CONTENTS

- It is Time to Operationalize the Indian Defense University

- Make the Poor Richer Without Making the Rich Poorer

It is Time to Operationalize the Indian Defense University

Context:

Thucydides, the ancient Greek philosopher, reportedly suggested that a nation which fails to blur the lines between its scholars and warriors risks having its decision-making influenced by timid minds and its combat led by foolish individuals. Consequently, numerous countries have established “defense universities” to foster intellectual rigor and improve strategic thinking within their armed forces.

Relevance:

GS3-

- Advancements in the Field of Defence

- Security Challenges

Mains Question:

As the nature of warfare evolves today, the importance of military education to address the emerging security challenges becomes increasingly evident. Discuss the significance of Professional Military Education (PME) in this context for India and suggest a way forward strategy in this regard. (15 Marks, 250 Words).

Significance of Military Education:

- As the nature of warfare evolves, the importance of military education and academic readiness to address contemporary and future security challenges becomes increasingly evident.

- The current dynamic and chaotic state of warfare, as evidenced in Europe and West Asia, demands that military officers achieve results amidst ambiguous initial information and rapidly shifting circumstances.

- To navigate these complex challenges effectively, officers require a well-structured Professional Military Education (PME) continuum, which enhances their ability to adapt to changing roles and escalating responsibilities throughout their careers.

- The development of Professional Military Education (PME) in the United States is of particular interest to us, as it shares similarities with India’s objectives for theaterization.

- In the vicinity of India, it’s noted that Pakistan has set up two such universities for its military, while China boasts three, although a report from the Australian Strategic Policy Institute identifies over 60 Chinese universities with ties to the military and security sectors.

Military Education in India:

- Progress in this area has been slow for the Indian armed forces, as with others, highlighting the need for a robust and inclusive educational framework grounded in academic excellence.

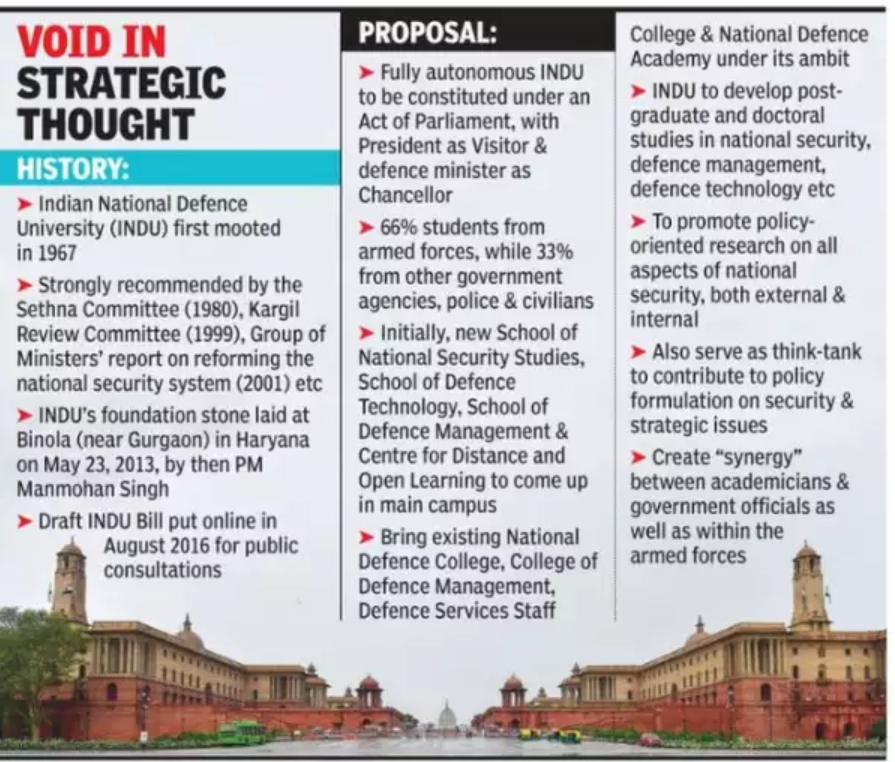

- This need was recognized shortly after independence, when in 1967, the Chiefs of Staff Committee proposed the establishment of a Defence Services University.

- A Study Group formed by the COSC in 1982 underscored the necessity of creating a supreme educational body.

- In 1982, a Study Group appointed by the Chiefs of Staff Committee (COSC) stressed the necessity of establishing a top-tier educational institution for the armed forces in the form of an Indian Defence University (IDU).

- Two decades later, following the Kargil conflict, a committee chaired by Dr. K. Subrahmanyam was formed to address this matter.

- Based on its recommendations, tentative approval was granted in May 2010 for the establishment of the IDU in Gurgaon.

- Despite optimistic reports in 2017-18, progress towards establishing the IDU has been sluggish.

Realising Professional Military Education (PME):

- India’s armed forces operate several world-class training and education institutions, forming a rich and extensive ecosystem for professional development.

- However, they lack a unified, integrated Professional Military Education (PME) framework and a multidisciplinary approach to strategic thinking.

- While the armed forces have affiliations with universities for degree programs, this arrangement is suboptimal.

- The IDU aims to rectify these shortcomings in India’s PME system by serving as a central institution for advanced military education, staffed by a well-qualified faculty comprising academics, serving and retired military officers, and civil servants. Essentially, it would bridge the gap between theoretical knowledge and practical application.

- The university’s curriculum would vary across its constituent colleges and institutions, but it would encompass a range of additional subjects relevant to national security and defense, spanning both sciences and humanities.

- The realization of the IDU is long overdue. Some have argued that with the establishment of the Rashtriya Raksha University (RRU) in Gujarat, the need for the IDU may be obviated.

- However, this argument is flawed because the objectives of the RRU Act do not specifically pertain to defense education, nor is its curriculum solely tailored to military requirements for war management and strategic planning.

Conclusion:

The IDU represents an idea whose time has come, and delays in its establishment come at the expense of defense preparedness, strategic acumen, and inter-service coordination. It is imperative to expedite the operationalization of the IDU so that the foundational elements of joint warfare can be established through a well-designed and forward-thinking military education curriculum.

Make the Poor Richer Without Making the Rich Poorer

Context:

The recent release of manifestos by political parties has ignited a fervent public debate concerning India’s inequality and the concept of redistribution as a means to narrow the gap between the affluent and the underprivileged. It is indisputable that economic inequality has markedly widened over the past two decades, not only in India but globally as well. It is immature to politicize this critical issue by disputing which political party’s governance has exacerbated economic inequality.

Relevance:

- GS2- Issues Relating to Poverty and Hunger

- GS3- Inclusive Growth

Mains Question:

A pragmatic approach to reducing the rich-poor gap is by maximising economic growth, minimising unemployment, lowering the tax burden and providing a safety net for the poor. Analyse. (10 Marks, 150 Words).

Bridging the Gap:

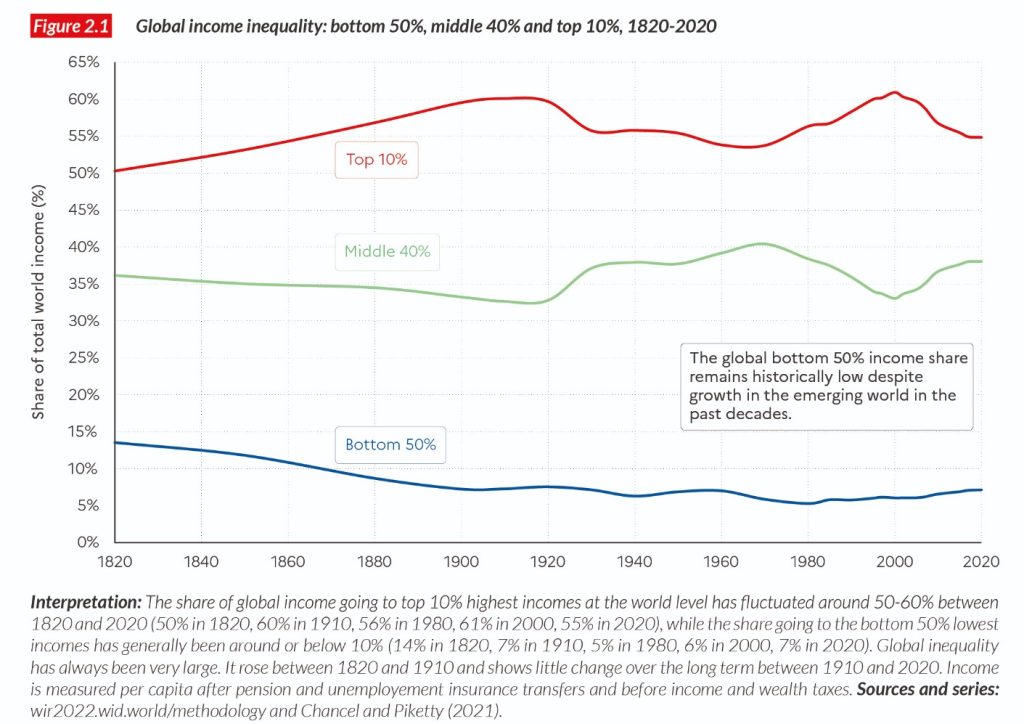

- The reality is that global inequality is on the rise, and it is not in the best interest of any society to allow this trend to persist.

- The genuine debate revolves around how to bridge this gap and strive for a more equitable and just society.

- Closing the wealth gap can be achieved by either diminishing the wealth of the rich, increasing the wealth of the poor, or both.

Is the Total Economic Pie Fixed?

- The underlying belief is whether the total economic pie is fixed or if it will expand rapidly enough for the wealthy to maintain their share while allowing for a greater share for the poor.

- If one subscribes to the notion that the economic pie is fixed or grows too slowly, then the approach to achieving a more equitable society aligns with what sociologists term a ‘Pareto Optimum,’ where improving one individual’s situation necessitates worsening another’s.

- Developed nations, constrained by slow growth, tend to adopt a ‘Pareto’ approach to inequality reduction.

- Conversely, developing nations with faster growth potential may not need to adhere to this approach. This philosophical contrast forms the basis of differing ideologies in addressing inequality.

Implementing a Wealth Tax or Reforming the System:

- The concept of implementing a wealth tax to redistribute from the ultra-rich to the poor originates from a ‘zero-sum’ perspective aimed at reducing economic disparity.

- It is reasonable to question whether the wealthy obtained their riches through fair means, particularly in countries like India where many may not have.

- If the system is corrupt and allows a select few to amass wealth illegitimately, then the focus should be on fixing the system rather than solely relying on taxation.

- If the system allows a select few to amass wealth illegitimately, then the focus should be on reforming the system rather than implementing taxation under the guise of addressing inequality.

- While an inheritance tax might seem morally justifiable, as it seems unfair that a child born into a wealthy family can inherit substantial wealth from day one while another born into poverty faces significant disadvantages, the ultimate aim is to reduce economic inequality, not merely address ethical dilemmas.

- Punitive measures aimed at taxing the rich neither generate sufficient resources to make a meaningful impact nor foster a conducive environment for reducing the rich-poor gap.

Expanding the Overall Economic Pie:

- At India’s current stage of development, economic growth is essential for expanding the overall economic pie.

- Economic growth requires investment, and an antagonistic approach of making the rich poorer could deter investments and lead to capital flight.

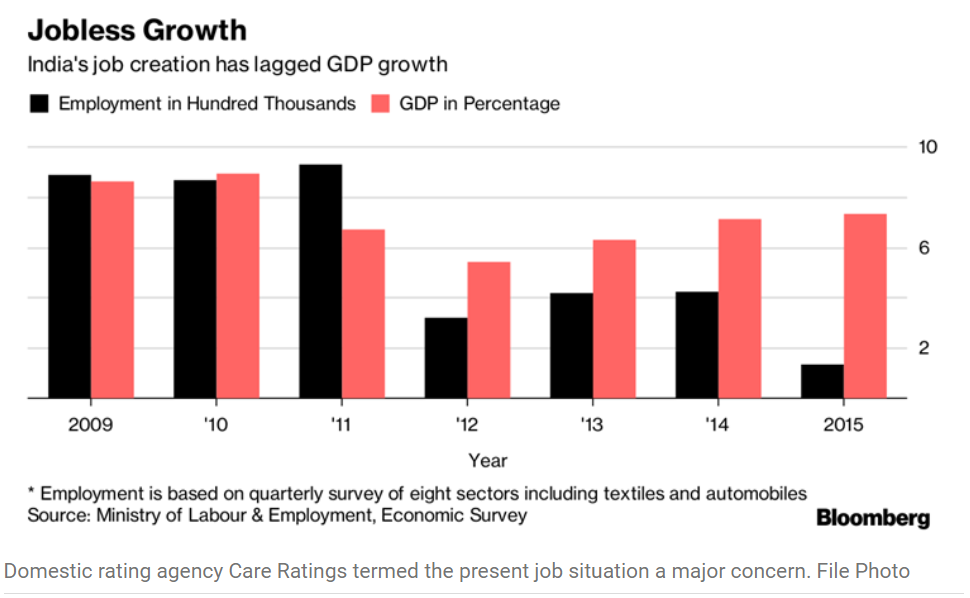

- India’s inequality stems from imbalanced economic growth and taxation. It is widely acknowledged that India is undergoing jobless growth, where headline GDP expansion fails to translate into increased employment, incomes, and prosperity for a significant portion of the population.

- Each percentage point of GDP growth currently generates less than a quarter of the number of formal jobs compared to the 1980s.

- This trend is primarily attributed to modern economic development models that prioritize capital over labor for efficiency.

- Thus, the key to reducing economic inequality lies in rebalancing the capital-labor imbalance through policy incentives focused on the labor market.

- This rationale underpins some of the promises outlined in the recent manifestos, such as providing youth with the right to apprenticeship, offering employment-linked incentives for corporations, and promoting economic activities that rely on unskilled labor.

Disparity in Taxation:

- Another factor contributing to India’s inequality is the disparity in taxation, where the burden falls disproportionately on the common person compared to corporations.

- For every 100 rupees collected in taxes, 64 rupees are contributed by the poor and middle class through indirect (GST) and income taxes, while only 36 rupees come from wealthy corporations.

- Consequently, the poor and average individual face a dual burden—they not only miss out on the benefits of economic growth but also bear a higher tax burden compared to corporations.

Establishing a Social Security Net:

- It’s crucial to establish a social security safety net through welfare initiatives for the underprivileged until they can benefit from economic progress.

- Funding for such programs can be sourced from a combination of accelerated growth, improved tax revenue, and efficient delivery of welfare services, without resorting to punitive measures against the wealthy.

- A pragmatic approach to narrowing the gap between the affluent and the impoverished involves prioritizing economic expansion, minimizing unemployment, lightening the tax burden on the average citizen, and providing support systems for those in need.

- This strategy requires a careful balancing act, incorporating incentives for the labor market, robust welfare safety nets, and strategies to attract investments.

Conclusion:

Hence implementing punitive and vindictive taxes on the wealthy to support the poor is neither feasible, wise, nor desirable. India can effectively address inequality by elevating the socioeconomic status of the poor without diminishing the wealth of the affluent.