The Economic Survey 2020 gives an unapologetic defence of wealth creation.

- Many Govt measures — well intended — but over years become counter productive — pharmaceuticals and agriculture

- Undermined the ability of the markets to support wealth creation

- Outcomes opposite to those intended.

Economic freedom

- enhances wealth creation — by efficient allocation of entrepreneurial resources and energy to productive activities, thereby promoting economic dynamism.

- India “mostly unfree”

- Ranks 79th among 162 — Index of Global Economic Freedom brought out by the Fraser Institute.

- Index of Economic

Freedom — Heritage Foundation — categorized as ‘mostly unfree’

- 2019 ranking — 129th among 186 countries, i.e., in the bottom 30 percent of countries.

- Low rank = India

chains opportunities for wealth creation by shackling economic freedom for its

citizens

- Excessive intervention, when market can do the job of enhancing citizens’ welfare perfectly well

There are two types of intervention by the Government:

- Direct participation — market maker or as a buyer or supplier of goods and services.

Example: banking, railways, civil aviation, etc.

- Indirect participation — regulation, taxation, subsidy or other influence.

Example: food and fertilizer subsidy, drug prices, etc.

Government intervention = dynamic interaction of supply and demand in markets affected –> distorts market equilibrium.

- Affects both consumer and producer welfare.

- This chance of welfare for both is lost for ever –> wastage due to price distortion ==> ‘deadweight loss’ — income lost forever

- Such interventions –> artificial prices in the market –> leads to rent-seeking, corruption and low incentive to producers to invest further.

There are four anti-diluvian laws — for intervention in the market

1. Essential Commodities Act, 1955

- to control the production, supply and distribution — of essential commodities.

- No Rules and Regulations in the act itself — but allows the States to issue Control Orders –> for dealer licensing, regulate stock limits, restrict the movement of goods and requirements of compulsory purchases at the time when there is a rise in the price of any of these essential commodities.

- Food and civil supply authorities in States execute the provisions of the Act.

- The major commodity groups included in the Act are:

- Petroleum and its products, including petrol, diesel, kerosene, Naphtha, solvents, etc.

- Foodstuff, including edible oil and seeds, vanaspati, pulses, sugarcane and its products like Khansari and sugar, rice paddy

- Raw Jute and jute textiles

- Drugs- prices of essential drugs are still controlled by the DPCO

- Fertilizers- the Fertiliser Control Order prescribes restrictions on transfer and stock of fertilizers apart from prices

- Onion and Potato

- Seeds of food crops, fruits, vegetables, cattle fodder, Jute and Cotton seeds

- Main objective — ensure the affordability of essential commodities for the poor by restricting hoarding.

Overarching — Also agricultural marketing and production.

- Agriculture — seasonal activity — thus storing of some products essential for off-season — stability of prices ensured. Thus an inherent trade-off for producers — building inventory and drawing it down

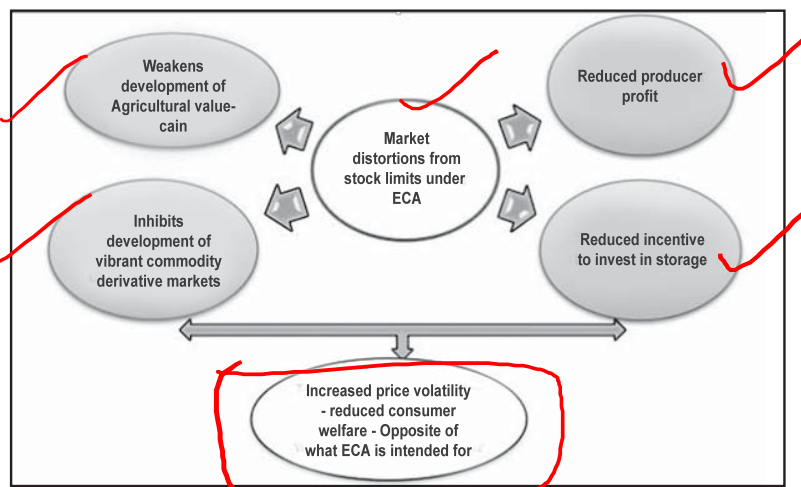

- ECA interferes

with this mechanism — dis-incentivizes investments in warehousing and

storage facilities — due to frequent and unpredictable imposition of

stock limits.

- Problem: No distinction between genuine stockholders for operations and those who are hoarding — just limits apply to the entire agriculture supply chain, including wholesalers, food processing industries and retail food chains.

- Thus reduces the

effectiveness of free trade and the flow of commodities from surplus areas

to markets with higher demand.

- Unintendedly distorts markets by increasing uncertainty and discouraging the entry of large private sector players into agricultural-marketing.

- These market distortions further aggravate the price volatility in agricultural commodities

- Example – the recent rise in onion prices.

ECA enacted when speculative hoarding and black marketing was a threat as agricultural markets were fragmented and transport infrastructure was poorly developed.

- But now, markets more integrated, competitive and better transportation….. Yet penalizes desirable consumption smoothing storage — Thus act is dubious and incompatible for development of an integrated competitive national market for food.

- Anti-hoarding

provisions of ECA discourage open reporting of stock holdings, storage

capacities, trading and carry forward positions.

- Result: No aggregated data of the total private storage capacity available in the country — policy makers cannot assess the impact of any production shocks on the prices.

- Discourages investment in modern methods of storage and in market intelligence — the lack of information on trades makes it harder for market participants to make accurate forecasts for the future — better private storage decisions and avoid volatility in prices.

Solution: Strengthen the Price Stabilization Fund (PSF)

- set up in 2014-15 to help regulate the price volatility of important agri-horticultural commodities like onion, potatoes, and pulses.

- It provides for maintaining a strategic buffer of the commodities like pulses and onions — calibrated release to moderate price volatility and discourage hoarding and unscrupulous speculation

- For building such stock, the scheme promotes direct purchase from farmers/farmers’ association at farm gate/Mandi.

- The PSF is utilized for granting interest-free advance of working capital to Central Agencies, State/UT Governments/Agencies to undertake market intervention operations.

- Apart from domestic procurement from farmers/wholesale mandis, import may also be undertaken with support from the Fund.

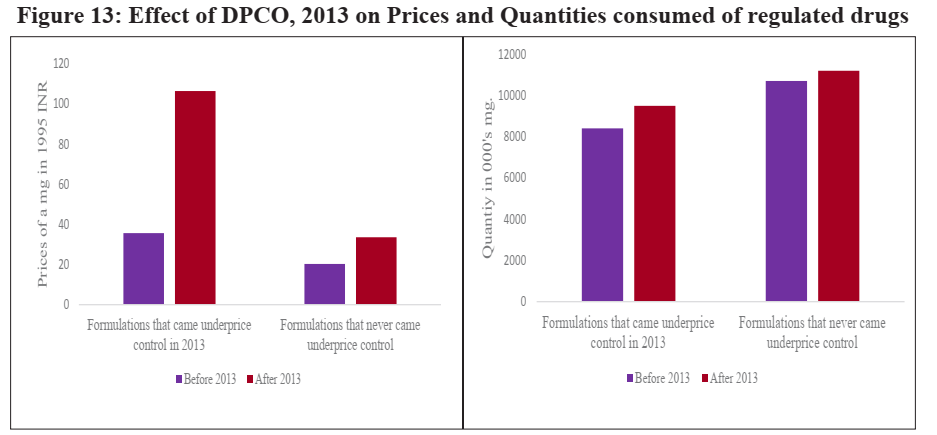

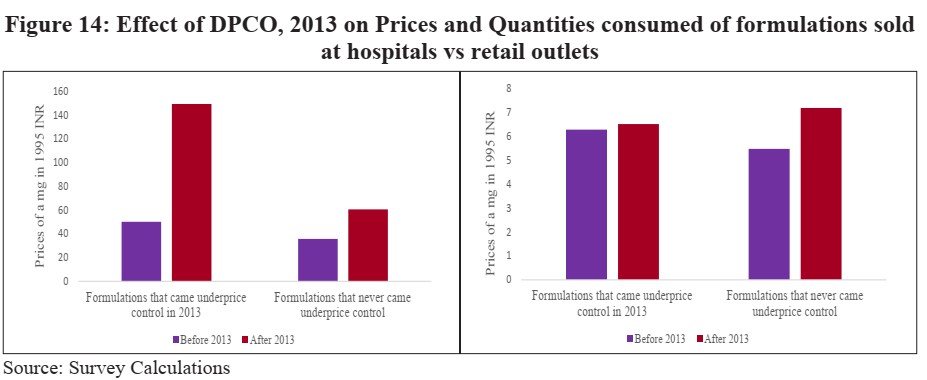

2. Drug Price Controls Under ECA

GoI historically — relies on price controls — to regulate the prices of pharmaceutical drugs — to avoid poverty

Tool: National Pharmaceutical Pricing Authority (NPPA) and Drug (Prices Control) Order (DPCO).

Difference-in-differences (DiD) is a statistical technique used to estimate the effect of a specific intervention or treatment (such as a passage of law, enactment of policy, or large-scale program implementation). The technique compares the changes in outcomes over time between a population that is affected by the specific intervention (the treatment group) and a population that is not (the control group).

- DiD is typically used to mitigate the possibility of any extraneous factors affecting the estimated impact of an intervention.

- This is accomplished by differencing the estimated impact of the treatment on the outcome in the treatment group and the estimated impact of the treatment on the control group.

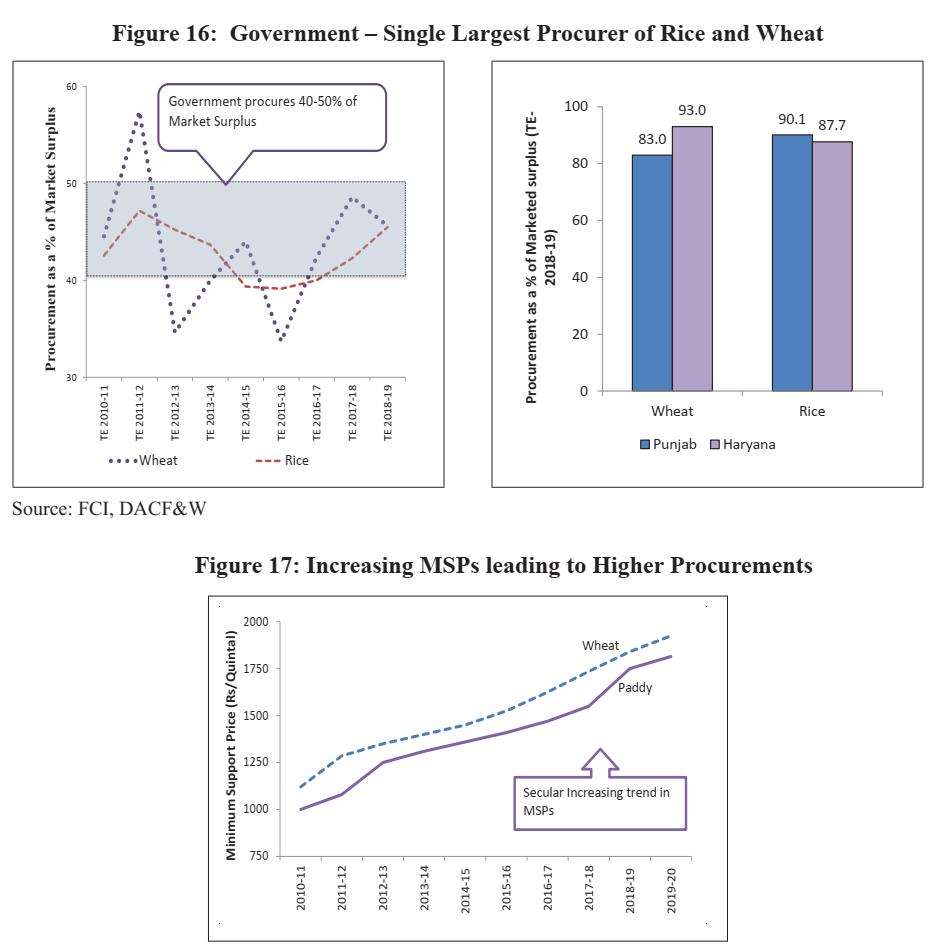

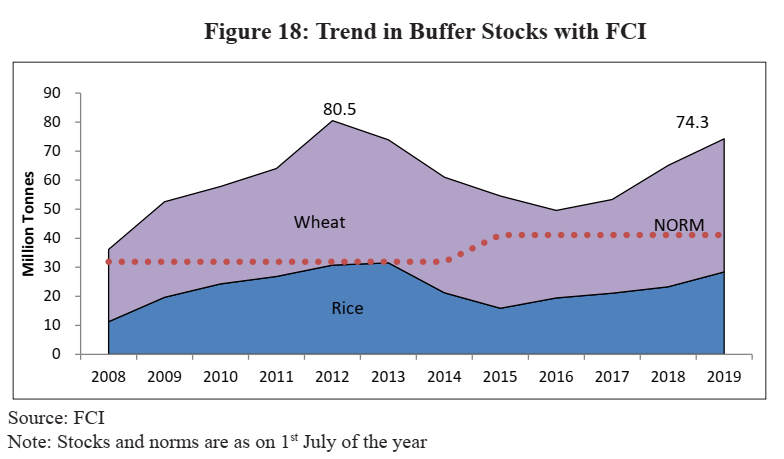

3. Government intervention in grain markets

The government controls input prices such as those of fertilizer, water, and electricity, sets output prices, undertakes storage and procurement through administrative machinery, and distributes cereals across the country through the PDS.

Reason: Ensuring food security — remunerative prices to producers and affordable pricing for consumers

- Food Corporation

of India is mandated to purchase, store, move/transport, distribute and

sell foodgrains and other foodstuffs.

- The government has emerged as the single largest procurer and hoarder of foodgrains — 40-50% of entire market surplus of wheat and rice

- MSPs = indicative price before sowing season– also a floor price — insurance of sort

- This disincentivizes the private sector to undertake long-term investments in procurement, storage, and processing of these commodities

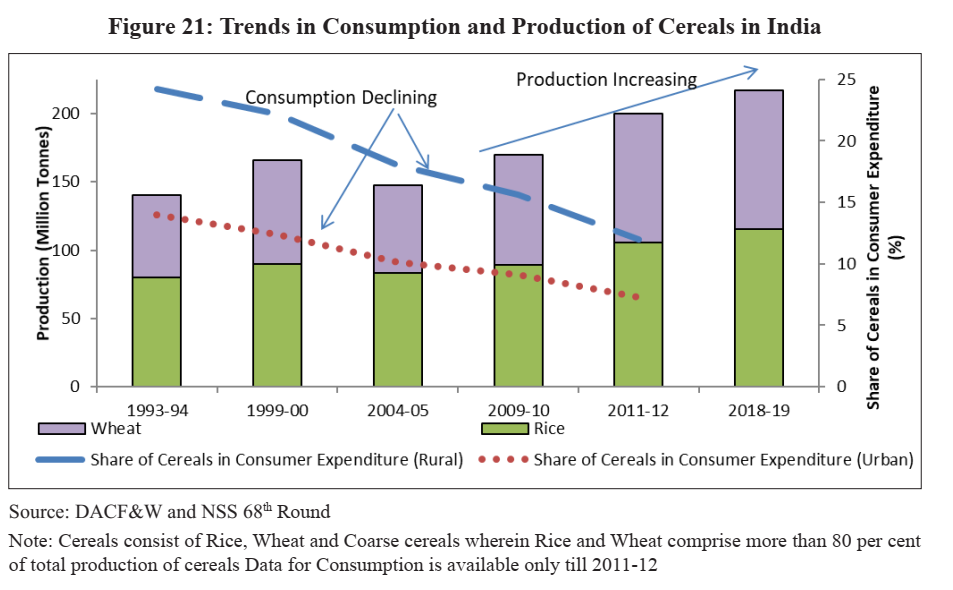

- Higher MSPs everytime — signal to farmers to opt for crops with assured procurement system (Rice and Wheat).

Market prices do not offer remunerative options for the farmers and MSPs have, in effect, become the maximum prices rather than the floor price – the opposite of the aim it is intended for.

- The current mix of policies of assured procurement (at MSPs), storage (through a monopolist administrative government organization) and distribution under TPDS have contributed to building up a high-cost foodgrain economy — high food subsidy cost — affects capital expenditure

- Higher Investments = Increased productivity, but increasing focus on subsidies = harms the growth of the agricultural sector in the long-run.

This imbalance between subsidies and investments needs to be urgently corrected for sustainable growth in Indian agriculture and overall inclusive growth.

Some Positive aspects

- Moved from being a food scarce country to a food surplus country

- Net exporter of cereals

But, foodgrain economy is, however, riddled with various economic inefficiencies.

What to do?

Incentivize diversification and environmentally sustainable production.

- Empower farmers through direct investment subsidies and cash transfers, which are crop neutral and do not interfere with the cropping decisions of the farmer.

- Internationally, there is a move towards conditional cash transfers (CCTs), aimed at tackling problems of food insecurity and poverty and for nudging people towards improved health and education levels.

Therefore, the foodgrains policy needs to be dynamic and allow switching from physical handling and distribution of foodgrains to cash transfers/food coupons/ smart cards. At the macro level, agricultural marketing, trade (both domestic and foreign) and distribution policies need to be aligned so that farmers receive the correct signals for diversification into remunerative and sustainable production.

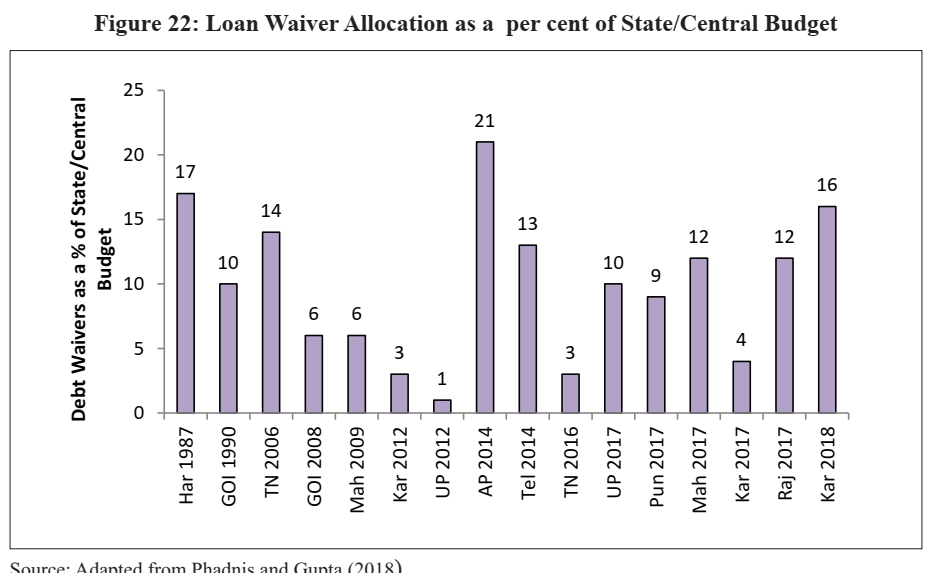

4. Debt waivers

Phenomenon usually just before or after an election — promise in election manifesto

States following suit from 2008 Union government example.

Government intervention in credit markets, in the form of full or partial, conditional or unconditional, debt relief has become increasingly common at the state level in India.

Arguments in support

- Borrowers suffer from “debt overhang” — all current income gets used up in repaying the accumulated debt, leaving little incentives to invest either in physical or human capital.

- Farmers are unlikely to receive new funding as the ability of the borrower to repay additional loans or grow his/her business/ farm is in question.

- Debt waiver — out of debt trap — cleans their balance sheet and reduces the burden of debt servicing.

- This clean-up = new investments as well as fresh fund rising as borrowers’ repayment capacity increases even if there is no change in income.

The survey examines the 2008 debt waiver offered by the Government of India.

- It found that neither agricultural investment nor productivity increased after the waiver.

- Also, there was little impact on consumption as well.

Arguments against

Debt waivers impact credit markets negatively — help under exceptional circumstances and remain unanticipated.

- An anticipated waiver — moral hazard and destroy the credit culture.

- Loan performance deteriorated the most in areas that were headed for election, indicating strategic default in anticipation of waiver.

- The waiver led to increased loan defaults on future loans and no improvement in wages, productivity, or consumption.

- It ends up reducing the formal credit flow to the very same farmers it intends to help.

- An unconditional and blanket debt waiver is a bad idea. It does not achieve any meaningful real outcomes for the intended beneficiaries while the costs to the exchequer are significant.

- A waiver can at best be an emergency medicine to be given in rare cases after a thorough diagnosis and identification of illness and not a staple diet.

In most cases, its side effects, the unintended consequences, far outweigh any plausible short term benefits.

Conclusion

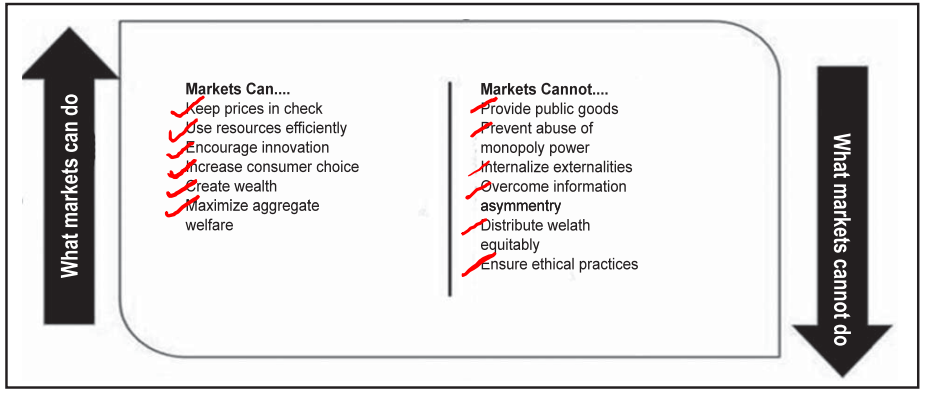

Competitive markets are effective in allocating resources in an economy. However, while the concept of a completely efficient market is rare, the costs of Government intervention may outweigh the benefits when “market failures” – a term that economists use to denote situations where markets may not work very well in allocating resources – are not severe.

There are several areas in the Indian economy where the Government needlessly intervenes and undermines markets. It is wrong to argue that there should be no Government intervention.

Instead, interventions that were apt in a different economic setting, possibly because the “market failures” were severe then, may have lost their relevance in a transformed economy where the “market failures” are not severe

- For example, ECA 1955 owes its origin in times of shortage and inefficient linking of markets.

- With enhanced production and integration of markets, these Acts have become an instrument of coercion and inhibit the proper functioning of markets of these essential commodities.

Each department and ministry in the Government must systematically examine areas where the Government needlessly intervenes and undermines markets. Eliminating such instances of needless Government intervention will enable competitive markets and thereby spur investments and economic growth.

MCQs

- Which of the following is/are the weakness of the markets?

1- Markets cannot prevent the abuse of monopoly power.

2- Markets cannot distribute public goods.

Select the correct answer using the codes given below.

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Ans. (C) Learning Zone: There some strengths and weaknesses of the market.

Markets cannot Provide public goods, prevent abuse of monopoly power, internalize externalities, overcome information asymmetry, distribute wealth equitably and ensure ethical practices.

Markets can keep prices in check, use resources efficiently, encourage innovation, increase consumer choice, create wealth and maximize aggregate welfare. - Factories Act, 1948 is/are applied to which of the following industries?

1- A manufacturing unit using power with 15 employees

2- Coal Mine employing 200 people.

3- A hotel with more than 50 people working.

4- A mobile unit belonging to armed forces.

Select the correct answer using the code given below.

A. 2 only

B. 1, 2 and 3 only

C. 1 and 3 only

D. 2 and 4 only

Ans. (C) The Factories Act, 1948 is a beneficial legislation. The aim and object of the Act is essentially to safeguard the interests of workers, stop their exploitation and take care of their safety, hygiene and welfare at their places of work. It casts various obligations, duties and responsibilities on the occupier of a factory and also on the factory manager. Act is applicable to

•any factory whereon ten or more workers are working or were working on any day of the preceding twelve months, and in any part of which a manufacturing process is being carried on with the aid of power. Hence the act is applicable to a manufacturing unit using power with 15 employees

•whereon twenty or more workers are working or were working on any day of the preceding twelve months, and in any part of which a manufacturing process is being carried on without the aid of power, or is ordinarily so carried on;

•but this does not include

•a mine. Hence the act is not applicable to coal mine with 200 people.

•a mobile unit belonging to the armed forces of the union,

•railway running shed

•In 2008, the Hotel industry was included under the Factories Act. Accordingly, the industry will now have to fix proper shifts and pay overtime if they work for more than 8 hours a day, apart from ensuring workers’ health, safety and welfare facilities. Hence option (c) is the correct answer. - Which of the distortions in the agricultural market that are caused due to the imposition of the Essential Commodity Act, 1955?

1- It weakens the development of agricultural value chain.

2- It reduces the producers’ profit.

3- It inhibits the development of vibrant commodity derivative markets.

4- It reduces the incentive to invest in storage.

Select the correct answer using the codes given below.

A. 1, 2 and 3 only

B. 2, 3 and 4 only

C. 1 and 4 only

D. 1, 2, 3 and 4

Ans. (D) The ECA, however, affects the efficient development of agricultural markets by creating market distortions.

As agriculture is a seasonal activity, it is essential to store produce for the off-season to ensure smoothened availability of a product at stable prices throughout the year. Therefore, producers face an inherent tradeoff between building an inventory in the harvest season and drawing down inventory in the lean season. ECA interferes with this mechanism by disincentivising investments in warehousing and storage facilities due to frequent and unpredictable imposition of stock limits.

As stockholding limits apply to the entire agriculture supply chain, including wholesalers, food processing industries and retail food chains, the Act does not distinguish between firms that genuinely need to hold stocks owing to the nature of their operations, and firms that might speculatively hoard stocks. Further, this reduces the effectiveness of free trade and the flow of commodities from surplus areas to markets with higher demand. ECA also affects the commodity derivative markets as traders may not be able to deliver on the exchange platform the promised quantity, owing to stock limits.

The Act distorts markets by increasing uncertainty and discouraging the entry of large private sector players into agricultural-marketing. These market distortions further aggravate the price volatility in agricultural commodities- the opposite of what it is intended for. - Which of the following item/s come under the purview of the Essential Commodities Act, 1955:

1- Petroleum products

2- Onion

3- Drugs

4- Jute

5- Seeds of food crops

Select the correct answer using the codes given below.

A. 1, 2 and 4 only

B. 2, 3, 4, and 5

C. 1, 2, 3, and 5 only

D. 1, 2, 3, 4, and 5

Ans. (D) Essential Commodities Act (ECA), 1955 was enacted to control the production, supply and distribution of, and trade and commerce in, certain goods considered as essential commodities. The Act itself does not lay out Rules and Regulations but allows the States to issue Control Orders related to dealer licensing, regulate stock limits, restrict the movement of goods and requirements of compulsory purchases under the system of the levy.

(i) Petroleum and its products, including petrol, diesel, kerosene, Naphtha, solvents etc.

(ii) Foodstuff, including edible oil and seeds, vanaspati, pulses, sugarcane and its products like Khansari and sugar, rice paddy

(iii) Raw Jute and jute textiles

(iv) Drugs- prices of essential drugs are still controlled by the DPCO

(v) Fertilisers- the Fertiliser Control Order prescribes restrictions on transfer and stock of fertilizers apart from prices

(vi) Onion and Potato

(vii) Seeds of food crops, fruits and vegetables, cattle fodder, Jute seeds and Cotton seeds - Consider the following pairs of the indices and the respective organisation/s which release them:

Index Organisation

1- Index of Global Economic Freedom – Fraser Institute

2- Index of Economic Freedom – Heritage Foundation and The Wall Street Journal

Which of the above pairs is/are correctly matched?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Ans. (C) The Index of Economic Freedom is an annual index and ranking created in 1995 by The Heritage Foundation and The Wall Street Journal to measure the degree of economic freedom in the world’s nations. The Fraser Institute produces the annual Economic Freedom of the World report in cooperation with the Economic Freedom Network, a group of independent research and educational institutes in nearly 100 countries and territories. - Which of the following statements are correct regarding the Price Stabilization Fund?

1- It seeks to contain inflation of food as well as non-food items.

2- Operational losses are shared between the Centre and the States.

3- It is under the purview of the Ministry of Consumer Affairs, Food and Public Distribution.

Select the correct answer using the code given below.

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

Ans. (B) Price volatility of some of the horticulture commodities affects the consumers by way of an increase in food consumption budget. To mitigate hardships to consumers, a new central sector scheme for providing working capital and other incidental expenses for procurement and distribution of perishable agrihorticultural commodities was approved.

•For this purpose, a corpus – ―Price Stabilisation Fund‖ of Rs. 500 Crore was announced in the Union Budget 2014-15 with a view to mitigate price volatility.

•To begin with, interventions would be supported for onions, potatoes and pulses only. Hence, statement 1 is not correct.

•A Price Stabilisation Fund (PSF) Trust was earlier established in 2004 for plantation crops such as coffee, tea, rubber and tobacco. It was later discontinued.

•It was set up under the Department of Agriculture, Cooperation & Famers Welfare (DAC&FW), Ministry of Agriculture. The PSF scheme was transferred from DAC&FW to the Department of Consumer Affairs (DOCA), Ministry of Consumer Affairs, Food and Public Distribution. Hence, statement 3 is correct.

Procurement of these commodities will be undertaken directly from farmers or farmers‘ organizations at farm gate/mandi and made available at a more reasonable price to the consumers. Losses incurred, if any, in the operations will be shared between the Centre and the States. Hence, statement 2 is correct. - With reference to the “Index of Economic Freedom”, consider the following statements:

1- It is published by the International Monetary Fund (IMF).

2- India has ranked at 129th among 186 countries in 2019.

Which of the above statements is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Ans. (B) The Index of Economic Freedom is an annual index and ranking created in 1995 by The Heritage Foundation and The Wall Street Journal to measure the degree of economic freedom in the world’s nations.

In the Index of Economic Freedom, India was categorized as ‘mostly unfree’ with a score of 55.2 in 2019 ranking the Indian economy 129th among 186 countries, i.e., in the bottom 30 per cent of countries. - Which of the following is/are the impact of the blanket debt waivers?

1- Disruption of credit culture

2- Reduction of the formal credit flow

Select the correct answer using the codes given below.

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Ans. (C) It is clear from the studies that an unconditional and blanket debt waiver is a bad idea. It does not achieve any meaningful real outcomes for the intended beneficiaries while the costs to the exchequer are significant.

Most importantly, debt waivers disrupt the credit culture and end up reducing the formal credit flow to the very same farmers it intends to help. - With reference to drug pricing in India, consider the following statements:

1- Drug prices in India are decided according to the cost-based pricing (CBP) of bulk drugs.

2- The price ceiling of a drug is based on the average price of all the brands having a market share of at least 1 percent of that medicine.

3- National Pharmaceutical Pricing Authority regulates the pricing of drugs in India.

Which of the statements given above are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

Ans. (B) National Pharmaceuticals Pricing Policy (NPPP) 2012 replaced the Drugs (Price Control) Order, 1994 which monitored and regulated the prices of essential medicines in the country.

NPPP seeks to regulate drug prices on the basis of essentiality of the drug through market-based pricing (MBP) of formulations as opposed to regulating bulk drug prices through cost-based pricing (CBP) of bulk drugs under the Drug Policy of 1994. Hence, statement 1 is not correct.

The new policy proposes to fix price ceiling on the National List of Essential Medicines (NLEM) on the basis of the simple average price of all the brands having market share (on the basis of moving annual turnover) of 1 percent or more of the total market turnover of that medicine. Hence, statement 2 is correct.

Under the DPCO, formulations are categorized into scheduled and non-scheduled formulations.

Scheduled formulations being those which contain scheduled bulk drugs, and likewise, non-scheduled formulations are those that contain non-scheduled bulk drugs.

The National Pharmaceutical Pricing Authority (NPPA) was constituted vide Government of India Resolution dated 29th August, 1997 as an attached office of the Department of Pharmaceuticals (DoP), Ministry of Chemicals & Fertilizers as an independent regulator for pricing of drugs and to ensure availability and accessibility of medicines at affordable prices. Hence statement 3 is correct.

•It fix/revise the prices of controlled bulk drugs and formulations and to enforce prices and availability of the medicines in the country, under the Drugs (Prices Control) Order, 1995.

•The organization is also entrusted with the task of recovering amounts overcharged by manufacturers for the controlled drugs from the consumers. It also monitors the prices of decontrolled drugs in order to keep them at reasonable levels. - “Drug Price Control Order (DPCO)” is often is seen in the news. Consider the following statements about it:

1- It specifies the list of drugs that come under the price ceiling and the formula for calculating the ceiling price.

2- National Pharmaceutical Pricing Authority (NPPA) is responsible for fixing and revising the prices of pharmaceutical products as well as the enforcement of the DPCO.

Which of the above statements is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Ans. (C) The Drugs Prices Control Order (DPCO) is an order issued under Sec. 3 of the Essential Commodities Act (ECA), 1955 that seeks to regulate the prices of pharmaceutical drugs. The DPCO, among other things, specifies the list of drugs that come under the price ceiling and the formula for calculating the ceiling price. The National List of Essential Medicines (NLEM) lists the pharmaceutical drugs that fall under price control.

National Pharmaceutical Pricing Authority (NPPA) is responsible for fixing and revising the prices of pharmaceutical products as well as the enforcement of the DPCO.