India’s Nuclear Energy Pivot: Budget 2025–26 at a Glance

| Focus Area | Budget Announcements |

| Installed Capacity | Target of 100 GW by 2047 (from 8.18 GW today) |

| Small Modular Reactors (SMRs) | ₹20,000 crore allocated to develop 5 indigenous SMRs by 2033 |

| Private Sector Entry | Legislative reforms to allow private and foreign investment |

| Legal Reforms Pending | Amendments to Atomic Energy Act, 1962 and CLNDA, 2010 |

Relevance: GS 3(Nuclear Energy)

The Historical Trajectory: From Vision to Isolation to Reengagement

| Milestone | Details |

| 1956 | Apsara, Asia’s first research reactor commissioned |

| 1963 | Work begins at Tarapore (first nuclear power reactors in Asia) |

| 1974 | Peaceful Nuclear Explosion → Global isolation |

| 1998 | Pokhran-II → Strategic negotiations begin |

| 2008 | NSG waiver allows India to re-enter the global nuclear market |

| 2010 | CLNDA introduced — slowed foreign participation due to supplier liability clause |

| 2025 | Shift toward private sector and international partnerships for scaling up nuclear power |

Why Nuclear Now? Rationale Behind the Shift

| Strategic Goal | Role of Nuclear Power |

| Energy Security | Provides stable baseload power unlike intermittent renewables |

| Decarbonisation | Low-carbon option to meet Net Zero by 2070 |

| Economic Growth | Powering GDP rise from $4 trillion to $35 trillion by 2047 |

| Urbanisation & Development | India’s per capita power consumption (1,208 kWh) lags far behind China (4,600) and the U.S. (12,500) |

Renewable energy (solar, wind, hydro) accounts for ~50% of capacity but only ~20–25% of actual energy generation due to intermittency.

Reforms on the Horizon: Legal, Regulatory, and Financial

Atomic Energy Act, 1962 – Proposed Changes

| Issue | Reform Needed |

| Monopoly of NPCIL | Allow private ownership & operation under safeguards |

| Fuel Supply & Waste Responsibility | Clear allocation between operator and supplier |

| Foreign Investment | FDI up to 49%, with safeguards on Indian control |

CLNDA, 2010 – Proposed Amendments

| Clause | Problem | Reform |

| Section 17(b) | Makes suppliers liable for accidents—deterring foreign partners | Limit or re-interpret supplier liability to enable partnerships |

Tariff & Commercial Disputes

Current Model – Under Atomic Energy Act — Tariff notified by govt

Dispute Example – NPCIL vs Gujarat Urja Vikas Nigam led to conflicting verdicts

Reform Direction – Move to Electricity Act framework with levelised cost model under CERC

Regulatory Framework

| Body | Current Status |

| AERB | Technically autonomous, but under DAE and not a legal entity |

| Reform Need | Establish an independent, statutory regulator (Bill lapsed in 2011) |

Institutional Strategy: Three-Track Expansion Plan

| Track | Objective |

| Standardised SMRs | Use 220 MW PHWR design for scalable, indigenous Small Modular Reactors |

| Accelerate 700 MW PHWRs | Fast-track land acquisition, licensing, and local supply chains |

| Revive Global Partnerships | Restart stalled talks with France (EDF) and U.S. (Westinghouse, GE-Hitachi) |

Financing & Incentivising Nuclear Power

| Challenge | Details |

| High capital costs | ~$2M/MW for nuclear vs <$1M/MW for coal |

| Lifecycle costs | Nuclear plants last 50–60 years but need funds for decommissioning and waste |

| Classification | Not yet considered “renewable”, hence not eligible for green finance |

- Green financing classification

- Long-term Power Purchase Agreements (PPAs)

- Viability Gap Funding (VGF)

- Special tax incentives for nuclear infrastructure

Private Sector Involvement: Opportunities and Roadblocks

| Company | Potential Role |

| Tata, Adani, Reliance, Vedanta | Build, operate, or co-finance new reactors |

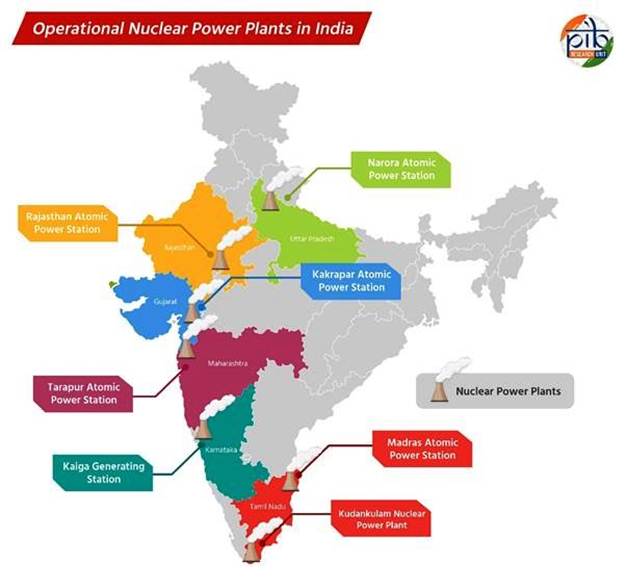

| NTPC-NPCIL JV | Four 700 MW units at Mahi Banswara, Rajasthan |

| REC JV | New financial partnership to support nuclear infrastructure |

JVs with public sector units already underway — but scaling to 100 GW will require private and foreign players.

Global Momentum in Nuclear Energy

| Event | Significance |

| COP28 (Dubai, 2023) | Declaration to triple global nuclear energy |

| IAEA–World Bank 2024 Agreement | Nuclear backed as key for developing economies |

| Ajay Banga (World Bank President) | Called nuclear essential for base-load power in modern economies |

Conclusion: What India Must Now Do

India’s nuclear renaissance must be decisive, comprehensive, and inclusive. The key pillars:

- Legislative reform to allow private participation while ensuring safety, accountability, and public trust

- Global partnerships based on updated liability and financing frameworks

- Institutional overhaul with an independent nuclear regulator

- Green classification and incentives for nuclear as low-carbon energy

- Fast-tracked projects combining scale (700 MW) with modular innovation (SMRs)

Nuclear power is India’s best shot at clean, reliable base-load electricity, essential for a high-growth, low-carbon future.