CONTENT

- SVAMITVA

- BHIM – UPI

SVAMITVA

Focus: Government Policies and Interventions

Why in news?

Minister of Panchayati Raj & Rural Development, Minister of State for Panchayati Raj reviewed the progress made regarding implementation of SVAMITVA Scheme and e-Panchayat Programmes.

About SVAMITVA

- SVAMITVA (Survey of Villages and Mapping with Improvised Technology in Village Areas) scheme is a collaborative effort of the Ministry of Panchayati Raj, State Panchayati Raj Departments, State Revenue Departments and Survey of India.

- Aim: To provide an integrated property validation solution for rural India.

- It is a scheme for mapping the land parcels in rural inhabited areas using drone technology and Continuously Operating Reference Station (CORS).

- The mapping will be done across the country in a phase-wise manner over a period of four years – from 2020 to 2024.

Benefits:

- The scheme will help in streamlining planning and revenue collection in rural areas and ensuring clarity on property rights.

- The scheme will enable creation of better-quality Gram Panchayat Development Plans (GPDPs), using the maps created under this programme.

- The Gram Panchayats are constitutionally mandated for preparation of Gram Panchayat Development Plans (GPDP) for economic development and social justice.

- The GPDP is based on a participatory process in convergence with schemes of all related Central Ministries/Line Departments related to 29 subjects listed in the Eleventh Schedule of the Constitution.

- Present Coverage Area: The program is currently being implemented in six states – Haryana, Karnataka, Madhya Pradesh, Maharashtra, Uttar Pradesh and Uttarakhand.

BHIM – UPI

Focus: GS III- Indian Economy

Why in News?

Union Minister of Finance & Corporate Affairs Smt. Nirmala Sitharaman, along with her counterpart, the Hon’ble Finance Minister of Bhutan, Mr Lyonpo Namgay Tshering, jointly launched BHIM–UPI in Bhutan today afternoon in a virtual ceremony.

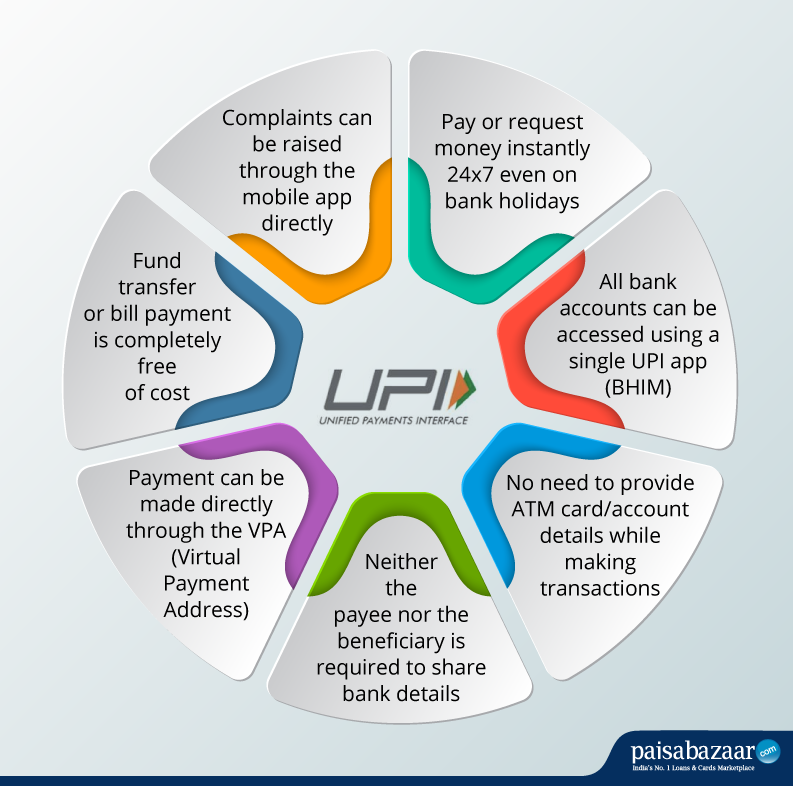

Bharat Interface for Money-Unified Payments Interface (BHIM-UPI):

- It is an initiative to enable fast, secure, reliable cashless payments through the mobile phone.

- BHIM is based on Unified Payment Interface (UPI) to facilitate e-payments directly through banks.

- UPI is an advanced version of Immediate Payment Service (IMPS) – round–the-clock funds transfer service to make cashless payments faster, easier and smoother.

- This is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

- Advantages of UPI Includes – Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- UPI Enables Single mobile application for accessing different bank accounts with Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines yet provides for a very strong feature of seamless single click payment.

- It also features Virtual address of the customer for Pull & Push providing for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

National Payments Corporation of India

- National Payments Corporation of India (NPCI), an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007.

- It is a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013), with an intention to provide infrastructure to the entire Banking system in India for physical as well as electronic payment and settlement systems.