Full Employment Level: Full employment is an economic situation in which all the available resources of the economy are fully utilised, and there exists no further scope of improvement in the economy. The Full employment level represents that economy is operating at its maximum potential. The level of unemployment is minimum, the prices in the economy are stable, resources are fully utilised, whatever firms are producing is getting sold, and there exist no shortages in the economy.

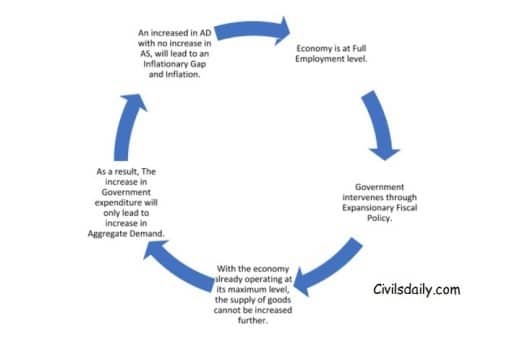

Inflationary Gap: the Inflationary gap is a situation which arises when Aggregate demand in an economy exceeds the Aggregate supply at the full employment level.

Excess of govt. spending above national income (fiscal deficit). Spending intended for increasing production level pushes up prices.

Inflation in a Demand-Pull scenario is basically caused by a situation whereby the Aggregate demand for goods and services in the economy rises and exceeds the available supply of the goods and services. In such a situation, the excessive pressure on demand will fuel the inflation in the economy.

Deflationary Gap: Deflationary Gap is a situation which arises when Aggregate demand in the economy falls short of Aggregate Supply at the full employment level. Shortfall in total spending of govt. generating fiscal surplus. Producing more than demand and the economy heads to a slowdown.

- Inflation tax

- Refers to loss of value by holders of cash

- Holders of fixed rate bonds(in case of unexpected inflation)

- Fixed income(not indexed to inflation)

- Capital gains tax resulting from inflation

- As a infuser of money into the market, the govt stands to gain at the cost of people’s income. This is a way of sustaining govt. expenditure.

- Inflation is always the level to which the govt may go for deficit financing.

- Inflation spiral

- Results out of a process of price and wage interaction

- It is when wages press prices up and prices pull wages up

- Aka wage-price spiral.

- Inflation accounting

- Calculating profits after adjusting the effects of current level of inflation

- Such profits are real profits which can be compared to a historic rate of inflation

- Inflation premium

- It is the bonus brought by inflation to the borrowers.

- Banks charge nominal interest rate on lending and inflation rate is not taken into account. If we take that in to account, the real interest rate paid by borrower will always be lower than nominal rate. This difference is inflation premium.

- Rising inflation premium shows depleting profits of lending institutions.

- To neutralise the inflation premium, the lender takes recourse to increase nominal rate of interest.

- Phillips curve

- A graph representing relationship between inflation and unemployment.

- According to it, there’s a trade-off between inflation and UE

- Very popular in 1960s with most countries opting for high inflation with the view of permanently checking UE.

- The idea was challenged in 70s by Milton Friedman, who argued that the trade-off was only short term, because once people expect higher inflation they demand higher wages and unemployment will rise back to its ‘natural rate’.

- Natural rate of UE is the UE rate that occurs at full employment when economy is producing at full potential.

- NAIRU- non accelerating inflation rate of UE

- If monetary policy tries to hold back UE below natural rate, inflation rises.

- Is that rate of UE which is consistent with a constant rate of inflation

- At NAIRU, the upward and downward forces on price and wage neutralise each-other and there is no tendency of change in rate of inflation.

- NAIRU is the lowest UE rate that an economy can sustain without any upward pressure on inflation rate.

- Reflation

- Situation deliberately brought by govt to reduce UE and increase demand aiming for a higher growth.

- Higher expenditures, tax cuts, interest rate cuts, printing money etc,.

- Another way of looking at reflation is that when the govt is trying to bring the economy out of recession. When govt frames policies to revive, it results in sudden and temporary increase in demand and prices of certain goods. This is also known as Reflation

- Stagflation

The most important difference between the Demand Pull and Cost Push Inflation is that while in the case of Demand Pull Inflation the overall output in the economy does not fall. Whereas, in case of Cost Push Inflation, along with an increase in prices the output level of the economy also falls.

The fall in output will cause employment to fall in the economy along with fall in growth. The falling growth along with rising prices makes cost push inflation more dangerous than the demand-pull inflation. The situation of rising prices along with falling growth and employment is called as stagflation.

- Skewflation

- Relative and episodic price increase(not across the board) pertaining to one or a small group of commodities.

- A rise in food prices or onion and potato, while rest being normal.