcare accessibility and affordability.

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY)

- Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) is the flagship scheme of the Union government as a part of the Indian government’s National Health Policy.

- AB-PMJAY provides a health cover of up to Rs. 5 lakh a family a year, for secondary and tertiary care hospitalization, to India’s bottom 40% poor and vulnerable population.

- The programme was launched in September, 2018.

- AB-PMJAY is under the aegis of Ministry of Health and Family Welfare.

- The PM Jan Arogya Yojana beneficiaries get an e-card that can be used to avail services at an empanelled hospital, public or private, anywhere in the country, with which they can walk into a hospital and obtain cashless treatment.

- The scheme has certain pre-conditions by which it picks who can avail of the health cover benefit. While in the rural areas the list is mostly categorized on lack of housing, meagre income and other deprivations, the urban list of PMJAY beneficiaries is drawn up on the basis of occupation.

Key Features of AB-PMJAY

- PM-JAY is a health assurance scheme that covers 10.74 crores households across India or approximately 50 crore Indians.

- It provides a cover of 5 lakh per family per year for medical treatment in empanelled hospitals, both public and private.

- It provides cashless and paperless service to its beneficiaries at the point of service, i.e., the hospital.

- E-cards are provided to the eligible beneficiaries based on the deprivation and occupational criteria of Socio-Economic Caste Census 2011 (SECC 2011).

- There is no restriction on family size, age or gender.

- All previous medical conditions are covered under the scheme.

- It covers 3 days of hospitalisation and 15 days of post hospitalisation, including diagnostic care and expenses on medicines.

- The scheme is portable and a beneficiary can avail medical treatment at any PM-JAY empanelled hospital outside their state and anywhere in the country.

- The Central government has decided to provide free testing and treatment of Coronavirus under the Ayushman Bharat Yojana.

-Source: The Hindu

Green Deposits

Context:

Recently, the Reserve Bank of India (RBI) said it is not mandatory for banks and Non-Banking Financial Companies (NBFCs) to raise green deposits.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- What are green deposits?

- Regulatory Framework for Green Deposits by RBI

- Potential Benefits for Depositors/Investors

- Limitations and Challenges:

What are green deposits?

- Green deposits are not very different from the regular deposits that banks accept from their customers.

- The only major difference is that banks promise to earmark the money that they receive as green deposits towards environment-friendly projects.

- For example, a bank may promise that green deposits will be used towards financing renewable energy projects that fight climate change.

- A bank may also avoid using green deposits to invest in fossil fuel projects that are considered harmful to the climate.

- A green deposit is just one product in a wide array of other financial products such as green bonds, green shares, etc., that help investors put money into environmentally sustainable projects.

Regulatory Framework for Green Deposits by RBI

Conditions for Accepting Green Deposits:

- Banks must establish approved rules or policies for investing green deposits.

- These rules must be publicly available on the banks’ websites.

Transparency Requirements:

- Banks need to disclose information about the amount of green deposits received.

- Banks must provide details on how the deposits are allocated to different green projects.

- Banks should report on the environmental impact of their investments.

- Claims made by banks regarding project investments and sustainability credentials must be verified by a third-party.

Sustainable Sectors Eligible for Green Deposits:

- RBI has identified sectors that qualify for green deposits.

- Eligible sectors include renewable energy, waste management, clean transportation, energy efficiency, and afforestation.

Prohibited Investments:

- Banks are not allowed to invest green deposits in projects related to fossil fuels, nuclear power, tobacco, gambling, palm oil, and hydropower generation.

Objective of the Rules:

- Prevent greenwashing, which involves misleading claims about environmental impact.

- Ensure that banks do not exaggerate the positive effects of green deposits.

- Avoid investments that are not truly environmentally friendly but marketed as such for higher returns.

Potential Benefits for Depositors/Investors:

- Depositors who care about the environment may find satisfaction in investing their money in environmentally sustainable projects.

- Green deposits can align with the values and beliefs of individuals who prioritize environmental sustainability.

- Investing in green projects can be seen as a way to contribute to environmental preservation and positive change.

Limitations and Challenges:

- The range of projects available for investment through green deposits is limited by design. This restricts the investment options for depositors.

- Critics argue that green investment products may primarily serve as a way to make investors feel good, without necessarily providing significant environmental benefits.

- Assessing the true environmental sustainability of a project can be complex, as it involves considering various second-order effects that may not be immediately apparent.

- It can be difficult for depositors/investors to determine if a project is genuinely environmentally sustainable, given the complexities and potential greenwashing in the industry.

-Source: The Hindu

Strategic Lithium Deal with Argentina

Context:

India is on the verge of finalizing a crucial agreement for five lithium blocks in Argentina, marking a pivotal step in diversifying its sources of critical minerals. This strategic move holds the potential to significantly diminish India’s dependency on China for essential resources, presenting a game-changing development in the country’s resource security.

Relevance:

GS III: Energy

Dimensions of the Article:

- Key Developments in India’s Lithium Exploration:

- Overview of Lithium

Key Developments in India’s Lithium Exploration:

Draft Agreement with CAMYEN:

- The Union Ministry of Mines, through Khanij Bidesh India Ltd (KABIL), has initiated a draft exploration and development agreement with Argentinean miner CAMYEN for potential acquisition and development of five lithium blocks.

Non-disclosure Agreement with ENAMI:

- KABIL has also entered a non-disclosure agreement with Chilean miner ENAMI, exploring possibilities for “exploration, extraction, processing, and commercialization” of lithium.

PwC Consultancy for Australian Projects:

- In another strategic move, KABIL has appointed consultancy major PwC to identify investable projects in Australia.

India’s Lithium Acquisitions in Argentina:

- Over the past year, India has intensified its pursuit of critical minerals, particularly lithium.

- Lithium plays a crucial role in India’s shift towards green energy, aligning with efforts to reduce carbon footprints.

- Argentina, known for its extensive lithium deposits and cost-effective production, emerges as a key source to fulfill India’s increasing demand for this vital mineral.

Argentina’s Lithium Industry:

- Argentina currently boasts two active lithium mines, with 14 projects under construction or in advanced exploration stages as of September 2023.

- The country is poised to become a leading lithium producer globally once these projects are operational.

KABIL Board Approval and Branch Office Proposal:

- The KABIL board has previously sanctioned the ‘Draft Exploration and Development Agreement.’

- The Ministry has subsequently greenlit a proposal to establish a Branch Office in Catamarca, Argentina, indicating a significant stride in India’s lithium acquisition ventures.

.

Overview of Lithium:

- Chemical Properties:

- Lithium is a chemical element denoted by the symbol Li and atomic number 3.

- Classified as a soft, silvery-white alkali metal.

- Special Characteristics:

- Distinguished by its lightness and softness, allowing it to be cut with a kitchen knife.

- Remarkably low density, enabling it to float on water.

Applications of Lithium:

- Rechargeable Batteries:

- Lithium is extensively utilized in rechargeable batteries for mobile phones, laptops, digital cameras, and electric vehicles (EVs).

- Often referred to as “white gold” in the context of EVs.

- Metal Alloys:

- Lithium metal is alloyed with aluminum and magnesium, enhancing strength and reducing weight.

- Aluminum-lithium alloys find applications in aircraft, bicycle frames, and high-speed trains.

- Toxicity:

- Lithium has no known biological role and is toxic in larger doses.

Natural Occurrence of Lithium:

- Earth’s Crust Presence:

- Lithium constitutes a mere 0.0007% of the Earth’s crust and is primarily found in minerals and salts.

- Global Reserves:

- Chile holds the world’s largest known lithium reserves, amounting to 9.3 million tonnes.

- Australia follows with 6.2 million tonnes.

- Indian Lithium Reserves:

- The Geological Survey of India identified 9 million tonnes in the Salal-Haimana area of Reasi district, J&K, ranking India as the third-largest lithium resource globally.

- Global Ranking:

- Argentina (2.7 million tonnes) and China (2 million tonnes) follow India in lithium reserves.

- Production Statistics:

- Global lithium production surpassed 100,000 tonnes in 2021, with Australia contributing 52% of the world’s lithium.

Future of Lithium Production:

- Projected Demand:

- The rising demand for batteries and EVs is anticipated to require 1.5 million tonnes of lithium carbonate equivalent (LCE) by 2025 and over 3 million tonnes by 2030.

- Production Requirements:

- To meet these projections, lithium production needs to triple by 2025 and increase nearly six-fold by 2030.

-Source: The Hindu

United Nations Relief and Works Agency for Palestinian Refugees in the Near East

Context:

India recently announced that it has provided US $ 2.5 million to the United Nations Relief and Works Agency for Palestine Refugees in the Near East or the UNRWA for the welfare of Palestinian refugees.

Relevance:

GS II: International Relations

United Nations Relief and Works Agency for Palestinian Refugees (UNRWA):

Establishment and Mandate:

- Established by United Nations General Assembly (UNGA) Resolution 302 (IV) on December 8, 1949, following the 1948 Arab-Israeli war.

- Commenced operations on May 1, 1950, with a mandate to provide direct relief and work programs for Palestinian refugees.

- The UNGA has consistently renewed UNRWA’s mandate, most recently extending it until June 30, 2023.

Scope and Operations:

- One of the largest UN programs, catering to around 5 million registered Palestine refugees across five fields of operation: Jordan, Lebanon, Syria, the Gaza Strip, and the West Bank, including East Jerusalem.

- Uniquely delivers services directly to beneficiaries.

- Services include education, healthcare, relief and social services, camp infrastructure and improvement, microfinance, and emergency assistance, particularly during armed conflicts.

Funding and Reporting:

- Funded predominantly by voluntary contributions from UN Member States.

- Receives some funding from the Regular Budget of the United Nations, primarily for international staffing costs.

- Reports solely to the UNGA.

Headquarters and Leadership:

- Originally headquartered in Beirut, Lebanon, moved to Vienna, Austria, in 1978.

- Relocated to the Gaza Strip in 1996, demonstrating the UNGA’s commitment to the Arab-Israeli peace process.

- The Commissioner-General, UNRWA’s chief officer, is the only leader of a UN agency reporting directly to the General Assembly. Appointed by the UN Secretary-General with the approval of an Advisory Commission.

-Source: The Hindu