CONTENTS

- Sardar Vallabhbhai Patel

- Sovereign Gold Bond Scheme

- Exercise SURYA KIRAN-XVI

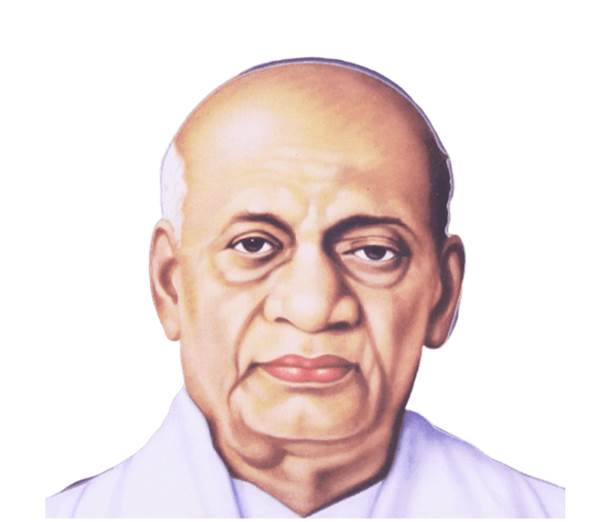

Sardar Vallabhbhai Patel

Focus: GS I- Modern History

Why in News?

The Prime Minister has paid homage to Sardar Patel on his Punya Tithi and recalled his everlasting contribution to India.

About Sardar Vallabhbhai Patel

- Vallabhbhai Jhaverbhai Patel (31 October 1875 – 15 December 1950), popularly known as Sardar Patel, was an Indian politician.

- He was the first Home Minister and Deputy Prime Minister of Independent India.

- He played an important role in the integration of many Indian princely states to make an Indian federation.

- He took charge of the task to forge a united India from over 560 semi-autonomous princely states and British-era colonial provinces.

- Using frank diplomacy backed with the option (and the use) of military action, Patel’s leadership enabled the accession of almost every princely state.

- Hence, he is recognized as the real unifier of India.

- He is also remembered as the ‘Patron saint of India’s civil servants’ as he established the modern all-India services system. He is also hailed as the Iron Man of India.

- Patel was in charge of the Provincial Constitution Committee and the Advisory Committee on Fundamental Rights, Minorities and Tribal and Excluded Areas, in the Constituent Assembly of India.

- Since 2014, every year on 31 October ‘Rashtriya Ekta Diwas’ or the National Unity Day is observed to pay tribute to Sardar Vallabhbhai Patel – an Indian politician who played a pivotal role in India’s freedom struggle and then during the integration of the country.

- He was awarded the Bharat Ratna posthumously in 1991.

Statue of Unity

- The Statue of Unity which is built in honour of Sardar Vallabhbhai Patel is dedicated to the nation.

- The Statue of Unity is the tallest statue in the world at 182 metres.

- It is located on the Sadhu Bet island on the Narmada river, which flows between the Satpura and the Vindhya mountain ranges.

Sovereign Gold Bond Scheme

Focus: GS II- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in News?

Recently the Finance Ministry said that the Sovereign Gold Bonds (SGBs) 2022-23-Series III will open for subscription during the December 19-December 23 period and the 2022-23-Series IV during March 06-10, 2023.

About Sovereign Gold Bond Scheme (SGB)

- The Sovereign Gold Bond Scheme was introduced in the Union Budget 2015-16 by the Union Cabinet which was chaired by PM Narendra Modi.

- It was launched to reduce the demand for physical gold and with an aim to invest a part of these physicals gold bars and coins that are purchased every year into financial savings in the form of gold bonds.

- Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity.

- The Bond is issued by Reserve Bank on behalf of Government of India.

- Government introduced these bonds to help reduce India’s over dependence on gold imports.

- The move was also aimed at changing the habits of Indians from saving in physical form of gold to a paper form with Sovereign backing.

- The bonds will be restricted for sale to resident Indian entities, including individuals, Hindu Undivided Family (HUFs), trusts, universities and charitable institutions.

- The bonds will be denominated in multiples of gram(s) of gold with a basic unit of 1 gram.

- The tenor will be for a period of 8 years with exit option from the 5th year to be exercised on the interest payment dates.

- The minimum permissible investment limit will be 1 gram of gold, while the maximum limit will be 4 kg for individual, 4 kg for HUF and 20 kg for trusts and similar entities per fiscal (April-March) notified by the government from time to time.

- In case of joint holding, the investment limit of 4 kg will be applied to the first applicant only.

- Bonds can be used as collateral for loans.

- The loan-to-value (LTV) ratio is to be set equal to ordinary gold loan mandated by the Reserve Bank from time to time.

Benefits of Sovereign Gold Bond

- As a low-risk investment, it is perfect for investors with low-risk appetite.

- Compared to physical gold, the cost to purchase or sell SGBs is quite low.

- The expense of buying or selling the SGB is also nominal in comparison to the physical gold.

- The gold bonds can be availed either in paper or in demat form as per the convenience of an individual.

- The gold bonds invested by the Investors can be gifted or transferred to others who are eligible under the scheme.

- They can also trade these bonds on stock exchanges subject to notifications of the Reserve Bank of India.

- These Gold bonds can be purchased through multiple payment modes such as cheques, cash, DDs or electronic transfer.

Exercise SURYA KIRAN-XVI

Focus: GS III: Security challenges

Why in News?

The 16th Edition of Indo-Nepal joint training Exercise “SURYA KIRAN-XVI” between India and Nepal will be conducted at Nepal Army Battle School, Saljhandi (Nepal).

About Exercise SURYA KIRAN

- Exercise “SURYA KIRAN” is conducted annually between India and Nepal with the aim to enhance interoperability in jungle warfare & counter terrorism operations in mountainous terrain and HADR under UN mandate.

- The two armies, through these contingents, shall be sharing the experiences gained during the conduct of various counter-insurgency operations over the years in their respective countries.

- The joint exercise would focus on evolution of combined drills for planning and conduct of tactical operations at unit level in counter terrorism operations and disaster response mechanism in general and role of armed forces in management of disaster.

- During the exercise, participants will be training together to develop inter-operability and share their experience including Counter Insurgency and Counter Terrorist operations and also on Humanitarian Relief operations.

- The joint military exercise will enhance the level of defence cooperation which will further foster the bilateral relations between the two nations.