Contents

- PM-Matsya Sampada Yojana and e-Gopala App

- EASE 2.0 Index Results and Doorstep Banking Services

- Shikshak Parv Initiative

- Virtual Hearings under EPF & MP Act, 1952

- Village Poverty Reduction Plan (VPRP)

PM-MATSYA SAMPADA YOJANA AND E-GOPALA APP

Focus: GS-III Agriculture

Why in news?

Prime Minister will digitally launch the Pradhan Mantri Matsya Sampada Yojana (PMMSY) in September 2020, along with the e-Gopala App.

Pradhan Mantri Matsya Sampada Yojana (PMMSY)

- PMMSY is a scheme to bring about Blue Revolution through sustainable and responsible development of fisheries sector in India under two components namely, Central Sector Scheme (CS) and Centrally Sponsored Scheme (CSS).

- The Scheme will be implemented during a period of 5 years from FY 2020-21 to FY 2024-25 established under the Department of Fisheries

- Nodal Ministry: Ministry of Fisheries, Animal Husbandry and Dairying. – The new ministry was formed on May 2019 in order to promote the allied farm sector that has huge potential to help achieve the government’s target of doubling farmers’ income by 2022.

- PMMSY envisages many new interventions such as fishing vessel insurance, support for new/up-gradation of fishing vessels/boats, Bio-toilets, Aquaculture in saline/alkaline areas, Fisheries and Aquaculture start-ups, Incubators, Integrated Aqua parks, etc.

- Special focus will be given for employment generation activities such as seaweed and ornamental fish cultivation.

PMMSY aims at:

- Enhancing fish production

- Increasing fisheries export earnings

- Doubling of incomes of fishers and fish farmers

- Reducing post-harvest losses

- Generation of additional 55 lakhs direct and indirect gainful employment opportunities in fisheries sector and allied activities

Major Benefits of PMMSY

- Address the critical gaps in the fisheries sector and realize its potential.

- Augmenting fish production and productivity at a sustained average annual growth rate.

- Improving availability of certified quality fish seed and feed, traceability in fish and including effective aquatic health management.

- Creation of critical infrastructure including modernisation and strengthening of value chain.

- Creation of direct gainful employment opportunities to about 15 lakh fishers, fish farmers, fish workers, fish vendors and other rural/urban populations in fishing and allied activities.

- Boost to investments in fisheries sector and increase of competitiveness of fish and fisheries products.

- Social, physical and economic security for fishers and fish workers.

e-Gopala App

e-Gopala App is a comprehensive breed improvement marketplace and information portal for direct use of farmers.

The e-Gopala App will provide solutions to farmers on all the following aspects:

- At present no digital platform is available in the country for farmers managing livestock including buying and selling of disease-free germplasm in all forms; availability of quality breeding services and guiding farmers for animal nutrition, treatment of animals using appropriate ayurvedic medicine/ethno veterinary medicine.

- There is no mechanism to send alerts and inform farmers about various government schemes and campaigns in the area.

EASE 2.0 INDEX RESULTS AND DOORSTEP BANKING SERVICES

Focus: GS-III Indian Economy

Why in news?

Union Minister of Finance & Corporate Affairs inaugurated Doorstep Banking Services by PSBs and participated in the awards ceremony to felicitate best performing banks on EASE Banking Reforms Index.

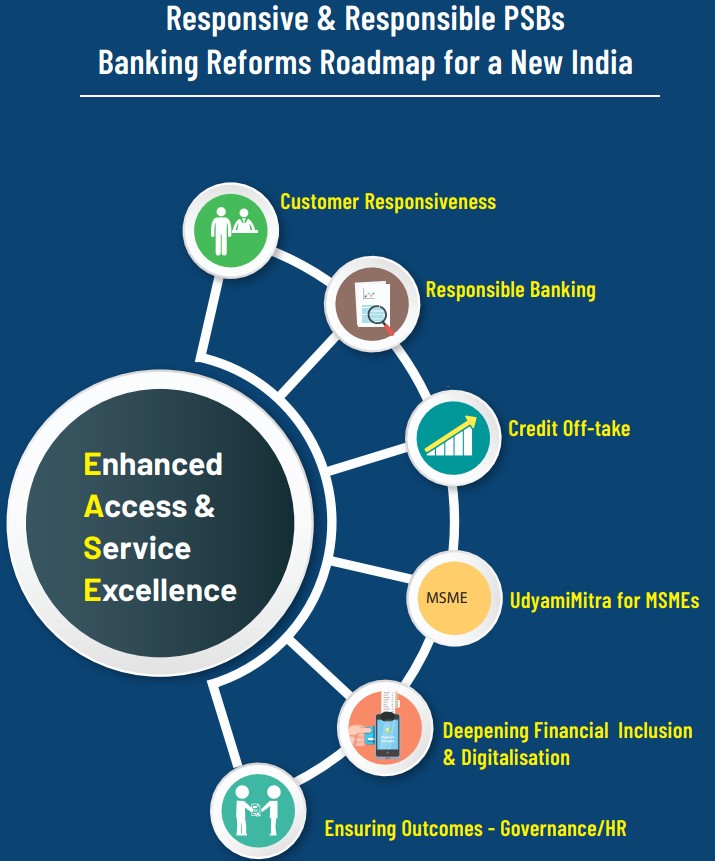

EASE

- A common reform agenda for PSBs, EASE Agenda, launched in 2018, is aimed at institutionalizing clean and smart banking.

- The subsequent edition of the program ― EASE 2.0 built on the foundation laid in EASE 1.0 and furthered the progress on reforms.

- Reform Action Points in EASE 2.0 aimed at making the reforms journey irreversible, strengthening processes and systems, and driving outcomes.

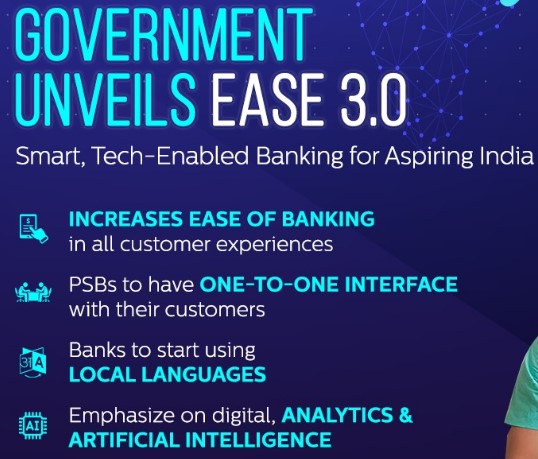

EASE 3.0 for tech-enabled banking

Ease (Enhanced Access and Service Excellence) 3.0 reform agenda aims at providing smart, tech-enabled public sector banking for aspiring India.

New features that customers of public sector banks may experience under EASE 3.0 reforms agenda include facilities like:

- Palm Banking for “End-to-end digital delivery of financial service”.

- “Banking on Go” via EASE banking outlets at frequently visited spots like malls, stations, complexes, and campuses.

- Digitalizing the experience at public sector bank branches.

- With EASE 3.0, the government is trying to enhance the customer experience with the introduction of features like Dial-a-loan, credit at a click, alternate-data-based lending or other analytics-based credit offers.

- The government aims to focus on digitalization in the Public Sector Banks (PSBs) among themes that include responsible banking, PSBs as Udyami Mitra, customer responsiveness, credit take-off, and deep financial inclusions.

Doorstep Banking Services by PSBs

- As part of the EASE Reforms, Doorstep Banking Services is envisaged to provide convenience of banking services to the customers at their door step through the universal touch points of Call Centre, Web Portal or Mobile App.

- Customers can also track their service request through these channels.

- The services shall be rendered by the Doorstep Banking Agents deployed by the selected Service Providers at 100 centres across the country.

- The services can be availed by customers of Public Sector Banks at nominal charges.

- The services shall benefit all customers, particularly Senior Citizens and Divyangs who would find it at ease to avail these services.

Performance of PSB on EASE 2.0 Index

- PSBs have shown a healthy trajectory in their performance over four quarters since the launch of EASE 2.0 Reforms Agenda.

- Significant progress is seen across six themes of the Reforms Agenda, with the highest improvement seen in the themes of ‘Responsible Banking’, ‘Governance and HR’, ‘PSBs as Udyamimitra for MSMEs’, and ‘Credit off-take’.

- PSBs have adopted tech-enabled, smart banking in all areas, setting up retail and MSME Loan Management Systems for reduced loan turnaround time.

- PSBs have instituted real-time visibility to retail and MSME customers on the status of their loans.

- Most branch-based services are now accessible from home and mobile, including in local languages.

- EASE Reforms Index has equipped Boards and leadership for effective governance, instituted risk appetite frameworks, created technology- and data-driven risk assessment and prudential underwriting and pricing systems, introduced Early Warning Signals (EWS) systems and specialised monitoring for time-bound action in respect of stress, put in place focussed recovery arrangements, and established outcome-centric HR systems.

EASE Reforms Index

- The EASE Reforms Index measures the performance of each PSB on 120+objective metrics across six themes.

- It provides all PSBs a comparative evaluation showing where banks stand vis-à-vis benchmarks and peers on the Reforms Agenda.

- The Index follows a fully transparent scoring methodology, which enables banks to identify precisely their strengths as well as areas for improvement.

- The goal is to continue driving change by spurring healthy competition among PSBs and by encouraging them to learn from each other.

- Progress made by PSBs are tracked quarterly through a published EASE Reforms Index leading up to the annual review.

SHIKSHAK PARV INITIATIVE

Focus: GS-II Social Justice

Why in news?

Ministry of Education organized a webinar on Inclusive and Equitable Education under Shikshak Parv Initiative.

Highlights of what transpired during the webinar

Experts from NCERT spoke about the National Education Policy 2020 that encapsulates the education of children with special needs as part of the underrepresented groups in education like girls, children belonging to scheduled caste communities, children from tribal communities and other backward classes etc.

It was further stated that the policy emphasizes the following areas such as:

- Inclusion of children with special needs in neighbourhood schools from preschool to class XII,

- Specific financial support to schools and school complexes as well as establishment of resource centers for learners with severe or multiple disabilities,

- Barrier free access,

- Provision for appropriate and specific support for learners like assistive devices, Braille books and large print books etc.,

- Support to research and development of such tools and devices,

- Home-based education for children with severe and profound disabilities & wide-scale dissemination of learning materials,

- Collaborations with NGOs & VOs for interventions like identification and assessment as well as community mobilization,

- Open schooling for learners with hearing impairment,

- Appointment of special educators at the ‘school complex’ level and cross-disability training to address the educational needs of all learners, including CWSN in home-based education programme,

- Scholarships for talented and meritorious CWSN at the secondary level.

Stress was given on The Indian Sign Language (ISL) which is a sign language that is predominantly used in South Asian countries.

- There are many special features present in ISL that distinguish it from other Sign Languages.

- Features like Number Signs, Family Relationship, use of space etc. are crucial features of ISL. Also, ISL does not have any temporal inflection.

VIRTUAL HEARINGS UNDER EPF & MP ACT, 1952

Focus: GS-II Governance, GS-III Indian Economy

Why in news?

- Minister of State for Labour & Employment (I/C) launched virtual hearing facility in quasi-judicial cases under EPF & MP Act, 1952 through Video conferencing by use of secure IT applications.

- The aim of integration of virtual hearing utilities with EPFO’s e-Court process on Compliance e-Proceedings Portal is to eliminate physical presence of parties in hearings before Adjudicating Officer leading to ease and convenience for employers & employees to appear in hearings from remote location of their choice.

- The system entails savings on time, travel and expenditure for parties, ensures compliance to social distancing norms during pandemic and fast tracks assessment of worker’s EPF dues to generate better confidence in the quasi-judicial mechanism.

What is Employee Provident Fund (EPF)?

- If you are a salaried employee in India, you would know that every month a certain amount of money is deducted from your salary as PF (provident fund).

- Employee Provident Fund (EPF) is a retirement savings scheme that the government of India has mandated for all salaried employees.

- EPF is the main scheme under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

- The funds deducted from your salary as PF goes to your PF account, which is maintained by the Employee Provident Fund Organization (EPFO).

- All organizations in India that have more than 20 employees, as per law, is mandated to register with EPFO.

- In simple words, it is a savings platform provided by the government to help the employees build a corpus for post-retirement life.

Employees Provident Fund Organisation (EPFO)

- EPFO is a Statutory Body, formed by the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

- EPFO is under Union Ministry of Labour & Employment.

- The EPFO has the dual role of being the enforcement agency to oversee the implementation of the EPF & MP Act and as a service provider for the covered beneficiaries throughout the country.

- EPFO assists the Central Board in administering a compulsory contributory Provident Fund Scheme, a Pension Scheme and an Insurance Scheme for the workforce engaged in the organized sector in India.

- It is also the nodal agency for implementing Bilateral Social Security Agreements with other countries on a reciprocal basis.

- The schemes cover Indian workers as well as International workers (for countries with which bilateral agreements have been signed.

- The EPFO’s apex decision making body is the Central Boad of Trustees (CBT).

VILLAGE POVERTY REDUCTION PLAN (VPRP)

Focus: GS-II Governance, Social Justice

Introduction

- The Article 243G of the Constitution intended to empower the Gram Panchayats (GPs) by enabling the State Governments to devolve powers and authority in respect of all 29 Subjects listed in the Eleventh Schedule for local planning and implementation of schemes for economic development and social justice.

- The local bodies (GPs) play a significant role in the effective implementation of flagship schemes on subjects of national importance, for transformation of rural India.

Gram Panchayat Development Plan (GPDP)

- Gram Panchayat Development Plan (GPDP) brings together both the citizens and their elected representatives in the decentralized planning processes.

- GPDP is expected to reflect the development issues, perceived needs and priorities of the community, including that of the marginalized sections.

- Apart from the demand related to basic infrastructure and services, resource development and convergence of departmental schemes, GPDP has potential to address the social issues.

Village Poverty Reduction Plan (VPRP)

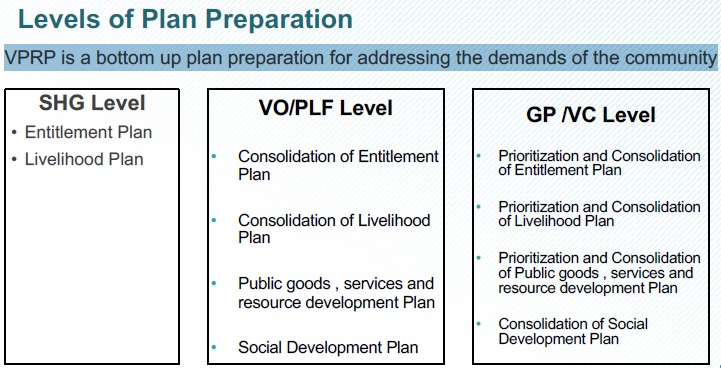

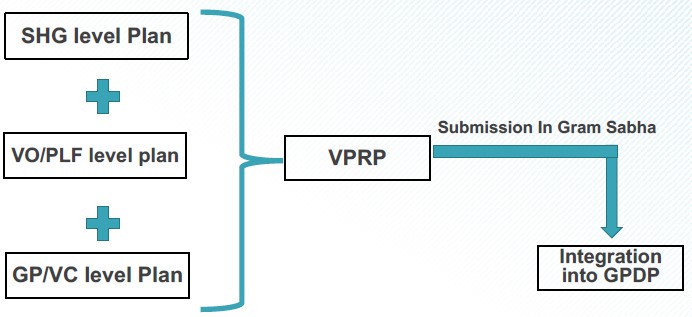

- The Village Poverty Reduction Plan (VPRP) is a community demand plan prepared by the SHG (Self-Help Groups) network which can be further integrated into the Gram Panchayat Development Plan (GPDP).

- This serves as the mission and plan document around which the Gram Panchayat and the SHG network work together to address the basic needs of the people.

- VPRP includes demands of SHG households and demands of other vulnerable sections of the community.

- This guarantees the representation of demands from all sections of the community.

- VPRP also Creates a fair, transparent and participatory plan.

- VPRP is a bottom up plan preparation for addressing the demands of the community.

Objectives of VPRP are three-fold

- Prepare a comprehensive and an inclusive demand plan of the community for local development

- Facilitate an interface between the SHG federation and Panchayati Raj institutions for development of demand plan

- Strengthen the community-based organisations and their leadership for active participation in poverty reduction activities

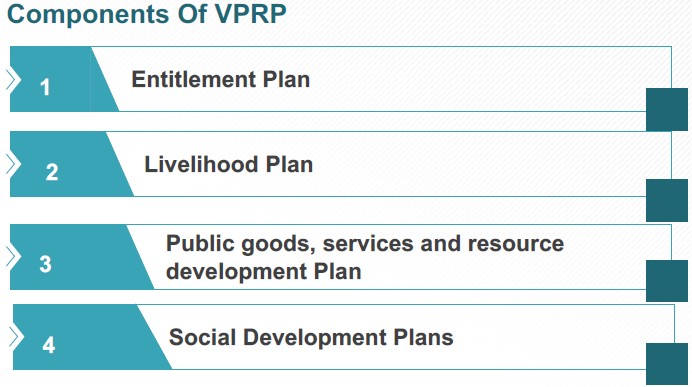

Components of VPRP

- Social inclusion – plan for inclusion of vulnerable people/household into SHGs under NRLM

- Entitlement – demand for various schemes such as MGNREGS, SBM, NSAP, PMAY, Ujjwala, Ration card etc.

- Livelihoods – specific demand for enhancing livelihood through developing agriculture, animal husbandry, production and service enterprises and skilled training for placement etc.

- Public Goods and Services – demand for necessary basic infrastructure, for renovation of the existing infrastructure and for better service delivery

- Resource Development – demand for protection and development of natural resources like land, water, forest and other locally available resources

- Social Development – plans prepared for addressing specific social development issues of a village under the low cost no cost component of GPDP