CONTENTS

- Debt Owed by South Asian Nations to China Hits Record Levels

- Giving Primacy to Human Development

Debt Owed by South Asian Nations to China Hits Record Levels

Context:

The indebtedness of various nations, particularly in South Asia and Africa, to China has surged in recent years. China stands out as the primary or predominant creditor for most of these countries, meaning they owe a significant portion of their external debt to China alone.

Relevance:

GS2-

- India and its Neighbourhood

- Bilateral Groupings and Agreements

- Regional Groupings

- Effect of Policies and Politics of Countries on India’s Interests

Mains Question:

China’s debt-trap policy raises significant concerns, not only for smaller nations but also for India. Analyse. (10 Marks, 150 Words).

Debt Trap Diplomacy:

- Cycle of Indebtedness: Debt trap diplomacy refers to a situation where an entity is compelled to accumulate further loans in order to service existing debts.

- Exploitation of Political Influence: In international relations, debt-trap diplomacy characterizes the practice of a creditor nation or institution providing loans to a borrower, at least in part, to enhance the lender’s political leverage. This term was coined by Brahma Chellaney, an Indian scholar.

- Tools of Coercion: While the concept is often associated with China, it has also been attributed to the International Monetary Fund (IMF); however, these allegations are subject to dispute.

Issues with China’s Debt-Trap Policy:

- Lack of Transparency: China’s lending practices lack transparency, with loans often being obscured as trade credits or routed through special purpose vehicles. China does not disclose records of its foreign loans, and borrowers are often bound by non-disclosure clauses.

- High Interest Rates: Chinese debt comes with high-interest rates, approximately three times higher than those offered by other countries for bilateral aid.

- Funding Projects with Low Credit Ratings: China tends to finance projects in countries with poor credit ratings and limited access to external finance. This approach safeguards China’s interests, often leading to the acquisition of project assets in case of default.

- Control Over Projects: China’s lending practices sometimes result in other countries having to relinquish control over key assets if they fail to meet debt repayment obligations.

Relevant Statistics:

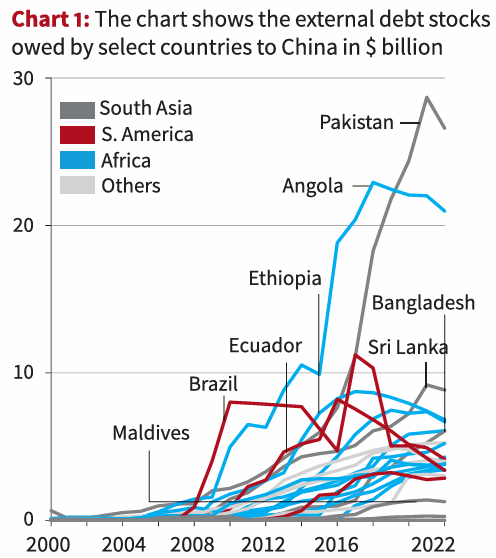

- The chart above illustrates the external debt amounts owed by specific countries to China in billions of dollars, focusing on the top 20 debtor nations in absolute terms as of 2022.

- External debt stock encompasses a nation’s obligations to non-residents, repayable in currency, goods, or services, encompassing various types of debts—public, publicly guaranteed, private non-guaranteed long-term, and short-term.

- The chart reveals a notable uptick in debt owed by countries in South Asia, Africa, and South America to China, particularly following the 2010s.

- The World Bank’s 2023 International Debt Report attributes this increase to China’s ‘Going Global Strategy,‘ launched in 1999 to enhance Chinese investment and lending overseas.

- By the close of 2022, low- and middle-income countries collectively owed China a substantial sum of $180 billion.

- By comparison, their total indebtedness to the International Bank for Reconstruction and Development—a global development institution owned by 189 nations—was slightly higher at $223 billion.

- Notably, China has redirected a significant portion of its recent loans towards neighboring nations, while decreasing its lending to African and South American economies.

- Pakistan’s total external debt owed to China surged rapidly from $7.6 billion in 2016 to $26.5 billion in 2022. Similarly, Sri Lanka’s debt to China nearly doubled from $4.6 billion to $8.8 billion during the same period.

- Bangladesh saw an increase from $0.97 billion to $6 billion, Maldives from $0.3 billion to $1.2 billion, and Nepal from $0.07 billion to $0.26 billion. The majority of these debts to China are in the form of loans for infrastructure projects.

Concerns for India:

- Neighboring Nations Succumb: The majority of India’s neighbors have fallen into China’s debt trap and have embraced China’s ambitious $8 trillion project, the One Belt One Road Initiative (OBOR).

- Disregard for India’s Sovereignty Concerns: India’s sovereignty concerns are dismissed by projects like the China-Pakistan Economic Corridor (CPEC), which necessitate India’s recognition of the Kashmir-controlled region as part of Pakistan due to the involvement of projects in that area.

- Shift in Perceptions Towards Traditional Partners: Through OBOR, China has been able to alter perceptions in India’s neighboring countries, leading to instances where countries like Bangladesh now prioritize their relationship with China over their historical ties with India.

- Threat to Indo-Pacific Strategy: China’s debt trap strategy is perceived as a threat to the Indo-Pacific region’s stability and openness, as it could lead to increased Chinese assertiveness in the region.

Scaling Back:

However, China has scaled back its overall lending in recent years due to two main reasons.

- Firstly, the World Bank’s debt report suggests that China’s own economic situation is not robust.

- Secondly, some of the countries it has lent to are struggling to make payments due to the financial underperformance of investments funded by China. Sri Lanka, for instance, defaulted on foreign debt in 2022 after facing months of food and fuel shortages.

- According to Reuters, Sri Lanka’s interest payments will account for nearly 54% of the country’s revenue this year, while Pakistan’s share is even higher at around 57%. Bangladesh’s interest payments will constitute 31.5% of its revenue. Moreover, most of these nations owe a significant portion of their bilateral debt to China.

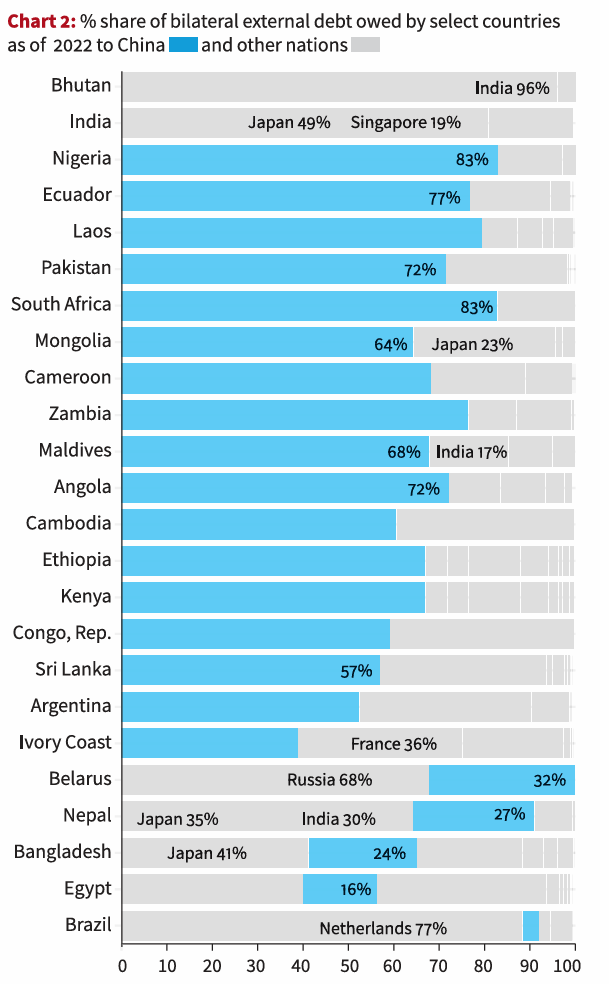

Proportionate Distribution of Bilateral External Debt owed by Specific Countries:

- The graph above illustrates the proportionate distribution of bilateral external debt owed by specific countries as of 2022, both to China and other nations.

- Pakistan, for instance, owes over 72% of its external bilateral debt to China, while Maldives owes 68%, Sri Lanka 57%, Nepal 27%, and Bangladesh 24%.

- Similarly, countries beyond South Asia also exhibit a significant portion of their bilateral debt owed to China, with Japan, Germany, and France being distant secondary creditors.

Conclusion:

It’s worth noting that China itself, during periods of robust economic expansion in the 1990s and 2000s, increasingly amassed foreign debt from countries like Japan, Germany, and France (as depicted in Chart 3). However, in recent years, its external debt stocks have markedly declined due to repayments.

Giving Primacy to Human Development

Context:

The concept of development has become a central theme for political parties during elections. Reflecting on the accomplishments of recent years, as depicted in the Human Development Report, highlights the challenges ahead and underscores the necessity for a well-defined strategy to embark on a prolonged journey.

Relevance:

GS2-

- Human Resource

- Issues Related to Women

- Gender

GS3- Inclusive Growth

Mains Question:

Given low levels of human development, high levels of inequality, low savings, and high debt, it is time to think about an alternate growth strategy which accords primacy to human development. Discuss. (15 Marks, 250 Words).

Analysing the Significant Reports on Inequality:

Two recent reports shed light on different aspects of India’s development.

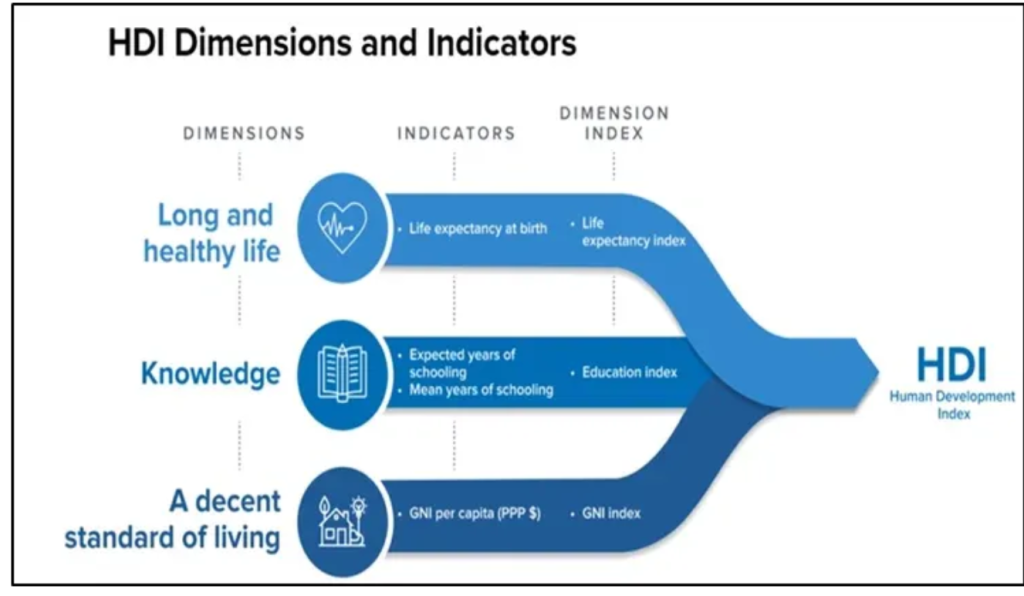

- Firstly, the Human Development Report 2023-24, released by the United Nations Development Programme, offers a comparative analysis and assesses achievements in human development.

- Secondly, a paper released by the World Inequality Lab in March 2024 presents long-term trends in income and wealth inequality in India from 1922 to 2023.

Human Development Report 2023-24 by the United Nations Development Programme:

- India’s rank on the UN Human Development Index stood at 134 out of 193 countries in 2022, showing a slight improvement from 2021 when it ranked 135 out of 192 countries.

- This marginal improvement is attributed to a slight increase in the HDI value, rising from 0.633 in 2021 to 0.644 in 2022.

- Consequently, India falls into the category of medium human development alongside nations like Myanmar, Ghana, Kenya, Congo, and Angola.

- Over the period from 1990 to 2022, India witnessed a significant increase in HDI value, rising by 48.4% from 0.434 in 1990 to 0.644 in 2022.

- Despite India’s advancement in ranking compared to 2021, it still lags behind Bhutan, Bangladesh, Sri Lanka, and China.

- Notably, India has made progress in the Gender Inequality Index, moving up to 108 out of 193 countries in 2022 from 122 out of 191 countries in 2021.

- However, India continues to face significant gender disparities, particularly in labor force participation rates.

- There exists a substantial gap between women (28.3%) and men (76.1%), with a difference of 47.8%.

- The report highlights concerns regarding the escalating inequality and its ramifications for advancing human development.

- The report delves into the consequences of heightened inequality, noting that the proportion of individuals reporting a high level of control over their lives is low and relatively uniform among the bottom 50% of the population.

- However, this control increases with income for deciles 6 and above. Thus, income disparities, often intersecting with other forms of inequality in human development, significantly influence individual agency.

World Inequality Lab study, 2022-23:

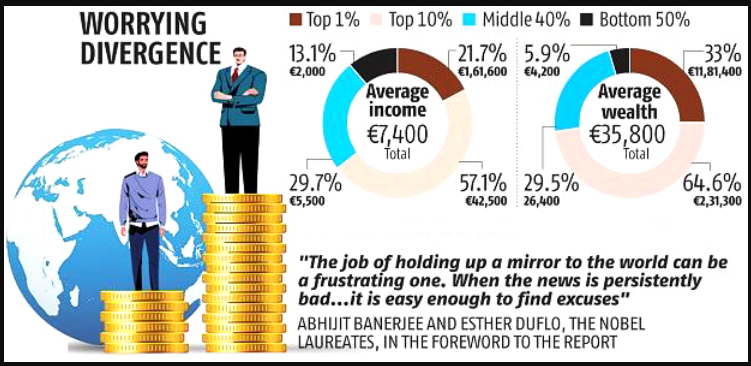

- According to the World Inequality Lab study, in 2022-23, the bottom 50% of the population in India received only 15% of the national income.

- The study reveals that the top 1% earns an average of 5.3 million rupees, which is 23 times the average income of an Indian (0.23 million rupees).

- Meanwhile, the average incomes for the bottom 50% and the middle 40% are 71,000 rupees (0.3 times the national average) and 165,000 rupees (0.7 times the national average), respectively.

- At the upper echelons of the income distribution, the wealthiest 10,000 individuals out of 920 million Indian adults earn an average of 480 million rupees (2,069 times the average Indian income).

- This glaring income disparity in India has significant implications for aggregate demand, consumption patterns, and human welfare.

- Analysis of real income growth rates across different percentiles of the income distribution reveals that growth for the top decile has been markedly higher than for the rest of the population.

- Moreover, within the top 10%, growth rates increase with rank, indicating that those at the very top have benefited disproportionately.

- Interestingly, during the period from 2014 to 2022, the incomes of the middle 40% of the income distribution appear to have grown at a slower pace than those of the bottom 50%.

- This skewed income distribution and the differential growth rates of income among higher percentiles suggest a potential decline in the size of the middle class.

- When economic growth becomes highly concentrated at the top, it accelerates the process of economic polarization, ultimately leading to the emergence of two distinct classes: the affluent and the marginalized.

Household indebtedness:

- Household indebtedness in India soared to a historic peak of 40% of GDP by December 2023, while net financial savings dwindled to 5.2% of GDP, as per a recent report.

- An analysis of household debt breakdown reveals a rapid expansion in unsecured personal loans, followed by secured debt, agricultural loans, and business loans.

- Annual household borrowing spiked to 5.8% of GDP in 2022-23, marking the second-highest level since India gained independence.

Conclusion:

Given India’s low levels of human development, high inequality, scant savings, and burgeoning debt, there is a pressing need to contemplate an alternative growth strategy that prioritizes human development as a catalyst for accelerated growth. Achieving this necessitates political determination and transcending short-term electoral gains. As an initial step, there is a crucial requirement to redefine the narrative of development.