Contents

- Defying Turkey, America recognises Armenian genocide

- Why is the Govt. tweaking the NPS?

- Groundwater depletion and winter cropping intensity

- RBI on cybersecurity norms for payment services

- China to hold talks on building asteroid defence system

Defying Turkey, America recognises Armenian genocide – Legacy IAS Academy

Context:

- U.S. President recognised the 1915 killings of Armenians by Ottoman forces as genocide in a historic moment, defying decades of pressure by Turkey.

- The statement is a massive victory for Armenia and its extensive diaspora.

- Starting with Uruguay in 1965, nations including France, Germany, Canada and Russia have recognised the genocide but a U.S. statement has been a paramount goal that proved elusive under other presidents until Mr. Biden.

Relevance:

GS-I: History (World History), GS-II: International Relations (Foreign policies affecting India’s Interests)

Dimensions of the Article:

- About the Armenian Genocide

- Why Armenians were targeted?

- Was anyone held responsible?

- What’s Turkey’s response?

About the Armenian Genocide

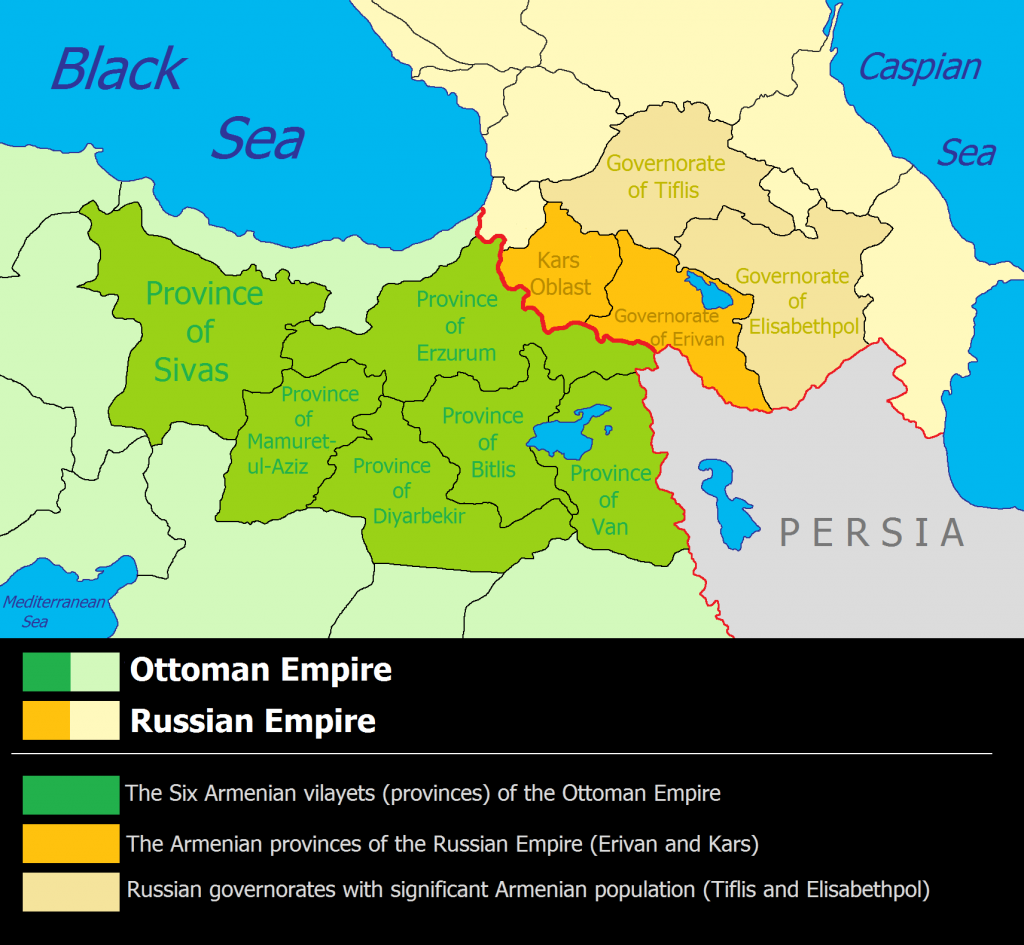

- Up to 1.5 million Armenians are estimated to have been killed in the early stage of the First World War within the territories of the Ottoman Empire.

- Armenians were largely living in the eastern fringes of the Empire.

- The Ottoman Turks unleashed Turkish and Kurdish militias upon them, killing and pillaging tens of thousands. Hundreds of thousands of Armenians were deported from eastern Anatolia (today’s Turkey) to concentration camps in the Syrian steppe. Most of the deaths occurred during this flight.

Was it a genocide?

- According to Article II of the UN Convention on Genocide of December 1948, genocide has been described as carrying out acts intended “to destroy, in whole or in part, a national, ethnic, racial or religious group”.

- Before the First World War broke out in 1914, there were 2 million Armenians in the Ottoman Empire.

- According to a study, in 1922, four years after the War, the Armenian population in the region was about 400 thousand. This has led historians to believe that up to 1.5 million Armenians were killed during the course of the War.

Why Armenians were targeted?

- In a way, the Armenians were victims of the great power contests of the late 19th and early 20th centuries.

- When the Ottoman Empire was in decline on its fringes by the last quarter of the 19th century, Armenians were seen by the rulers in Constantinople as a fifth column.

- The resentment started building up after the Russo-Turkish war of 1877-78 in which the Turks lost territories.

- In the Treaty of Berlin, big powers dictated terms to the Ottomans, including putting pressure on Sultan Abdülhamid II to initiate reforms “in the provinces inhabited by Armenians, and to guarantee their security against the Circassians and Kurds.”

- The Sultan saw this as a sign of strengthening ties between the Armenians and other rival countries, especially Russia.

- Post the treaty, there were a series of attacks on Armenians by Turkish and Kurdish militias. In 1908, the Young Turks wrested control from the Sultan and promised to restore imperial glory and under them the empire became more and “Turkik” and persecution against the ethnic minorities picked up.

- In October 1914, Turkey joined the First World War on the side of Germany. In the Caucasus, they fought the Russians, their primary geopolitical rival. But the Ottomans suffered a catastrophic defeat in the Battle of Sarikamish by the Russians in January 1915. The Turks blamed the defeat on Armenian “treachery”. First, Armenians in the Ottoman Army were executed.

- On April 24 (now known as the Remembrance Day) the Ottoman government arrested about 250 Armenian intellectuals and community leaders and most of them were later executed.

- The Ottoman government passed legislation to deport anyone who is a security risk – fearing that Armenians in eastern Anatolia would join the Russians if they advanced into Ottoman territories. Then they moved Armenians, including children, en masse to the Syrian Desert. That was a march of death.

Was anyone held responsible?

- After the fall of the empire, many Ottoman officials, including a governor in Anatolia, were tried and executed for the atrocities committed against Armenians.

- But the Three Pashas fled the country and took refuge in Germany. They were sentenced to death in absentia.

- In 1921, Talat Pasha, the Grand Vizier and the key architect of the atrocities, was assassinated on the street of Berlin by Armenian student Soghomon Tehlirian.

What’s Turkey’s response?

- Turkey has acknowledged that atrocities were committed against Armenians, but denies it was a genocide (which comes with legal implications) and challenges the estimates that 1.5 million were killed.

- The Turkish Foreign Ministry has issued a strong statement to Mr. Biden’s announcement saying it doesn’t not have “a scholarly and legal basis, nor is it supported by any evidence”.

-Source: The Hindu

Why is the Govt. tweaking the NPS?

Context:

- PFRDA has recently announced that the National Pension System (NPS) will no longer compel investors to convert 40% of their accumulated retirement corpus into an annuity, as poor yields on annuities and high inflation are translating into negative returns.

- Over the past year, NPS has enormously delivered high returns and there was a drastic difference between February and March return because stock markets crashed in March 2020.

Relevance:

GS-III: Indian Economy (Growth & Development of Indian Economy), GS-II: Social Justice (Government Initiatives, Management and Development of Social Sector)

Dimensions of the Article:

- Who can join NPS?

- NPS Benefits

- The story so far about NPS

- What overhaul is the PFRDA planning?

- What prompted this rethink?

Who can join NPS?

Any employee from public, private and even the unorganised sectors can opt for this. Personnel from the armed forces are exempted. The scheme is open to all across industries and locations.

The other eligibility criteria for opening an NPS account:

- Must be an Indian citizen.

- Must be between the ages of 18 and 65.

- Must be KYC compliant.

- Must not have a pre-existing NPS account.

NPS Benefits

- NPS offers returns higher than traditional instruments like the PPF (Public Provident Fund).

- It offers many investment options to subscribers who also have a say in where their funds are invested.

- The NPS reduces the retirement liabilities of the government.

- If the subscriber has been investing for at least three years, he/she can withdraw up to 25% for certain purposes before retirement (age 60). This withdrawal can be done up to 3 times with a gap of at least 5 years between each withdrawal. These restrictions are only for tier I and not tier II accounts.

- The entire amount cannot be withdrawn by the account-holder on retirement [Changes to be introduced]. As of April 2021, 60% can be withdrawn which has now been made tax-free. The rest 40% has to be kept aside so that the subscriber can receive a regular pension from an insurance firm.

The story so far about NPS

- Started as the New Pension Scheme for government employees in 2004 under a new regulator called the Pension Fund Regulatory and Development Authority (PFRDA), the National Pension System (NPS) has been open for individuals from all walks of life to participate and build a retirement nest-egg.

- Given the dominance of informal employment in India, the Employees’ Provident Fund Organisation, which is contingent on a formal employer-employee relationship, only covers a fraction of the workforce.

- The NPS has been gradually growing in size and now manages ₹5.78 lakh crore of savings and 4.24 crore accounts in multiple savings schemes.

- Of these, over 3.02 crore accounts are part of the Atal Pension Yojana (APY), a government-backed scheme for workers in the unorganised sector that assures a fixed pension payout after retirement.

- The rest constitute voluntary savings from private sector employees and self-employed individuals, for whom some significant changes are on the anvil.

What overhaul is the PFRDA planning?

- The law regulating the NPS allows members to withdraw just 60% of their accumulated savings at the time of retirement.

- With the remaining 40%, it is mandatory to buy an annuity product that provides a fixed monthly income to retirees till their demise.

- Members who accumulate up to ₹2 lakh in their NPS account at the time of retirement are exempted from the mandatory annuitisation, and can withdraw the full amount.

- Separately, the regulator has decided that the annuity purchase stipulation for 40% of members’ retirement corpus should be dropped altogether. Legislative amendments to this effect are being worked out for Parliament’s approval.

What prompted this rethink?

- Falling interest rates and poor returns offered by annuity products had triggered complaints from some members and experts about the compulsory annuitisation clause.

- “If someone opts for a lifetime annuity at retirement with a return of purchase price to the nominee once the person dies, the rates are varying between 5% and 5.5%.

- Since annuities are taxable, deducting the tax and factoring in the inflation means annuities are yielding negative returns”.

- With retail inflation running at about 5%-6% over the past year, the returns on annuities are, in fact, negative, even if one does not factor in the tax.

- To avoid forcing people into such an unattractive investment, the regulator has now proposed to give members a choice to retain 40% of their corpus with the NPS fund managers even after retirement.

- This, the PFRDA chief believes, will allow them to get better returns, and these savings can be paid out to members over 15 years through something like the systematic withdrawal plan offered by mutual funds.

- While this change shall need Parliament’s nod, the expansion of the annuity-free withdrawal limit from ₹2 lakh to ₹5 lakh is being done immediately.

- “Suppose somebody reached ₹2.1 lakh at retirement, he will get an annuity component of ₹84,000, which, today, will give an income of ₹400 or ₹450 a month — a pittance.

- So, now, we will allow those with savings up to ₹5 lakh to take the entire corpus out if they choose,” the PFRDA chief said.

-Source: The Hindu

Groundwater depletion and winter cropping intensity

Context:

Study of India’s main irrigation types on winter cropped areas finds that that 13% of the villages in which farmers plant a winter crop are located in critically water-depleted regions.

Relevance:

GS-III: Agriculture (Agricultural Resources, Issues related to agriculture and food security)

Dimensions of the Article:

- The current scenario on Winter Cropped Areas and Irrigation types

- Reasons for Depletion of Groundwater

- Alternative sources

- Unsuited soils and poor infrastructure

The current scenario on Winter Cropped Areas and Irrigation types

- India is the second-largest producer of wheat in the world, with over 30 million hectares in the country dedicated to producing this crop.

- But with severe groundwater depletion, the cropping intensity or the amount of land planted in the winter season may decrease by up to 20% by 2025.

- Some of the important winter crops are wheat, barley, mustard and peas.

- The international team studied India’s three main irrigation types on winter cropped areas: dug wells, tube wells, canals, and also analysed the groundwater data from the Central Ground Water Board.

- They found that 13% of the villages in which farmers plant a winter crop are located in critically water-depleted regions.

- The team writes that these villages may lose 68% of their cropped area in future if access to all groundwater irrigation is lost. The results suggest that these losses will largely occur in northwest and central India.

Reasons for Depletion of Groundwater

- Increased demand for water for domestic, industrial and agricultural needs and limited surface water resources lead to the over-exploitation of groundwater resources.

- There are limited storage facilities owing to the hard rock terrain, along with the added disadvantage of lack of rainfall, especially in central Indian states.

- Green Revolution enabled water intensive crops to be grown in drought prone/ water deficit regions, leading to over extraction of groundwater.

- Frequent pumping of water from the ground without waiting for its replenishment leads to quick depletion.

- Subsidies on electricity and high MSP for water intensive crops is also leading reasons for depletion.

- Water contamination as in the case of pollution by landfills, septic tanks, leaky underground gas tanks, and from overuse of fertilizers and pesticides lead to damage and depletion of groundwater resources.

- Inadequate regulation of groundwater laws encourages the exhaustion of groundwater resources without any penalty.

- Deforestation, unscientific methods of agriculture, chemical effluents from industries, lack of sanitation also lead to pollution of groundwater, making it unusable.

Alternative sources

- The team then looked at canals to understand if they can be promoted as an alternative irrigation source and as an adaptation strategy to falling groundwater tables. But the results showed that “switching to canal irrigation has limited adaptation potential at the national scale. We find that even if all regions that are currently using depleted groundwater for irrigation will switch to using canal irrigation, cropping intensity may decline by 7% nationally”.

- We can conjecture based on other literature and say that adoption of water-saving technologies like a sprinkler, drip irrigation and maybe switching to less water-intensive crops may help use the limited groundwater resources more effectively.

Unsuited soils and poor infrastructure

- There are several first-generation (productivity) and second-generation (sustainability) problems. In the green revolution era, policy-supported environment led to a large increase in rice cultivation in northwestern India mainly in Punjab and Haryana which are ecologically less suitable for rice cultivation due to predominantly light soils.

- This policy-supported intensive agriculture led to unsustainable groundwater use for irrigation and in turn groundwater scarcity.

- There was also post-harvest residue burning to make way for the timely sowing of wheat.

- There are enough groundwater resources supported with higher monsoon rainfall in eastern Indian states like Bihar. But due to lack of enough irrigation infrastructure, farmers are not able to make use of natural resources there.

- So, we need better policies in eastern India to expand the irrigation and thus increase agriculture productivity. This will also release some pressure from northwestern Indian states.

-Source: The Hindu

RBI on cybersecurity norms for payment services

Context:

The Reserve Bank of India (RBI) will soon issue cybersecurity norms for payment service providers (PSPs), following a series of data breaches faced by operators including Mobikwik and payment aggregator JusPay.

Relevance:

GS-III: Indian Economy (Economic Growth and Development in India)

Dimensions of the Article:

- What is digital payment system?

- Different digital payment modes in India

- About cybersecurity norms

- National Payments Corporation of India (NCPI)

What is digital payment system?

- Digital payment system is a way of payment which is made through digital modes- completely online. No hard cash is involved in digital payments.

- In this system, payer and payee both use digital modes to send and receive money.

- It is also called electronic payment.

- Example- Internet Banking, Debit Cards, Credit Cards, e-Wallets.

Different digital payment modes in India

Cards

- Banking cards offer consumers more security, convenience, and control than any other payment method.

- There are wide variety of cards available – including credit, debit and prepaid.

Internet Banking

- It is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution’s website.

- Different types of online financial transactions are: National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS), and Immediate Payment Service (IMPS).

Unstructured Supplementary Service Data (USSD)

- This service allows mobile banking transactions using basic feature mobile phone (dialling *99#), there is no need to have mobile internet data facility for using USSD based mobile banking.

- Key services offered under *99# service include, interbank account to account fund transfer, balance enquiry, mini statement besides host of other services.

Mobile Banking

- Mobile banking is a service provided by a bank that allows its customers to conduct different types of financial transactions remotely using a mobile device.

- It uses software, usually called an app, provided by the banks or financial institution for the purpose. Each Bank provides its own mobile banking App.

Unified Payments Interface (UPI)

- It is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- Each Bank provides its own UPI App.

Mobile Wallets

- It is a way to carry cash in digital format. Instead of using physical plastic card to make purchases, we can pay with our smartphone, tablet, or smart watch.

- An individual’s account is required to be linked to the digital wallet to load money in it.

Aadhaar Enabled Payment System (AEPS)

- AEPS is a bank led model which allows online interoperable financial transaction at PoS (Point of Sale / Micro ATM) through the Business Correspondent or Bank Mitra of any bank using the Aadhaar authentication.

About cybersecurity norms

- While the standards for fintech-driven payment services providers will be similar to cyber hygiene norms issued recently for banks and non-banking finance companies, the RBI is quite clear that firms will have to do more than observe the minimum standards to ensure safety as digital transactions gain further traction.

- On cyber frauds, Reserve Bank of India has issued very recently basic guidelines on cyber hygiene and cybersecurity for banks and certain NBFCs.

- Having said that, the minimum standards set by the regulator for the regulated entities are needed, but they would never be enough.

- As digitisation increases in any sphere, payments or otherwise, as people do more and more digital transactions, institutions themselves will have to do more than the minimum standards that regulators set, to deal with any cybersecurity threats.

- Over the next decade, the critical challenge for regulators would be to speed up the absorption of fintech without undermining the financial system’s integrity or stability.

‘No antitrust norms’

- The National Payments Corporation of India (NPCI) had laid down a framework for a more even distribution of share of third-party app providers in the UPI system, the senior RBI official noted, adding that the regulator was, however, not looking at any antitrust provisions against dominant players at this juncture.

- If UPI is gaining popularity, you will have to think twice about stepping in and controlling the market share of two or three popular apps because that could actually hurt absorption of this tech in the population.

National Payments Corporation of India (NCPI)

- National Payments Corporation of India (NCPI) is an umbrella organisation for all retail payments systems in India.

- It was set up with the guidance and support of the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA).

Objectives:

- To consolidate and integrate the existing multiple systems into a nation-wide uniform and standard business process for all retail payment systems.

- To facilitate an affordable payment mechanism to benefit the common man across the country and propel financial inclusion

-Source: The Hindu

China to hold talks on building asteroid defence system

Context:

- China will hold discussion on building a defence system against near-earth asteroids – China is stepping up efforts towards realizing its longer term space ambitions.

- China has made space exploration a top priority in recent years, aiming to establish a programme operating thousands of space flights a year and carrying tens of thousands of tonnes of cargo and passengers by 2045.

Relevance:

Prelims, GS-III: Science and Technology (Space technology, Developments in Science and Technology)

Dimensions of the Article:

- What’s the difference between a Comet, Asteroid and Meteor?

- Where asteroids are located?

- International Lunar Research Station: Russia and China

What’s the difference between a Comet, Asteroid and Meteor?

- Asteroid: A relatively small, inactive, rocky body orbiting the Sun.

- Comet: A relatively small, at times active, object whose ices can vaporize in sunlight forming an atmosphere (coma) of dust and gas and, sometimes, a tail of dust and/or gas.

- Meteoroid: A small particle from a comet or asteroid orbiting the Sun.

- Meteor: The light phenomena which results when a meteoroid enters the Earth’s atmosphere and vaporizes; a shooting star.

- Meteorite: A meteoroid that survives its passage through the Earth’s atmosphere and lands upon the Earth’s surface.

Where asteroids are located?

- Most asteroids lie in a vast ring between the orbits of Mars and Jupiter.

- Not everything in the main belt is an asteroid, for instance, comets have recently been discovered there, and Ceres, once thought of only as an asteroid, is now also considered a dwarf planet.

- Many asteroids lie outside the main belt. For instance, a number of asteroids called Trojans lie along Jupiter’s orbital path.

- Three groups — Atens, Amors, and Apollos — known as near-Earth asteroids orbit in the inner solar system and sometimes cross the path of Mars and Earth.

International Lunar Research Station: Russia and China

- China and Russia have agreed to build a International Lunar Research Station (ILRS), possibly on the moon’s surface, marking the start of a new era in space cooperation between the two countries.

- The ILRS is a comprehensive scientific experiment base with the capability of long-term autonomous operation.

- The station would be built on the lunar surface and/or on the lunar orbit that would carry out scientific research activities such as the lunar exploration and utilization, lunar-based observation, basic scientific experiment and technical verification.

- Russia and China will adhere to the principle of co-consultation, joint construction, and shared benefits.

- They will facilitate extensive cooperation in the ILRS, open to all interested countries and international partners.

- ILRS will strengthen scientific research exchanges, and promote humanity’s exploration and use of outer space for peaceful purposes.

-Source: The Hindu