Contents

- Russia and the Czech Republic tensions

- Assam earthquake

- RBI report on Growth of ARCs

- India, Australia and Japan push supply chain resilience

Russia and the Czech Republic tensions

Context:

- In mirror moves, Russia and the Czech Republic have expelled diplomats from the other country over a story about a Russian plan to ‘poison’ Czech politicians in 2020.

- Prague (capital of Czech Republic) accused Russian embassy officials of being intelligence operatives, and said that it suspected them of being involved in a 2014 explosion at an arms depot that left two dead.

Relevance:

GS-II: International Relations (Important Foreign policies and developments), GS-I: Geography (Maps)

Dimensions of the Article:

- Diplomatic tensions: Russia, Czech Republic, US and Baltic States

- Czech accusations on Russian embassy officials (Not important)

- Maps of the region:

Diplomatic tensions: Russia, Czech Republic, US and Baltic States

- The diplomatic escalation between Prague and Moscow now in 2020-21, is believed to be the most serious since 1989, when the Soviet domination of Eastern Europe ended.

- It also adds to the worsening of relations between the West and Russia, which are already being tested by Russia’s military buildup on its western frontier as well as in Crimea, which it annexed from Ukraine in 2014.

- The US has also said that it stands with its NATO ally in its “firm response against Russia’s subversive actions on Czech soil”.

- The US too has adopted a tough posture against Moscow, and expelled 10 Russian diplomats after accusing the Kremlin of carrying out the “SolarWinds” hack and interfering in the 2020 election.

- Slovakia and the Baltic states of Estonia, Latvia and Lithuania followed suit in solidarity by expelling diplomats as well.

Czech accusations on Russian embassy officials (Not important)

- Russia offered scathing criticism of the Czech Republic’s decision, saying, “In their desire to please the United States against the background of recent US sanctions against Russia, Czech authorities in this respect even outdid their masters from across the pond”.

- According to Czech intelligence, Russian operatives were involved in a 2014 blast near their border with Slovakia.

- Reports in Czech media claimed that munitions at the depot were destined for Ukraine to fight Russia-backed forces, or to forces against the Syrian government of Bashar al-Assad, which Russia supports.

- Two persons linked with the blasts have been identified by the Czech Republic, and stand accused in the attempted poisoning of Sergei Skripal, a former Russian double agent.

- Russia has denied all accusations, calling them absurd.

Maps of the region:

-Source: Indian Express

Assam earthquake

Context:

Several houses and buildings were damaged after an earthquake of magnitude 6.4 on the Richter scale hit Assam.

Six aftershocks, of magnitude ranging from 3.2 to 4.7, occurred in the two-and-a-half hours following the main tremor.

Relevance:

GS-III: Disaster Management (Earthquakes) GS-I: Geography (Important Geophysical Phenomena)

Dimensions of the Article:

- About the Fault line involving Assam Earthquake

- About Himalayan Frontal Thrust (HFT)

- Earthquake zones of India

- Back to the basics

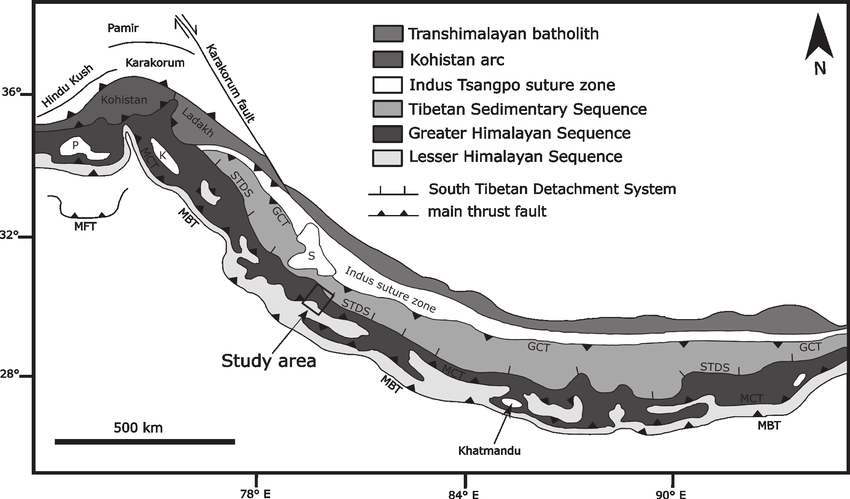

About the Fault line involving Assam Earthquake

- The primary earthquake had its epicentre at about 80 km northeast of Guwahati, and a focal depth of 17 km, the National Centre for Seismology (NCS) said.

- The preliminary analysis shows that the events are located near to Kopili Fault closer to Himalayan Frontal Thrust (HFT).

- The area is seismically very active falling in the highest Seismic Hazard zone V associated with collisional tectonics where Indian plate sub-ducts beneath the Eurasian Plate.

- When an earthquake occurs on one of these faults, the rock on one side of the fault slips with respect to the other. The fault surface can be vertical, horizontal, or at some angle to the surface of the earth.

About Himalayan Frontal Thrust (HFT)

- The Main Frontal Thrust (MFT), also known as the Himalayan Frontal Thrust (HFT) is a geological fault in the Himalayas that defines the boundary between the Indian and Eurasian Plates.

- The fault is well expressed on the surface thus could be seen via satellite imagery.

- It is the youngest and southernmost thrust structure in the Himalaya deformation front. It is a splay branch of the Main Himalayan Thrust (MHT) as the root décollement.

- It runs parallel to other major splays of the MHT; Main Boundary Thrust (MBT) and Main Central Thrust (MCT).

- The MFT accommodates almost the entire rate of subduction of the Indian Plate therefore, it is no surprise that numerous earthquakes have occurred along this fault, and is expected to produce very big earthquakes in the future.

- Many earthquakes associated with the MFT has resulted in visible ground ruptures, as seen in the Bihar earthquake of 1934 and 1505 magnitude 8.9 earthquake.

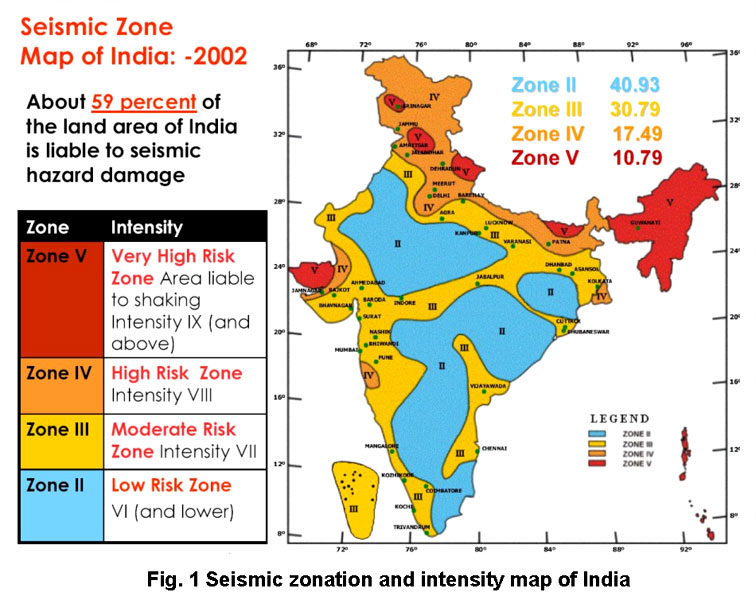

Earthquake zones of India

- The major reason for the high frequency and intensity of the earthquakes is that the Indian plate is driving into Asia at a rate of approximately 47 mm/year.

- Geographical statistics of India show that more than 50% of the land is vulnerable to earthquakes.

- The latest version of seismic zoning map of India divides India into 4 seismic zones (Zone 2, 3, 4 and 5).

Zones of Seismicity

- Zone 1: Currently the Division does not include a Zone 1. NO area of India is classed as Zone 1.

- Zone 2: This region is liable to MSK VI or less and is classified as the Low Damage Risk Zone.

- Zone 3: This zone is classified as Moderate Damage Risk Zone which is liable to MSK VII.

- Zone 4: This zone is called the High Damage Risk Zone and covers areas liable to MSK VIII. Jammu and Kashmir, Ladakh, Himachal Pradesh, Uttarakhand, Sikkim, the parts of Indo-Gangetic plains (North Punjab, Chandigarh, Western Uttar Pradesh, Terai, North Bengal, Sundarbans) and the capital of the country Delhi fall in Zone 4.

- Zone 5: Zone 5 covers the areas with the highest risks zone that suffers earthquakes of intensity MSK IX or greater. The region of Kashmir, the Western and Central Himalayas, North and Middle Bihar, the North-East Indian region, the Rann of Kutch and the Andaman and Nicobar group of islands fall in this zone.

Back to the basics: Click Here to read more about Earthquakes, Earthquake waves and how they are measured

-Source: Indian Express

RBI report on Growth of ARCs

Context:

According to a Reserve Bank of India (RBI) report on Asset Reconstruction Companies (ARCs), the growth of the ARC industry has not been consistent over time and not always been synchronous with the trends in non-performing assets (NPAs) of banks and non-banking financial companies (NBFCs).

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Mobilization of Resources)

Dimensions of the Article:

- What is an Asset Reconstruction Company?

- Asset reconstruction and the process

- Highlights RBI’s report on Growth of the ARC Industry

- Issues with Indian ARCs

- RBI on the New ARC

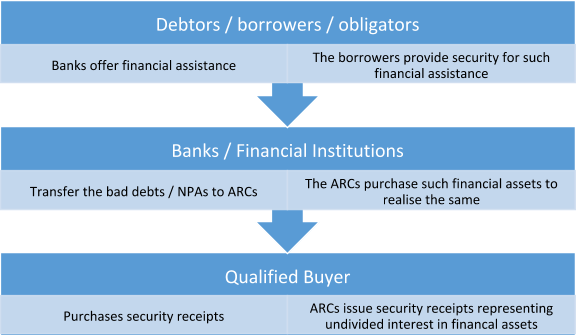

What is an Asset Reconstruction Company?

- An asset reconstruction company is a special type of financial institution that buys the debtors of the bank at a mutually agreed value and attempts to recover the debts or associated securities by itself.

- The asset reconstruction companies or ARCs are registered under the RBI. Hence, RBI has the power to regulate the ARCs.

- ARCs are regulated under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act, 2002).

- The ARCs take over a portion of the debts of the bank that qualify to be recognised as Non-Performing Assets. Thus, ARCs are engaged in the business of asset reconstruction or securitization (securitization is the acquisition of financial assets either by way of issuing security receipts to Qualified Buyers or any other means) or both.

- All the rights that were held by the lender (the bank) in respect of the debt would be transferred to the ARC. The required funds to purchase such such debts can be raised from Qualified Buyers.

- The ARC can take over only secured debts which have been classified as a non-performing asset (NPA). In case debentures / bonds remain unpaid, the beneficiary of the securities is required to give a notice of 90 days before it qualifies to be taken over.

Asset reconstruction and the process

Asset Reconstruction – It is the acquisition of any right or interest of any bank or financial institution in loans, advances granted, debentures, bonds, guarantees or any other credit facility extended by banks for the purpose of its realisation. Such loans, advances, bonds, guarantees and other credit facilities are together known by a term – ‘financial assistance’.

Process of Asset Reconstruction

The main intention of acquiring debts / NPAs is to ultimately realise the debts owed by them. However, the process is not a simple one. The ARCs have the following options in this regard:

- Change or takeover of the management of the business of the borrower.

- Sale or lease of such business.

- Rescheduling the payment of debts – offering alternative schemes, arrangements for the payment of the same.

- Enforcing the security interest offered in accordance with the law.

- Taking possession of the assets offered as security.

- Converting a portion of the debt into shares.

Highlights RBI’s report on Growth of the ARC Industry

- The ARC industry began with the establishment of the Asset Reconstruction Company India Ltd (ARCIL) in 2003.

- After remaining subdued in the initial years of their inception, a jump was seen in the number of ARCs in 2008, and then in 2016.

- There has been a concentration in the industry in terms of Assets Under Management (AUM) and the Security Receipts (SRs) issued.

- The growth in ARCs’ AUM has been largely trendless except for a major spurt in FY14.

- The AUM of ARCs has been on a declining trend when compared with the volume of NPAs of banks and NBFCs, except during the period of high growth in the AUM around 2013-14.

- During 2019-20, asset sales by banks to ARCs declined, which could probably be due to banks opting for other resolution channels such as Insolvency and Bankruptcy Code (IBC) and SARFAESI.

Issues with Indian ARCs

- Indian ARCs have been private sector entities registered with the Reserve Bank. Public sector AMCs in other countries have often enjoyed easy access to government funding or government-backed. The capital constraints have often been highlighted as an area of concern for ARCs in India.

- Despite the regulatory push to broaden, and thereby enhance, the capital base of these companies, they have remained reliant primarily on domestic sources of capital, particularly banks.

- Banks supply NPAs to the ARCs, hold shareholding in these entities and also lend to them, which makes it necessary to monitor if there is a “circuitous movement of funds between banks and these institutions”.

RBI on the New ARC

- The movement in asset quality of banks and NBFCs following the Covid-19 pandemic could bring ARCs into greater focus and action.

- The ARC proposed in the Budget will be set up by state-owned and private sector banks, and there will be no equity contribution from the Centre.

- The ARC, which will have an Asset Management Company (AMC) to manage and sell bad assets, will look to resolve stressed assets of Rs. 2-2.5 lakh crore that remain unresolved in around 70 large accounts.

- The introduction of a new ARC for addressing the NPAs of public sector banks may also shape the operations of the existing ARCs.

- There is a definite scope for the entry of a well-capitalised and well-designed entity in the Indian ARC industry. Such an entity will strengthen the asset resolution mechanism further.

-Source: Indian Express

India, Australia and Japan push supply chain resilience

Context:

The Supply Chain Resilience Initiative (SCRI) was formally launched by the Trade Ministers of India, Japan and Australia – who are three members of the Quad grouping except the U.S.

Relevance:

GS-II: International Relations (Foreign Policies and Agreements affecting India’s Interests), GS-III: Indian Economy

Dimensions of the Article:

- What is Supply Chain Resilience?

- India, Japan and Australia’s Supply Chain Resilience Initiative (SCRI)

- India, Japan and Australia on supply chain disruptions and measures

What is Supply Chain Resilience?

- In the context of international trade, supply chain resilience is an approach that helps a country to ensure that it has diversified its supply risk across a clutch of supplying nations instead of being dependent on just one or a few.

- In unanticipated events -whether natural, such as volcanic eruptions, tsunamis, earthquakes or even a pandemic; or manmade, such as an armed conflict in a region — that disrupt supplies from a particular country or even intentional halts to trade, could adversely impact economic activity in the destination country.

India, Japan and Australia’s Supply Chain Resilience Initiative (SCRI)

- India, Japan and Australia launched the Supply Chain Resilience Initiative (SCRI) with the aim to create a virtuous cycle of enhancing supply chain resilience with a view to eventually attaining strong, sustainable, balanced and inclusive growth in the Indo-Pacific region.

- The SCRI was first proposed by Japan with the aim of reducing dependence on China amid a likelihood of rechurning of supply chains in the Indo-Pacific region amid the Covid-19 pandemic.

- SCRI will initially focus on sharing best practices on supply chain resilience and holding investment promotion events and buyer-seller matching events to provide opportunities for stakeholders to explore the possibility of diversification of their supply chains.

- Joint measures may include supporting the enhanced utilisation of digital technology and trade and investment diversification.

- Expansion of the SCRI may be considered based on consensus, if needed, in due course. The ministers have decided to convene at least once a year to provide guidance to the implementation and development of the SCRI.

Objectives of the SCRI

- To attract foreign direct investment to turn the Indo-Pacific into an “economic powerhouse”.

- To build a mutually complementary relationship among partner countries.

- To work out a plan to build on the existential supply chain network. Japan and India, for example, have an India-Japan competitiveness partnership dealing with locating the Japanese companies in India.

India, Japan and Australia on supply chain disruptions and measures

- The three sides agreed the pandemic “revealed supply chain vulnerabilities globally and in the region” and “noted the importance of risk management and continuity plans in order to avoid supply chain disruptions”.

- Some of the joint measures they are considering include supporting the enhanced utilisation of digital technology and trade and investment diversification, which is seen as being aimed at reducing their reliance on China.

- The SCRI aims to create a virtuous cycle of enhancing supply chain resilience with a view to eventually attaining strong, sustainable, balanced and inclusive growth in the region.

China’s response

China’s Foreign Ministry described the move as ‘unrealistic’ – saying that the formation and development of global industrial and supply chains are determined by market forces and companies’ choices. According to China artificial industrial ‘transfer’ is an unrealistic approach that goes against the economic laws.

-Source: The Hindu