CONTENTS

- Allowing Foreign Institutional Investors to Invest in Green Bonds in India

- Navigating Life as a Consumer with Disability

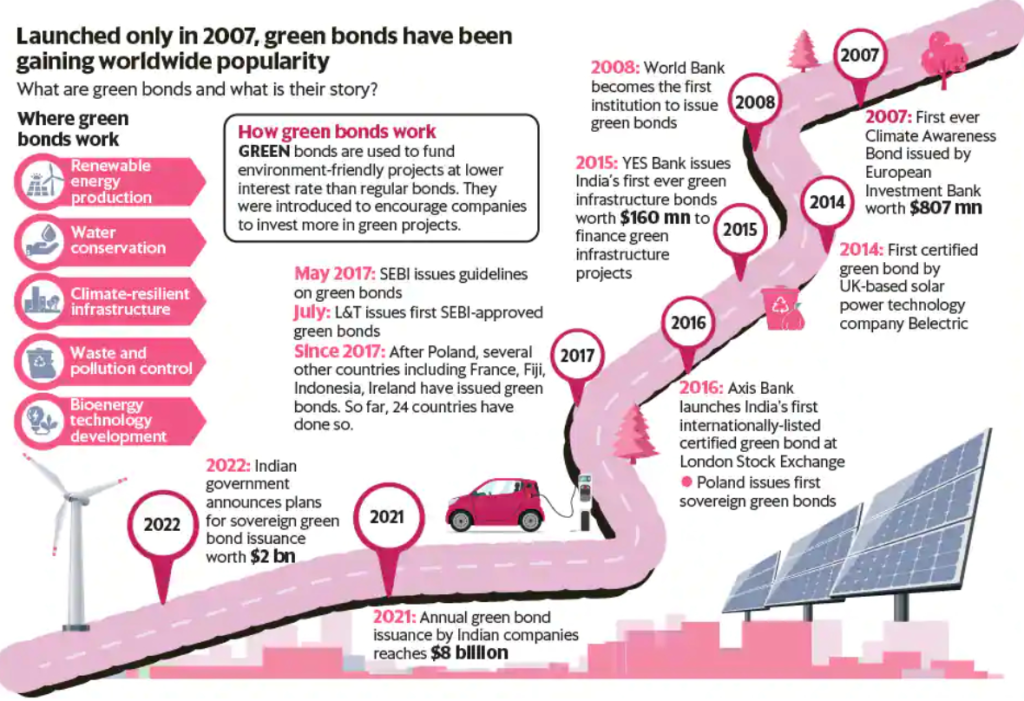

Allowing Foreign Institutional Investors to Invest in Green Bonds in India

Context:

In the recent development, the Reserve Bank of India (RBI) has given the green light for Foreign Institutional Investors (FIIs) to invest in India’s Sovereign Green Bonds (SGrBs). These FIIs include a diverse range of investors such as insurance companies, pension funds, and sovereign wealth funds of various nations. SGrBs represent a unique form of government debt designed specifically to finance projects aimed at propelling India towards a low-carbon economy.

Relevance:

GS3-

- Indian Economy-Mobilization of Resources

- Environment- Conservation

Mains Question:

What are Sovereign Green Bonds? How will investments by Foreign Institutional Investors in green government securities accelerate India’s transition to a green economy? (15 Marks, 250 Words).

Significance of the Move:

- This move holds significant promise for advancing India’s green transition. By allowing FIIs to participate in funding India’s green initiatives, the pool of capital available for the country’s ambitious sustainability goals is greatly expanded.

- These goals include achieving net-zero carbon emissions by 2070, with a target of deriving 50% of India’s energy from non-fossil fuel sources.

- Additionally, there’s a commitment to reducing the nation’s carbon intensity by 45%, a pledge made by Prime Minister Narendra Modi at the COP26 summit in Glasgow in 2021.

Issuance of SGrBs by the RBI:

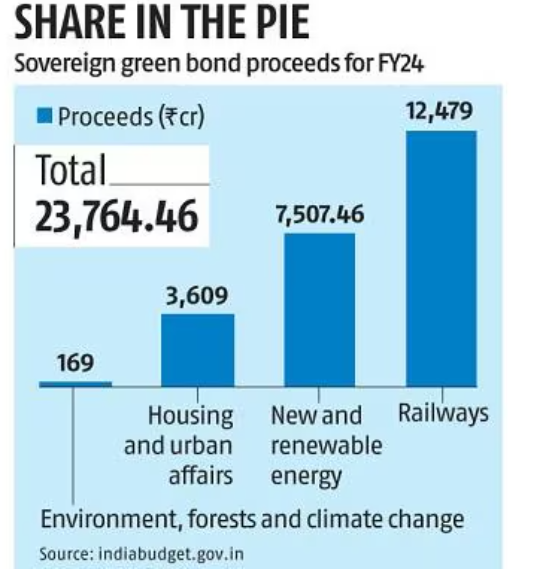

- Previously, the RBI had issued SGrBs totaling ₹16,000 crore in two separate tranches in January and February of the previous year, with maturity dates set for 2028 and 2033. However, despite being oversubscribed on both occasions, the primary participants were domestic financial institutions and banks. This limited the sources from which the government could borrow for green projects.

- Furthermore, these green Government-Securities (G-Secs) were categorized under the Statutory Liquidity Ratio (SLR), a liquidity requirement set by the RBI, mandating that financial institutions maintain a certain percentage of their assets in the form of specified securities before extending loans to customers.

- SGrBs offer a lower interest rate compared to traditional G-Secs, and the difference in interest is termed as a greenium. However, global central banks and governments are encouraging financial institutions to embrace greeniums as part of expedited efforts toward a more environmentally sustainable future.

Why FIIs can be interested in SGrBs?

- Experts in climate finance suggest that India stands to benefit from allowing FIIs to invest in green G-Secs.

- They argue that FIIs are seeking to diversify their portfolio of green investments, especially given the significant regulatory support available, particularly in developed nations. Therefore, investing in India’s green G-Secs presents an attractive opportunity for them.

- Ashim Roy, the Energy Finance lead at the World Resources Institute in India, pointed out that FIIs may also be motivated to acquire green credentials, especially when such investment opportunities are limited in their home markets.

- Additionally, India’s successful implementation of the Sovereign Green Bonds Framework in late 2022 has alleviated concerns about greenwashing, further enhancing the appeal of investing in Indian green securities.

Recent Developments:

- In the 2022-23 Union Budget, Finance Minister Nirmala Sitharaman announced the government’s intention to issue Sovereign Green Bonds (SGrBs) aimed at expediting funding for various government projects.

- These projects encompass a range of initiatives such as offshore wind harnessing, grid-scale solar power production, and the promotion of battery-operated Electric Vehicles (EVs).

- The concept of the “green taxonomy gap” refers to the absence of a standardized system for assessing the environmental or emissions credentials of investments.

- However, a significant hurdle existed as the Reserve Bank of India (RBI) had not established a green taxonomy— a method to evaluate investments’ environmental credentials to prevent instances of greenwashing, where projects falsely claim green credentials to attract funding.

- To bridge this gap, the Finance Ministry took a proactive step by releasing India’s inaugural SGrB Framework on November 9, 2022. This framework outlined the types of projects eligible for funding through this category of Government-Securities (G-Secs).

- The listed projects included investments in renewable energy projects like solar, wind, biomass, and hydropower, particularly those integrating energy generation and storage.

- Additionally, the framework supported initiatives such as public lighting upgrades to LED, construction of low-carbon buildings, energy-efficient retrofits for existing structures, and measures to reduce electricity grid losses.

- Furthermore, it extended to promoting public transport, providing subsidies for EV adoption, and developing EV charging infrastructure.

- In an effort to ensure the credibility and alignment of India’s SGrB Framework with international standards, the government sought validation from Norway-based evaluator Cicero, comparing it against the green principles outlined by the International Capital Market Association (ICMA). Cicero rated India’s framework as “green medium,” emphasizing its good governance.

Conclusion:

The World Resources Institute (WRI) has emphasized the importance of identifying new green projects with reliable audit trails and significant impact, particularly those sectors with limited private capital inflow, such as Distributed Renewable Energy and clean energy transition finance for Micro, Small, and Medium Enterprises (MSMEs). This underscores the critical need to strategically deploy the proceeds from SGrBs towards initiatives that offer substantial environmental benefits and align with sustainable development objectives.

Navigating Life as a Consumer with Disability

Context:

Each year, on March 15, World Consumer Rights Day is observed worldwide to raise awareness about the fundamental rights of consumers. However, amidst the celebrations and discussions surrounding consumer rights, there’s often a group of consumers who remain unseen and unheard—individuals with disabilities.

Relevance:

GS2-

- Welfare Schemes for Vulnerable Sections of the population by the Centre and States and the Performance of these Schemes

- Mechanisms, Laws, Institutions and Bodies constituted for the Protection and Betterment of these Vulnerable Sections

Mains Question:

A collaborative effort between businesses and the government, supported by a robust legal framework, is imperative to protect the rights of consumers with disabilities and provide them an equal participation in the marketplace and society. Analyse. (15 Marks, 250 Words).

Hurdles Faced by Individuals with Disabilities:

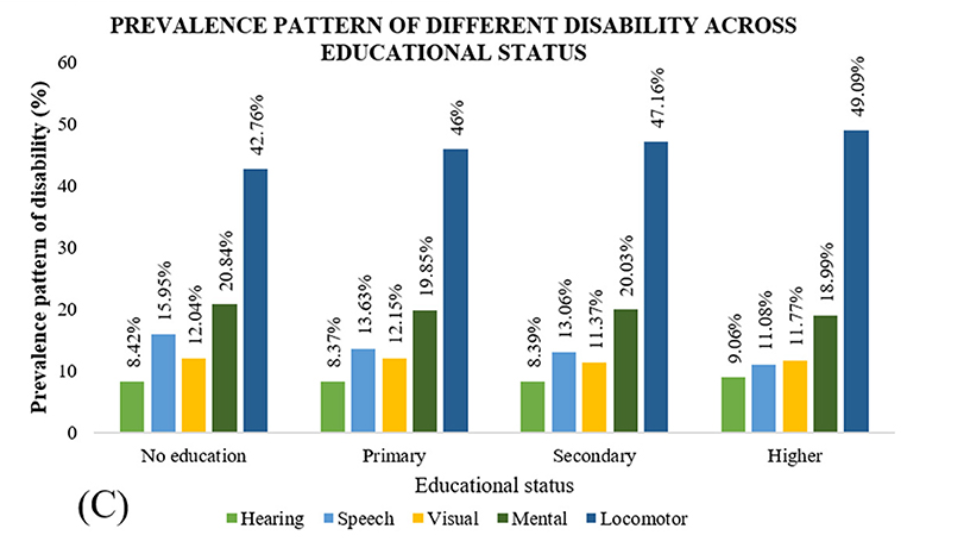

- The daily struggles of individuals with disabilities illustrates the pervasive challenges faced by individuals with disabilities in fulfilling even the most basic of tasks.

- These obstacles not only strip away their dignity, independence, and privacy but also undermine their fundamental right to lead autonomous lives.

- The widespread inaccessibility encountered by disabled consumers not only hampers their ability to participate fully in society but also perpetuates inequality by denying them equal access to goods, services, and opportunities.

- Two significant hurdles faced by individuals with disabilities are- the lack of accessibility in both goods and services, as well as customer support options.

- This raises a crucial question: who should be accountable for addressing this widespread inaccessibility and who possesses the capability to improve the consumer experience for persons with disabilities?

Businesses:

- Businesses represent a key starting point in this endeavor. Typically, businesses do not view individuals with disabilities as their primary target demographic, resulting in offerings that are often inaccessible and tailored primarily for “mainstream” consumers.

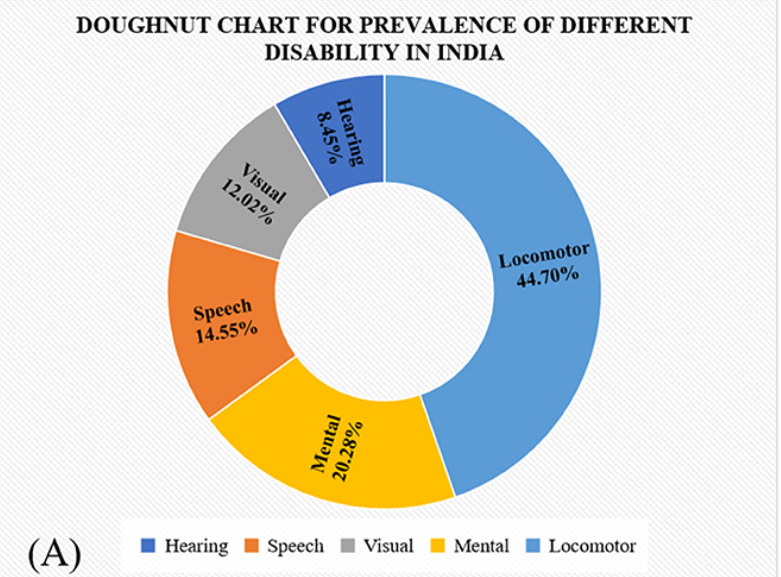

- In India, persons with disabilities constitute approximately 5-8% of the population (according to the World Bank, 2009).

- Therefore, businesses could potentially expand their customer base by ensuring the accessibility of their offerings, not merely as an act of generosity, but as a strategic move to reach a broader audience.

Government:

- Another entity with the potential to enact meaningful change is the government. Effective policy measures can help bridge the gap in awareness and sensitivity among businesses.

- For instance, in October 2023, the Food Safety and Standards Authority of India (FSSAI) issued an advisory to all food business operators, urging them to incorporate QR codes containing product information on all food products.

- This simple yet impactful initiative enables individuals with visual impairments to access crucial product information independently.

Legal Reforms:

- Legal reforms play a crucial role in empowering individuals with disabilities by ensuring their rights and interests as consumers are protected.

- The primary legislation in this domain is the Rights of Persons with Disabilities Act (RPWDA) of 2016. This comprehensive legislation bestows a range of rights upon individuals with disabilities, including the rights to equality, accessibility, and reasonable accommodation.

- Of particular significance are the provisions within the RPWDA concerning universally designed consumer goods and accessible services, as outlined in Sections 43 and 46.

- Additionally, the Rules notified under the RPWDA mandate that all Information and Communications Technology (ICT) goods and services adhere to accessibility standards established by the Bureau of Indian Standards (BIS), set forth by the government.

- In the event of a violation of these rights, individuals with disabilities have recourse to file complaints with the Disability Commissions established under the RPWDA.

- Another avenue for seeking remedies is the Consumer Protection Act (CPA) of 2019. This legislation not only delineates various consumer rights but also grants Consumer Commissions the authority to impose penalties and award compensation in response to consumer complaints.

Way Forward:

- While commendable, such measures are often limited in scope. Therefore, the government could consider implementing comprehensive accessibility guidelines encompassing all goods and services.

- In contrast to the Rights of Persons with Disabilities Act (RPWDA), the Consumer Protection Act (CPA) boasts robust enforcement and compliance mechanisms.

- However, unlike the RPWDA, it lacks specific provisions dedicated to safeguarding the rights of consumers with disabilities.

- This disparity might discourage individuals with disabilities from filing complaints with Consumer Commissions. Therefore, it is imperative to harmonize the CPA with the RPWDA to ensure equitable treatment for all consumers.

- It is important to note that Disability Commissions under RPWDA typically issue recommendatory directions, which may not always lead to effective redress.

- India can draw inspiration from successful initiatives undertaken in countries like Australia, the United States, and Canada and integrate similar strategies into its policies.

- By doing so, India can take significant strides towards creating a more inclusive society where individuals with disabilities can fully participate in economic activities and enjoy equal access to products and services.

Success Stories:

- Individuals with disabilities have successfully obtained remedies through Consumer Commissions in numerous cases.

- For instance, in the case of S. Suresh v. The Manager i/c, Gokulam Cinemas, a person with locomotor disability who encountered accessibility barriers at a cinema hall was awarded compensation amounting to ₹1,00,000.

- In response to a complaint lodged by Rahul, a notable healthcare service provider, Practo, was instructed to make its website and application accessible to individuals with disabilities.

- Similar complaints regarding accessibility barriers in various sectors such as banking, insurance, and hospitality have also been filed.

- These legal frameworks serve as crucial tools in ensuring that individuals with disabilities can assert their consumer rights and obtain redress in instances of discrimination or accessibility barriers.

Conclusion:

In addition to these legal reforms, it is vital to enhance awareness regarding the rights and resources available to consumers with disabilities under these key legislations. While consumer awareness has been a focal point for the state, notably through initiatives like the flagship Jago Grahak Jago Campaign, individuals with disabilities have often been overlooked in these efforts.