CONTENTS

- Missing in Manifestos: Children’s Issues

- Can Domestic MFs Invest in their Overseas Counterparts?

Missing in Manifestos: Children’s Issues

Context:

Children constitute about 30% of India’s population, yet they are often overlooked during elections. Despite having the largest child population globally, political parties frequently ignore children’s interests. This article looks at the some of the major political parties’ pledges for the future of our children and nation, particularly in nutrition, education, and health.

Relevance:

GS2-

- Welfare Schemes for Vulnerable Sections of the population by the Centre and States and the Performance of these Schemes

- Mechanisms, Laws, Institutions and Bodies constituted for the Protection and Betterment of these Vulnerable Sections

- Issues Relating to Development and Management of Social Sector/Services relating to Health, Education, Human Resources

Mains Question:

Children constitute about 30% of India’s population, yet they are often overlooked during elections. In this context, examine where do the issues of child education and healthcare stand in the recently released manifestos. (15 Marks, 250 Words).

Education:

- In terms of education, the ruling party’s manifesto promises to enhance the network of PM SHRI Schools, Ekalavya Schools, and others in line with the National Education Policy, 2020, aiming to make them “world class.”

- However, improving a few cost-intensive model schools to provide high-quality education to a limited number of children is not a substitute for making systemic changes to the public education system.

- Recent statewide reforms in Andhra Pradesh and New Delhi demonstrate that India requires every government school to be a model school to effectively serve millions of students.

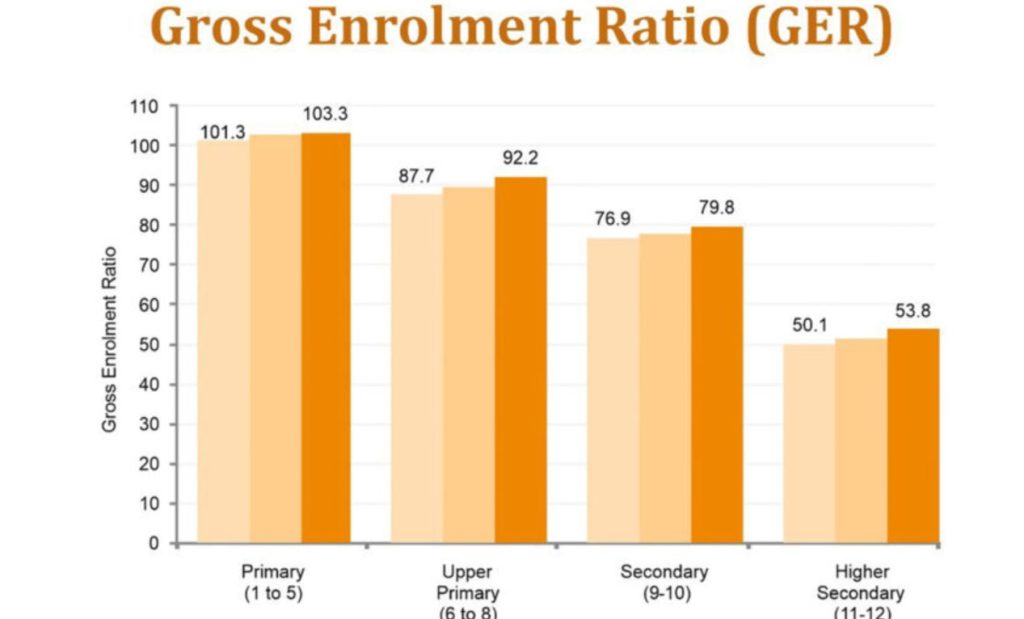

- The ruling party’s manifesto also aims for a 100% Gross Enrollment Ratio (GER) from pre-school to secondary level but does not specify concrete steps to achieve this.

- According to the Unified District Information System for Education, the Gross Enrollment Ratio (GER) for Class 1-8 is already around 100%. For secondary and higher secondary levels, the GER is about 80% and 57%, respectively, due to a lack of systemic support.

- Achieving a 100% GER from pre-primary to secondary school is possible only if free and compulsory education, as stipulated by the Right to Education Act (RTE), 2009, includes pre-primary, secondary, and higher secondary classes.

- The opposition parties’ manifestos promise to amend the RTE Act to make education from Class 1-8 compulsory and free but fail to acknowledge the importance of extending it to the largely unregulated pre-primary sector.

- They also propose expanding the RTE Act to cover ages 3 to 18 years. The ruling party does not address the RTE Act at all.

- Additionally, the opposition manifestos pledge to provide financial support through scholarships or economic opportunities for children’s families to reduce dropout rates.

Nutrition and Healthcare:

- Regarding nutrition, the ruling party’s pledges to focus on eliminating malnutrition among tribal children, while the Congress promises to address nutritional deficiencies among children in general.

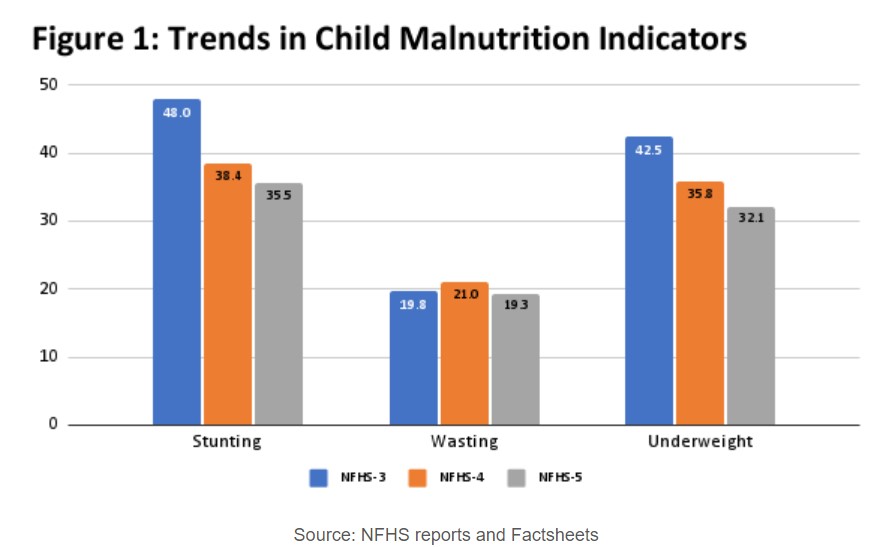

- However, neither party specifies concrete measures, despite POSHAN tracker data indicating that at least 4.3 million children (aged 0-6) are malnourished.

- The Integrated Child Development Services (ICDS), a key initiative to combat malnutrition among children under five, includes a nutrition program, nutrition and health education, and health check-ups. It is noteworthy that some parties commit to universalizing the ICDS Scheme to cover all children from 0-6 years old, ensuring nutritious meals in all Anganwadis.

- The mid-day meal program has effectively provided nutritious meals to children from Class 1-8. Building on this success, the opposition parties plan to extend the scheme up to Class 12, while the or to expand the Chief Minister’s Breakfast Scheme to aided schools for children in Classes 1-5.

- Malnourished children are more susceptible to preventable illnesses, leading to higher mortality rates. The National Family Health Survey of 2022 highlighted India’s ongoing struggle with chronic malnutrition among children, hindering the achievement of the Sustainable Development Goal of eradicating hunger by 2030.

- Access to healthcare for children remains a significant challenge. In this context, some parties promise to allocate budget for comprehensive healthcare during the first 1,000 days of a child’s development is commendable.

Manifesto Gaps and Recommendations:

- Manifestos could have included aspects like involving children in democratic decision-making, ensuring their safety online, and preventing their exploitation.

- Children are crucial stakeholders, a fact acknowledged by India’s ratification of the United Nations Convention on the Rights of the Child in 1992. However, no manifesto adopts a “child-rights based approach.”

- The larger problem is that political parties do not view children as distinct entities; rather, they lump them together with ‘women’ or ‘youth,’ which diminishes attention to their specific needs and requirements.

Conclusion:

Some manifestos do make notable efforts to address children’s welfare, with certain parties including dedicated sections on child welfare and rights. Voters need to evaluate the vision and commitment of parties to secure the future of children.

Can Domestic MFs Invest in their Overseas Counterparts?

Context:

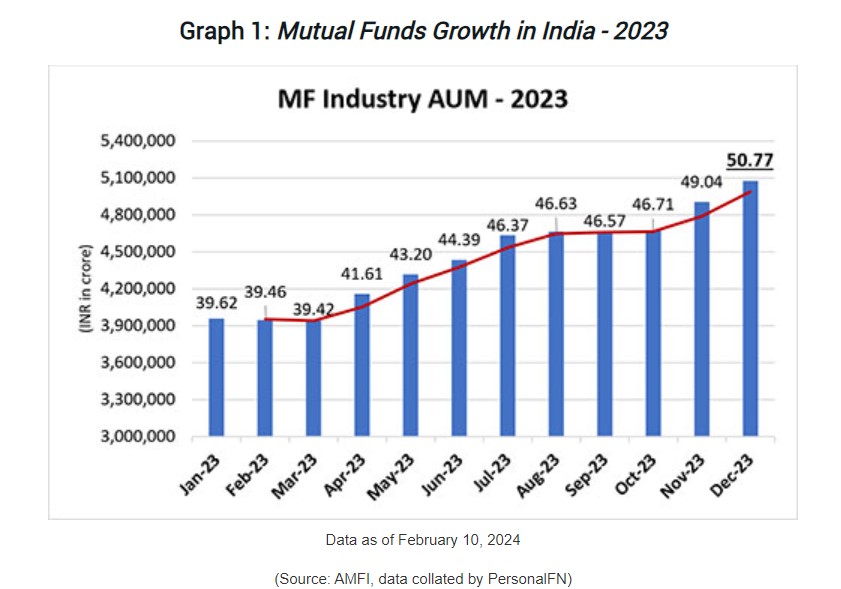

On May 17, the Securities and Exchange Board of India (SEBI) released a consultation paper proposing a framework to enable domestic Mutual Funds (MFs) to invest in their overseas counterparts or Unit Trusts (UTs) that allocate a portion of their assets to Indian securities. Comments on this framework are being accepted until June 7.

Relevance:

GS3-

- Capital Market

- Mobilization of Resources

Mains Question:

Can Domestic MFs in India invest in their overseas counterparts? What does a proposed framework by SEBI put forward in this regard and what are some of the associated concerns? (15 Marks, 250 Words).

What is the Framework’s Purpose?

- Recognizing India’s strong economic growth prospects, SEBI notes that Indian securities present an attractive investment opportunity for foreign funds.

- This has led various international indices, exchange-traded funds (ETFs), MFs, and UTs to invest a part of their assets in Indian securities.

- For instance, the consultation paper highlights that the MSCI Emerging Markets Index has an 18.08% exposure to Indian securities.

- Indian mutual funds, on the other hand, diversify their portfolios by launching ‘feeder funds’ which invest in overseas instruments like units of MFs, UTs, ETFs, and/or index funds. This strategy not only aids diversification but also facilitates global investments.

- However, uncertainty about investments with Indian exposures has deterred domestic MFs from investing in these instruments.

- SEBI’s comprehensive assessment sees potential in allowing such investments with “limited exposure to Indian securities.”

- Within the proposed framework, SEBI aims to implement essential safeguards to ensure that Indian instruments remain “true to their label” and allow investors to achieve desired exposure to overseas securities.

- If a fund has significant exposure to Indian securities, the primary goal of making an overseas investment is compromised.

SEBI’s Proposals:

- SEBI has proposed several key measures. Notably, it has capped the exposure of overseas instruments to Indian securities at 20% of their net assets.

- SEBI considers this cap “appropriate” as it balances facilitating investments in overseas funds with Indian exposure while preventing excessive exposure.

- The regulator has also stipulated that Indian mutual funds must ensure that all investor contributions to the overseas MF/UT are pooled into a single investment vehicle.

- Furthermore, these funds must guarantee that all investors receive gains proportionate to their contributions, with no preferential treatment.

- SEBI stresses that investments should be made independently by the manager of the overseas instrument, without influence from investors or undisclosed parties. It also requires periodic public disclosures of the portfolios of these overseas MFs/UTs to ensure transparency.

- Additionally, SEBI cautions against any advisory agreements between Indian mutual funds and overseas MFs/UTs to prevent conflicts of interest and avoid any undue advantage.

Breach of Investment Limit:

- If an overseas instrument surpasses the 20% limit, the Indian mutual fund scheme investing in it enters a six-month observation period. During this time, the overseas instrument or fund must rebalance its portfolio to comply with the cap.

- Additional investments in the overseas instrument are permitted only once the exposure drops below the limit.

- If the portfolio is not rebalanced within six months, the mutual fund must liquidate its investment in the overseas instrument within the same timeframe.

Conclusion:

A key consideration is the RBI’s upper limit for overseas investments by mutual funds. RBI Governor Shaktikanta Das has stated there are no plans to increase this limit. Consequently the CEO of Baroda BNP Paribas Mutual Fund, mentioned that the regulatory changes would not have an immediate practical impact, as the industry limit for overseas investments is already effectively exhausted. According to Soni, such investments offer diversification opportunities for Indian investors.