Focus: GS-III Indian Economy

Introduction: What was done so far?

- Boosting manufacturing is seen as India’s best chance to create jobs for the thousands that enter the job market each year.

- To enable Indian businesses to boost productive capacity — either by augmenting existing factories or laying down new factories — the government sharply cut the corporate tax rate in 2019.

- At the same time, RBI has cut the benchmark interest rate in the economy by as much as 250 basis points (bps) between February 2019 and May 2020.

- Over this period, the RBI has also worked with the banks to improve the transmission of these cuts to the banking system.

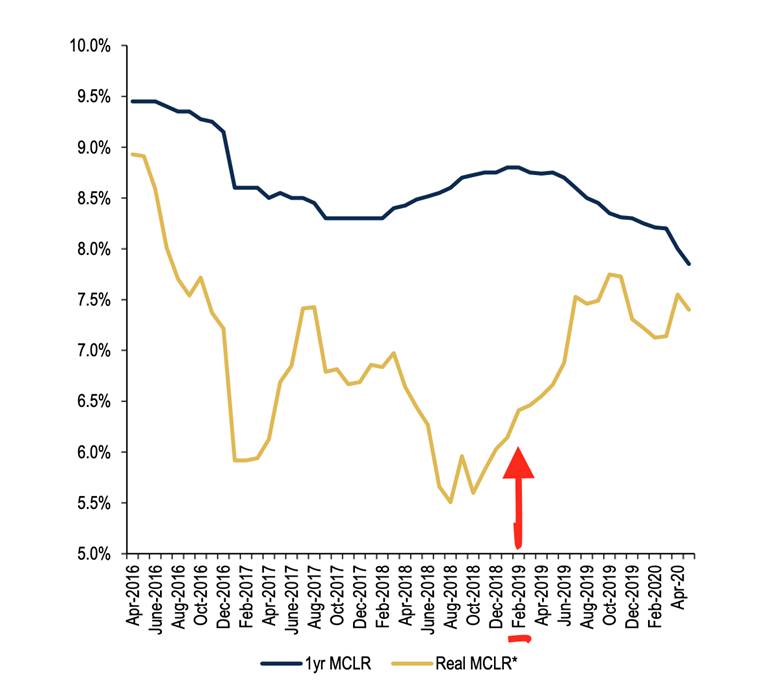

- Over the last 12 months, for instance, RBI has cut 150 bps and the MCLR (marginal cost lending rate or the rate that a bank charges the last customer seeking loan) has come down.

- On the face of it, it is not just the nominal interest rates that have come down; even the real interest rates have come down.

Real Interest

- Real interest rate is essentially derived after subtracting the inflation rate from the nominal interest rate.

- So, if the nominal interest rate is 10% and inflation is 8% then the real interest will be 2%.

- Since RBI targets retail inflation, which is calculated by the Consumer Price Index (CPI), it is easy to believe that the real interest rates are coming down.

Real Interest (R) = Nominal Interest Rate (N) — Inflation Rate (I)

- If N is falling sharply and I is increasing — the latest retail inflation was over 6% — then, R or the real interest rate must be falling.

- A low real interest rate should encourage businesses to borrow more and make new investments in the economy.

However, Businesses are not Borrowing more and making New Investments

- In common perception “inflation rate” refers to the “retail” (CPI) inflation in the economy, faced by Consumers. However, it is not the same for businesses.

- While calculating that “R” or the real interest rate for a firm in the manufacturing sector — say a steel manufacturer or a TV or car manufacturer — it would be odd to use “retail” inflation.

- Since these products are sold wholesale, one should use Wholesale Price Index-based inflation.

What happens to the real interest rate for the manufacturing sector when we calculate the real interest rate by using core-WPI as the inflation rate (I)?

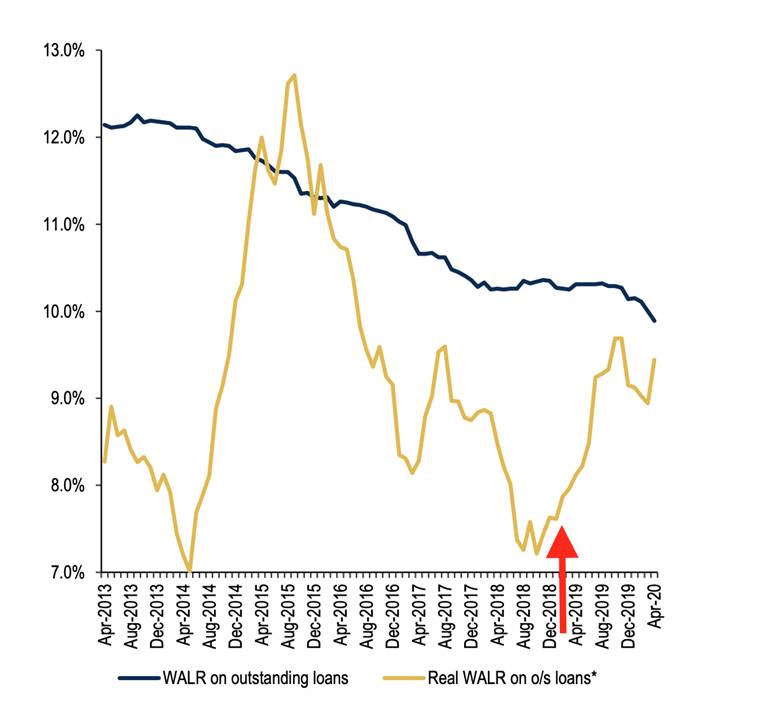

- Contrary to common perception, real interest rates have actually gone up.

- When you look at the chart with real MCLR (Marginal Cost of Funds based Lending Rate) and real WALR (Weighted Average Lending Rate) – unlike, the MCLR, which is lower because it is for the newest borrower, the WALR is the interest rate charged on all the outstanding loans of a bank, and as such, is much higher than MCLR.

- This is because the core-WPI has decelerated even faster than the rate at which nominal interest rates have come down.

- This odd situation has arisen because retail and wholesale inflation rates are diverging.

- The RBI targets the retail inflation but, as shown above, the relevant inflation rate to monitor for boosting investments right now could be the core-WPI.

-Source: Indian Express